Revenge of the retail

Most of us have been stuck in front of our screens as a result of the global lockdown for quite a while now. With entertainment limited to binge watching TV series, many have turned to speculation and day trading.

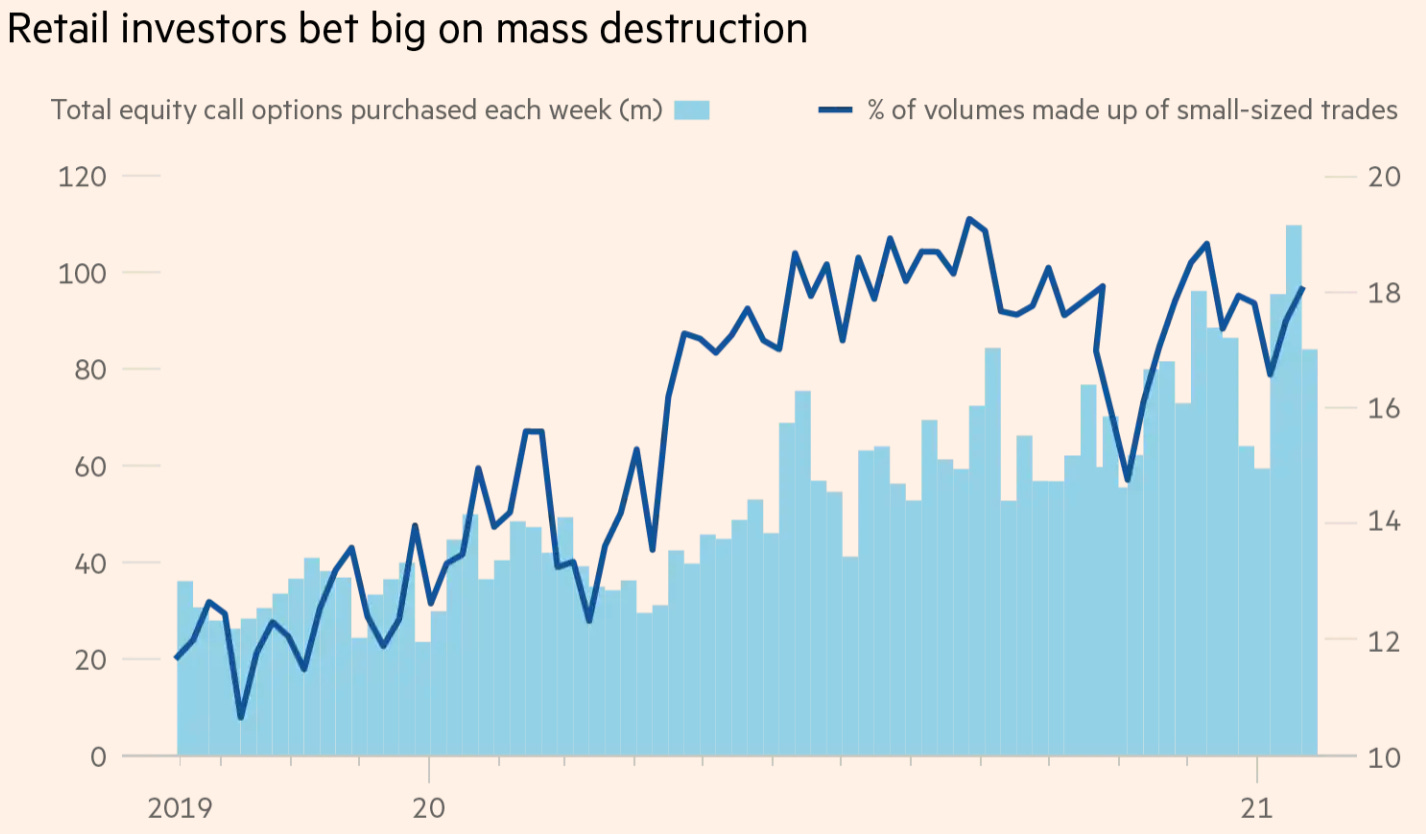

This pattern is reflected in market statistics and contributed to the market rally while causing additional volatility. This isn’t a new pattern but it’s certainly grown in size (those Covid stimulus checks didn’t hurt).

