Where do DEXs come from?

We’ve previously written about Decentralised Exchanges (DEXs) and their novel ways of engaging users and capital providers. They have demonstrated formidable growth with Uniswap (the largest DEX) now processing 35% of Coinbase volume (the largest traditional exchange).

And yet Uniswap employs ~15 people vs ~1500 at Coinbase!

How do these businesses / communities emerge? Some are a result of a multi-year R&D process supported by VCs, while some have more unorthodox origins.

This is the story of SushiSwap - a DEX launched 6 months ago.

SushiSwap launched on August 27th 2020 as a fork of Uniswap by an anonymous team, led by an individual with a social media nickname ‘Chef Nomi’. Sushi’s ‘product’ was a basic copy paste of Uniswap - an interface allowing token swaps.

It’s not of those ‘spot five differences’ challenges - it’s clear copying. In the traditional world this would have ended badly, but in the world of open source software, where code is publicly available, such forks cannot be stopped.

Uniswap also had another product, a very lucrative one, and that’s the one SushiSwap was really after.

It’s the tooling that allows anyone to become a market-maker and provide liquidity to collect the trading spread. The interesting point here is that unlike traditional world which allows USD -> Stock trades, in crypto you can trade Stock A -> Stock B. This feature, unique to crypto, allows those who are fully invested to generate additional yield on their assets. And that’s what Sushi was after.

In order to draw that capital away from Uniswap onto its network, Sushi had to come up with a different set of economic incentives.

On Uniswap, liquidity providers earn fees as long as they are actively providing capital. Once capital is withdrawn, the income stream stops. SushiSwap chose a different path where providing liquidity earned rewards in the form of SUSHI tokens. This SUSHI token has a claim over the portion of fees the platform generates (0.3% per trade) and distributes those fees to its holders. This effectively turns liquidity providers into shareholders and allows them to benefit not just from the direct return on their capital, but also from the growth of the whole network.

By creating this additional economic loop SushiSwap drew $800mn of capital from Uniswap within one week. Sushi token rallied and got listed by major centralised exchanges in record time.

The drama

This method of launching and scaling was dubbed a ‘vampire attack’ and created a lot of contention in the crypto community.

In crypto that’s a big challenge - without a community of strong supporters it’s hard for a project to stay relevant and scale. But their problems didn’t stop there.

The founder of SushiSwap - Chef Nomi - was in control of a ‘Development Fund’ wallet which held 10% of Sushi tokens. And just 10 days into Sushi’s existence he sold all of the tokens in that wallet and pocketed ~$14mn. Nice pay check for a few weeks of work…

Sushi token price tanked 70% and massive outflows followed. With market losses of hundreds of millions of dollars, tokenholder outrage was quite understandable. Despite the losses, there was still $1bn+ sitting in Sushi’s product with serious vested interest. What do you do when an anonymous founder pockets the project’s funds and is still in control of the keys to the code that governs the protocol?

Numerous investigations were launched alongside social media campaigns to pressure Chef Nomi to release the control of the project. Within one day of the theft, a working group emerged, led by reputable investors / founders in the space and Chef Nomi ended up releasing Sushi keys to them, which allowed the project to continue to function with some level of trust.

And then, a week later, Chef Nomi returned all the stolen funds back to Sushi!

You can’t make this stuff up… Was it a result of social media peer pressure or was Chef Nomi identified on the back of some investigation and pressured to return the funds? Who knows, but the outcome of this messy process was full recovery of stolen funds and project control being passed to a group of people abiding to certain governance rules.

It’s an interesting case study of decentralised governance, where economic incentives drive group behaviour aimed at achieving the best possible outcome for their interests.

Case study aside, what does this mean for the future of Sushi? Do such events lead to a project’s demise or the opposite - higher level of trust following a major stress test?

The answer lies in the number below.

22%

This is the market share of this 6-month old decentralised exchange.

$3.48bn is sitting on Sushi to provide liquidity and $235mn is being traded daily.

A decentralised app which launched as a copycat and went through a crisis, which would have destroyed a traditional business. And yet it has still been able to accumulate a massive market share. This means that the incentive structure is strong enough to bring developers, users and capital providers together to work towards a viable product / business.

What are these incentives?

The answer may not surprise you

It’s the cashflow.

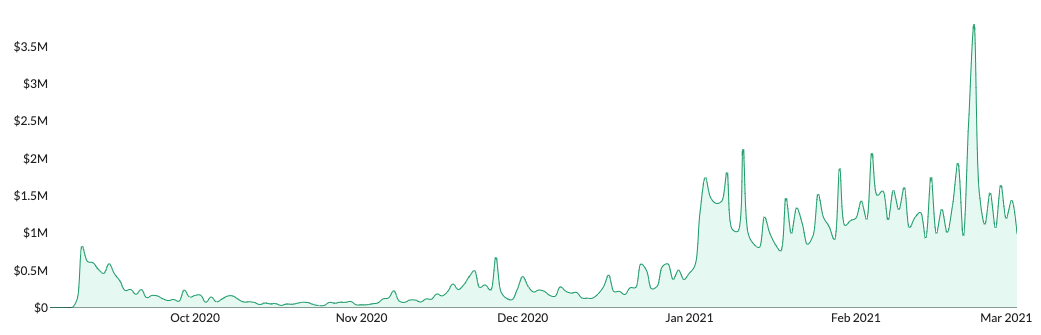

Being a popular trading venue is quite lucrative and Sushi’s revenue has been exceeding $1mn per day for a few months now.

That’s usually enough to get people excited.

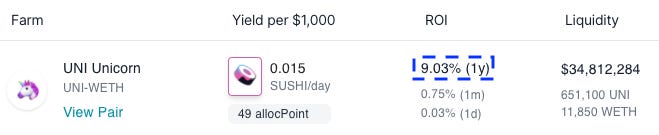

This revenue includes both the yield earned by those providing liquidity as well as the fees taken by Sushi as a matching engine. While liquidity providers capture 80%+ of this revenue, the rest is distributed to Sushi token holders, providing a decent dividend yield.

An anonymous team builds and launches a product and a freely tradable token -> the product attracts users and charges fees -> fees are distributed to token holders.

This flow has a very clear resemblance to a typical publicly-listed company (which is great, because we finally have crypto tokens backed by real cashflows), but there also are some key distinctions. Due to the composability nature of such tokens, they are more functional than traditional stocks. Imagine buying a stock and supplying it to traders who want to sell it short or simply trade it (while still earning your dividend yield). The stock itself becomes an additional tool to generate returns.

There it is - the case study of a decentralised app launched by an anonymous team, which went though a major crisis and yet in just 6 months it grew to become one of the top players in its market with solid revenues and token economics.

Next time you’ll be ordering rolls you may remember that not all sushi is created equal.