Quest for the ultimate yield

The first crypto pioneers achieved exponential growth on the back of strong incentive models, paving the way for wider adoption. Both legitimate projects and opportunistic copycats popped up, some of them quite ridiculous. Here are just a few ‘high yield deposits’ that emerged over the last months:

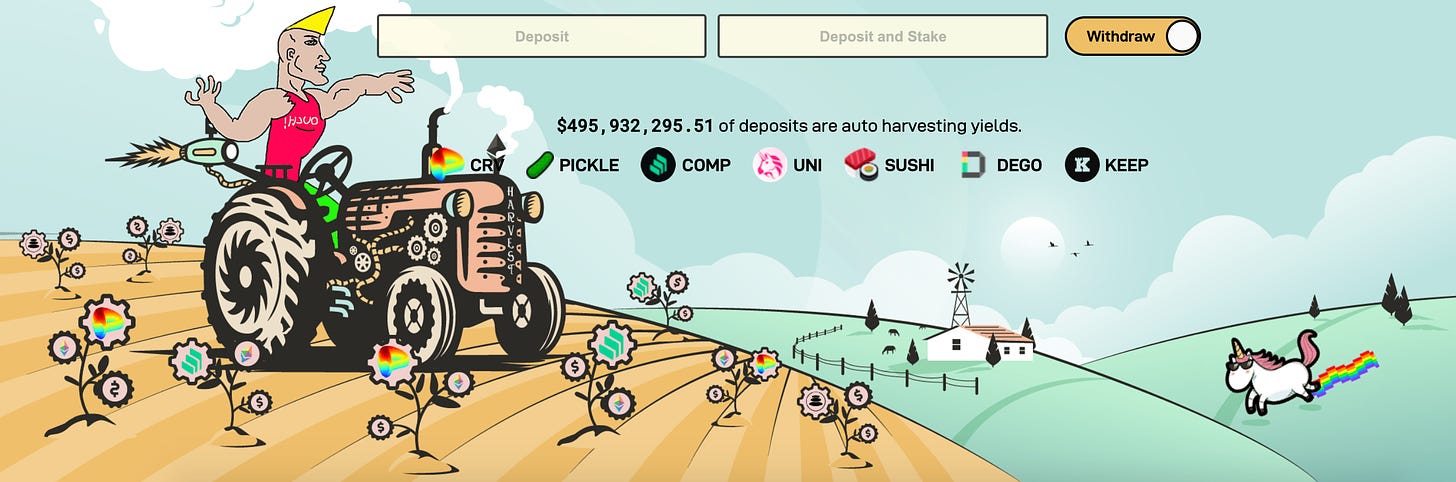

What in the normal world is called providing deposits / financing or simply lending, in the crazy land of crypto gets called ‘yield farming’ and ‘liquidity mining’. Dedicated crypto social media channels quickly promoted the theme and generated a brand new trend. One of such ‘yield farming’ aggregators looks like this:

Ridiculous? Yes.

So childish you want to dismiss it straight away? Absolutely.

That is until you look closer and see that “$496mn of deposits are auto harvesting yields”.

$496mn. In just a few months. On open source platforms that look like this. Makes you wonder how much capital will be deployed once this looks serious enough.

That’s an interesting feature of crypto - because of the lack of regulation and abundance of capital in the ecosystem where new millionaires emerge weekly, the crypto crowd can afford to look childish, defiant and unprofessional. It’s often done on purpose to appeal to the audience of the cool early adopters, while the capital at stake is quite ‘grown up’.

But we digress. What do you do when the coins you’ve been holding can finally generate income or when you realise your USD can now earn 10%+ vs 0 on a bank account? You start looking for the best yield possible! For the sake of sanity, let’s call this the ‘optimal’ yield and not simply the highest - there’ve been a few projects offering 2000% yield only to collapse within days. In the traditional world, you would call your banker, look at comparison websites or use a roboadvisor. Since crypto is designed by digital natives, this problem is solved by automatic aggregators.

Every trend needs a symbol

Here’s another ridiculous image to reinforce your perception that this is all nonsense.

This creature is an unofficial logo of a project launched in early 2020, called yearn.finance. It was created by a sole developer - he wanted to find the best yield for his coins so he built a bot that was scanning the network and shifting the deposit from one platform to another. Optimal yield is achieved by finding the best rates available, while taking into account transaction costs (each ‘shift’ executed on the blockchain costs money).