An even more interesting point is that these retail participants are acting in a coordinated manner. This happened before - back in the roaring 1920s investors were pooling their money into ‘stock pools’ to help the glamorous radio stocks run high. The age of internet, however, took this to a whole new level.

In just a few days of January this year, millions of people coordinated their trading activity via social media (mainly Reddit, which is now worth $6bn) with an objective to ‘squeeze’ some stock prices and punish hedge funds betting against them.

Some stocks rallied 5x in a matter of days, only to collapse the following week leaving lots of retail investors to pick up the losses. All of this happened among elevated social media noise and philosophical justifications for what is effectively the very definition of market manipulation.

Lots can be said about such ‘protest trading’ - it certainly goes in line with the zeitgeist of the last few years, but we aren’t here to talk about socioeconomic trends. We are here to look under hood of how it all came crashing down.

The poster child of this phenomenon is a US unicorn Robinhood - which, unlike the character that inspired it, hasn’t delivered on the promise of helping out the middle class.

T+2

Robinhood is an incredibly successful FinTech business which turned the brokerage model upside down and pioneered ‘zero commission trading’ (in reality it’s obviously not free). The smart fee structure led to strong user growth and influenced the whole industry, forcing competition to catch up.

It turns out, however, that while FinTechs provide great UI they still operate on the same rails as traditional brokers. Which brings us to the magical rule of T+2.

In the good old days of physical trading after a trade has been agreed, its counterparties had 2 days to ‘settle’ it - i.e. to bring in the cash in exchange for physical documents. This tradition still stands for equity trading despite a workflow which is mostly digital. During this settlement period the transaction is ‘up in the air’ - the stock hasn’t been delivered and cash hasn’t been transferred.

As a result of this brokers have to hold sufficient reserves in line with regulation in order to mitigate potential failed trades, margin calls etc. In the times of heightened volatility these reserve requirements blow up, often endangering the very livelihood of the brokers.

That’s exactly what happened to Robinhood - it raised margin requirements on the most trending stocks, restricted trading, forcefully closed positions and had to raise $1bn+ of emergency funding.

It’s not their fault - it’s a direct result of the ‘back office’ processes which don’t allow for immediate settlement and create additional challenges. This did however leave a very negative aftertaste with their users, let alone threatening the company’s very survival.

If only there was a different way to manage this…

Crypto to save the day

This brings us all the way back to DEXs.

Since the Trading 2.0 article came out the range of stocks available in crypto grew dramatically. Mirror Protocol now ‘lists’ Tesla, Google, Apple and many other stocks which can be traded exactly like crypto:

Once you buy a stock you can deposit it into a market-making pool (just like the other coins), often at a substantial yield:

While being a fully decentralised process of trading and holding shares, it’s still a difficult user experience. It will evolve though and it’s possible to image how traditional stocks start trading outside the native stock exchanges in size. This isn’t regulated yet and once it is, certain restrictions may be applied but one thing will always stay true - no one will ever be able to force close your position.

There’s one other interesting use case here. If crypto allows to synthetically engineer an asset tracking listed stock prices, why not unlisted stock prices?

FTX pioneered this with a pre-IPO contract on Coinbase - one of the most successful centralised crypto exchanges, which is expected to IPO in the next few months. This product gained traction and in fact became a signalling tool for private market deals happening ahead of the IPO.

It’s a more complex asset than the stock itself - if there’s no IPO by a certain date this contract settles at a value substantially below the market price and the investor is left with a cash loss and no stock. It is an interesting experiment though and it can be argued it has some utility.

These are very high risk assets and I’m sure we’ll see lots of fortunes made and lost until we find a sustainable way of trading these ‘stocks’. We do, however, live in the age when users want to be in control and demand transparency and freedom. This might bode well for an alternative stock trading universe.