Transaction costs

How much does it cost to deposit money into a bank? How much does it cost to make an internal bank payment between your current and savings account? How much does it cost to upload a photo on the internet?

We’ve come to expect certain things for free. We are used to ‘freemium’ models where certain things come for free and certain things come at a cost (and sometimes these costs are hidden). Alternatively, we expect to get a certain product for free while understanding that 'if you're not paying for the product, you are the product' - i.e. we are being monetised in a different way but we are OK with it.

Blockchains don’t work that way. Every transaction costs something. Each blockchain is a living network and in order to incentivise miners, stakers and other ‘service providers’ to maintain in, they have to be paid. Each blockchain transaction needs to be computed and it costs money. More specifically, it costs ‘gas’ which you burn when you do anything on the blockchain.

Gas

On the Ethereum network ‘gas’ is a fee you have to pay in order for your transaction to go through. It’s paid for in ETH, which you would have to buy before doing on-chain transactions. The more transactions take place on the blockchain, the more gas is burned and the more ETH has to be bought - the network effects are clear.

How expensive is this gas?

Here’s how much it costs to deposit coins into a crypto ‘bank’:

Here’s how much it costs to turn your selfie into an NFT:

Here’s how much it costs to swap coins via a DEX (before trading fees):

Would you like to place your coins into a DEX to earn income? It will cost you a bit more:

Not exactly ‘freemium’…

Ethereum hasn’t always been this expensive, but as it got more adoption there are so many users burning so much gas, the costs have gone up.

To be fair, not all blockchains are this expensive.

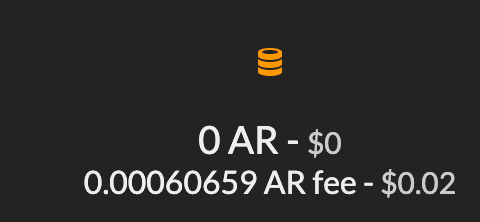

Publishing one of the previous issues on the Arweave blockchain (here) didn’t cost much:

Trading on Binance Chain isn’t that expensive either:

This one, however, is far from being a fully decentralised blockchain network, but it’s still a useful reference point.

There are numerous teams working on a variety of approaches to bring down the gas cost of the Ethereum network - think of it as a more efficient combustion engine which needs to burn less fuel to achieve the same result. If they succeed (and there’s a lot of capital betting they will), the network will become more affordable.

The paradox

Ethereum transactions have become materially more expensive over the last year:

And yet the the number of transactions is growing, not decreasing:

What happens in the real economy when fuel become more expensive? People switch to public transport, consume less etc - i.e. there is demand elasticity to pricing.

In our case we can see that demand is growing despite the costs getting higher. Even though the network isn’t cheap, people are still willing to use it! That’s when you know there is a real product-market fit.

What’s going to happen with the broader adoption of the network once it becomes cheaper (hopefully in a few months)? Something to keep an eye on…