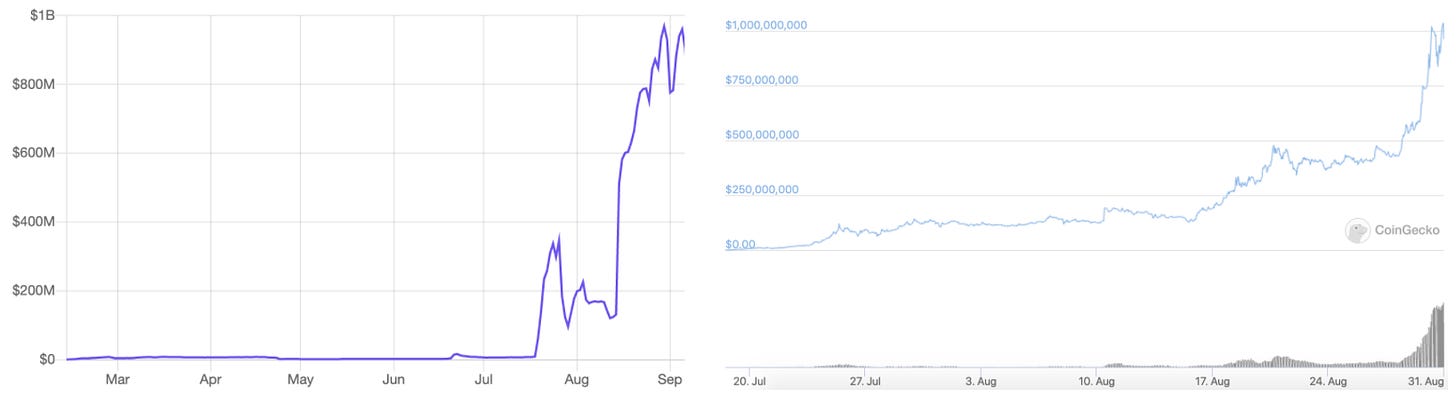

In the true spirit of crypto, its founder opened his project to other users and by July 16th 2020 yearn.finance had $8mn of AUM.

On July 17th the founder published a blog post, announcing a token launch and an incentive model (i.e. you invest into ‘deposits’ via this aggregator - you get free yearn.finance tokens). It’s important to note that the founder didn’t allocate a single token to himself and gave 100% to the users.

A month later yearn.finance had $1bn of AUM and reached a $1bn MCap.

A billion dollars deposited in 30 days. A unicorn valuation in less than a year. $0 raised.

This is the power of open platforms when the right incentives are in place.

A couple of months later yearn.finance boasts a wide selection of deposit providers and the list is growing.

The product has been evolving non-stop and is morphing into a network. This is where things get interesting.

Community

The beauty of open platforms is that you don’t know where they will take you. You don’t know what the final product will end up being. What you do know is that you need a strong community of users / builders who are incentivised to make this network succeed.

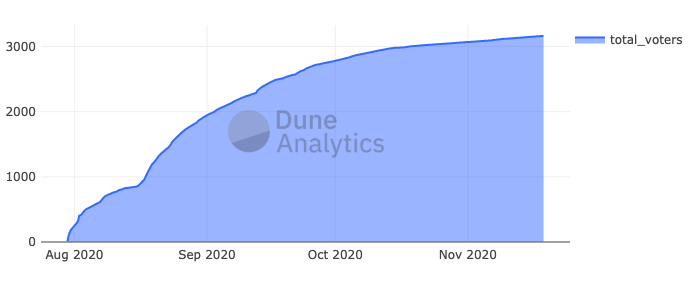

Early platform users were awarded tokens -> they started using the platform even more and contributing to it -> more product features emerge -> more value is captured -> tokens appreciate -> community contributes even more.

This virtuous loop formed a real community around yearn. Token holders built additional tools, e.g. trading and voting, and have been running the governance of the network.

3000 people are actively voting on the future of the network! Not a bad run from 1 person in July.

The community quickly decided that ‘yield optimisation’ services shouldn’t be free and introduced a performance fee accruing to the token holders, not unlike traditional equity. Moreover, if you want to vote, you place your ‘shares’ in special custody which generates additional yield for you - you finally have a real incentive to be an active voter!

