2015 was a milestone year for crypto - a new generation blockchain platform launched and propelled the space into the stratosphere. It was called Ethereum.

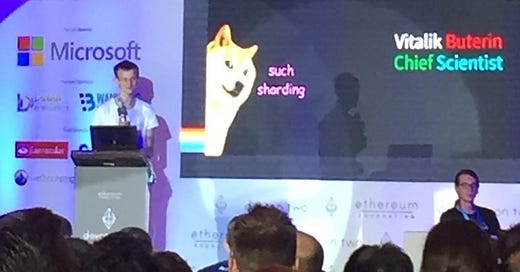

Below is the photo of its founder at a developer conference in 2016 (he was 21 when the network went live!).

It’s easy to dismiss this technology / trend as something geeky and hyped up but don’t let this deliberate playfulness fool you - this network alone has a Market Cap of $51bn, is on track to generate $606mn of revenues this year; and it allowed an open ecosystem to blossom with hundreds of billions processed, traded, raised and deployed, let alone millions of software development hours contributed towards it.

In short, Ethereum led a revolution in open-sourced software development by going beyond the Bitcoin blockchain capabilities and further enhancing the concept of ‘programmable money’. It introduced the concept of ‘smart contracts’ which allows its coins (i.e. money / currency / securities depending on your use case) to be tied into an algorithm which exists as an immutable code in a ‘digital escrow’ protected by the network. A smart contract is effectively a piece of code which performs a task and is stored on the blockchain network in a way which makes it immutable. Below is a basic visual representation of this logic - the old way (a) vs the new (b) .

It is precisely because of this ‘trustless’ nature of this code and associated transactions, one doesn’t need to rely on trusted 3rd parties (i.e. banks) to facilitate certain flow and can simply be a member of an anonymous decentralised network.

For example, two parties might enter into a ‘contract’ (which is effectively a ‘if -> then’ rule) where upon a certain event a payment has to be made (e.g. insurance / gambling). Whilst this sounds very basic and like nothing to be excited about, imagine deploying such a contract with no counterparty risk, no cross-border restrictions, real-time mark-to-market and an impossibility to default on this contract or hide your collateral. Now imagine that all financial assets have a common standard and you can easily swap real estate into a stock or a share in a physical object, e.g. a car, into a bond in any currency. All of this can happen in real time and at a cost equivalent to a SWIFT payment.

These ‘smart contracts’ allow for financial assets to be codified and managed in a brand new way, which has never been possible before.

OK, so we can replicate our financial rules and processes on a new technology platform, does it really matter? Yes, it does. It changes the whole business model because it changes the most important thing - economic incentives.