If the mountain won’t come to you…

Crypto is a self-centred ecosystem with most products being first adopted by the crypto-natives, whose capital gets recycled many times over. In order to expand, it needs more real-world use cases - hence payment and credit card integrations; futures listings on CME, numerous ETFs and other ways of attracting capital.

Another way to solve this is instead of trying to convince ‘real capital’ to come into a siloed ecosystem is to bring the ecosystem’s capital and tech to the real-world assets. If real-world assets can be financed via and serviced by this new financial / tech platform, it would have already justified its existence.

Thanks to rapid innovators, such solutions already exist.

A ‘Decentralised Asset Finance’ provider Centrifuge converts invoices / receivables of real-world businesses into tokens which exist on crypto rails. Its proprietary platform Tinlake sources capital and facilitates invoice factoring and other types of asset financing.

Traditional securitisation meets advanced software infrastructure. Business model is similar to traditional peer-to-peer platforms with the exception of capital flowing more fluidly and these tokens being part of the broader ecosystem.

There are multiple pools available on the platform with some decent yield.

Paperchain securitises receivables from media platforms so that artists could be paid on time.

This product solves cash flow problems for its users and provides a superior risk adjusted rate of return to investors.

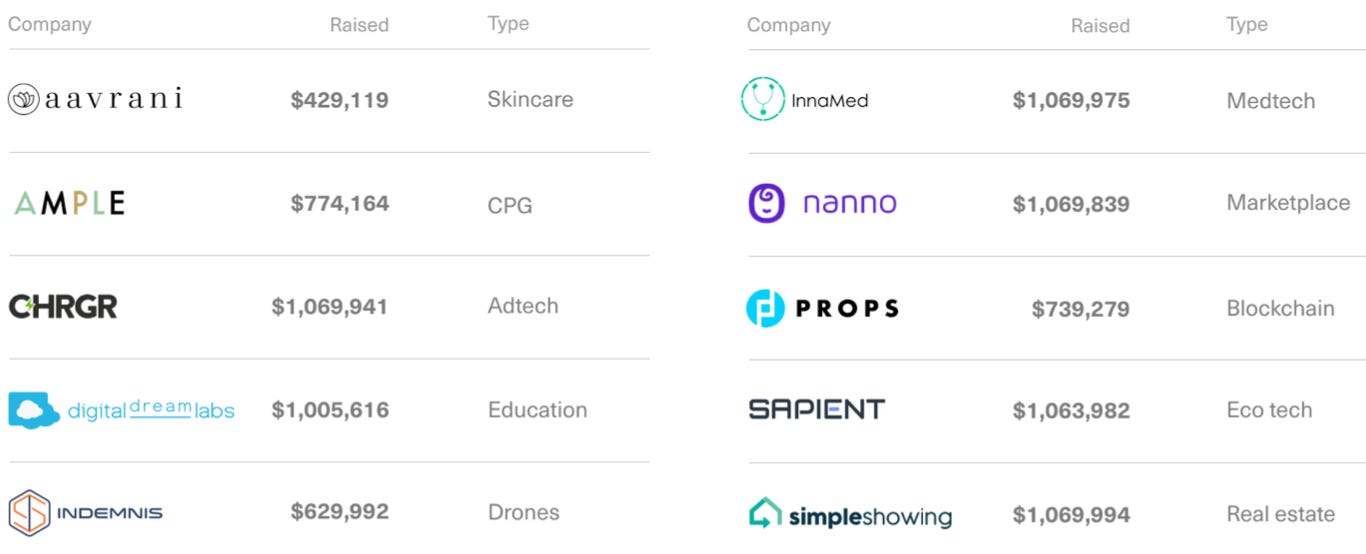

Republic is a new generation crowdfunding platform where traditional capital raising is enhanced by a native token.

These securitised assets exist on platforms, where secondary trading, fractional ownership and collateralisation are possible, making them a more attractive choice versus their traditional peers.

All for one and one for all

Let’s say these digital platforms are indeed a smart and convenient way to manage investment processes and flows. That’s still ‘just’ software innovation, rather than financial.

As you would come to expect, this gets interesting once we look at how these platforms interact with one another via a system of symbiotic economic relationships.

