One of the (fair) critiques of DeFi is that it exists in self-isolation and is a self-serving system. To a certain extent, it’s true. DeFi assets exhibited enormous growth…

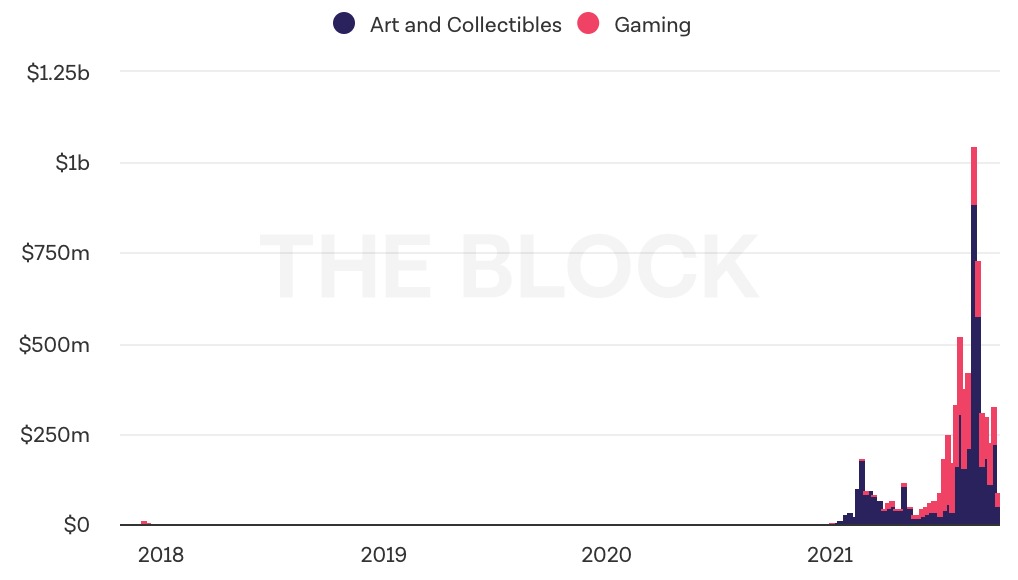

… but apart from financial use cases (e.g. credit / payments / speculation), the scale of ‘consumption’, while having grown exponentially, is still very humble compared to the size of the DeFi market.

This consumption revolves around NFTs, virtual worlds and gaming. Such digital consumption will no doubt continue to grow, but DeFi could do more.

There’s a common saying that FinTech targets the front-end of finance (i.e. makes same products better / move convenient) while DeFi addresses the back-end - i.e. the whole infrastructure of finance which would allow for new product and limitless innovation. It’s therefore fascinating to monitor the early use cases of capital pools of DeFi and traditional finance (TradFi) being bridged.

Global pool of capital

DeFi is exciting because it allows to treat all blockchain assets as one fluid capital pool, which can be codified to follow certain rules. This leads to nimble capital flows and ultimately lower cost of capital.

Centrifuge is one of such pioneers and allows seamless financing of working capital assets, real estate and even gig economy revenue streams:

Maple Finance is a DeFi protocol syndicating loans to market makers:

Borrowers need to go through a due diligence process and once they are approved and whitelisted, they are able to borrow from the DeFi ecosystem.

This is an extremely efficient way of coordinating capital and over $2bn has been committed to such lending pools across several DeFi protocols. So far there have not been any notable defaults on such loans, but they will of course come and this will be the real test of these products.

Lending is, first and foremost, a risk management business. A 10% return on your loan becomes almost irrelevant if there is a default and your principle is at stake. This business requires thorough due diligence prior to issuing the loan and strong rule of law and efficient set of institutions that would allow you to recoup (some of) your capital should things go south.

The attractiveness of DeFi, however, has been that is moves at the speed of light and its relatively low credit risk when it comes to lending on the blockchain. Blockchain loans require 100%+ collateral, are fully transparent and have an efficient system of recovering such collateral in an event of default. The ‘real world’ is more messy and it may be harder to recover losses if you are lending to an offshore entity.

As the space matures and more institutional players come in, they can still benefit from the efficiency of DeFi processes while leveraging real world best practices. Will this split DeFi into blockchain-native financial flows and 'real world’ flows? Time will tell but either way, we expect this use case to grow drastically.

Merging the two worlds

The use case above demonstrates how demand for capital from ‘one world’ can be met by supply of capital from another one. But if ‘Finance is Code’, surely we can do more?

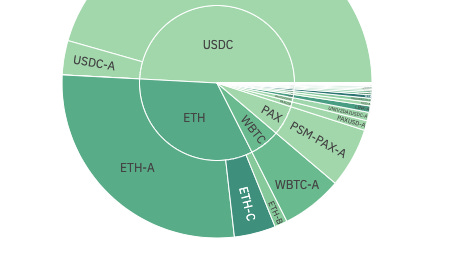

Let’s look at DAI - one of the major stablecoins in the DeFi ecosystem. This stablecoin is designed to always trade around 1 USD and in order for the DAI coins to be minted, they require for some collateral to be locked into the Maker DAO protocol:

The piechart above shows various crypto assets currently backing the DAI stablecoin. Such interoperability of DeFi assets allows for seamless existence of its ecosystem. Could we somehow treat real world assets as crypto native, embed them into DeFi and therefore have one global ecosystem of assets?

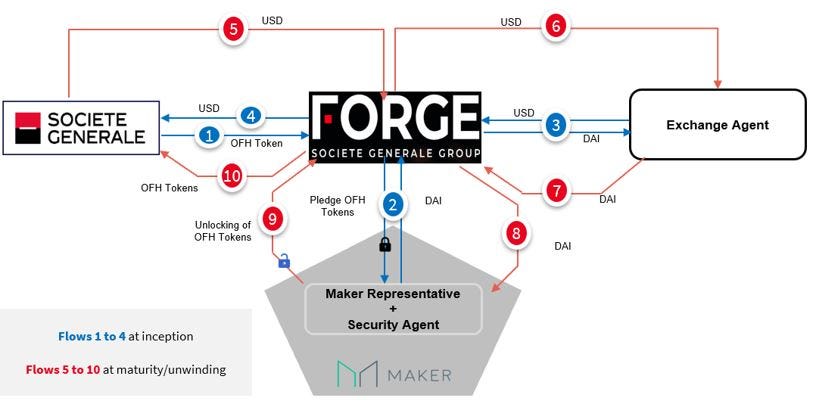

That’s exactly what Societe Generale is attempting to achieve. One of the world’s largest banks submitted a proposal to the Maker DAO community offering to issue one of its bonds as a token on the Ethereum network and to have it whitelisted as collateral backing the DAI stablecoin.

This is fascinating on many levels - one of them being that a global bank is posting investment proposals on open forums asking a widely distributed community of voting token-holders to accept its proposal. The other, of course, is the innovation itself.

The structure is complex but the bottom line is that the two worlds are finally starting to collide and while there’s a lot of work ahead, the mere fact of such initiatives being launched indicates DeFi may not be self-serving after all.

Author is the Managing Partner of Re7 Capital - a stablecoin centric DeFi fund.