Despite a decline from the cycle highs, Total Value Locked (TVL) in DeFi has remained steady over the past few months. It has even witnessed a slight increase as prices have risen. However, much of this capital and activity is concentrated on just a few chains.

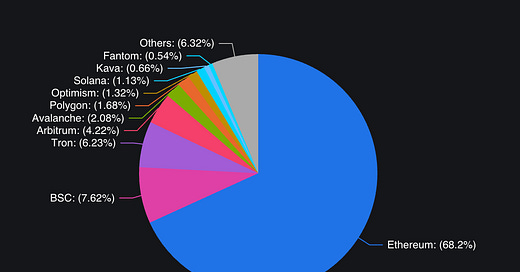

While DeFi Llama lists over 190 blockchains, the top 5 account for almost 90% of TVL with Ethereum holding over 2/3 of the total.

What is preventing capital from transitioning to the plethora of new or non-EVM blockchains that have recently become operational?

Decentralised finance operates on a set of so-called "money legos'' that can stack and interact seamlessly. While the ecosystem on Ethereum has developed over the years, many other chains are trying to attract capital but may be missing some key pieces of infrastructure that grease the wheels of on-chain activity and provide further options to capital allocators.

Native Stablecoins

We mean this in two ways.

Firstly, having native USDC or USDT on chain is highly beneficial, allowing prominent actors in DeFi to onboard to the chain with ease. The proliferation of bridged assets has made it easy to move between the different ecosystems in DeFi. But using these as the main stablecoins of choice on a new chain opens up additional risk that limits capital allocations.

Only a small amount of USDC in circulation is locked in bridges as users will always prefer native issuance for security reasons

Secondly, it's beneficial to have native stablecoins, particularly those of the Collateralised Debt Position (CDP) type. This allows leverage and yield on native protocols and liquid staked tokens. It can also be worth it to have a number of varieties. Ethereum for example has LUSD that is simple and straightforward with only a single collateral type. This limits risk and makes it very secure while limiting growth. Other CDP stablecoins can fill the niche for long tail tokens or more exotic interest bearing assets.

Spot Decentralised Exchanges

Needless to say, it's advantageous that a Decentralised Exchange (DEX) is typically one of the first protocols introduced in an ecosystem. However, there are a few nuances.

A fork of Uniswap v2 can effectively incentivise capital migration to any chain. It also limits security concerns when there is a dead simple DEX on the chain. Many of the newer chains tout speed, order book DEXs, and various new protocols. These all have their place, but straightforward AMM protocols still reign, even on Ethereum.

Stableswaps are another important DEX configuration. No one moving lots of money around on chain wants to take large slippage when trading between tokens that would be 1:1 on another blockchain.

Lending Platforms

Lending protocols are one of the largest DeFi categories with over $10b TVL

As with CDP protocols, lending protocols allow users to leverage their token positions and hedge. On Ethereum these are some of the largest protocols by TVL and serve as capital anchors in the ecosystem. At the same time, while they are important for a chain ecosystem, lending protocols also take a lot of care to deploy and manage, as they are more susceptible to attacks than DEXs.

For other chains, it would be ideal to have protocols that are deployed as forks of the typical Compound or Aave pooled lending models. Additionally, they can differentiate themselves by segregating various types of tokens into distinct lending protocols. A good example of this is Bastion on Aurora, where multiple Compound-style pools are deployed that let more risk-averse users deposit in parts with more vanilla assets that have deeper liquidity, while also creating smaller markets for long-tail assets.

Other Anchor Protocols

While each chain should include a range of the above-mentioned protocols to establish basic financial services, the key to success may lie in exploring innovative new primitives.

