*****

Re7 is hiring!

*****

Pictures

Lots has changed since we first wrote about NFTs and how they allow for creation of content which can be monetised directly by its creators and holders.

This beautiful creature is trading at $200k and before you dismiss this as complete nonsense, it’s worth noting that this specific NFT brand - Bored Ape Yacht Club (BAYC) - crossed the chasm of being accepted into the pop culture with Snoop Dogg, Adidas and others striking marketing deals and jumping on the Gen Z bandwagon.

Once a brand like BAYC gets enough traction, it gets adopted for marketing campaigns and content creation. The important point here is that such NFTs are owned by a distributed set of individuals / funds and don’t sit on the balance sheets of their creators, creating network effect and a sense of community.

The catch is that there is a finite number of apes in existence (10k) and there is now a market with ever growing demand to source them. This gives the owners optionality of renting them out instead of selling to collect royalties when others use the IP. In this case when your asset is featured in movies, games or music, you will generate some decent cash flow on it.

Yuga Labs - creators of BAYC - recently raised capital at a reported $4bn valuation and their pitch deck lifts the veil on the future possibilities of this ecosystem. It’s a fascinating read and is worthing going through. It is exciting to see digital content being turned into assets which can be owned and have utility (i.e. produce cash flow).

Music

If pictures can become produce assets, why not music? Turns out, it can.

You can now bid on new tracks:

And trade them on a secondary market:

Snoop Dogg seems to be really enjoying the NFT trend…

It’s probably fair to assume that openly published songs (and no doubt videos) will have the same impact on media companies as mp3 had on CDs and traditional way of music distribution (and the margins of the relevant stakeholders).

Finance

Why is this relevant for those dabbling in DeFi?

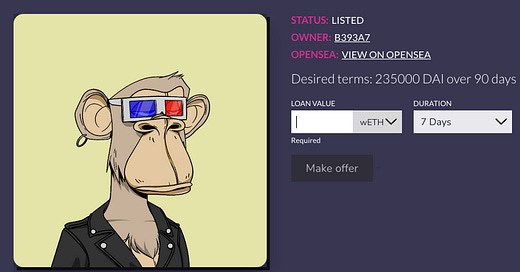

Well, so far it has been possible to lend against BAYCs (and other picture projects):

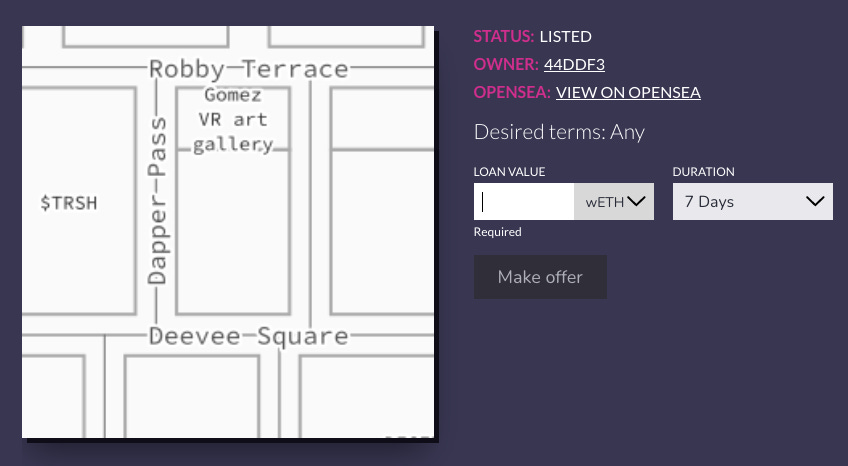

As well as land in a virtual metaverse (another use case we wrote about):

But these assets have not been producing explicit cash flow… yet. As this space matures a bit more and these funky assets start producing consistent flows we can expect a wide range of financial use cases to apply here, offering interesting opportunities for those keeping an eye on the space.

Author is the Managing Partner of Re7 Capital - a stablecoin centric DeFi fund.