Dollar’s reserve status

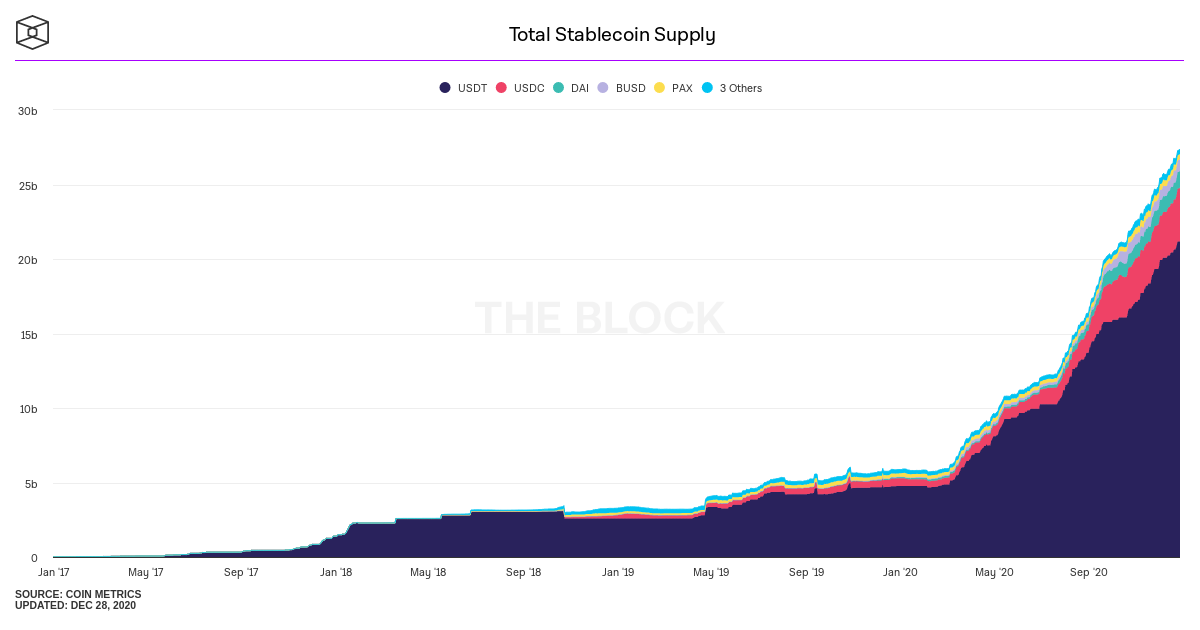

We previously wrote about the importance of stablecoins for crypto adoption. Their relentless growth continues to impress.

As the circulating volume grew, it finally caught the regulators’ attention. Given that existing stablecoins are supposed to be fully backed by USD collateral, regulators demand that the reserves get audited and stablecoin issuers become regulated in line with banks. Not an unreasonable request - banks effectively issue debt (i.e. non fully collateralised assets which also form the monetary base) while USDC, USDT and other USD-linked stablecoins issue ‘bills’ backed by their collateral. The only difference is that crypto issuance is fully digital, making it more convenient, faster etc. Fundamentally it’s the same thing though and it’s reasonable to expect regional central banks and regulators to have strong desire to control the issuance of their local currency.

Could this drive the next generation of stablecoins? To answer that, let’s review what a ‘stablecoin’ is exactly. They are coins that live on crypto rails and are linked to USD 1:1. Why do they need to exist? The reason is that BTC, ETH and all other crypto coins are volatile and are therefore a poor form of payment and savings (not investments). Having USD clones on blockchain solves that volatility problem.

Does it have to be USD though? Can it be some other coin which is not linked to a real-world currency and not volatile at the same time? Now we are talking about creating a brand new currency. A currency, not pegged to fiat money and therefore beyond the control of regulators; a currency which one could use for non-speculative transactions. That would be some real financial innovation.

