The big rotation

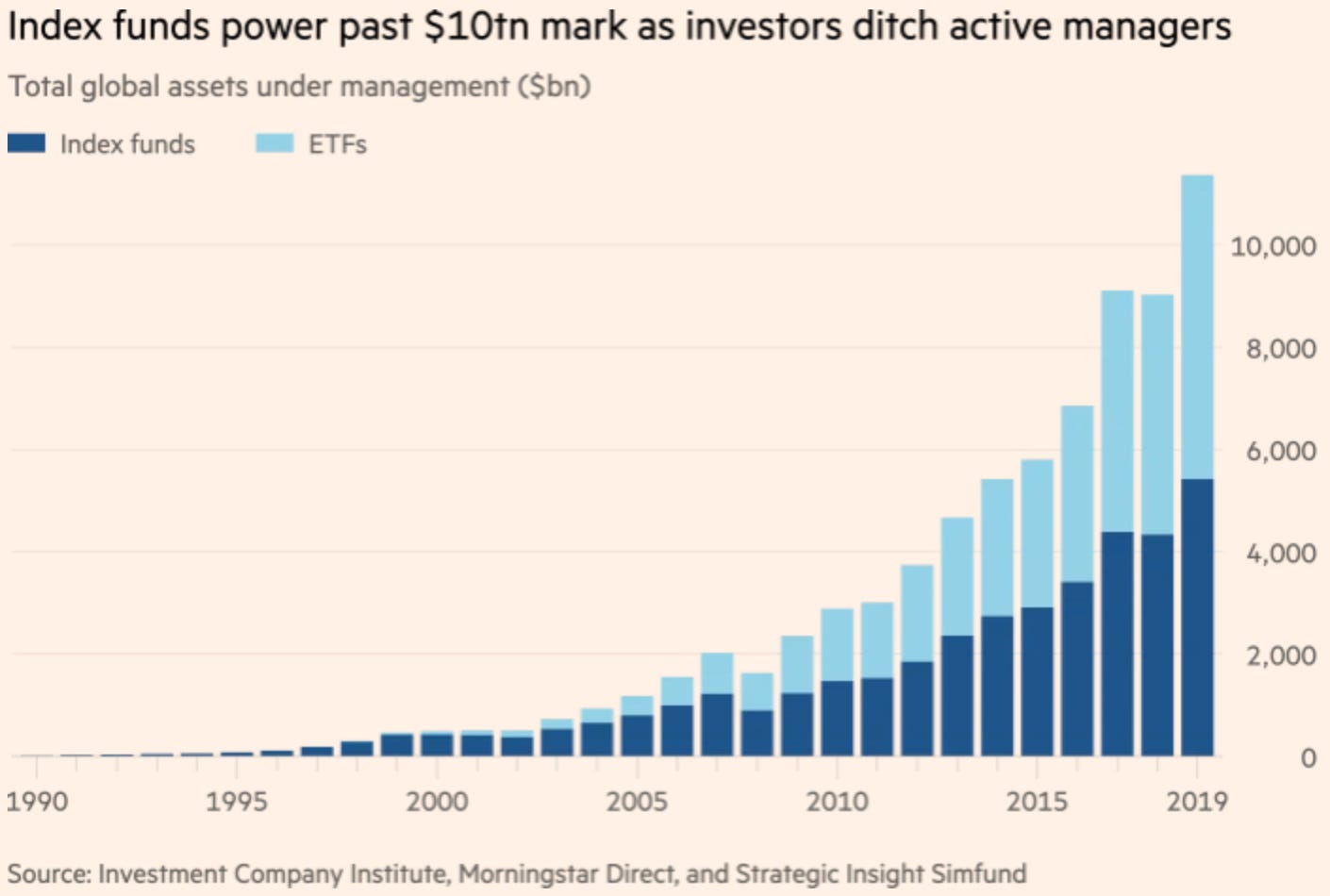

With global GDP per capita rising dramatically since 1950s, a middle class has emerged and started building up its savings and pensions. As a result mutual funds bloomed to accommodate the growing investment appetites. Active managers pitched exciting strategies and their ‘edge’ over the markets and their peers - and charged fat fees for it.

Fast forwarding a few decades, it turned out that beating the market isn’t that easy and most managers aren’t worth the trouble!

As you see, it actually makes sense to invest passively - you will worry less, spend less and most likely achieve a better outcome!

Investors caught up with this eventually and shifted their portfolios towards cost efficient passive funds, whose objective is simply to replicate a target index.

Crypto is no different

While Bitcoin is breaking through its All Time High price today and sets new records, many coins have not reached their previous peaks of 2017 / 2018 when the previous crypto bubble burst. Same logic applies here - sticking to the ‘benchmark’ is a safer way to achieve your investment objective and it takes much less stress and time to do that.

Decentralised Finance (DeFi) is the booming sector in crypto today with products that have real users and coins that generate real income. How does one gets exposure to it? New protocols emerge every week and it takes a full-time team to keep track of the space!

Enter ETFs and Index solutions. A decentralised crypto protocol PieDAO launched a series of ETFs / indices offering a simple way to get exposure to the sector - much like a traditional ETF would.

Their DEFI index provides full transparency into the underlying components:

Another provider - TokenSets - allows anyone to create their own index tracking any type of payoff they wish:

Niche and customisable ETFs achieved incredibly strong adoption in the real world as they allowed non-sophisticated investors to get direct thematic or sectoral exposure, while keeping things simple. It’s fascinating to see similar products emerging in the world of crypto, in line with the broader financial trends.

Not different, but better

As always, there is catch with everything crypto-related. In the real world, once you buy your cost-efficient passive index, you (should) hold it for a very long time as these instruments really outperform over a multi-year horizon. While your fund is sitting there, it’s not generating any income for you beyond some dividends the underlying companies might pay. That income is coming from the underlying assets within the fund, however. The asset itself is not being ‘productive’, quite the opposite - your bank / broker will charge you annual admin fees.

Crypto is, of course, more fun. Just like you can ‘deposit’ your coins to provide liquidity to traders (covered here), you can deposit your ‘index’, achieving additional yield on the actual fund, not just the assets within it!

This creates an additional positive loop for your portfolio, making it even more attractive over the long run versus holding dispersed individual assets directly.

This is yet another example of a financial product built in a crypto-native way and interoperable with other solutions. It provides indirect and often unexpected benefits, making it a superior product to its traditional equivalents.