Composability

The killer app of such networks is that all functions are written in the same format - it doesn’t matter if it’s trading, borrowing or providing insurance. The community has therefore quickly built new products, connected to the ones that exist on the blockchain and embedded them all into one portal!

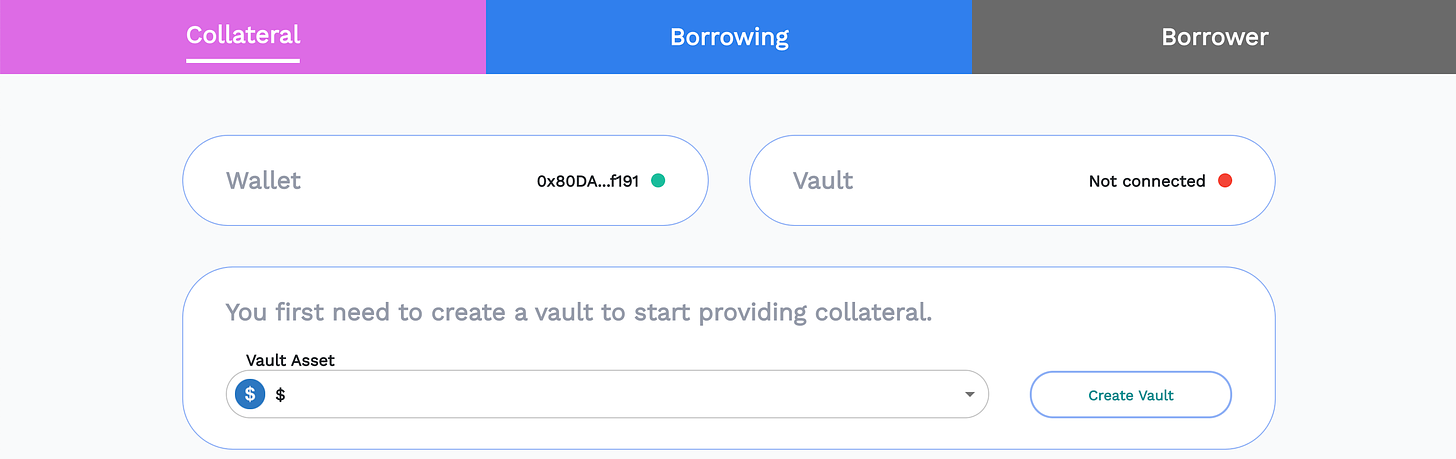

You can use assets as collateral and borrow on the back of them.

