Taking control

Let’s say you’ve decided to jump down the rabbit hole and bought some crypto via numerous brokerage exchanges available (still not investment advice btw). How is it different (i.e. more productive) than speculating in FX or commodities? Well, unlike traditional finance, you can take control and custody of your assets.

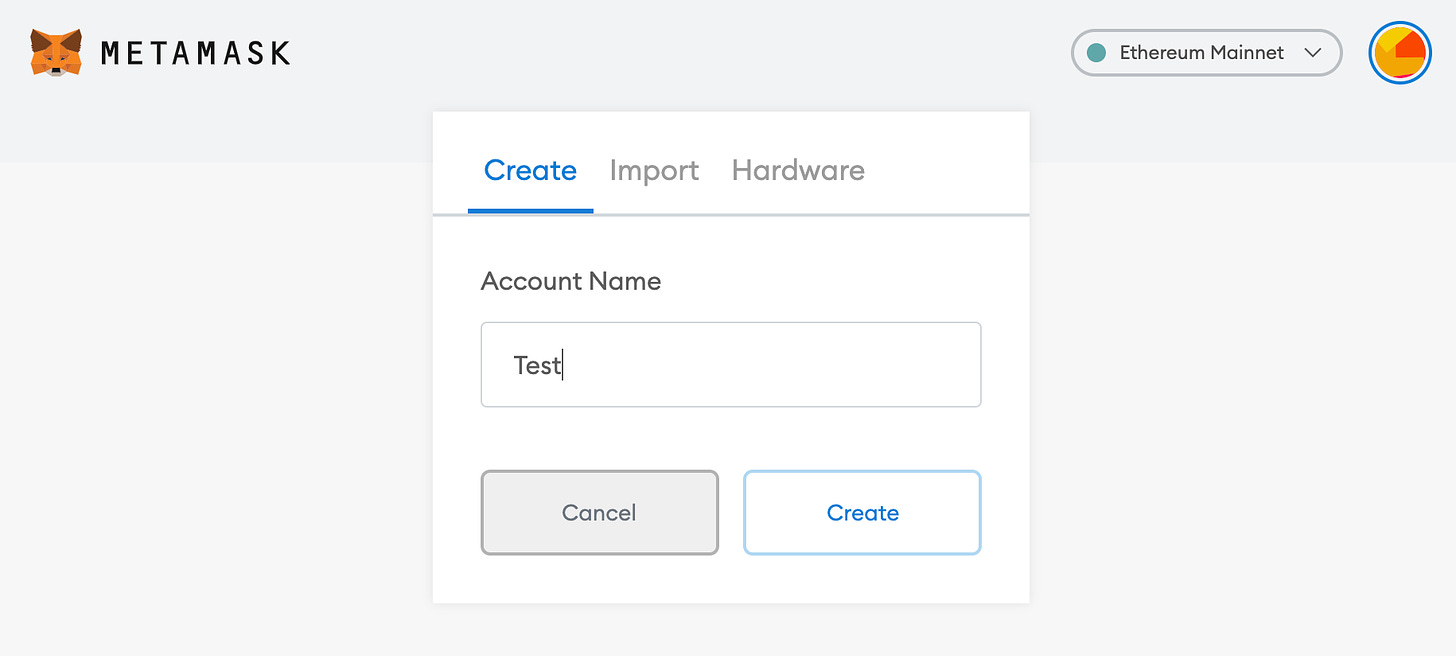

With just a few clicks you can set up your own wallet outside of any broker and outside of anyone’s control. Below you can see a visual flow of how easy it is to set up an account using Metamask - one of the most commonly used providers.

That’s it!

