Over a weekend in early March, USDC (the second largest stablecoin in the market) lost its peg and temporarily traded as low as 90 cents on the dollar. The market was reacting to fears that the dollar collateral held in the US banking system that Circle uses to back USDC with was missing in the aftermath of Silicon Valley Bank's collapse. Then news came out that the US government was stepping in and made all depositors, including Circle, whole. USDC quickly traded back towards par.

The crypto market has had over a month to digest the impact of the USDC depeg. In the wake of an event that many in the space considered a black swan, market participants are reevaluating the safety of various stablecoin assets to determine the risks inherent in each one.

There is a class of stablecoin that we think have unique properties that can allow them to maintain improved stability even in the event of market events like the USDC depeg. With over $10bn serving as collateral for Collateralised Debt Position (CDP) stablecoins it’s important to understand how they work and how they fared during and after the USDC depeg.

What are Collateralized Debt Position Stablecoins?

Collateralised Debt Position (CDP) stablecoins are issued directly on the blockchain and are backed by a basket of assets, rather than just one asset like most other stablecoins. Users mint this type of stablecoin by depositing tokens as collateral in a smart contract, and borrowing the CDP stablecoin. This "minting" increases the circulating supply of the asset. When users want to reclaim their collateral, they bring the CDP stable to the protocol to “burn,” repaying their debt to unlock their collateral tokens.

DeFi Llama lists over 81 CDP stablecoins in the market. Each offers trade offs in accepted collateral types, loan-to-value ratios, and other risk management parameters. Here are some of the largest ones:

How do CDP stablecoins maintain their peg?

CDP stablecoins are designed to maintain a stable value relative to a specific asset, such as the US dollar, by adjusting the supply of the stablecoin based on market demand. If the price of the stablecoin falls below its peg, users are incentivised to reduce the supply of the stablecoin by buying it cheaply off the market and repaying their debt. If the price of the stablecoin rises above its peg users are incentivised to open debt positions and sell the stablecoin for more than $1 of collateral. This increases the supply and reduces the price.

CDP stablecoins are almost always overcollateralised, which means that the value of the collateral locked in the protocol is greater than the value of the stablecoins minted by users. This is done to ensure that the stablecoin remains at peg even if the value of the collateral falls. If the value of the collateral falls too much and users don't add more collateral, the protocol would take on bad debt and the created "stablecoin" would fall off peg. In order to prevent this, protocols incentivise liquidations in a way similar to other decentralised lending protocols. When a user's debt position gets under a set value, the collateral is sold off at a discount and the full debt repaid any spread going to the liquidator.

As long as smart contracts are functioning and there is sufficient liquidity to liquidate the collateral, the protocol and the debt-backed stablecoin should remain solvent.

How did CDP stablecoins perform during the black swan USDC depeg?

Now that we understand the basics of the asset class, we can look at how various models performed during a black swan event like the USDC depeg.

While working over the long weekend of the USDC depeg to manage positions, we quickly realised some of these CDP assets were acting as a type of "safe-haven" asset, with users buying them off the market in the rush to exit USDC.

