Exploring NFT Finance

NFT AMMs, Lending, and Derivatives Oh My!

Branching out from our usual explorations in DeFi, we are going to dive into the adjacent world of NFTs (non-fungible tokens). While it’s the crazy pictures and eccentric characters that usually capture headlines in the NFT space, there is a lot of innovation happening under the hood.

Most interesting to us are the new experiments in NFT finance. Protocols are creating new use cases for NFTs by building on some of the concepts of DeFi.

New markets are using the decentralised liquidity pools and automated market making (AMM) and applying it to NFT trading. Other protocols allow for lending and borrowing on NFTs. Add in protocols that create derivatives like options or perps based on NFT prices. All of this is adding a new layer of sophistication to the NFT market.

AMMs for NFTs

Automated market makers are the dominant form of exchange on the blockchain. In DeFi, we use these every day to trade tokens. AMMs work based on a formula that prices swaps between two tokens in a pool.

In contrast, most NFTs are still traded using a traditional order book model. Participants enter bids and asks for specific NFTs or for any piece in a collection, and then the market fills these as people buy and sell.

SudoSwap was the original platform to pioneer the AMM model for NFT markets, but newer protocols like Putty's Caviar are coming onto the scene as well. The chart below shows how total volumes have grown since the launch of SudoSwap’s AMM.

In contrast to the traditional order book NFT markets, AMMs offer new options for customization for both liquidity providers and traders. Just as the DeFi AMMs have seen constant innovation since the early days of Uniswap v1, we expect the design space for NFT AMMs to expand as well.

NFT Lending

Money markets are now a ubiquitous feature in DeFi and some of the largest holders of assets on chain. While still early, there are several options in the market to lend or borrow against NFTs.

Each protocol has nuances for how they match lenders and borrowers as well as manage risk. Some protocols like BendDAO offer a pooled capital model similar to Aave or Compound. Still others like NFTFi and Arcade use an order matching approach where borrowers and lenders can submit bids and offers for loans.

For borrowers, accessing capital without selling your NFT is an attractive proposition. Some more sophisticated users are also using these protocols to hedge their NFT holdings.