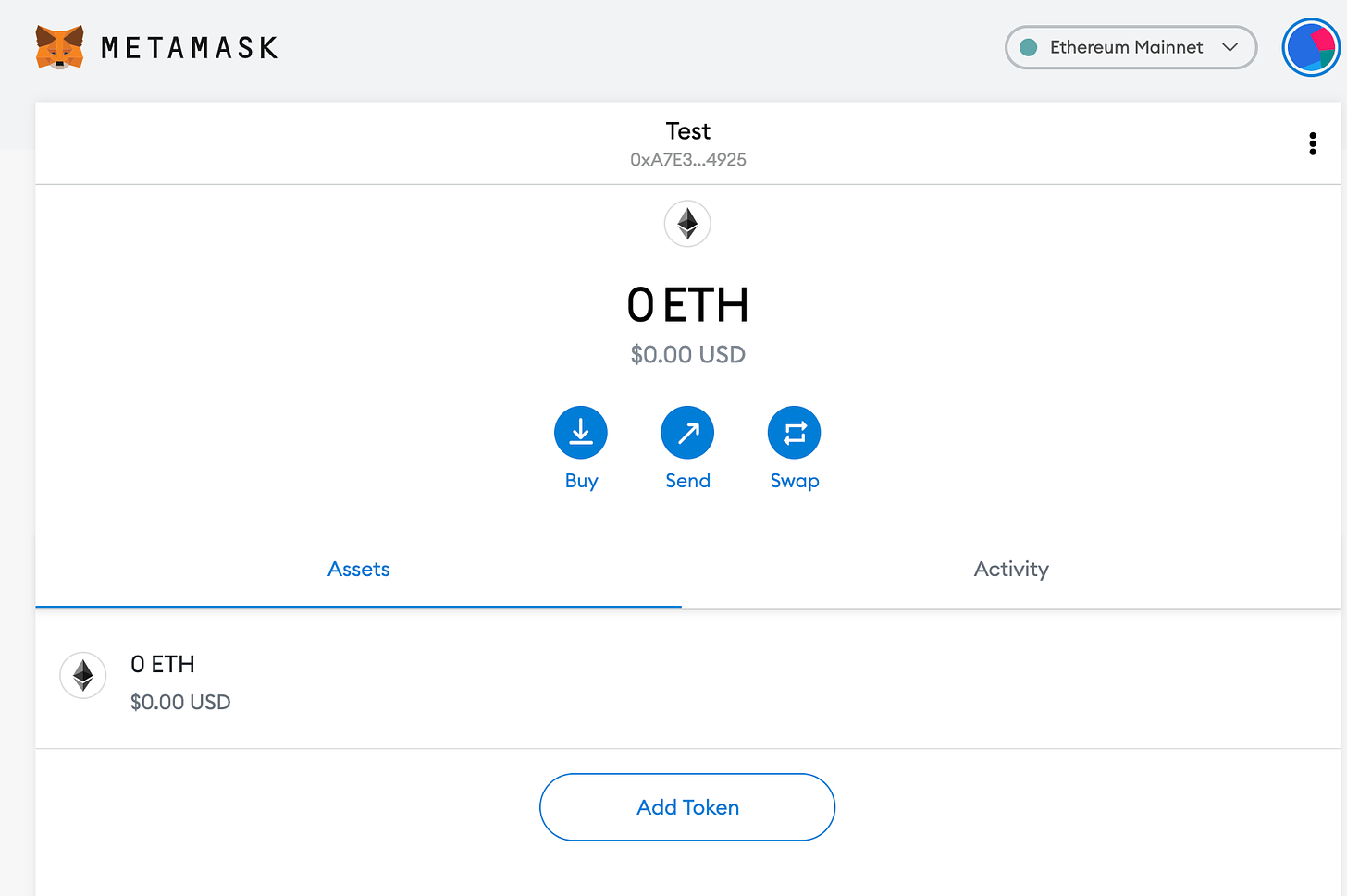

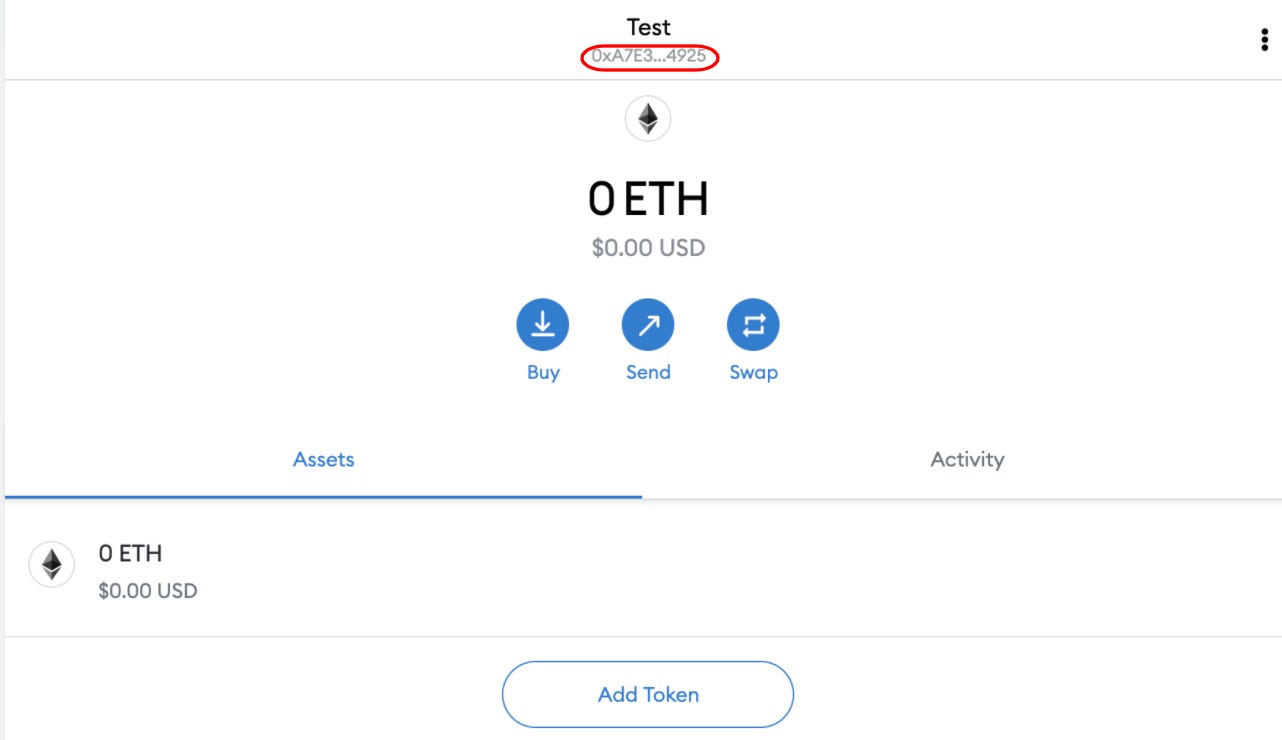

This is your wallet (i.e. account) onto which you send stablecoins, volatile coins and any other coins that comply with a certain standard. All you need to do is to expand your wallet name and you can use that address to fund your newly opened decentralised non-custodial account, which only you can access. Even if Metamask (or any other provider) goes wild, your wallet will still be intact, you’ll just need a different UI to interact with it.

your address = your brokerage account = your bank account = your history = your ID

The information is fully transparent and anonymous. The address I’ve created for test purposes is 0xA7E3e19fd1C897a0a4B902273567Dd2416014925 and you can see everything about it on https://etherscan.io/.

Banks with no doors

Now that you have your ‘crypto passport’, let’s walk into a bank.

