Market efficiency

A substantial piece of economic theory is based on the Efficient Market Hypothesis - a hypothesis that asset prices reflect all available information, i.e. they are ‘fairly priced’ at any given moment in time.

It’s a contentious hypothesis with most market participants dismissing it altogether given the regular bubble / burst nature of the markets. Some take a more philosophical view that the markets are efficient but on a different time horizon - i.e. if markets overheat and then collapse in a disorderly fashion that’s actually an efficient self-correction, just over a slightly longer period.

What everyone agrees on is that there aren’t any ‘free profits’ - i.e. if market inefficiencies arise resulting in opportunities to extract risk free or unusually large profits, they disappear almost immediately due to immense pools of capital constantly scanning global markets for the tiniest of opportunities. These pools ‘scalp’ every market tick for profits and never allow large discrepancies to arise.

Some inefficiencies are very persistent though as they exist because of structural gaps. Let’s say you discover that you can buy a stock in your domestic market, convert it into its depositary receipt / parent company shares, sell those new shares into the local currency, deposit cash with another broker in that market and buy some other asset, which you can sell back in your local market at a profit. The reality is that you can’t action this ‘opportunity’ as it will take several weeks to shift assets around and who knows where prices will be by then. This leads to some ‘spreads’ persisting in the market where assets aren’t priced efficiently but it’s too costly or risky to try and ‘close’ those spreads.

Things work very differently in crypto.

Atomic Transactions

Crypto allows you to ‘package’ multiple transactions into one, where all of these sub-transactions have to happen instantaneously one after the other.

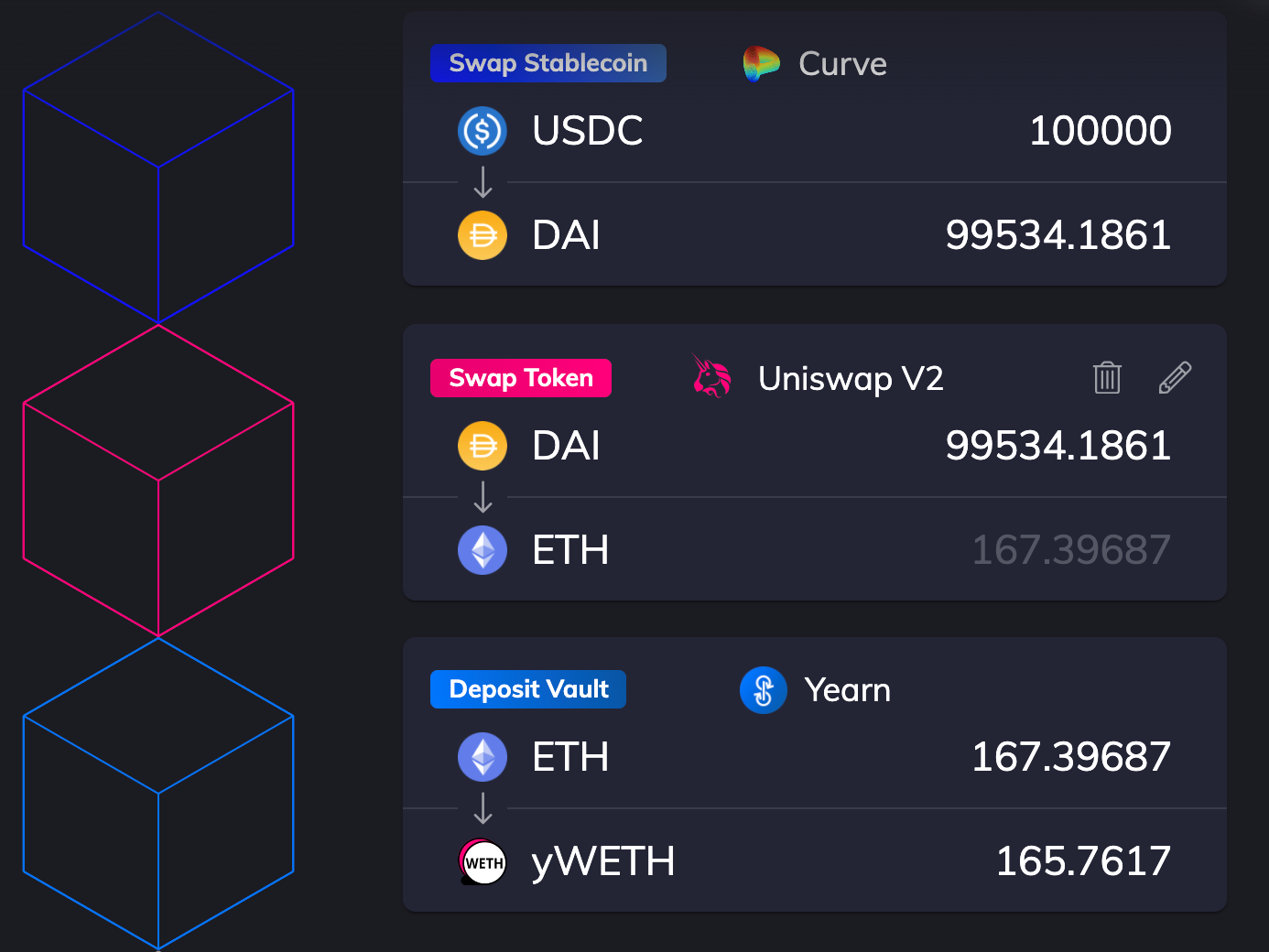

For example you may wish to convert multiple tokens and place the final one on a deposit as one transaction. No problem:

Would you like to deposit your coin into a DEX to provide liquidity and then swap your stake to deposit another token elsewhere - all as one transaction? Done!

This unique feature of the blockchain networks allows us to rethink the nature of financial transactions and brings us to a whole new level of efficiency. But even a ‘packaged’ transaction should require some amount of capital.

Does it though?

In a flash

Couldn’t one transaction begin with ‘borrow’ and end with ‘repay’?

It absolutely can and it’s called a flashloan. You can identify an opportunity, borrow capital, conduct a series of trades and repay the loan in one single transaction. Below is an example of such a transaction:

Step-by-step breakdown:

You have 6k USDC

Borrow 94k USDC

Swap 100k USDC for 253 ETH

Swap 253 ETH for 145k sUSD

Swap 145k sUSD for 146k USDC

Pay back 94k USDC

-> Profit 46k USDC (1 USDC = 1 USD)

In one step someone was able to borrow, trade and repay $94k, making a risk free profit on $46k. This involved 3 different platforms and was completed in one transaction!

Flashloans are native features of blockchain transactions and they’ve been made easy to use by Aave - another crypto ‘bank’. Rolled out just in the begging of the year, Aave has already facilitated $1bn+ of flashloans.

There’ve been instances of $10mn+ borrowed in individual transactions, indicating that scale of such arbitrage opportunities can be substantial.

What happens to financial markets when you no longer need any capital to perform certain transactions? That has literally never happened before. But is happening now.

This implies a completely different set of market participants (i.e. software developers instead of traders) and a whole new market infrastructure, most likely a much more efficient one.