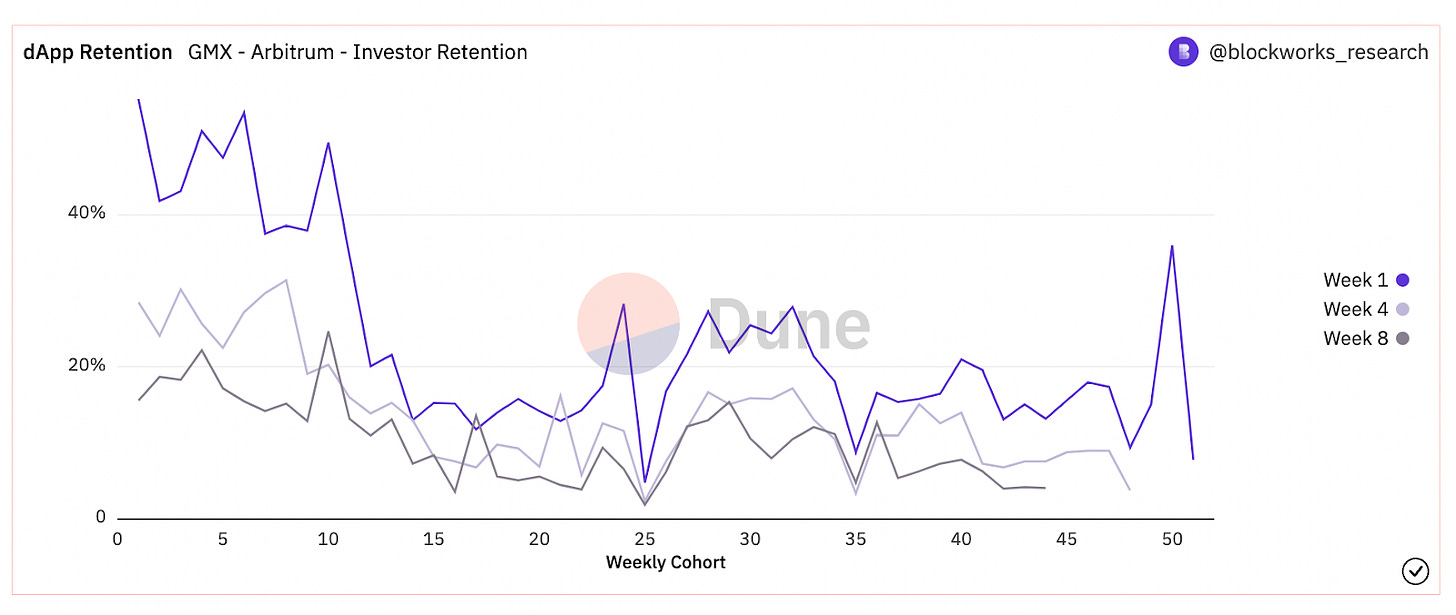

High GMX retention created an anchoring set of users that later expanded to other protocols on Arbitrum.

Although not every blockchain can boast such success, the growth of GMX on Arbitrum exemplifies the benefits of having an anchor protocol in a new chain's ecosystem. GMX has remained one of the largest protocols on Arbitrum, and represents a unique offering for the chain. In turn, this brought a set of users that were sticky from using the protocol. From there users are more likely to branch out and explore other areas of the chain.

What have we seen work well?

As active liquidity providers in DeFi, we’ve seen all kinds of ways for chains to incentivise usage and attract new capital. What has worked well are a few key ideas that help to limit risk and increase confidence for allocators:

Work with protocols that have early traction: As discussed above, anchor protocols that create a unique offering for a chain will attract new users. By incubating and working closely with promising protocols in the ecosystem, newer chains can create a culture around the protocols that differentiate the services available. Beyond GMX on Arbitrum, other good examples include Optimism’s work with Synthetix (an old DeFi blue chip that was a first-mover to Layer 2) and Velodrome (a fork of a previously failed project that was able to find great traction in a newer ecosystem).

Don’t be afraid to keep things simple: While new DeFi legos are shiny and will help to attract users, there still needs to be a base layer of simple protocols to attract larger capital. If all of the protocols on a new chain are new, exotic or unknown quantities, it will be much harder for more risk-averse capital to justify moving over. Instead, make sure that the basics are covered off and perform well. This will allow allocators to “park” money while exploring the chain and evaluating the newer opportunities.

Partner with Established Protocols and LPs: when newer chains work with established DeFi protocols it helps to reduce risk for allocators. Examples include Aave moving early on to Avalanche and other Layer 2 solutions, which provided a trusted lending market with battle-tested code. DeFi native LPs like us also are always looking for new opportunities and we work directly with chain ecosystem partners to source opportunities and provide early liquidity for protocols. By connecting new projects with established LP partners, new chains can attract capital while making the allocation less risky for LPs.

Where does this leave chains looking for more TVL?

It may be an uphill battle to attract new liquidity in an environment where all markets including those outside of crypto are undergoing a period of uncertainty. However, DeFi users are among the most outgoing market participants. If you build it, they will come and try it out.

But DeFi as a technology continues to move up the maturity curve, and it will no longer be enough to just have the most basic of DeFi primitives available in an ecosystem.

Chains looking to increase their total value locked will benefit from making the experience of users as seamless as possible. Without all of the pieces working together, the entire experience suffers and it makes it much harder to grow. This means providing the full range of services DeFi users have come to expect in an ecosystem and creating a complete package where DeFi's composability can really shine.

Re7 Capital - DeFi liquidity providers