Core Pillar of Crypto

Stablecoins

The fundamental functions of money

We’ve established that (some) cryptocurrencies have inherent value and can be viewed as investable assets. They are, however, volatile by definition and are therefore a poor form of payment and credit collateral and cannot serve as savings / income generating instruments. Simply put, while crypto might be a good alternative to gold or Nasdaq, it’s not actually convenient as a currency!

In order for crypto to truly function as an alternative monetary system with scalable financial potential, it needed a tool that could solve all of the above - effectively a digital dollar. And since there aren’t any limits to human ingenuity, that’s exactly what we got. Enter stablecoins - digital currencies, pegged to USD with monetary / algorithmic mechanisms keeping the rate fixed at 1:1.

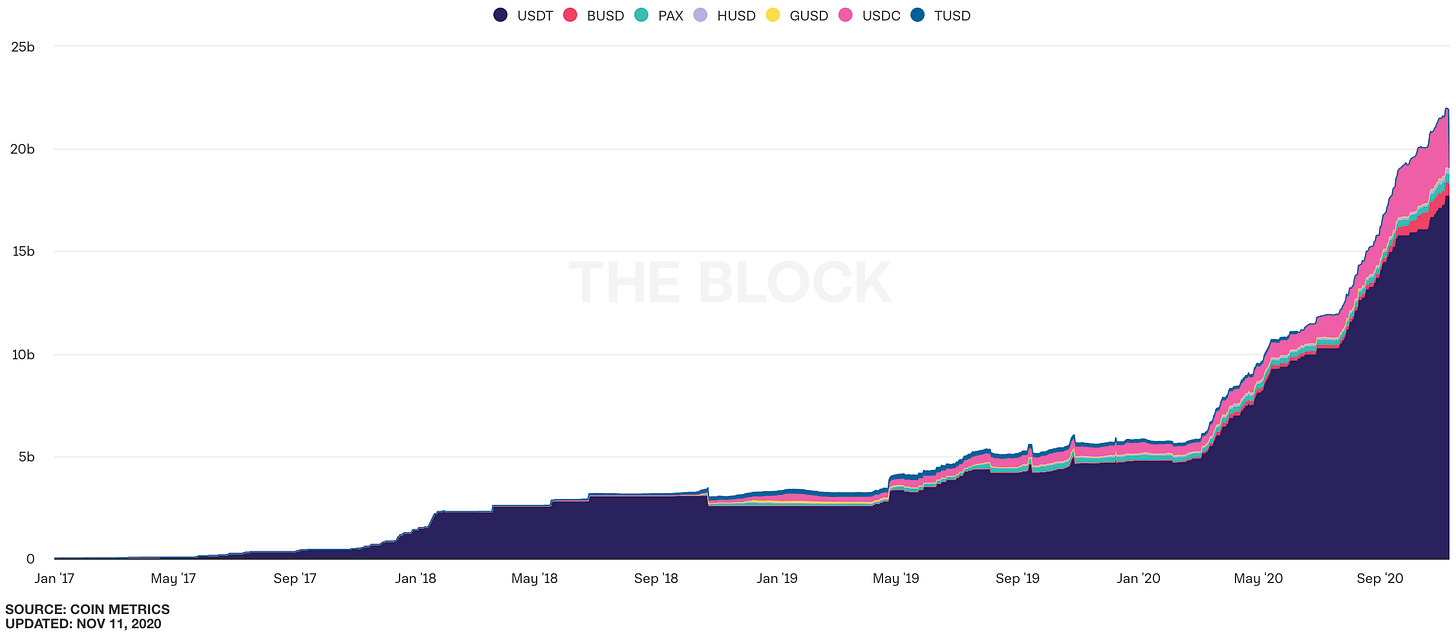

“Digital USD on open crypto rails” quickly gained traction (with multiple providers offering their versions) as it allows for instantaneous cross-border payments, borrowing, lending, income generation, etc. without any exchange rate volatility.

$20bn+ of stable assets allowed credit and investment products to blossom over the last few months at a phenomenal pace of innovation. This is still a very young market with the “Move Fast and Break Things” attitude, yet it’s becoming visibly mature with hundreds of billions at stake now across the whole ecosystem. There are constant signs of validation emerging with Facebook and various Central Banks working on their own stablecoins and US banks being able to hold reserves for stablecoin issuers.

Are Stablecoins reliably stable?

Financial assets are, of course, only truly tested in the times of volatility and crisis as their perceived safety might vanish in an instant. Crypto is a very complex set of tech infrastructure and few people truly understand it at the code level, adding another set of risks. Hence for now we have to rely on formal tech audits and empirical data (which, to be fair, is still quite limited from a statistical perspective).

Below we can see the 12m performance of three largest stablecoins (USDT, DAI and USDC) vs Bitcoin (red).

Over these 12 months the BTC market has experienced sharp corrections, margin calls, indictments of some of the largest exchanges and a strong bull rally. Stablecoins held their pegs throughout these cycles and structural shocks (their volatility is barely visible) as they have done over the previous years.

Why do Stablecoins matter so much?

The ‘killer apps’ of the previous crypto cycles have been unregulated activities and financial speculation. While exciting, it’s a very niche use case.

The scale comes when this ‘new financial system’ allows to generate deposit yield 10x higher than the traditional system. It comes when creators of content (articles, tweets, media) can be paid in real time with no geographical barriers. It comes when physical assets, such as real estate, ships, art and many others can become as liquid as stocks and have lending value attached to them.

And, most importantly, the scale comes when all of the above is interoperable and composable - i.e. all imaginable financial transactions can happen on the same open platform where every single bank, exchange, broker, insurer, wallet and investor can process complex transactions with one click.

This is the exact opposite of how the existing financial system works with regulated participants operating in silos and extracting hefty margins for being ‘trusted partners’.

The new system won’t be built in a day and we’ll most definitely see failures, regulatory interventions and hacks, but if one thing is clear from history it’s that progress can’t be stopped and open global systems always win. And once you add direct economic incentives on top of them, they become truly unstoppable.