Beyond CEXs and DEXs

We’ve extensively covered the Decentralised Exchange business model, how it differs from Centralised Exchanges and how it allow for more widely-spread value distribution. DEXs operate on different ‘rails’, but could there be a way to create a similar peer-to-peer mechanism on centralised exchanges? Is market making there only available to High Frequency Trading giants or, given the right tools, could we all benefit from providing that service (and capital)?

Making the market on centralised platforms is ‘simply’ a combination of someone having capital to deploy and an ability to write an algorithm / trading bot, which will execute orders in micro seconds in line with certain rules. It’s a very complex endeavour however, as one needs to build a ‘connector’ in order to be able to programmatically instruct exchanges (often more than one) on top of creating, testing and constantly upgrading the trading code. Due to this complexity, only a narrow group of highly skilled people can run their own bots and they usually end up working for large and lucrative firms, which are deploying capital at scale.

Turns out, there is another way.

By now, it shouldn’t come as a surprise that crypto industry is full of businesses working towards re-envisaging existing business models with an objective to have users end up with a higher share of the economic value.

Enter Hummingbot

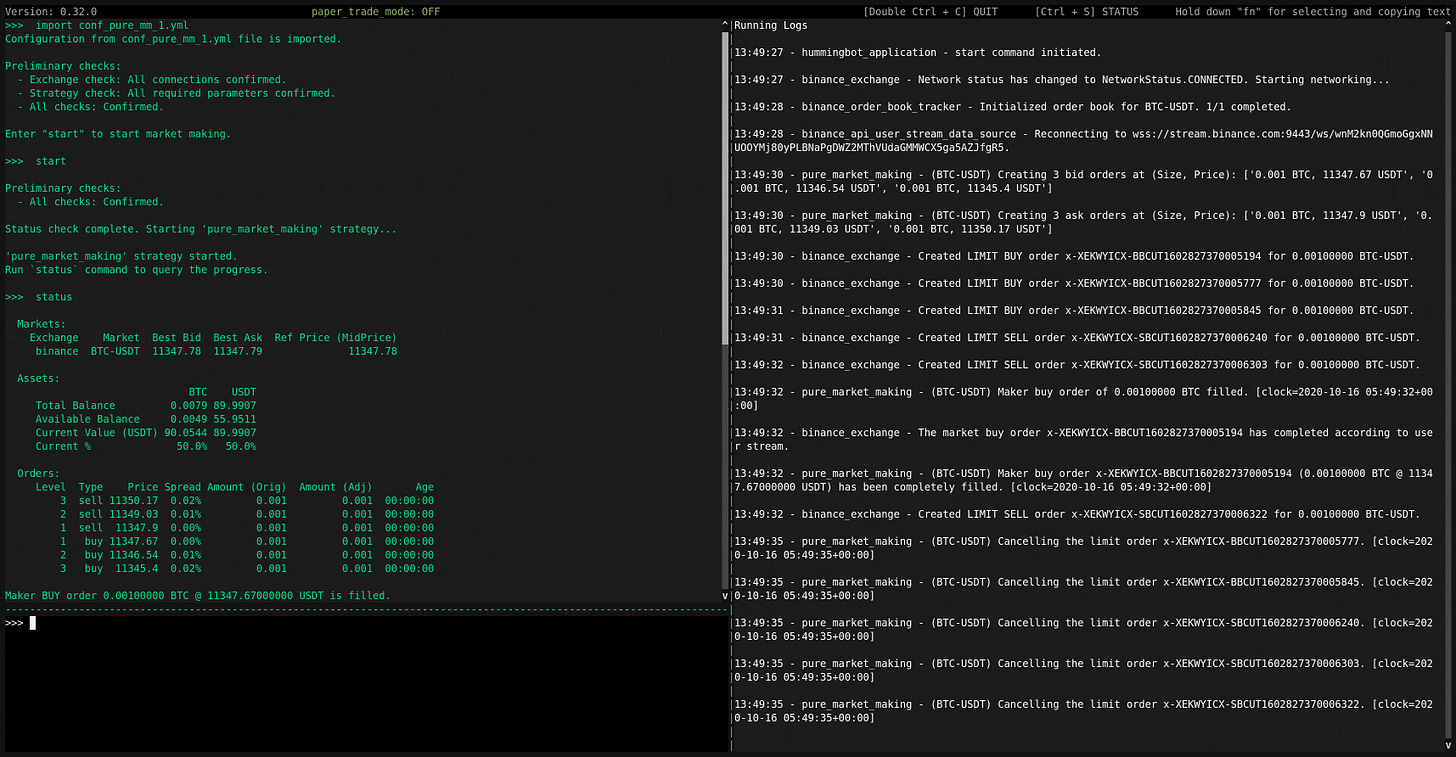

The process of providing market liquidity in an algorithmic way consists of several building blocks of code. Turns out, a large chunk of the code isn’t actually about your trading rules, but rather the code ‘infrastructure’ you need to have in place.

Hummingbot built openly-available software, which can be installed on anyone’s device and which already has that ‘infrastructure’ built in. This basically means that now anyone can use an existing tool, modify it slightly and start providing liquidity, earning yield on their capital!

This leads to a substantial democratisation of the market as coding skills don’t necessarily have to be a blocker for someone to start utilising their savings in a better way.

Hummingbot’s user interface helps gather all the necessary information, making working environment smoother and even allowing to switch between different strategies (e.g. market making vs cross exchange arbitrage).

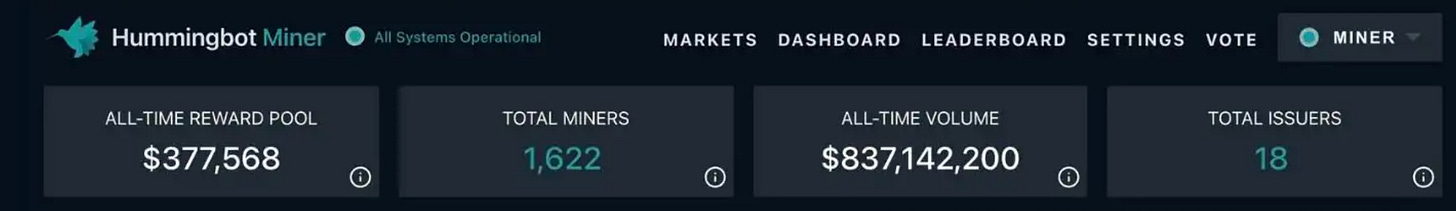

In just one year of being live, this tool generated incredible traction and processed ~$1bn of traded volume!

Supply and demand

The numbers above show clear demand for such tooling and appetite for capital to be deployed. Where does this capital get deployed into though? Obviously any liquid asset would be a fit, but is there value that can be added to the other side of this use case?

Turns out, bootstrapping liquidity is a challenge for younger and smaller issuers. They don’t have as much traction as already listed assets, don’t have the volume and therefore their negotiating position is weaker when they are sourcing liquidity from exchanges and market makers. With a tool like this, however, if an issuer has a strong ‘community’ / user base, they could simply partner up with Hummingbot and source liquidity from a widely distributed pool of capital providers.

This is another great case study of how crypto allows for use cases, which re-distribute a share of the economic value away from a narrow group of institutions to a wider range of people.