Reality Check

The numbers (usually) don't lie

Is this time different?

We’ve seen that crypto now has cool products, interesting concepts and strong user growth. But with BTC nearing its all time highs, it’s important to take a step back and look at the numbers to see if any of this makes economic sense. Not just the number of users or capital deployed, but rather intrinsic value, cash flows and profits.

In the 2017 bubble cycle there wasn’t a single live coin generating fundamental cash flows, let alone a mechanism of embedding those flows into their intrinsic value. I’m not taking into account coins, where the only utility comes from paying transactional fees and ‘burning’ them to reduce supply and make the asset scarce.

If we look at the revenue generated by Protocol Layer coins, i.e. the ‘operating systems’ of crypto, we can see that not much has changed. There are two clear leaders - BTC as the ‘digital gold’ and Ethereum as the smart contract layer where most creative activity is happening.

And yet neither have a clearly defined economic model which creates intrinsic cash flow-driven value instead of depending on capital inflows (with a caveat that Ethereum’s economics is evolving and will have stronger fundamentals as the 2.0 version goes live).

Things look more interesting at the ‘Apps’ level.

These are live apps sitting on top of Ethereum’s ‘operating system’ with quite a few of them generating real revenue despite being rather young startups. They have real users, real utility and most of them have real token economic models.

As a side note, out of top 3 apps - Uniswap, Compound and SushiSwap - the first two are properly established companies with strong teams, public presence and backing by top VCs. SushiSwap, however, is a purely open source ‘app’ with anonymous founders and no institutional backers. It didn’t stop it from making it into top-3 apps revenue-wise! Brave new world…

Intrinsic value

One question still remains - does this revenue trickle down into the underlying tokens or does it sit at a ‘company level’ while the actual tokens have no claim over the cash flow?

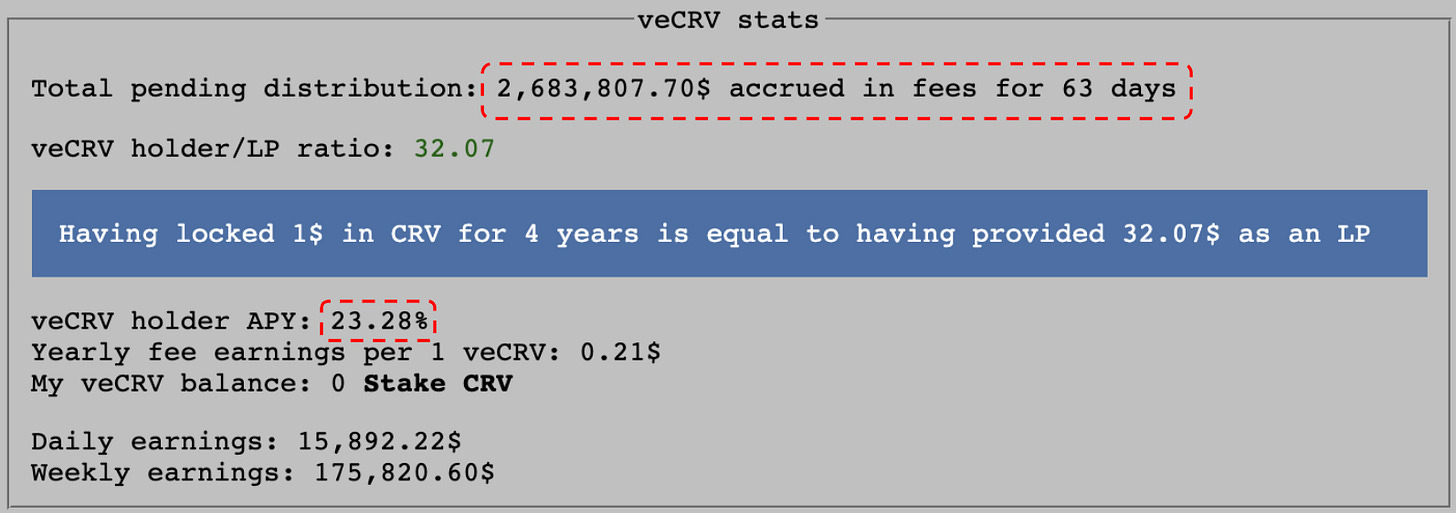

Let’s have a look at Curve - one of the leading DEXs with $1.4bn in deposits and daily trading volume of $80mn. You can see below that it generates ~$16k of revenue per day with ~$2.7mn accumulated over the last 2 months.

The accumulated revenue is used to buy back Curve tokens from the market and distribute those tokens to existing tokenholders who participate in the governance of this app. Governance participation implies token lock up for a fixed period - it’s a standard mechanism applied in crypto to reduce speculation.

It’s the same logic as share buybacks and it creates a direct link between the app’s revenue and the intrinsic value of its tokens. In this instance Curve tokenholders can expect a 23% yield on the coins they lock up. Not a bad ‘dividend yield’ for an app that went live just this year.

Investable assets

This fundamentally changes the narrative and makes this market investable. Investable not on the back of a conceptual vision and promises of a better tomorrow, but on the back of real cashflows which can be modelled and coins which can be valued.

If an asset can be valued it can be debated whether it’s priced fairly or not. What cannot be debated is that it’s a real asset (not too different from stocks) which should have a market for it. A market, which is not going to go away.