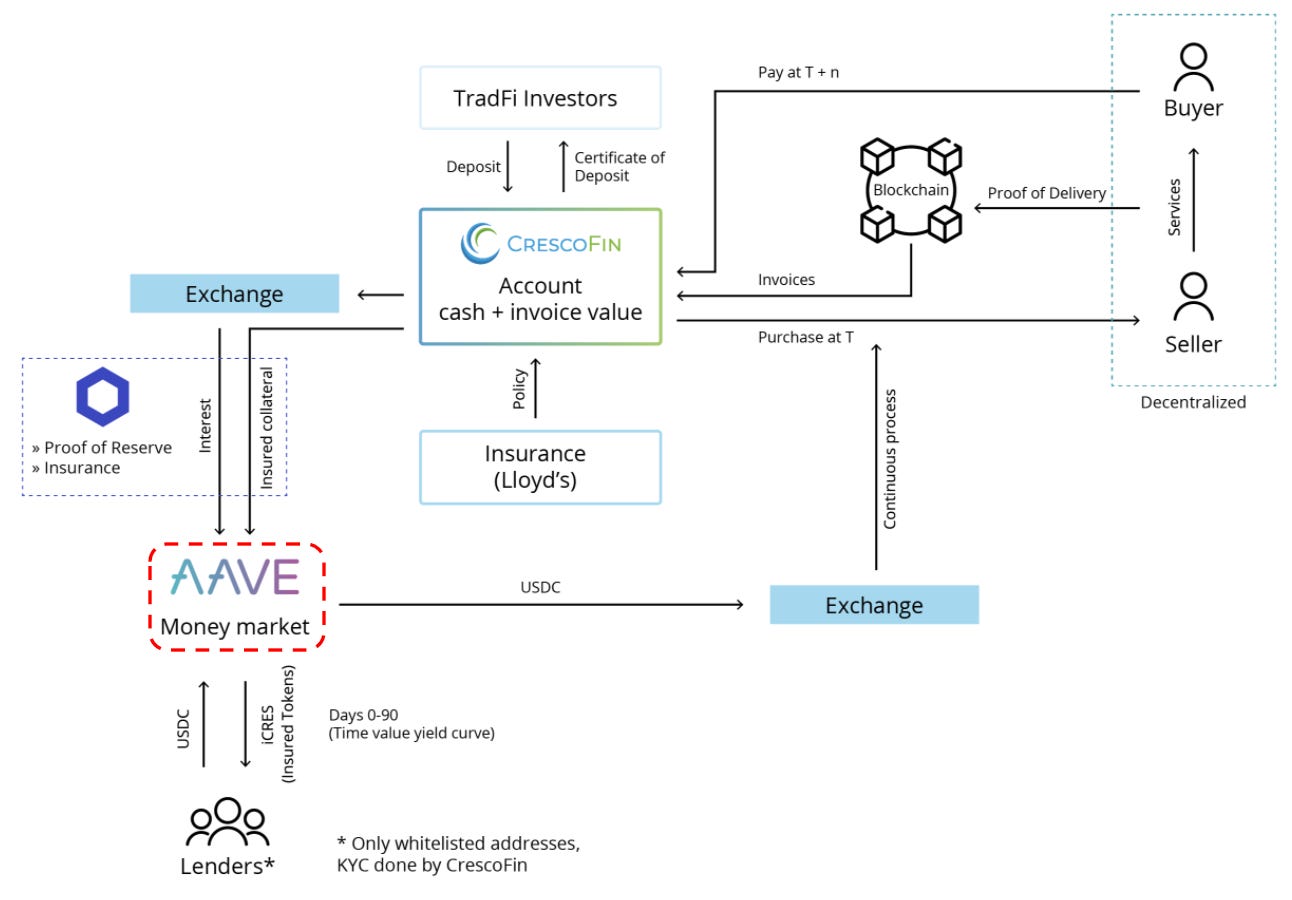

Below is an overview of how one of such securitisation players - CrescoFin - intends to organise the process and then have these assets sit on Aave, a money-market protocol similar to Compound (covered in the Banking 2.0 edition).

It’s a complex mechanism, but simply put, the securitised pool of assets can be ‘deposited’ onto an Aave account, where it can potentially generate additional yield or be used as collateral for new loans. Aave tokenholders therefore benefit from the growth of their ecosystem with CrescoFin assets flowing in, while the asset provider benefits from immediately leveraging the crypto pool of capital and composability features it offers.

By using crypto as digital rails to facilitate securitisation and portfolio management, real world companies that have no need or desire to deal with coins, can still benefit from this innovation. The embedded positive economic inventive loop is simply a great bonus on top. A bonus, which is a unique differentiator of this technological solution.