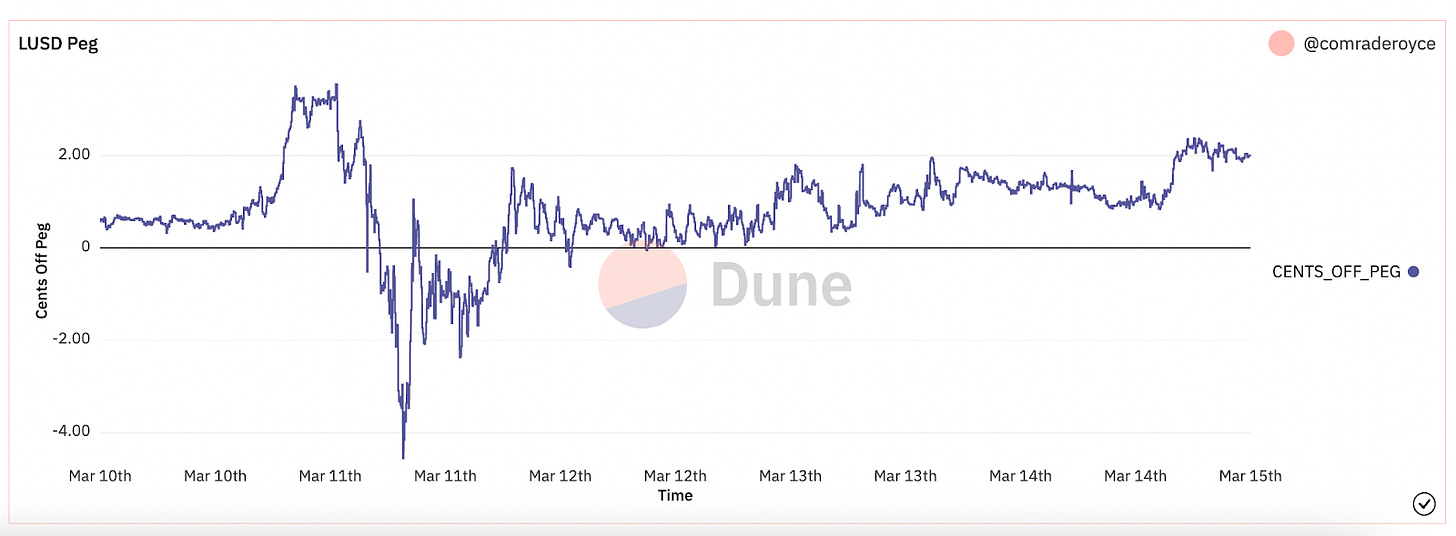

The most notable example of this was LUSD, a stablecoin backed entirely by ETH, which traded at a hefty premium to USDC and even a premium to a dollar’s worth of other assets.

Other CDP stablecoins sold off.

DAI, the largest of the CDP stablecoins, had implicit risk because over 60% of the collateral backing DAI is USDC. The result was DAI traded down in line with USDC. Yet DAI also has other collateral backing. Once the USDC collateral reached a max limit, DAI also started to trade at a premium to USDC.

At the same time, CDP stables with more varied collateral types started to serve as a safe-haven for the market. The result was that over the depeg weekend, most notable CDP stables traded at a premium to USDC.

But is the market efficient?

Our answer is: not really. Despite trading at par with USDC or at a premium to it, many of these stablecoins still traded at a discount to their fair value.

While some of this market activity was related to legitimate fear of insolvencies, the reality was that most CDP stablecoins remained fully solvent throughout the ordeal.

In our own monitoring of the blockchain and in conversations with teams, we found that liquidations proceeded in an orderly fashion. USDC collateral was removed from protocol balance sheets when user positions became too risky. The same mechanisms that manage the CDP pegs during downturns in volatile collateral like ETH and BTC worked to de-risk USDC collateral during the depeg.

This provided an opportunity for savvy market participants. Users with debt positions were able to repay their loans cheaply and other users were able to exit to these assets by paying a premium over USDC.

What are the benefits of CDP stablecoins vs other models?

CDP stablecoins offer the transparency and composability inherent in much of DeFi. By having open balance sheets and clear processes for offloading collateral, market participants can form a clear view of risks and act accordingly. This is in sharp contrast to centralised stablecoins like USDC, where the lack of transparency in the traditional banking system was the root cause of the depeg.

While there are downsides to the CDP model, their performance during the USDC depeg shows they have an important role to play in the DeFi ecosystem. Overcollateralisation has long been touted as a reason why these types of stablecoins won't be able to scale. But in adverse market conditions we have seen this kind of asset can offer unique stability.

Re7 Capital - DeFi liquidity providers