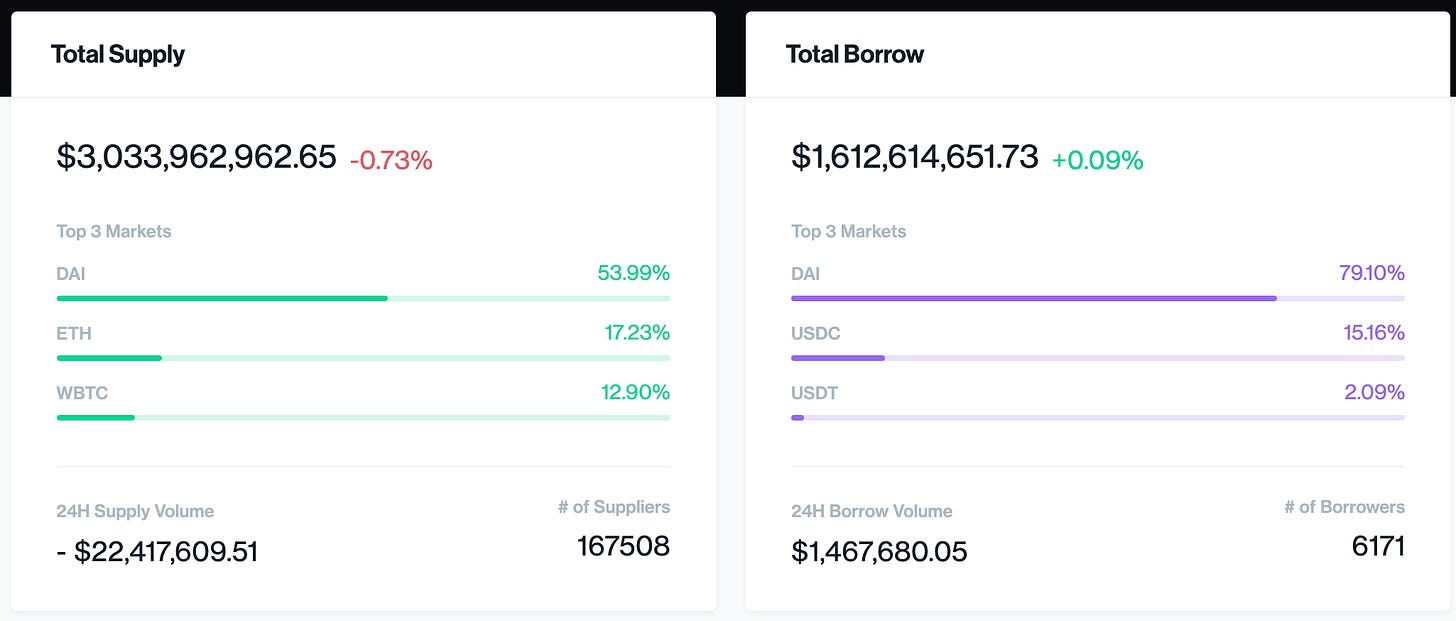

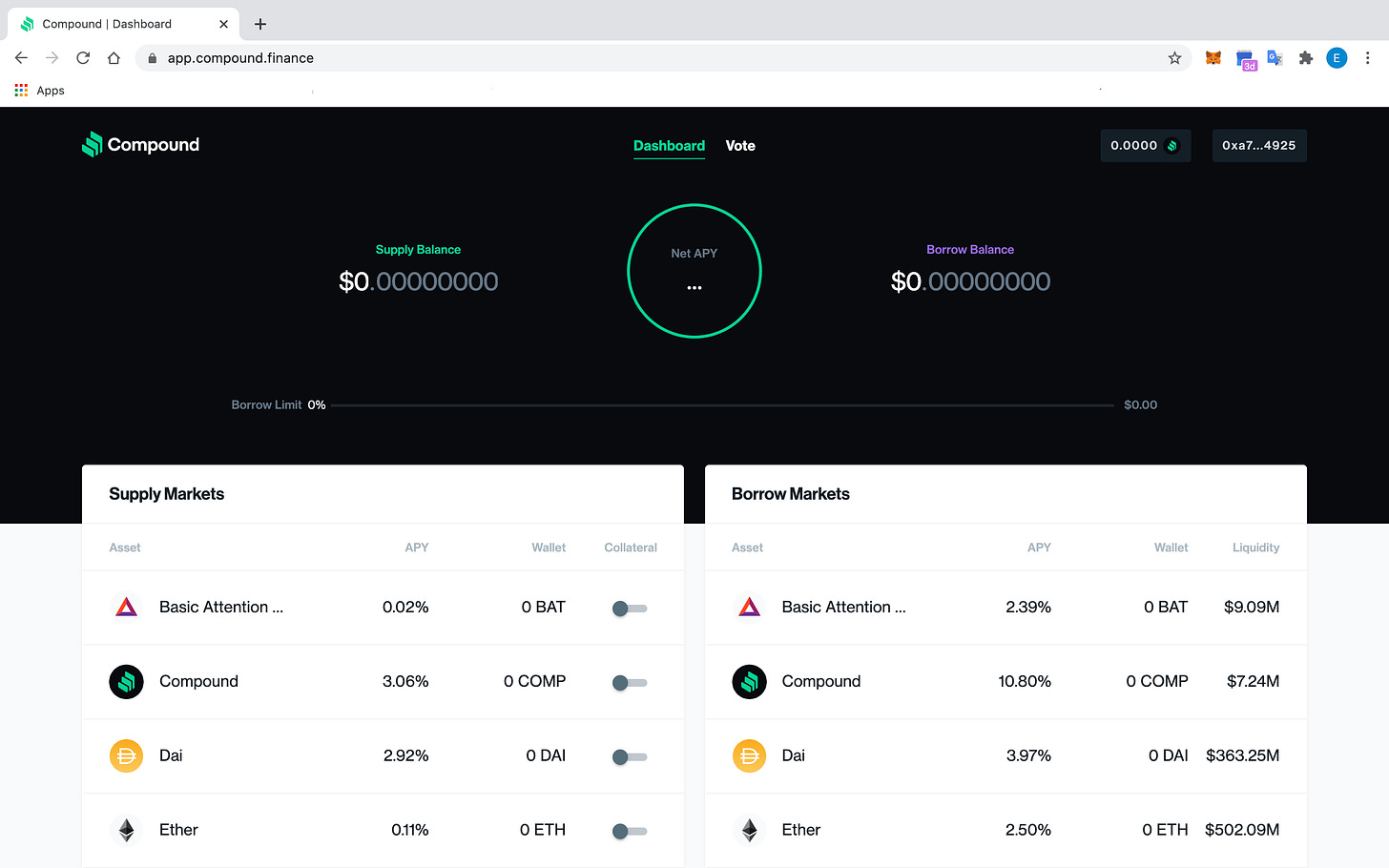

One of the most successful banking platforms in crypto is Compound. Here’s how much it’s ‘holding’:

$3bn of deposits and $1.6bn of loans serviced by an open platform, set up by a small team of software engineers!

So how does it work? You access it through your usual browser, connect you wallet to the protocol and after a couple of clicks you’re in!