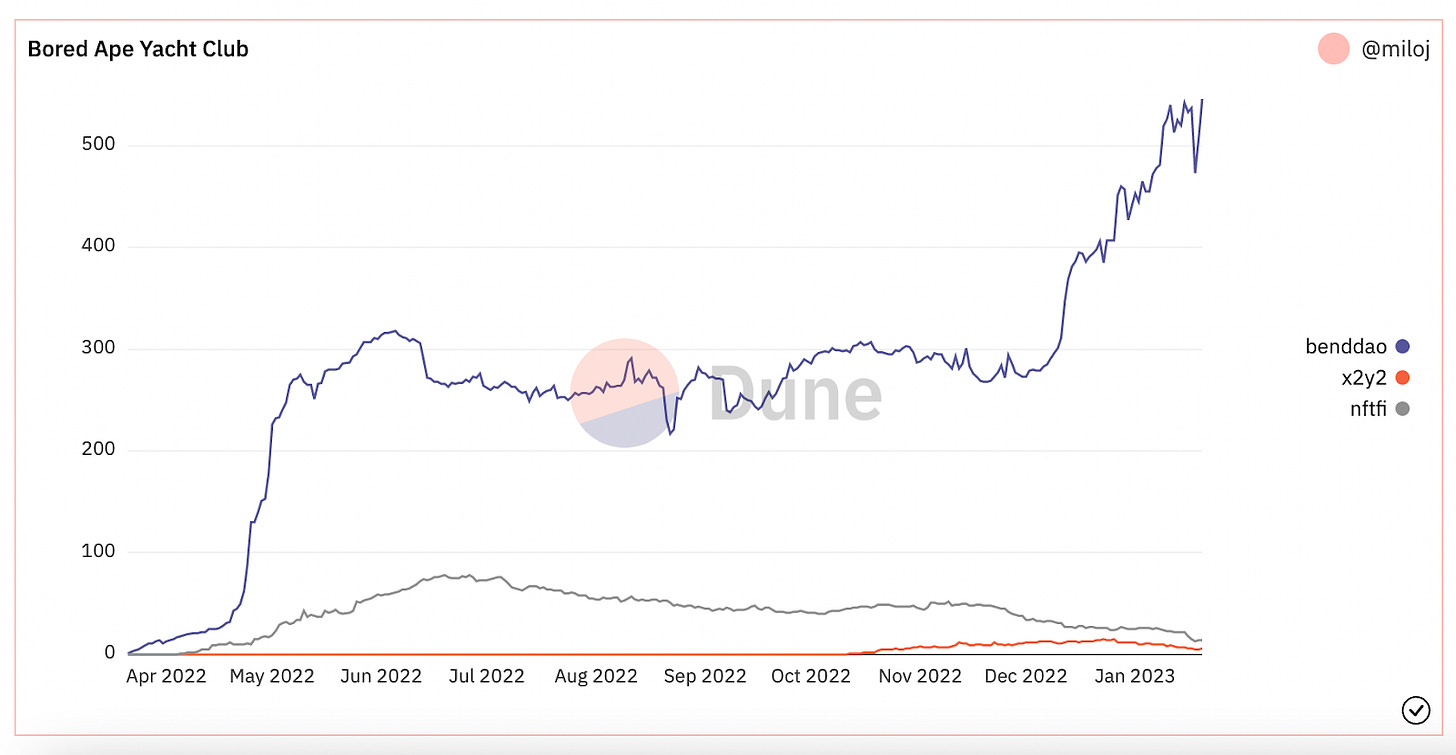

While NFT lending is new, there has been a lot of interest from collections large and small. Below you can see that BendDAO has over 500 Bored Apes locked in their lending contracts, as whales with multiple apes take advantage of the credit facility.

Total Bored Apes in Lending Protocols

In the NFT lending space, as with DeFI, chain data allows for detailed inspection of counterparty history and loan details across the space. By compiling liquidity measures and loan origination data from multiple platforms, we can get a good view of the total trading and lending data for a collection. All of these inform the underwriting and risk management for a loan book very different from traditional finance.

For lenders, attractive rates could offset the risk of lending against a volatile and new asset class. While liquidity is still growing, the lending markets are offering competitive terms for both lenders and borrowers.

Average borrow rages for Bored Ape NFTFi Loans, %

In the chart above, the average loan APR on NFTFi for the Bored Ape collection shows a regular trend. While APRs are still in the double digits, they have been steadily decreasing as more lenders enter the market and originating loans become more competitive.

NFT Derivatives

In many markets derivatives are an increasingly large share of trading volume. In DeFi there are now various protocols that offer leverage for perpetual trading, options and many flavours of structured products.

While not as developed in NFT finance, there are protocols that now offer NFT derivatives. Putty is a platform for NFT options that matches users through an order book for buying and selling calls or puts.

NFTPerp is a market launched to bring perpetuals to NFTs. The perpetual prices free float based on market demand, but funding is applied from a deviation against a floor price oracle.