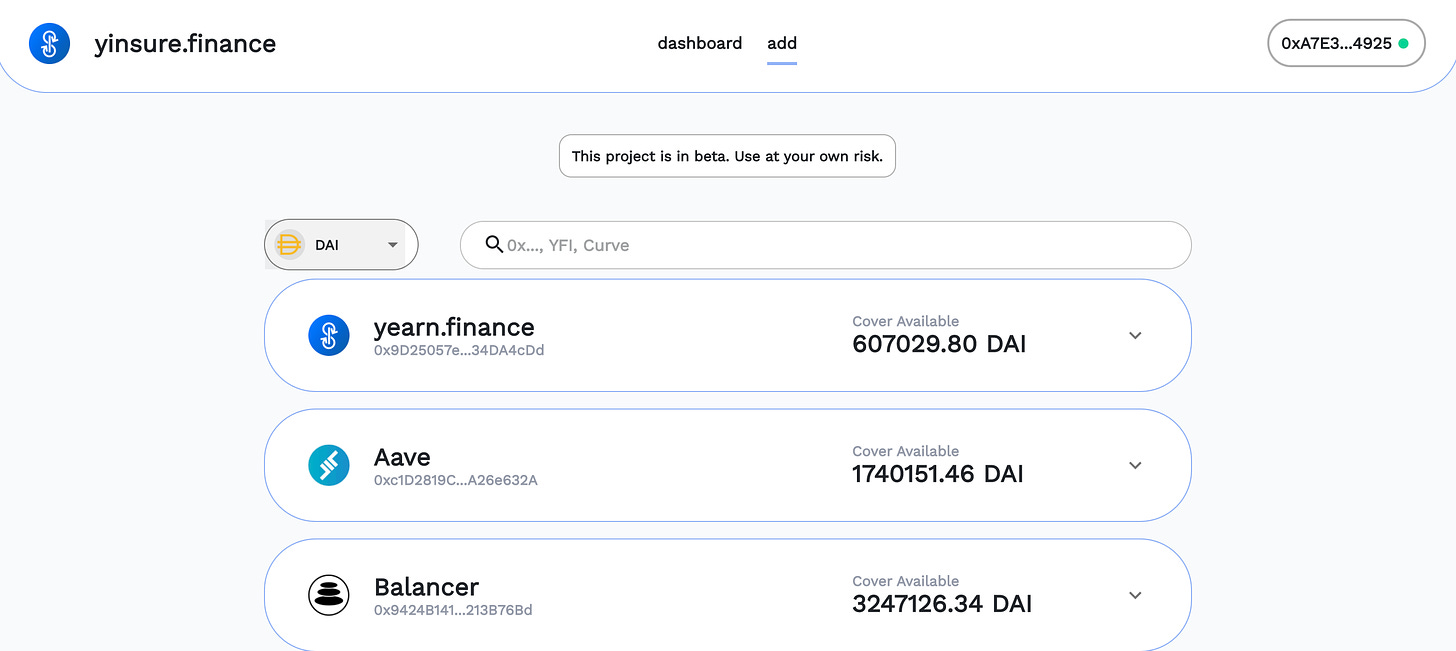

You can get insurance / hedging…

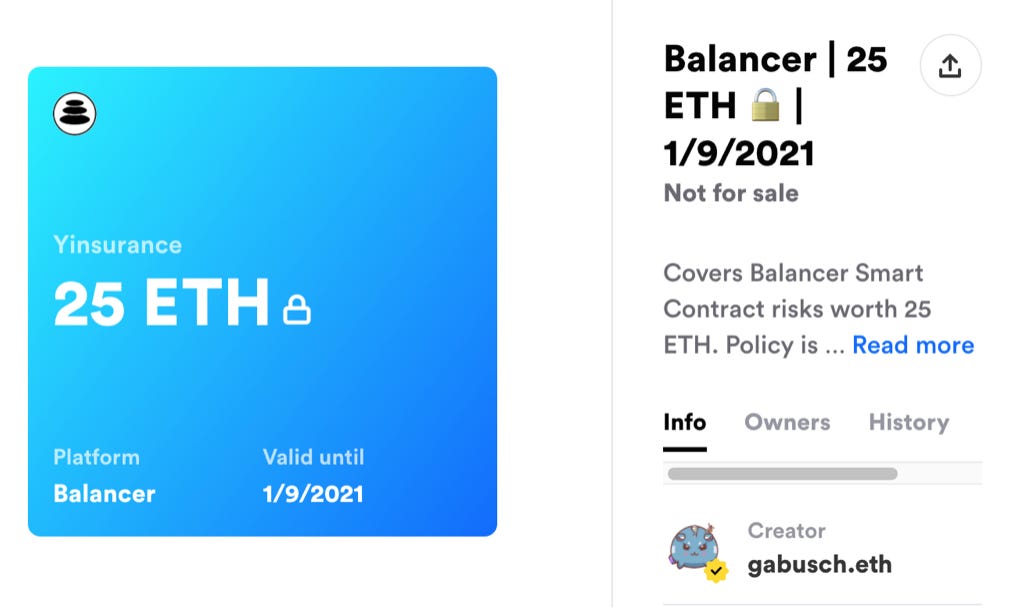

… or trade your insurance as a Non Fungible Token (a visual representation of a unique asset / financial contract - to be covered in more depth in future posts).

This is no longer a deposit aggregation service - yearn.finance is a living being on an open network and by interacting with other platforms it has become a financial supermarket. And it all started just a few months ago with one person looking for a good deposit rate.

Interconnectedness of all things

Traditional FinTech roboadvisors replicate investment processes of large banks / funds and provide more or less the same product (an investment portfolio in line with pre-defined criteria) to a broader range of customers at a lower cost. It’s a good tool and it does what it’s supposed to. Crypto roboadvisors look like this:

It’s an ever-changing web of code (read financial products) where all imaginable financial payoffs can merge into one. On a stand-alone basis these products look like they are just replicating their real world predecessors. Viewed as one network, however, they present a whole new spectrum of opportunities, features and exciting financial structures.

That’s the real innovation.