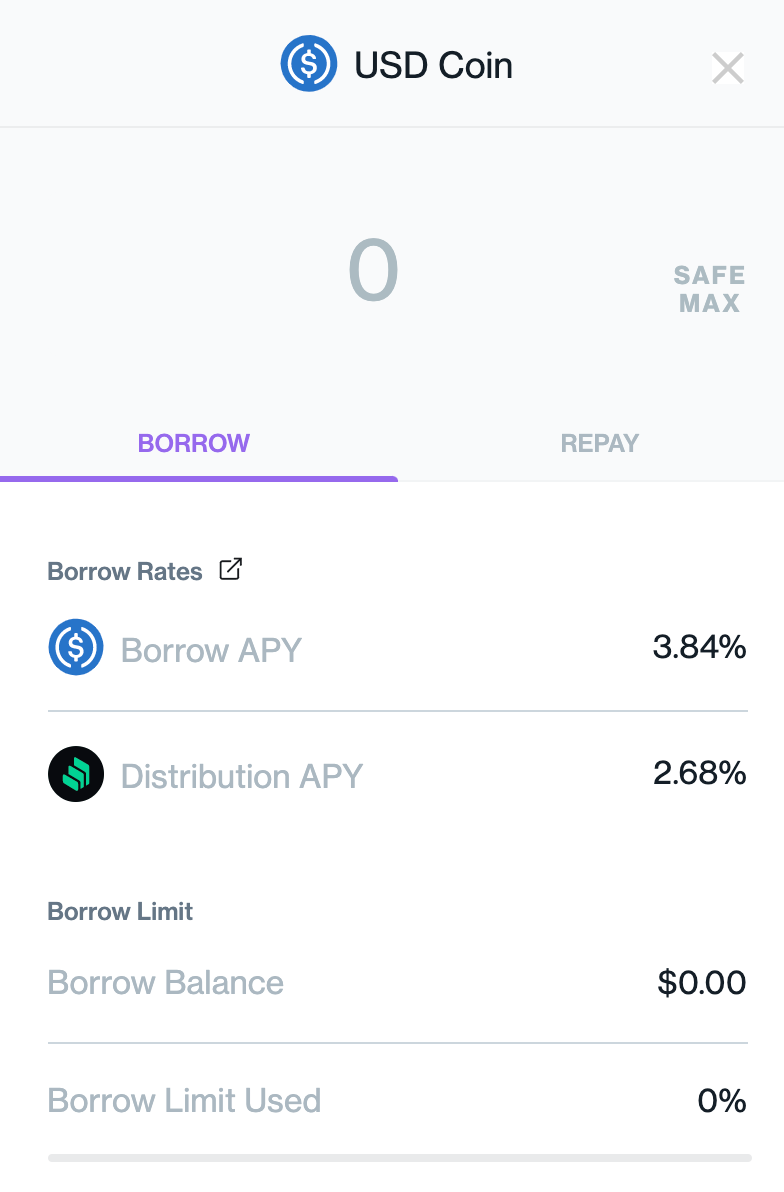

You can then deposits coins to generate some yield. The whole list includes 9 coins with the highest deposit yield being 17.48% for one of the stablecoins. That’s 17.48% on your USD savings vs 0 on traditional bank deposits. That’s one of those famous ‘zero to one’ moments when a new product is 10x+ better than the existing alternative.

