“We insure a lot of things, sure.”

That was Warren Buffett’s answer earlier this year when he was asked if Berkshire Hathaway would write pandemic insurance.

Insurance and re-insurance are some of the best ‘cash machine’ business models ever invented. They are highly reliable and serve as a stable source of cheap funding - it’s no coincidence Mr. Buffett’s empire was forged around them.

This lucrative business goes all the way back to Babylonian times where it was initially practiced as a method of distributing risk. In the Middle Ages insurance was a vital instrument for sea merchants, allowing fellow travellers and traders to pull their capital together and spread the risks between various members of the community. With every sea voyage having the same risk/return profile as venture capital investments (i.e. you are lucky if more than 10% of your ships make it back), such financial arrangements greatly boosted marine trade.

Eventually a more formal market emerged in London, where ship owners, merchants and captains would meet in Lloyd’s Coffee House to exchange news and conduct business.

The rest is history - the Lloyds of London market was formed (and still exists and prospers) where all imaginable insurance policies are issued and traded. The global insurance market is now dominated by a concentrated group of highly sophisticated regulated institutions, while the good old peer-to-peer insurance model went into oblivion as it could no longer keep up with funding requirements and streamlined pools of capital.

Protect thyself

While the insurance market is very advanced and mature, the range of financial risks you can insure against as an individual is quite restricted. You can hedge yourself from some financial market risks using numerous instruments (if your capital size allows of course), but your counterparty risks remain - in fact these are the key risks. What can you really do to protect yourself from a broker, bank or an investment platform going under?

You could do your research to avoid the obvious red flags and spread your risks across multiple counterparties, but is it enough? Or you could only deal with the most trusted institutions and use the most conservative instruments. That might protect you, but it comes at a substantial opportunity cost and probably means you aren’t keeping up with real inflation and your savings are being eroded anyway.

Wouldn’t it be great if you could protect yourself from these 3rd party risks? Wouldn’t it be great if you could split these risks with the other customers / users? Or even supply your own capital to protect others to generate some income?