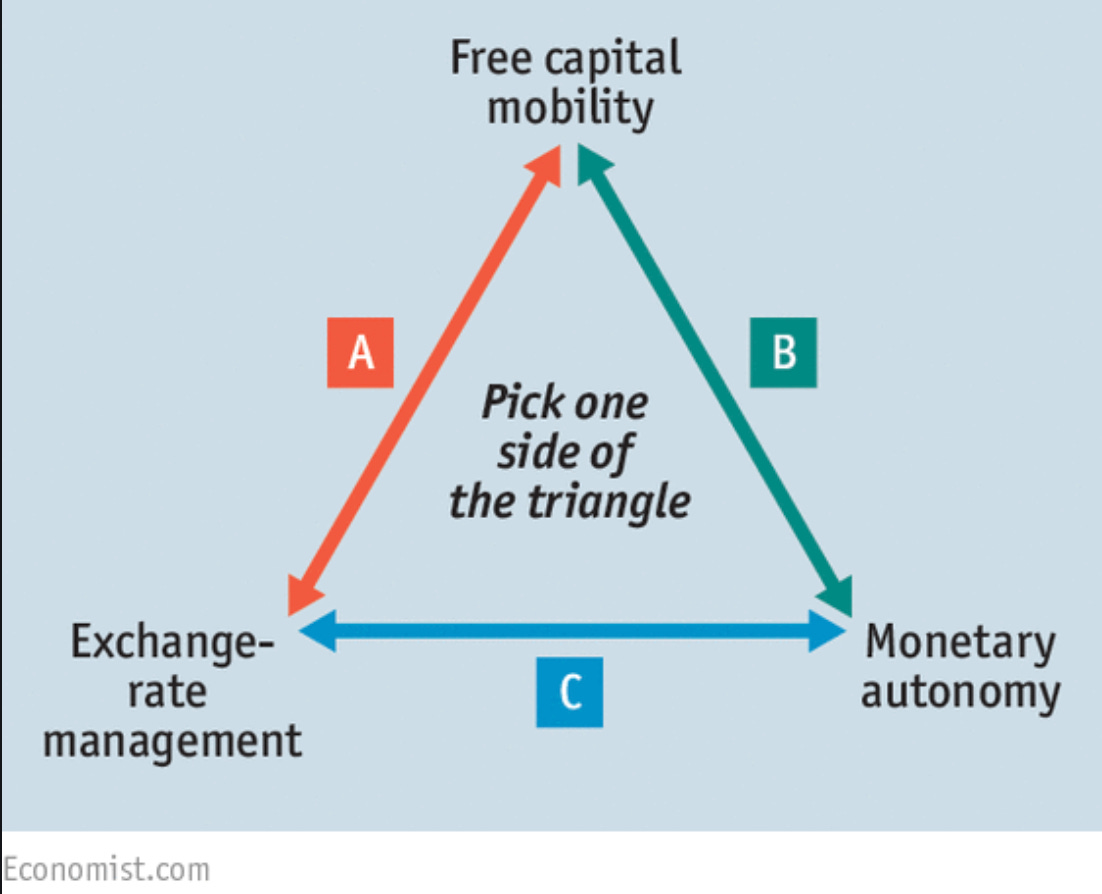

The impossible trinity

In the real world free market flows are always mitigated by the relevant monetary authorities as any existing system requires a tradeoff:

Historically any imbalance arising from FX moves, capital flows etc. would have been addressed ‘manually’ by the relevant decision makers. Naturally such decisions are subject to politics, individual biases and other ‘inefficient’ factors.

Can this manual process be replaced by an algorithm?

