The State of DeFi

Post FTX review

Last week was one of the most eventful for the crypto market since its inception. We saw the swift implosion of one of the largest exchanges (FTX) over the course of a single week. Lack of transparency and alleged fraud created a USD10bn hole and the company filed for Chapter 11 last Friday. Trust in centralised crypto counterparties has been considerably shaken (again) and waves of contagion have begun, creating liquidity issues for some other exchanges.

In the meantime, DeFi protocols performed without a hitch.

Automation, enforced via smart contracts, ensures that user funds cannot be quietly mishandled by the insiders. [There always are smart contract risks, but there is a difference between an external cybersecurity attack and quiet appropriation of depositors’ capital].

Transparency, enabled by blockchain - an open global public ledger, removes the need for bank runs. When a balance sheet is visible online in real time and all numbers add up, there is simply no need to run for the doors.

Decentralised credit markets on Ethereum continued to function smoothly, orderly processing liquidations and their utilisation mechanisms kept balanced liquidity flowing through the market.

Take Euler Finance for example. The DAI and ETH borrow rates spiked, but depositors quickly filled the difference chasing after the increase in yield.

Liquidations proceeded as normal across the Ethereum ecosystem. There were over $20m in liquidations over the last week as prices declined.

DeFi creditors, protected by market incentives like enforced liquidation risk, were often repaid early. Interestingly, Alameda (FTX sister company) repaid its MIM loan backed by FTT, along with numerous outstanding loans from Aave and Compound.

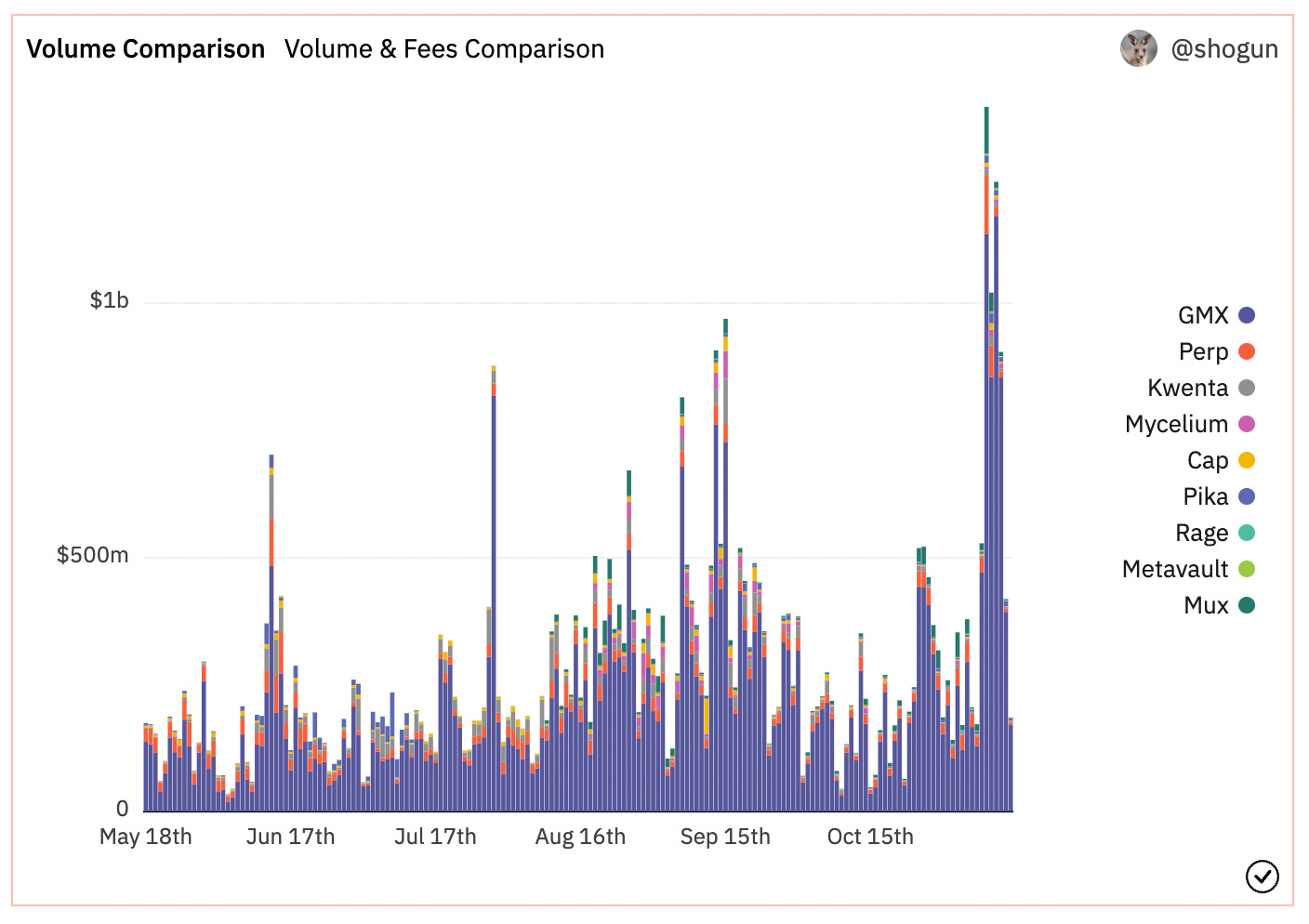

On-chain trading continued without interruption and saw some of its highest volume days ever. Leveraged trading protocols like GMX saw huge volumes.

For decentralised exchanges where funds sit in smart contracts, the kind of fund movement and obfuscation that allows for fraud just isn’t possible. Funds are protected by code yet again.

On-chain analysis also continues to shine, both in tracking fund movements and in preventing risk. DeFi money managers continue to use it heavily to monitor everything from exchange rates to capital flows.

Not a single DeFi native stablecoin depegged in a meaningful way. FRAX, MIM, DAI and others saw lots of pressure, but their mechanisms performed as expected and maintained stability.

But DeFi is not 100% absolved. Centralised and opaque protocols without sensible risk parameters also got hurt. In the Solana ecosystem, for example, we are seeing the downside results of centralised custody and protocol control.

solBTC and solETH, wrapped assets on Solana held in FTX custody, are now trading well below their native asset prices. Compromised admin keys of projects have meant that Serum and others are looking at forks to stay alive.

So even with DeFi, risk management is paramount. Continuing to push for decentralised, immutable and secure protocols is more important than ever.

It is unfortunate that actions of a small group of people in one large organisation will undoubtedly cast a shadow on the whole industry, but it’s important to remember that centralised brokers have nothing to do with the underlying blockchain technology.

DeFi has an ability to provide transparent mechanisms for all market participants and enforce the rules prevents blowups like the one that played out over the past week. The value of DeFi is apparent now more than ever and we are determined to continue supporting it.

Re7 Capital - a DeFi firm focusing on stablecoins and ETH