Beyond Finance: Part I

Digital Collectibles

It’s not about the money

Those who’ve been following crypto for a while might associate the peak of the 2017 bubble with this pretty little thing:

Called CryptoKitties, these are programmable images of cats that live on the blockchain network. They are crypto-native objects, very similar to ETH and others, freely transmittable between wallets and interchangeable for other coins. Every kitty is unique with each element being codified to generate a unique combination of eyes, colour, tail etc.

Kids used to collect stickers and now grown-ups collect these ‘cards’ where every single one is unique, their ownership can be viewed on-chain, making them a perfect collectible to boast about. Once they got traction, the amount of trading activity in them was so large that it clogged the network, substantially slowing down all other transactions. Ultimately, with the excitement reaching its peak, one of them was sold for $170k.

$170k for a digital image of a cat? If that’s not an indicator of a market bubble then it’s hard to imagine what it might be (it was). With the speculative mania fading away kitties slowed down, prices normalised and for most people it remained a memory of the good old bubble days.

As it turns out, however, this was yet another fundamental innovation in the crypto land, which opened doors to new realities.

Non Fungible Tokens (NFTs)

That’s the official name of a crypto ‘standard’ (think of it as a file type - pdf, jpeg etc). The ‘normal’ coins follow a certain standard which defines their properties, one of them being a free ability to swap one into another. The NFT standard allows for more creativity where unique content can be created right on the blockchain and can function as part the wider ecosystem with all the benefits of composability. In short, it allows to create digital art, collectibles and many other types of objects which were unthinkable before this.

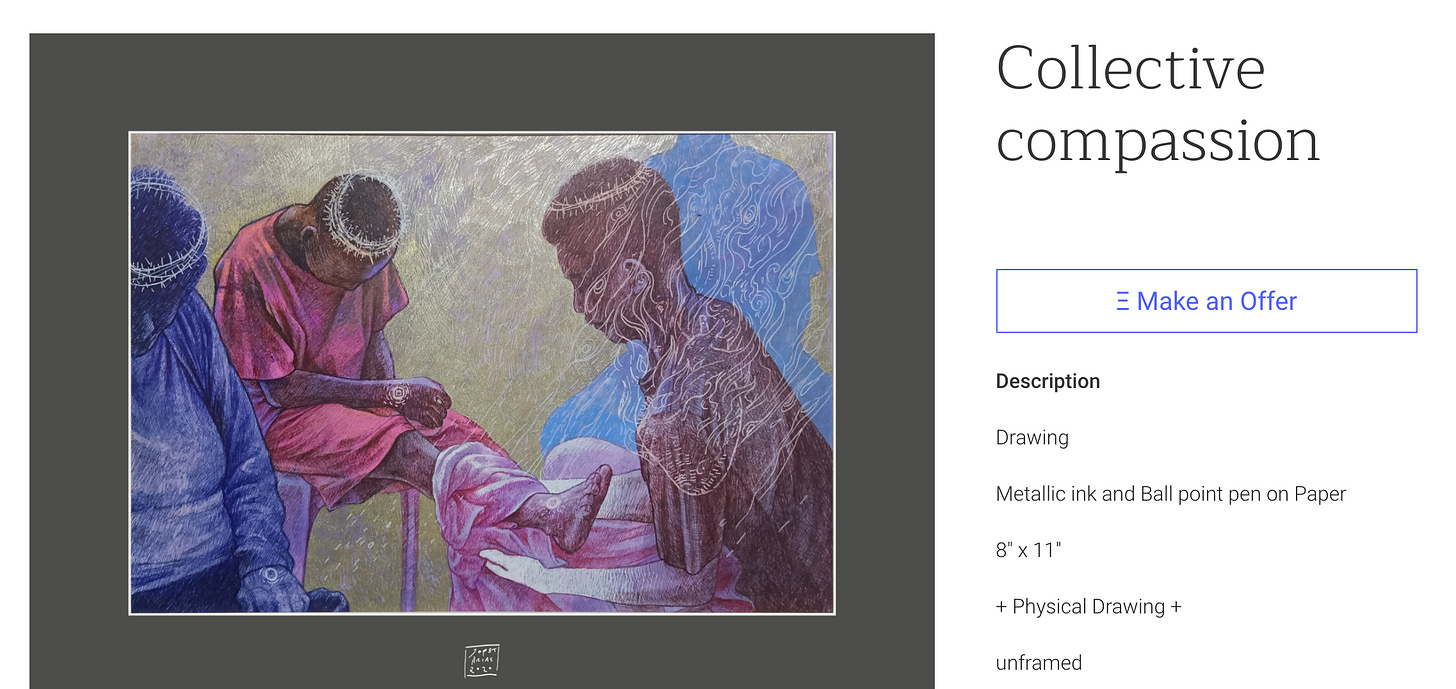

Digital Art? Sure:

The logic of this is intuitive yet questionable. If physical art is understandable and has both investment and aesthetic value, this is little bit more confusing. Aesthetics - sure, but why can’t you just screenshot the same image? That’s the question that’s most often asked about these objects. Turns out, when a limited number of digital assets is created and you can prove you are rightful owner of the original, people attach value to it. Drawing parallels to the physical world, we might enjoy a Water Lilly Pond poster in our apartments but the original is far more desirable.

Now let’s go one step deeper. For those of us engaged in social media, what’s the representation of our identity there?

Avatars - how much would you be willing to pay for your profile picture to be a) unique; b) designed by a famous artist; c) you would have proof of ownership that it’s only yours; d) it easily sellable online at any time? Turns out, people would pay quite a bit.

These are CryptoPunks -a collection of 10,000 unique characters on the Ethereum network. As crazy as it sounds (and looks), they have been featured in Christie's of London and Art|Basel among others and a few days ago one of them was sold for $760k.

If by this time you haven’t given up on crypto and still hope there’s some sanity left, let’s go one step deeper.

Monetising content

This is one of the most often used images of our time:

What if each of them owned this image and they were to rent it out every time the image is used in publications and other media? Wouldn’t it be a great way for artists and content creators to monetise their brands and content?

Whats’s the other content that can be owned, rented and sold? Why not tweets:

The lovely tweet from Mr Musk was proposed to be put on blockchain as an NFT file and it will be tradable as memorabilia thanks to the Cent platform.

A digital publication (newsletters, articles etc - which are effectively just web links) can also be registered as NFT files which are native crypto objects and can therefore have similar composability like the rest of crypto. Publishing platforms like Mirror are on track to allow us to embed NFTs as smoothly as we currently reference web links:

Wrapping this up and in case you were wondering - NFTs and DeFi exist on the same rails so you can already use your collection as collateral to borrow and lend, benefiting from innovation across the whole crypto universe. Try doing that with physical collectibles…

Maybe it is about the money after all…