Re-inventing the wheel

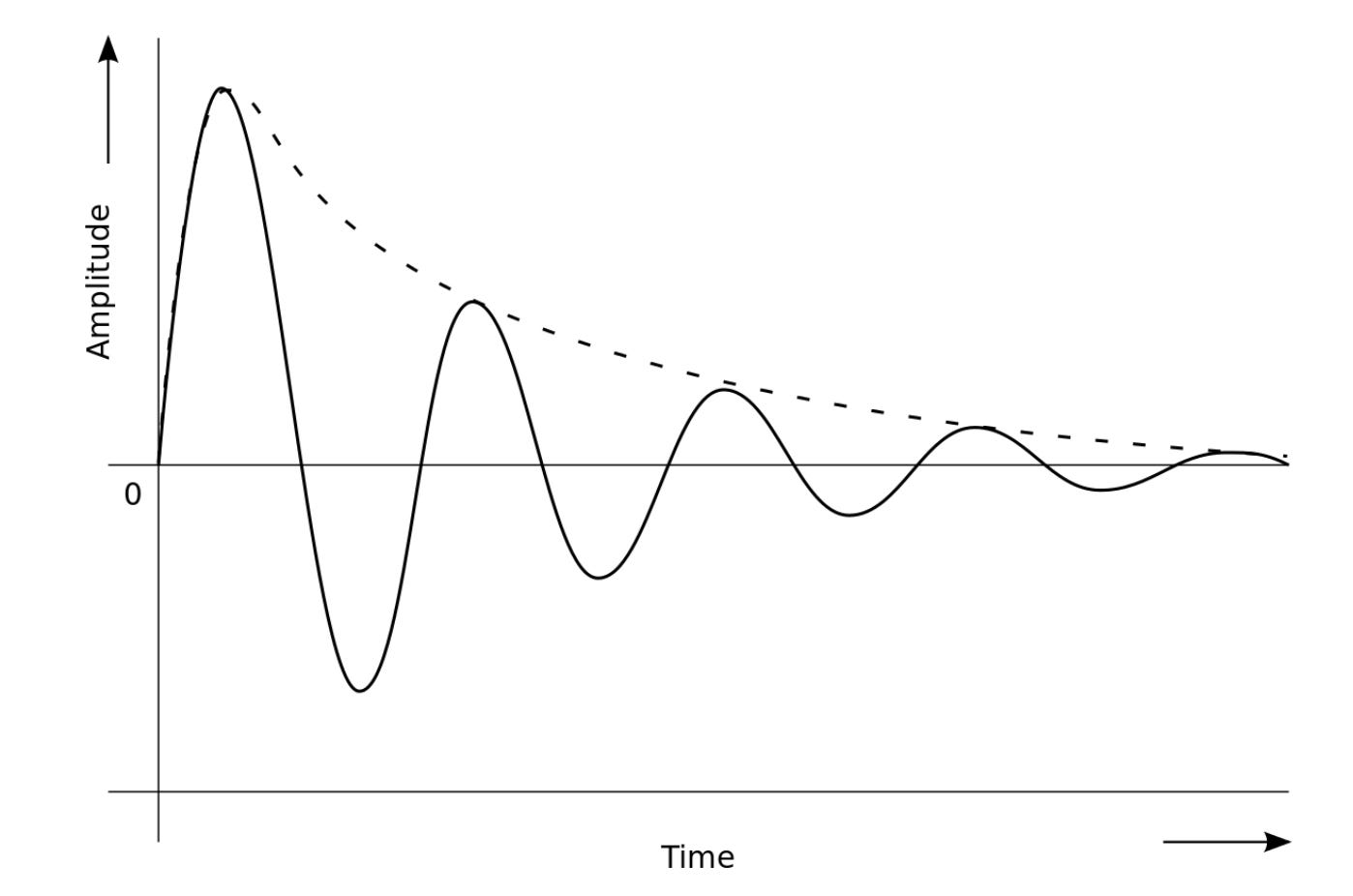

Several projects have emerged where they are creating a complex system of economic incentives to create a coin which would always revert back to its mean / fair value.

Effectively this requires a recreation of an interest rate system, yield curves, bond markets and other mechanisms necessary for any successful freely traded currency. Wrapping all these rules into an algorithm which isn’t supposed to change in the future is a complex challenge and the jury is still out on whether existing algorithmic stablecoins can withstand inevitable market shocks.

The innovation is exciting however and the pace of experimentation is very encouraging!