Back to the future

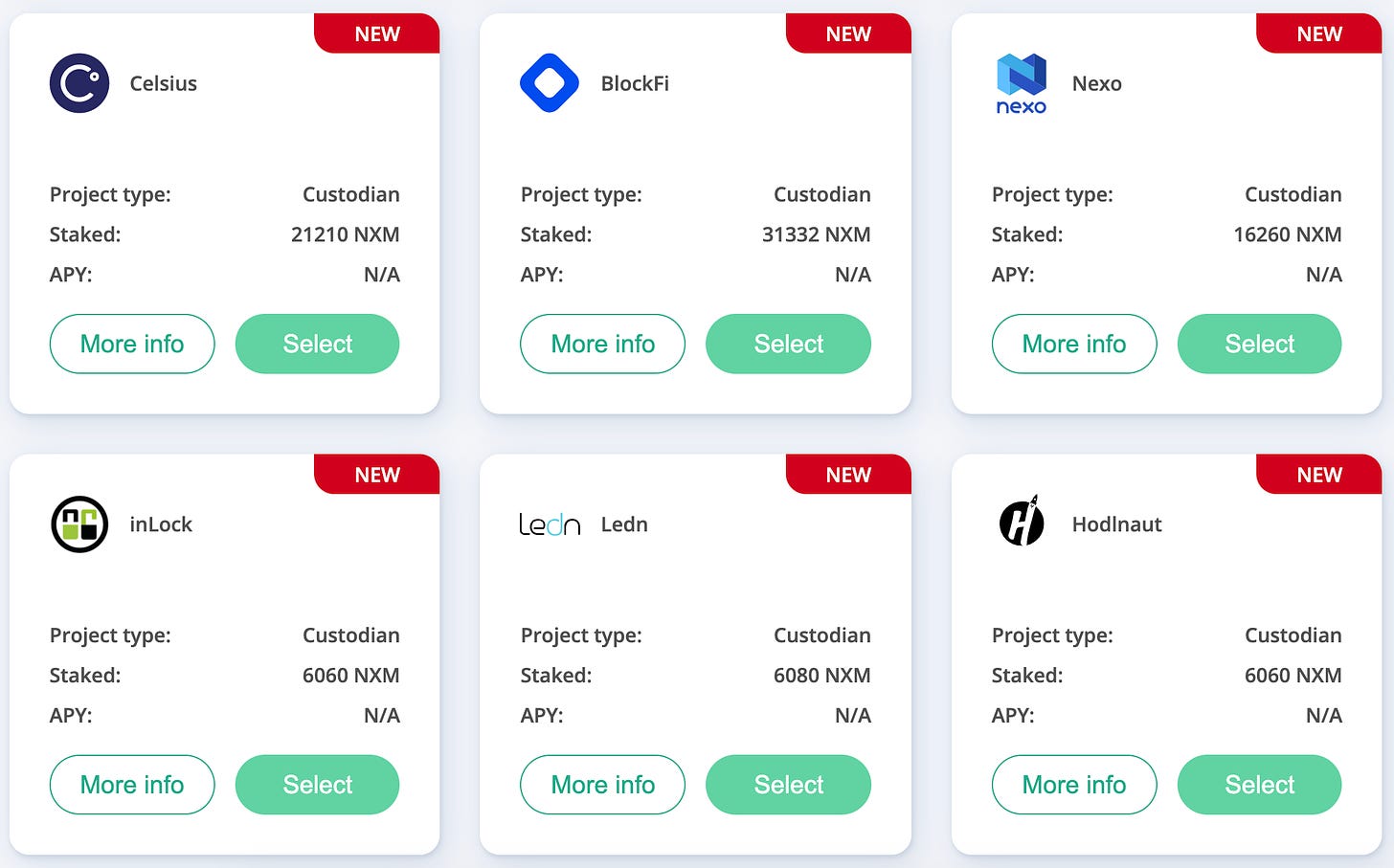

For those living in the cryptoland, this is a reality. You could join a ‘mutual’ - a classic company structure in the insurance industry - and buy insurance to protect yourself from the risks of your custodians going under:

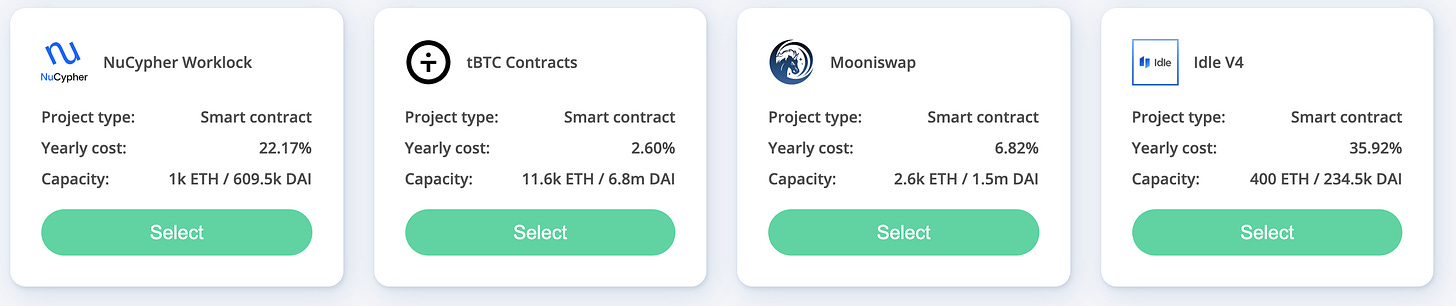

You can insure the risks of DEXs and ‘crypto deposit’ providers going under:

