This is a special edition of Financier 2.0, written by the StakeWise DAO.

StakeWise is a liquid staking protocol on Ethereum enabling any Ether holder to earn a passive yield by staking without capital lock-up.

Staking

September 2022 was monumental for the whole blockchain world. Ethereum, the most active chain, went through a technical upgrade which migrated it to a new consensus algorithm. In practice this means that instead of using hardware to mine blocks, now it is required to buy ETH and lock it into a staking smart contract. Such stakers earn interest on the capital they deploy in exchange for underwriting legitimate blockchain transactions.

This newsletter previously provided colour on liquid staking - a new type of a derivative instrument which turns ETH into a yielding asset without the need to run any technical infrastructure. Such ease, however, comes at a cost.

Decentralisation

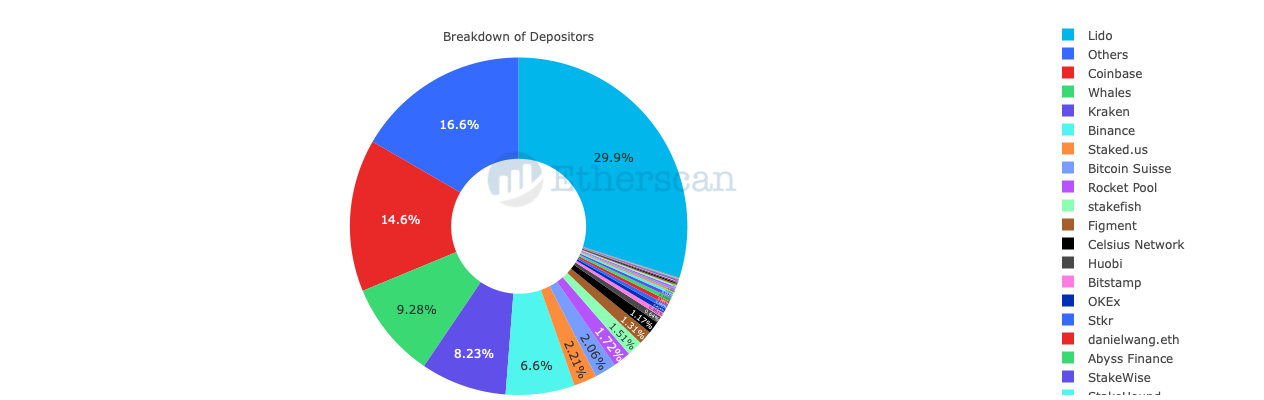

We have become accustomed to thinking of Ethereum as a decentralised network, but the data from the Beacon Chain deposits shows a worrying centralisation trend. At most 18% of the network - some 2.5 million Ether - is controlled by solo stakers running nodes at home. In comparison, the share of the network controlled by the four major players - Coinbase, Kraken, Binance and Lido - is around 60%, and growing.

Why is so much capital being committed to just a handful of companies? We believe that the simplicity and benefits of liquid & delegated staking are the root cause. Services like Lido or Coinbase Staking remove the economic & technical barriers to participating in staking, and so only the enthusiasts prefer to stake solo. For most stakers, it is just easier to use one of the main staking services or an exchange. But it is a dynamic that runs counter to Ethereum’s mission: to become a permissionless, censorship-resistant and financially robust network for value exchange.

In response to these growing centralisation pressures, we are working on solutions that will help decentralise the network and help Ethereum change its course. Our next step is StakeWise V3.

