When does a product stop being self-serving?

Any new product is an experiment. It may be an attempt to build something new in a well-established market or it may be an attempt to create a new market.

At first, however, it all starts with a dream.

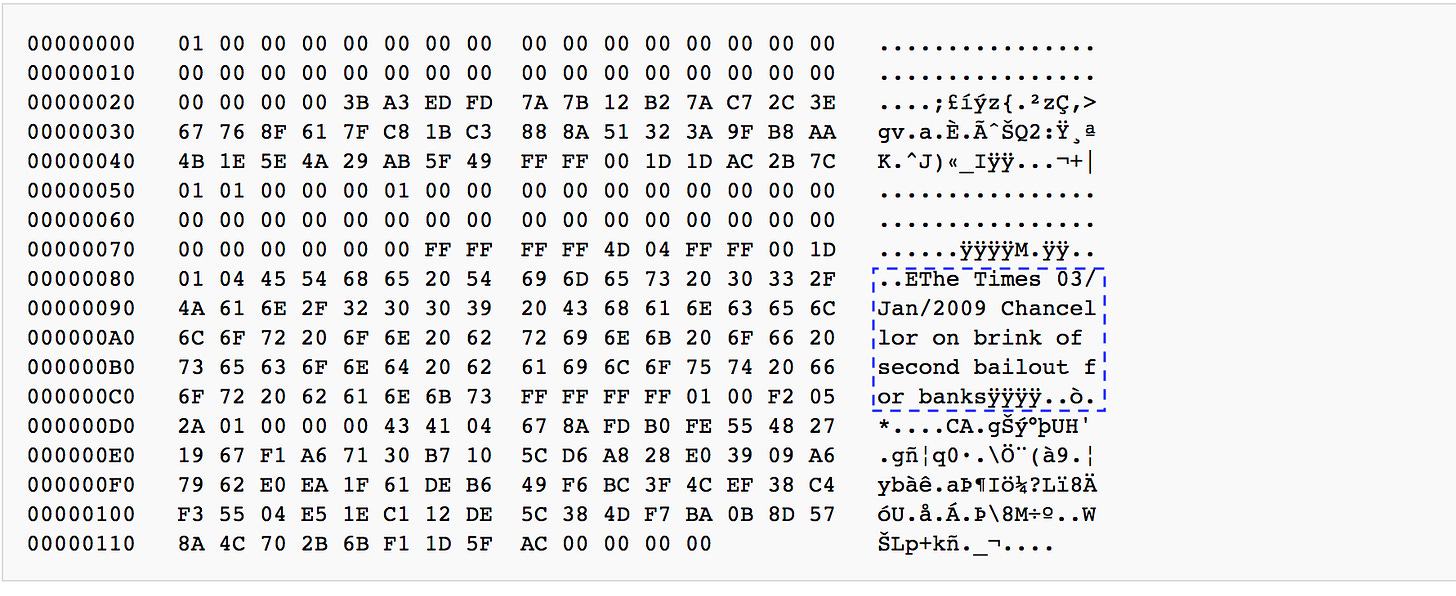

Crypto industry started as a dream of a new, better, financial ecosystem, idealistically immune from crises.

This purist dream hasn’t, however, found acceptance beyond a small group of people with deep technical skills and those with the need to circumvent financial controls for illegal and unethical use cases.

In a way, this was a product market fit (PMF) but it was hardly the one to be excited about or even acknowledge.

Ok, so it’s a tool for illegal payments and only miners benefit from it -> ignore, it will die off / get banned

Enter speculation

The next ‘use case’ (driven by Bitcoin’s price growth and the ‘digital gold’ narrative) was speculation. New coins emerged, some of them literally as ironic experiments around the madness of the crowds and their appetite to buy anything hoping for a quick fortune.

In order to accommodate investor appetite for trading, financial infrastructure had to be put in place - brokers, exchanges, wallets, custodians, etc.

Ok, people are speculating on assets that have no intrinsic value / utility. Sure, someone will benefit by collecting fees from this, but it’s self serving -> ignore it, it’s an empty bubble that will burst

Smart Contracts and ICOs

We’ve covered this before - in short, 2nd generation blockchain platforms (Ethereum) allowed to build apps that would exist right on top of the decentralised crypto network as software.

Suddenly, you could create a decentralised Uber, a decentralised casino and many other exciting things.

The PMF of this cycle? ICOs - initial coin offerings - where billions of dollars have been raised by selling (often dubious) tokens on the blockchain. Use case - regulation circumvention, speculation and greed. An incredible market rally of 1000%+ and its quick demise.

Ok, so crypto is all about scams, easy money and regulatory arbitrage, surely it will die or get banned -> it’s affecting capital markets now and is too big to ignore, but better to stay away

