Masters of the universe

Money management has always been a lucrative vocation. It requires skill, knowledge, a strong network, infrastructure (team / process / tech) and, of course, access to capital. In the pre-internet days access to information would have been item number one, but today it’s distributed much more evenly.

These days retail investors can track their favourite stocks with great ease, trade them very cheaply (in some cases with zero direct cost - e.g. Robinhood), build their own cheap portfolios (roboadvisory, ETFs) and even invest in private assets (crowdfunding, peer-to-peer lending etc).

An obvious implication of this is a substantial reduction in money managers’ margins (i.e. fees) and market polarisation. Passive investing options are all about scale and race to the bottom (some funds charge 0 fees), while the market for active managers shrank, became more specialised and more expensive to run.

Setting up a regulated active strategy is very cumbersome and costly, leaving almost no room for smaller players, while regulation made it very hard for retail investors to access such investment products.

Let’s say you have some great investment ideas and would like to manage external capital but your career hasn’t started in investment banking and you live far away from Wall St. What do you do then?

Social trading

One of the leading companies solving this is eToro - a “social trading company that focuses on providing financial and copy trading services”. Anyone can run their own strategy and anyone can ‘copy’ it for a fee.

eToro’s platform facilitates this for 13mn+ users and is a trusted platform for this type of product.

This business model fits perfectly with crypto and decentralised alternatives have emerged already - dHEDGE offers a very similar solution.

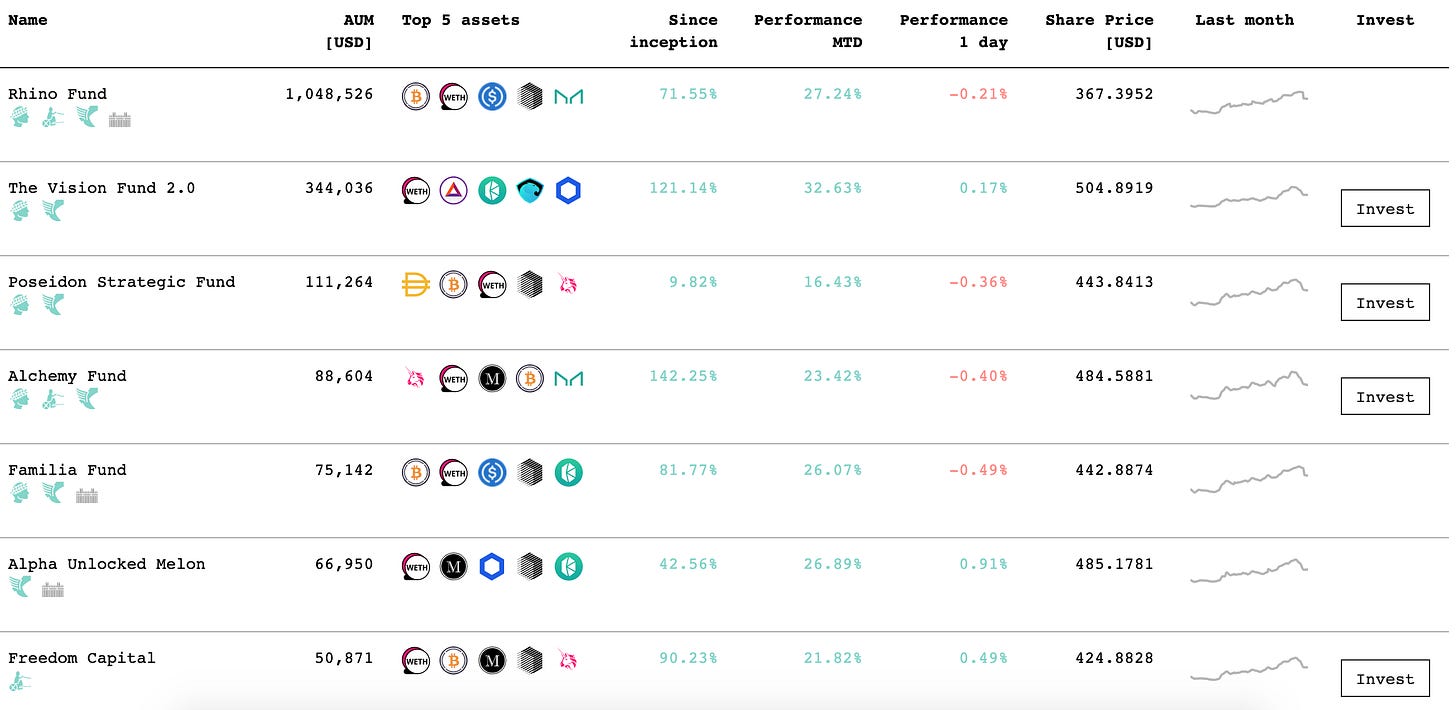

All information about the strategies is fully transparent on the blockchain…

… and there’s a native token which creates network effects and positive economic loops which we’ve come to expect from crypto.

Funds of tomorrow

Things get a little more complicated if you want to set up a proper fund. It requires complex structuring, administrators, custodians, auditors, compliance and regulatory approvals. Some of this is a must because regulators need to protect investors’ money and some of it is good governance to provide confidence to investors that the managers won’t ‘run off with the money’.

While crypto technology can’t prevent silly investment decisions, it can certainly lower the governance risks. Imagine seeing evey single trade executed by your fund manager…

… their full portfolios…

… and all fund documentation in an open way, including the pre-defined list of approved exchanges, withdrawal and strategy restrictions etc.

This is actually more than you would see from regulated fund managers in the traditional world!

All of the above is provided by Melon Protocol - a leading crypto platform for fund set up and management. 300+ funds currently operate on this platform.

The blockchain network serves as the custodian, administrator and governance mechanism. This removes the need to rely on trusted 3rd parties and makes the process of setting up a fund (and investing in it) extremely easy.

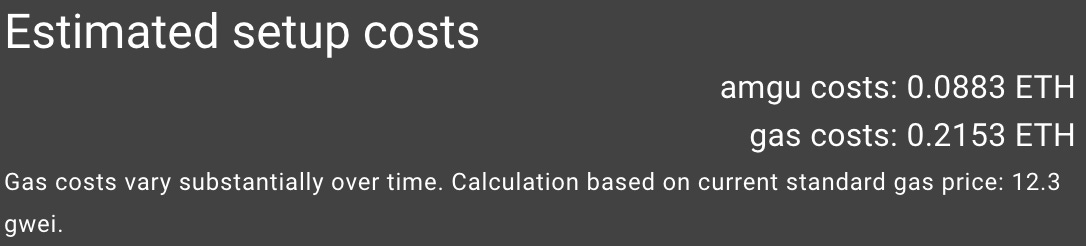

The best part is that it costs just $165 to set a fund up!

Democratisation of finance

How’s all of this possible? To a large extent it’s due to the fact that regulators haven’t yet caught up with this nascent space and they definitely will. Some restrictions will be imposed and rules will have to be followed. Unless, of course, you are an anonymous fund manager with no footprint beyond the crypto fund platform. And why wouldn’t you be anonymous if all you need are track record and investment history, which are fully verifiable on the blockchain and open for anyone to audit?

Even when regulation catches up, though, you won’t need to rely on 3rd parties which impose governance rules over you for a fee - the blockchain will do it for you.

With anyone being able to launch funds and anyone being able to invest in them, we can expect a lot of new sources of competition over the years to come. Money management will become much more distributed and future movies about managers of Other People’s Money will probably look very different.