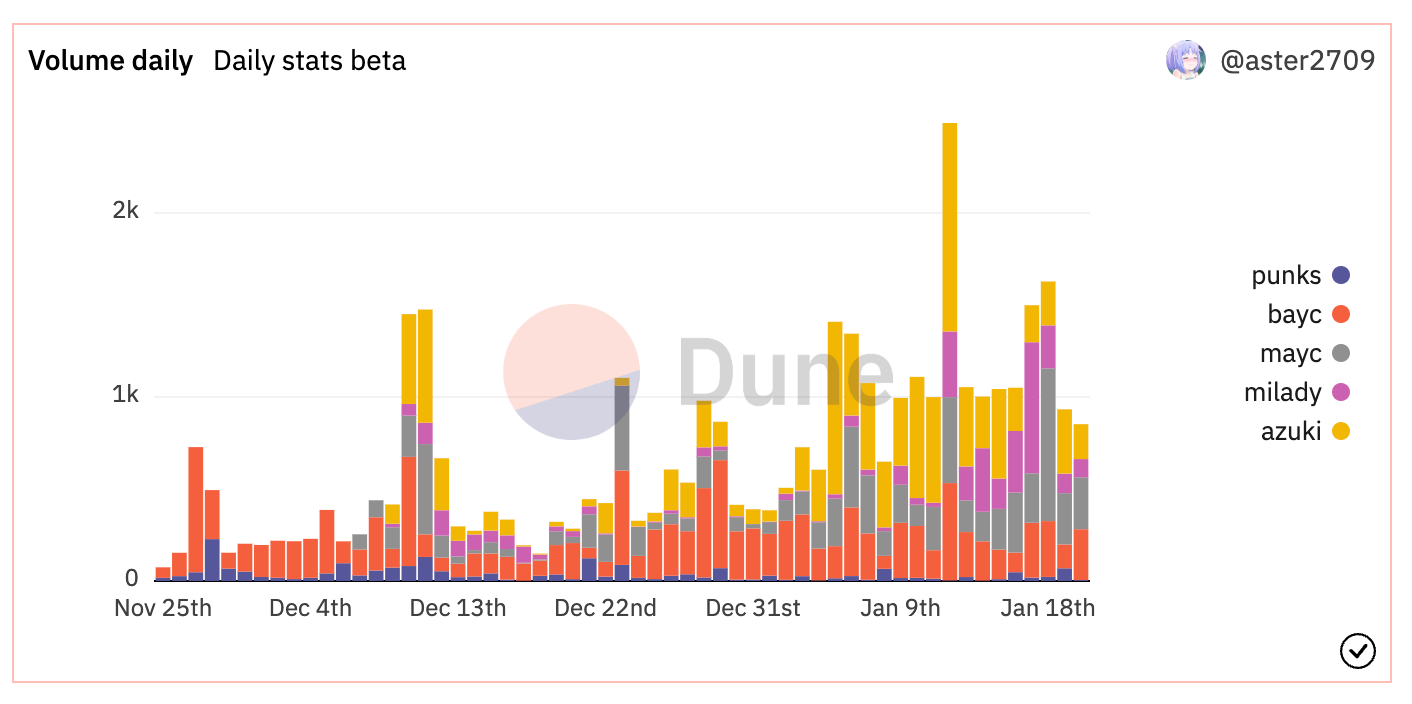

NFTPerp Daily Volume, ETH

These offerings let users with less capital participate in the upside of NFT prices and collections. It also will let market makers and others hedge positions, supporting the overall liquidity in NFT finance. While still in beta, NFTPerp has seen multiple days with volumes well over 1,000 ETH traded. With deeper liquidity in the market we expect to see opportunities for market making and arbitrage to open up between derivatives and “spot” NFTs.

Other offerings and vaults are in the works across the space, and while it is still very early, we look forward to the new innovations that will come from NFT derivatives.

What’s next for NFT finance?

While it may be cliche in crypto, for NFT finance, we really are early. With a handful of protocols as early movers in the space, there is lots of experimentation and tweaking that will take place.

More liquidity coming into these NFT finance protocols will expand the market. With some estimates putting the NFT market at multiple billions, there will be plenty of space for more money to enter NFT finance.

Deploying capital in the NFT space no longer means just buying funny photos of animals. NFTs are also showing up in other representations of value. For example, NFTs have found a home in representing real-world assets. NFTs are also a main use case in some DeFi protocols like Uniswap v3 and Liquity Chicken Bonds. Proper financial infrastructure will be a key part in growing the NFT space beyond speculating on JPEGs. While today NFTs represent mostly art and culture, soon we could see NFT lending against real estate, NFT commodity derivatives, or AMMs focused on NFT collectible trading.

NFTs are just a method of representing value onchain. We saw the explosive growth of DeFi during the last cycle as small and simple protocols gave way to more complicated and larger protocols that exist today. We expect a similar trajectory for the NFT finance space and will be eagerly watching its growth.

Re7 Capital - DeFi liquidity providers