Bubbles are good

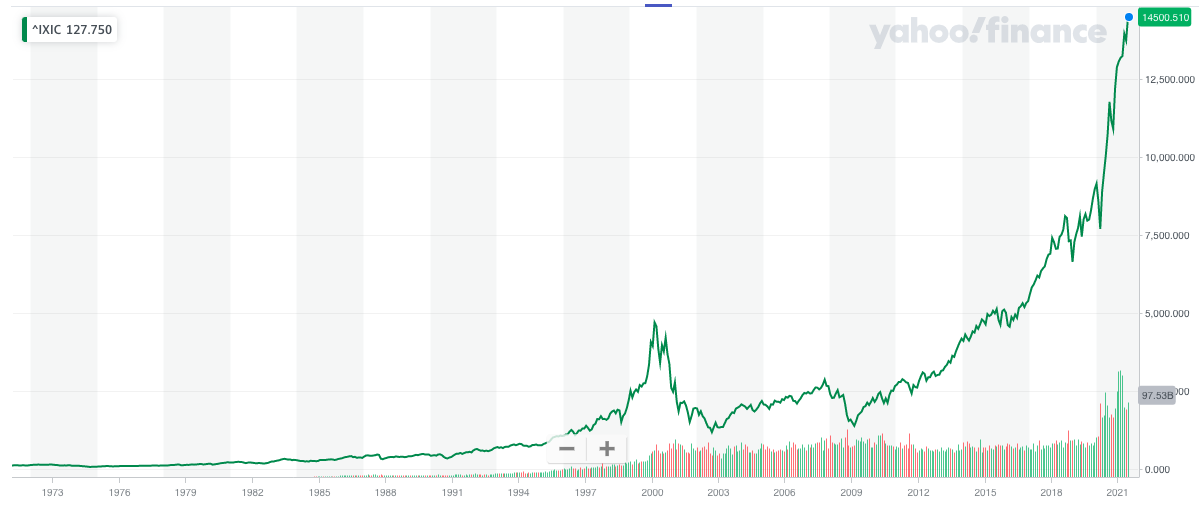

Dotcom bubble has a bad reputation for no good reason. There are generations of financiers who grew up (career wise) educated on the case studies of the Asian market crash, the Dotcom bubble and the 2008 crash. These stories are cautionary / boogyman tales that communicate the message to avoid future crises at all cost. Have a look at NASDAQ’s chart below:

While you can clearly see the crash on the chart, in the long run, was it such a big deal after all? In fact, wasn’t it a good thing? Weren’t Web 2.0 giants born from the seeds of the capital flows that drowned the market in cash and allowed for teams to experiment and build previously unthinkable businesses?

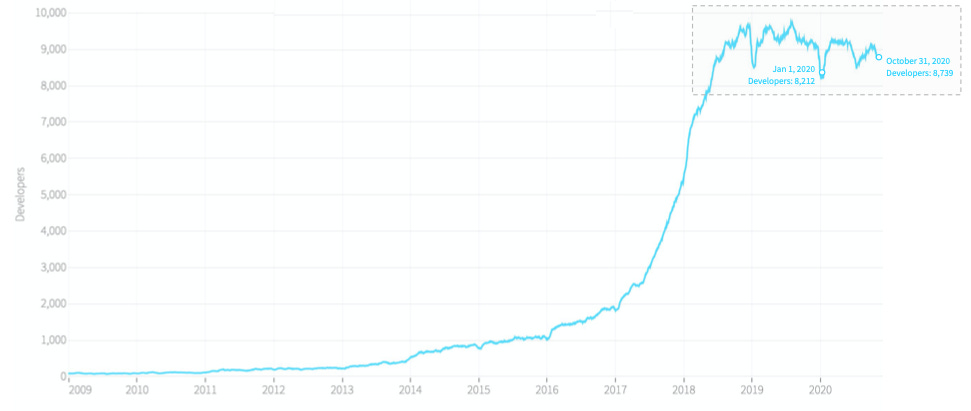

The ICO bubble was no different and while a lot of capital has been lost, look at what it did to the number of people building products in crypto:

That exponential growth in 2017 and 2018 happened behind the scenes - while we were reading articles about yet another failed / prosecuted ICO raise, thousands of software entrepreneurs were entering the crypto industry to build the next generation of products. Would all that effort finally bring a legitimate PMF?

DeFi Summer

Last year, an impressive ecosystem of products emerged that centres around finance. The fundamentals have been covered in this newsletter before and the user growth continues to impress.

$100bn+ of capital from both retail and sophisticated investors (~3mn users in total) are interacting with DeFi products. They are lending, borrowing, trading, insuring, securitising etc. Crypto finally has blockchain-native apps that have users, generate revenue and pay dividends. This is finally ‘real’.

A fair and unbiased reviewer of DeFi would also point out that while the space is exciting, the majority of the flows are crypto-centric, i.e. have little utility in the ‘real world’. While it’s a fair reflection of the situation * today *, there are live projects allowing their customers to get paid faster while waiting for music royalties, refinance real estate etc. More and more traditional financial institutions are getting involved with crypto and DeFi more specifically. Also, let’s keep in mind that crypto is a $2tn+ industry so even self serving is good enough. And let us not forget about rapidly growing digital consumption (e.g. NFTs).

Ok, so there is a rapidly growing ecosystem with a couple of million users and impressive innovation, but it’s still mostly an end in itself and ‘real world’ use cases aren’t widely spread -> it has clearly grown into an industry, but it’s still uncertain so let’s wait for now

Should you though?

Clearly we don’t think so. The famous saying “First they ignore you, then they laugh at you, then they fight you, then you win” doesn’t apply to crypto alone - it applies to most new radical / disruptive ideas and products. We have 10+ years of data from the crypto industry showing that an open ecosystem and human ingenuity drive new discoveries and new use cases. The industry is stronger (and more legitimate) than ever before and we don’t see any signs of this trend reversing.

DeFi could stagnate or it could become the rails for the Future of Finance. We are betting on the latter and are looking forward to announcing our new project that will contribute to the growth of this exciting ecosystem. Stay tuned!