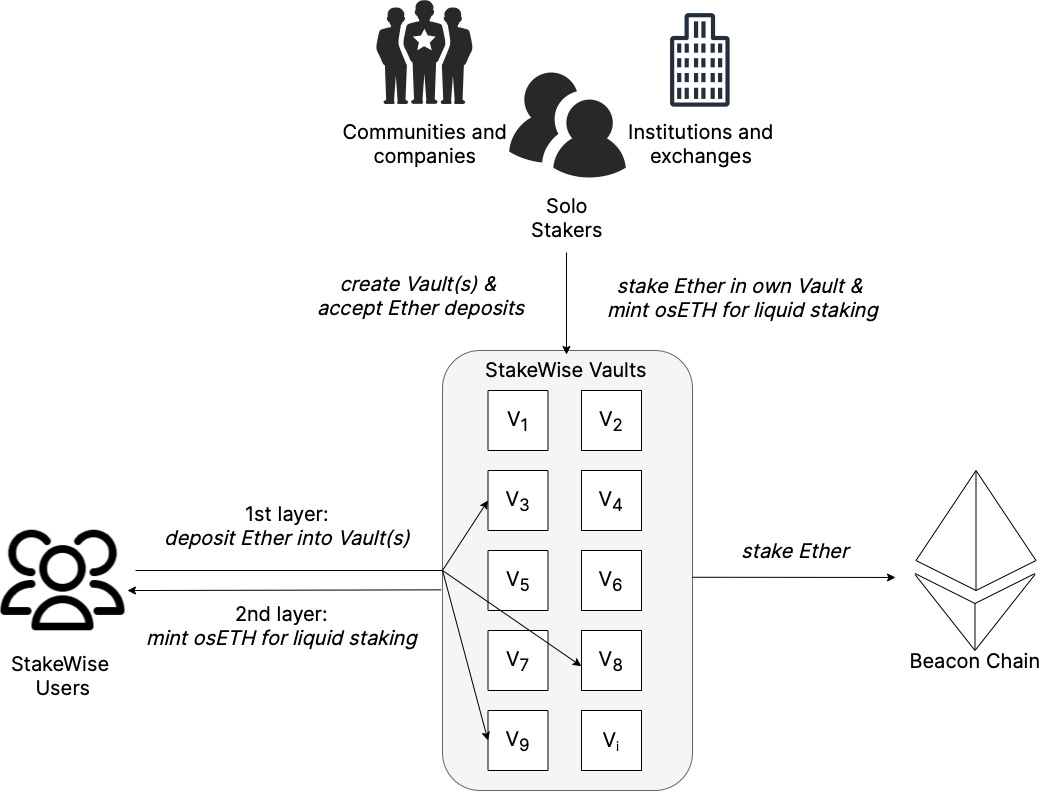

StakeWise V3 is a novel staking protocol where anyone can become a node operator and mint osETH, a liquid staked ETH token, based on their own node. Like the Ethereum network itself, it is permissionless and decentralised.

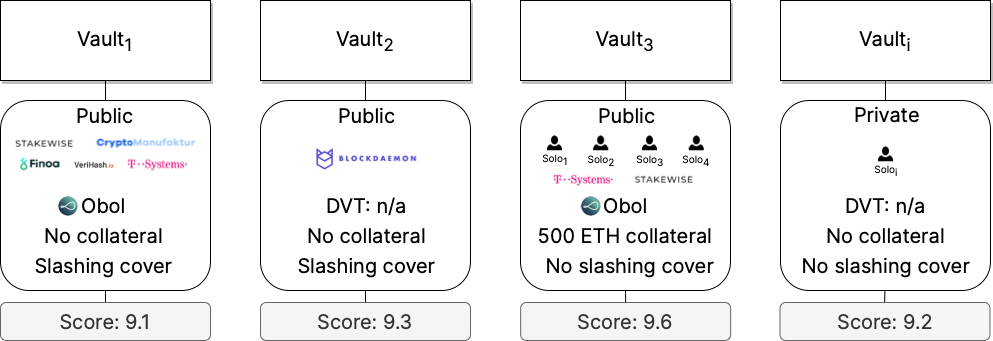

StakeWise V3 relies on a 2-layer staking process that gives StakeWise users the freedom to choose which node operator(s) will run validators for them. We call this the Allocation layer, i.e. the stage where users decide whom to allocate their Ether for staking. It enables anyone - solo stakers, crypto communities, TradFi organisations, new businesses - to run validators for others in exchange for a fee, lowering the barrier to entry. It also gives StakeWise users the means to directly influence decentralisation on Ethereum through choices of operators that handle their stake.

After allocating Ether, stakers have the option to mint osETH tokens based on their deposits into Vaults. This is the Tokenisation layer, i.e. the stage where a staked Ether token is minted to access DeFi for additional opportunities. Solo stakers in particular benefit from Tokenisation, because it allows them to allocate Ether into their personal Vault and mint osETH against it, accessing the economic benefits provided by liquid staking. However, it’s not just for them - anyone can mint osETH tokens based on their stake in the Vault(s), including the users who chose Vaults operated by minority operators, helping to decentralise Ethereum.

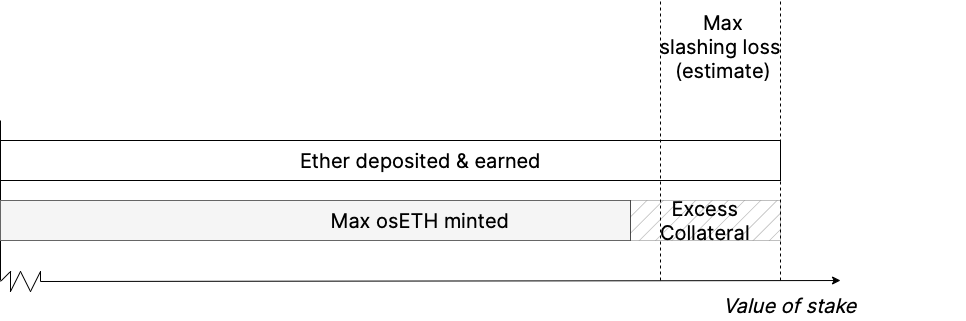

osETH tokens accrue staking rewards for as long as they are held and, uniquely, are overcollateralised. The extra capital buffer provided during minting protects osETH holders from slashing losses and downtime penalties. It offers stakers who don’t want to allocate Ether to any specific Vaults the option to just buy osETH from the market and stake without worrying about slashing or downtime. osETH can always be redeemed for the underlying ETH in the Vaults or for ETH in the liquidity pool(s).

The only way to reverse the centralisation trend that liquid staking services bring to Ethereum is by proactively encouraging the reallocation of new Ether inflows towards smaller but quality operators, and increasing the participation of solo operators in the network. StakeWise V3 aims to achieve both.

Those wishing to rally behind StakeWise DAO’s values are welcome to join our Discord and contribute to our v3: https://discord.gg/8Zf7tKyXeZ.

Re7 Capital - a DeFi firm focusing on stablecoins and ETH