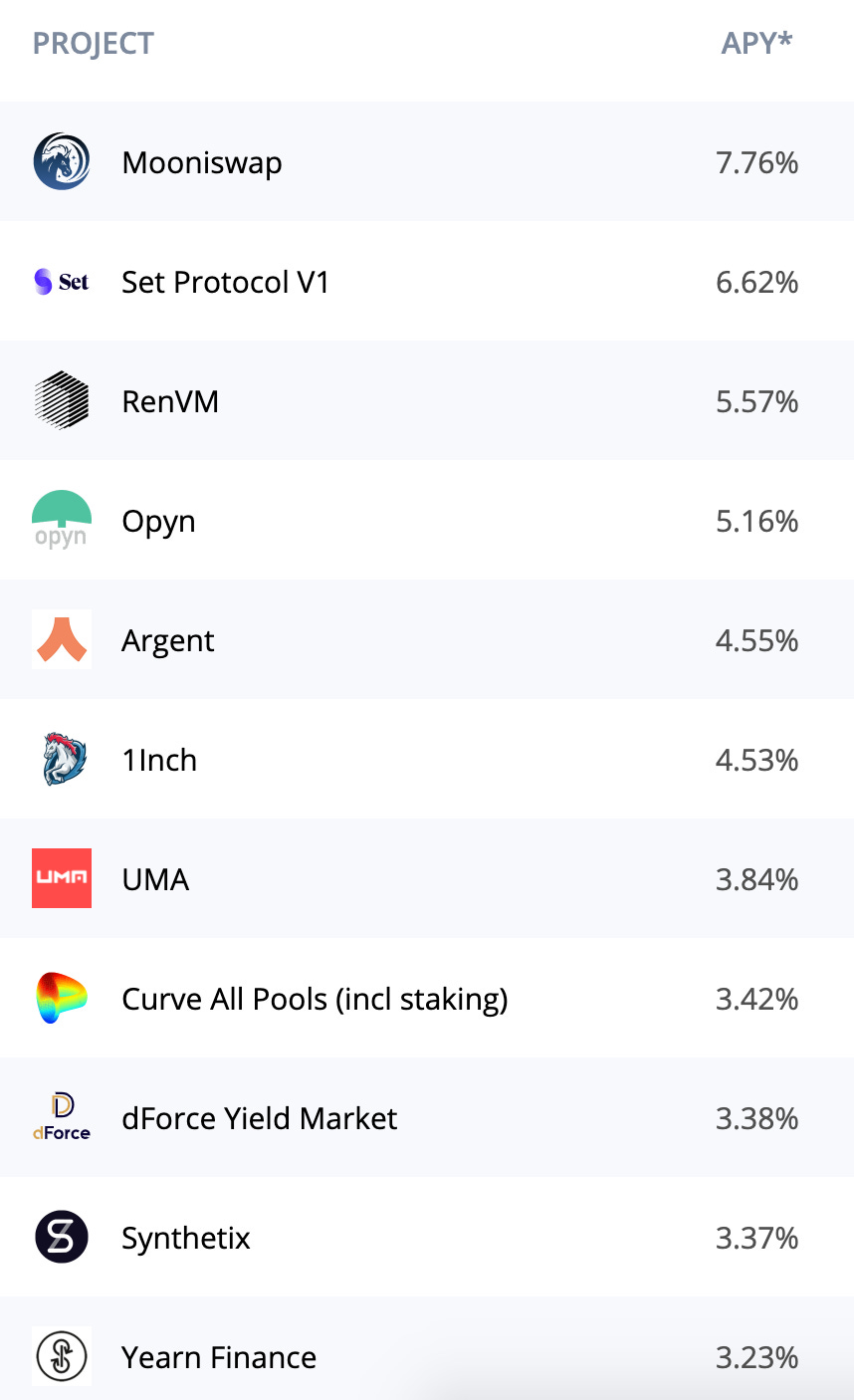

Or you can write insurance, earning decent yields:

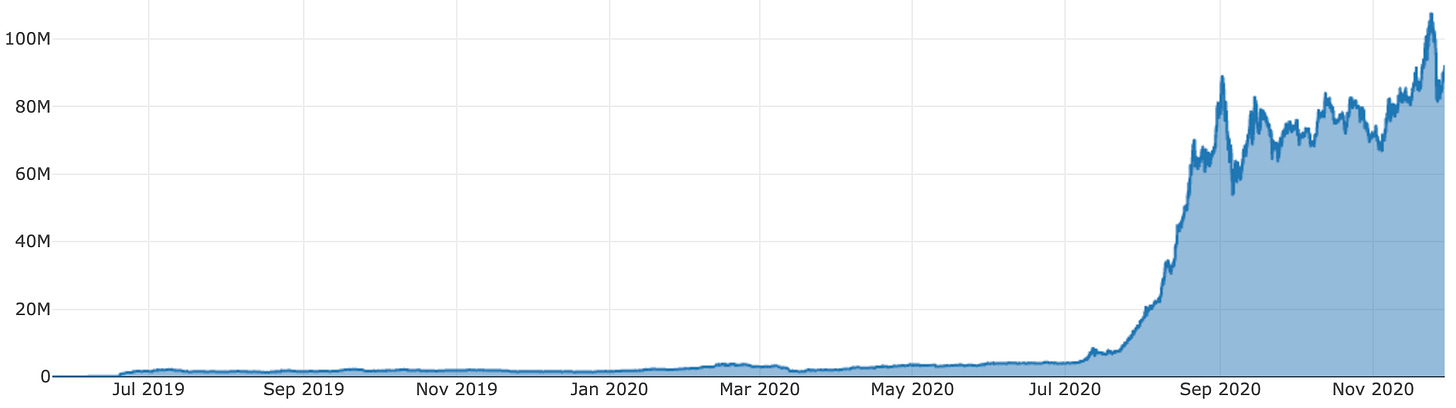

Nexus Mutual - the leading crypto insurance player - facilitates all of the above and allows for substantial de-risking of the nascent ecosystem. Its astonishing growth shows that peace of mind is in high demand.

