Financial weapons of mass destruction

That’s the unflattering nickname Warren Buffett assigned to derivative contracts back in 2002.

Derivates, as their name suggest, derive their value from the underlying asset but trade independently. These are important tools in both financial markets and physical trade, and like any tool they can be used for both good and bad (let’s call it productive and speculative). As a reference point, in the 17th century they were used to protect rice farmers in Japan from price fluctuations as well as to speculate on tulip prices.

There are thousands of academic papers and corporate pitches arguing for and against the use of derivates, but the important point is that their market size exceeds global GDP by ~10x and without them our financial system would be the fraction of its current size. Which would not only mean lower bonuses for bankers, but also higher cost of debt for borrowers and ultimately less consumption for us all.

Out of dozens of confusing instruments, the most infamous ones are Credit Default Swaps (CDS) and Collateralised Debt Obligations (CDO). They are the ones usually blamed for excessive speculation and leverage during the housing bubble and the ultimate 2008 recession.

What are they? The most straightforward (and perhaps excessively cynical) CDO explanation is this one. And CDS is effectively an insurance against a credit default.

Both of them can be used to repackage and redistribute risk (the good) as well as for getting excessive leverage and obfuscating bad credit (the ugly). The market for these instruments shrank dramatically on the back of post-2008 negative PR and are now viewed to be much riskier than they were initially perceived to be.

Why is this relevant in the context of crypto - a tech platform leading us into the brighter tomorrow? Well, turns out that if you give skilled software developers a laptop, a financial network to plug into and the right economic incentives, suddenly the risks of yesterday disappear from the rear view mirrors.

Re-inventing the wheel

DeFi, like any other financial system, is built on credit. Whether it’s traditional banking style lending as described here or leveraged trading as seen below,

credit is what fuelled DeFi’s rapid growth and it’s logical to have the next wave of innovation to focus on risk mitigation and credit protection. Cybersecurity / platform risks have been addressed already, but financial innovation needn’t stop there. Credit risks are separate from hack risks and need to be hedged separately.

Tranching - a key component of credit collateralisation - found its way into DeFi with some platforms already offering multi-tier access to risk:

You can choose your risk profile and whether you want to be in the highest quality / lowest risk tranche or if you want to maximise your return. So far such platforms only allow you to pick the tranche of a specific credit issuer / product, but my bet is that in the very near future we’ll see those providers pooled together. Just like the CDOs were supposed to, this will help diversify the risks (but will not protect you from systemic risks where everything moves in one direction).

Is this better than pooled mortgages? Hopefully the answer is yes - blockchain is a transparent platform and it’s much harder to mislead professional participants about the quality of the underlying credit.

Time will tell if blockchain is going to be up to the challenge.

With CDOs helping us spread the risk and lower sensitivity to specific bad loans, credit swaps were next in line.

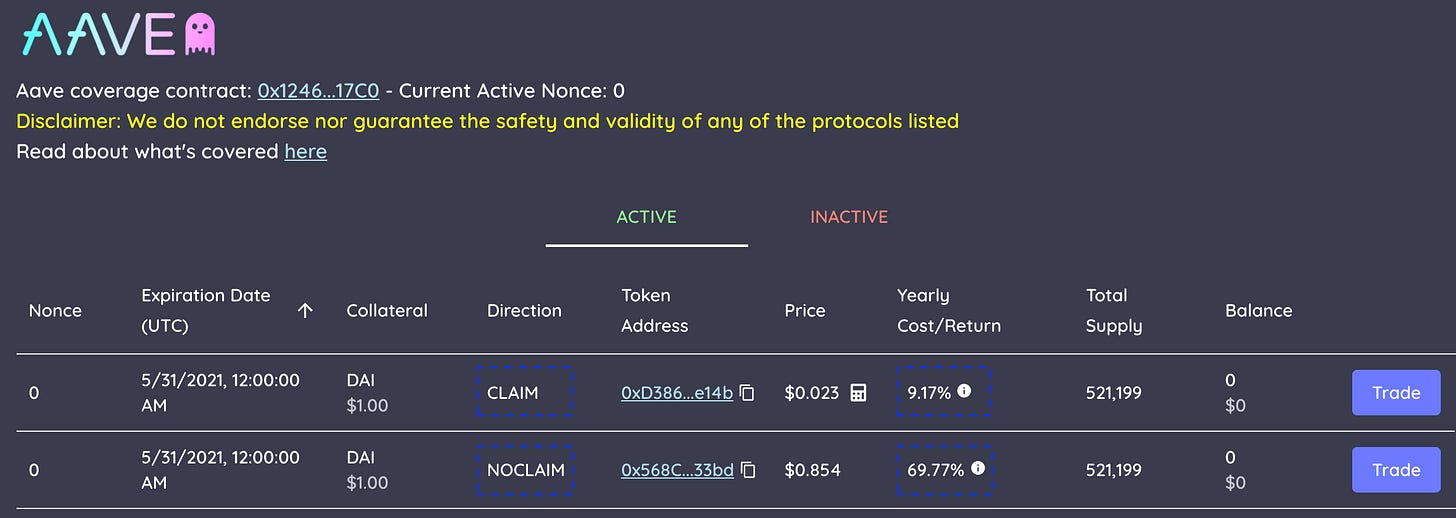

Cover Protocol is working on enabling CDS style protection, where you would be able to trade swaps on the underlying lending platform, i.e. betting on whether there is going to be a CLAIM event or not:

And just like that, the infamous credit derivatives are back in business.

Crypto industry was built as a rebellion against the legacy financial system:

It is therefore ironic that it took DeFi just one year to start replicating the same products for which big banks have been criticised for over a decade.

Let’s hope it doesn’t get ugly this time.