As you can also see in the image above, you can borrow $500mn+ at this particular moment in time (if you have the right amount of collateral of course).

What’s even more exciting - imagine using the shares you own and effectively putting them on a deposit and generating income on them! In the traditional world only very large asset managers can do it by allowing hedge funds to borrow their shares to bet against them. Here anyone can do it, no matter the size of your account.

This is the ultimate democratisation of finance.

So we have an open platform where anyone can deposit and borrow freely, there’s no central trusted party involved and there’s no credit risk and it’s not a ponzi scheme?How’s that even possible?

Smart contracts

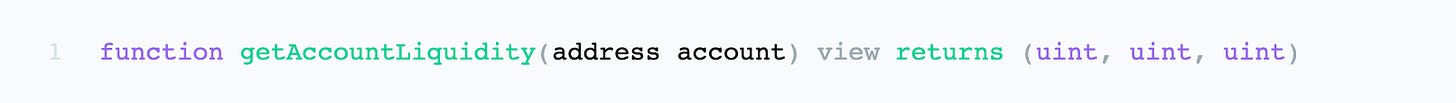

Behind this simple user interface there’s complex code, which is constantly checking the real time market value of each account’s assets and debt value. Then, using a predetermined Lending Value tells the contract if you’re solvent or not (just like a normal bank would).

However, Compound is not holding these assets ‘on its books’. Instead it functions as an open peer-to-peer platform, but unlike traditional p2p platforms, it has a unique way of solving the bad debts problem.

What do banks do if you default on your loan? They sell it to a collector agency / distressed fund at a huge loss. In our case Compound built a set of tools which allows anyone to run a Liquidation Bot. This bot allows anyone in real time capture the accounts going underwater, repay the debt and receive the collateral along with a 10% bonus. The open and fully transparent nature of blockchain data allows to capture the loans right before they go bad, which is impossible with traditional asset loan books on p2p platforms. You can only have the same risk management controls at a third party provider (i.e. a broker) but then you run counterparty risk.

full control of your assets + 10x higher deposit income + no counterparty risk = banking 2.0

Icing on the cake

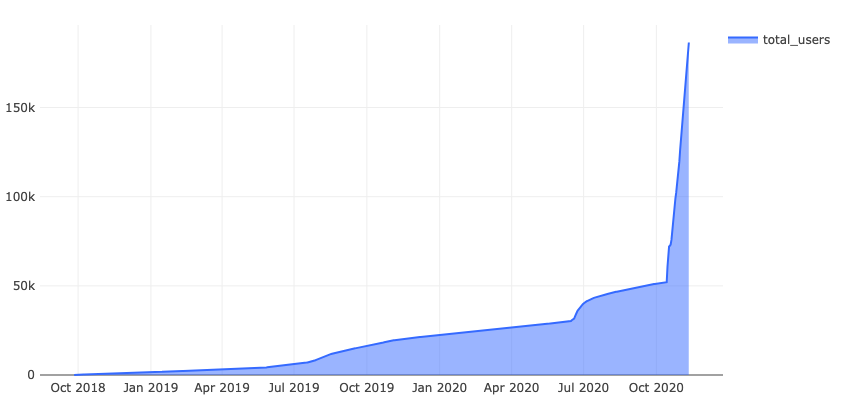

Below you can see Compound’s growth:

Just in case having a ‘10x’ product wasn’t enough, Compound very smartly leveraged the positive virtuous cycle of crypto incentives. For every instant that you hold a deposit or a loan with its network, Compound gives you their tokens. Tokens, which give you voting rights and ultimately ‘dividend’ rights. For free.

In the short term, it makes your loans cheaper and your deposits more attractive. In the long run, it creates a phenomenal moat and user loyalty. You become a true participant of this network, a ‘shareholder’ if you will.

With a good product the more you use it -> the more value you get. With a crypto product, the more others use it -> the more value you get. A great deeper explanation of this ‘network flywheel’ can be found here.

It’s an entirely new business model with a different incentive structure and value distribution mechanism. Airbnb tried doing something similar to reward its ‘super hosts’ but encountered regulatory barriers. It’s hard to imagine traditional banks doing this.

So there you have it - a bank where you have no risk of a bank run, which gives you full control of your assets and gives you its ‘shares’ as you use it. Wouldn’t you like your high street bank to do that for you?