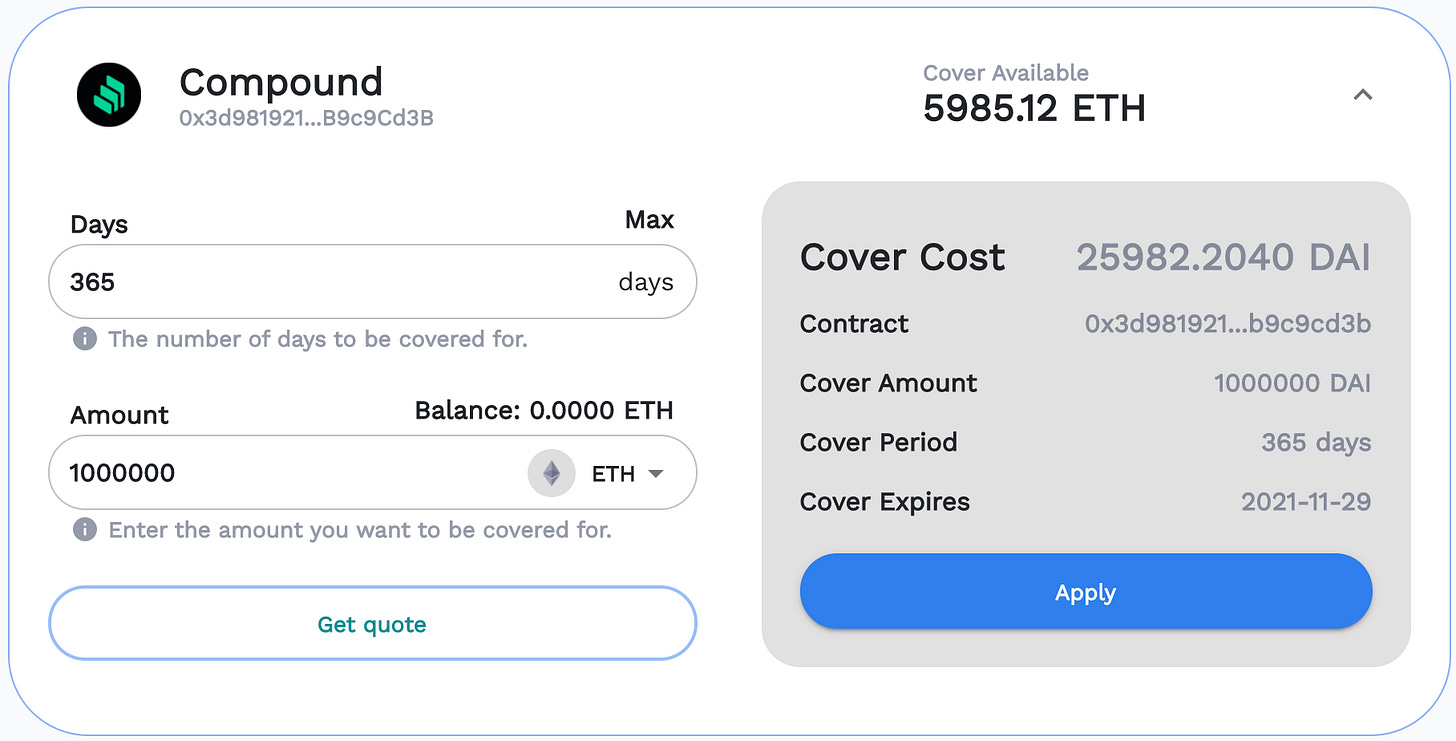

yearn.finance (covered in Deposits 2.0) embeds insurance into its aggregation platform - e.g. you can hedge $1mn of Compound exposure (covered in Banking 2.0) for 1 year at a 2.6% cost.

It’s probably the easiest way in the world to protect yourself from your bank going under…

Crypto allows us to go back to the world where market participants can divide the risks across their community, making the whole ecosystem more robust.

Thanks to the beautiful composability of crypto solutions, it is really easy and affordable to hedge financial risks and it’s not implausible to imagine a future where decentralised finance is a safer ecosystem than the traditional one!