Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

How Layer 2 ecosystems differentiate through identifying formation and G2M strategy

Data that illustrates Base’s differentiation in retail adoption

The role of gateways and smart wallets in driving retail participation

The Base of Web3

Everyone is excited about the current adoption cycle playing out before our eyes.

There’s no shortage of projects working towards providing the necessary infrastructure to enable the onboarding of millions of users to Web3 rails.

One area is Layer 2 (L2) blockchain ecosystems - their main objective being to reduce costs and enhance transaction throughput for everyday users in a more affordable, performant environment vs. their respective L1 chains.

At the start of 2022, there were just 3 L2s that had >$500m in total value-bridged.

Fast forward to today, there are now 8. Above $100m, this number jumps to 14.

The L2 landscape is becoming increasingly competitive.

The moats are not likely to be just performance. We need to look more holistically - particularly at the user funnels and G2M strategy.

At Re7, our market intelligence systems help validate and inform theses in real-time.

One of these long-standing theses has been Base leading the L2 charge in 2024 from its ability to differentiate itself by leveraging Coinbase’s user network.

Being tied to Coinbase at the hip, Base has effectively already bootstrapped an early network effect already familiar with Web3.

Base has experienced the largest cumulative growth by a wide margin for total-value-locked vs. its peers (200%+).

Base (yellow) is now also eating market share for daily active users at 30%.

Base Yourself in Retail Shoes

Coinbase is priming Base to be used as a retail network in the early stages.

In December 2023, Coinbase announced free transfers of USD on Base using the Coinbase wallet.

The hallmarks of retail activity can also be seen empirically with memecoins and SocialFi sectors driving >50% of all transactions on-chain.

But we also see it for DeFi too. Take exchanges.

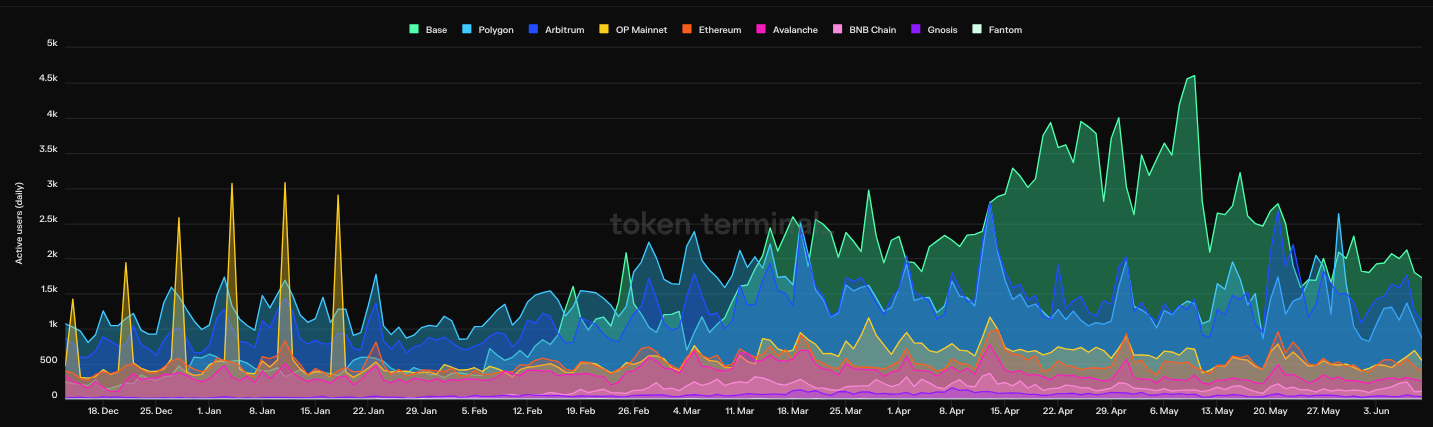

Uniswap has far more active users on Base (white) than any other network since March 2024.

If stronger retail forces are driving Base activity, we would expect the average trading volume for each user to be lower on Base vs. its peers.

Base (red) has the lowest avg. trading volume per active user at $1k.

The same dynamics are also seen for lending. Aave’s active users are predominantly on Base (green).

The avg. loan size per active user on Base (red) is far lower than its peers at ~$21k.

These charts also allow us to see 3 cohorts of projects emerge:

1 = Ethereum mainnet (use cases for higher value transactors)

2 = main cluster of L2s (mix of retail and higher value transactors)

3 = Base L2 (pure retail transaction sizes)

One potential takeaway is Base as an ecosystem has fully leaned into the retail market. The retail identity may have itself become the moat.

Smart Wallet

Enhancing user gateways to L2s will likely play a key part in enabling further retail adoption for Base.

Earlier in June, Coinbase introduced ‘Smart Wallets’ that bring gasless transactions and utilise easier login processes (e.g. passkeys). These wallets are ERC-4337 compliant and mobile friendly.

Although Coinbase Smart Wallets support several chains, these wallets are likely to be designed to add relatively higher value to Base than any other ecosystem.

After all, Coinbase could position Base dapps more closely to Smart Wallet users through integrations and partnerships.

After a week since launching, >95% of Coinbase Smart Wallets have been created on Base.

Show Me the Incentive and I’ll Show You the Outcome

It’s becoming increasingly clear that ecosystem teams have to form a clear market identity and a corresponding G2M strategy.

This has become increasingly more pressing as an increasingly crowded market fights for the same user mindshare.

The emergence of non-crypto native enterprise-based L2s will face the same set of challenges - porting over their existing customers on-chain. But with challenges comes opportunity.

ETH Yield Strategies To New Heights

Last week, we highlighted how and why ETH borrow rates were increasing

DeFi loans have now topped $11b. This represents a 2-year peak - driven by Ether.fi and Ethena

Aave’s V3 leads the pack for borrow amt at $6b, aided by the introduction of weETH as collateral

Represents the continued high demand for ETH farming with a wide range of DeFi opportunities that pay more than the high borrow rates.

Global MCAP

$2.47T; Global market capitalisation has been chopping ~$2.5T for 2 weeks. Macro heavy week that may drive volatility incl. FOMC, PPI, UK monthly GDP, China CPI/PPI.

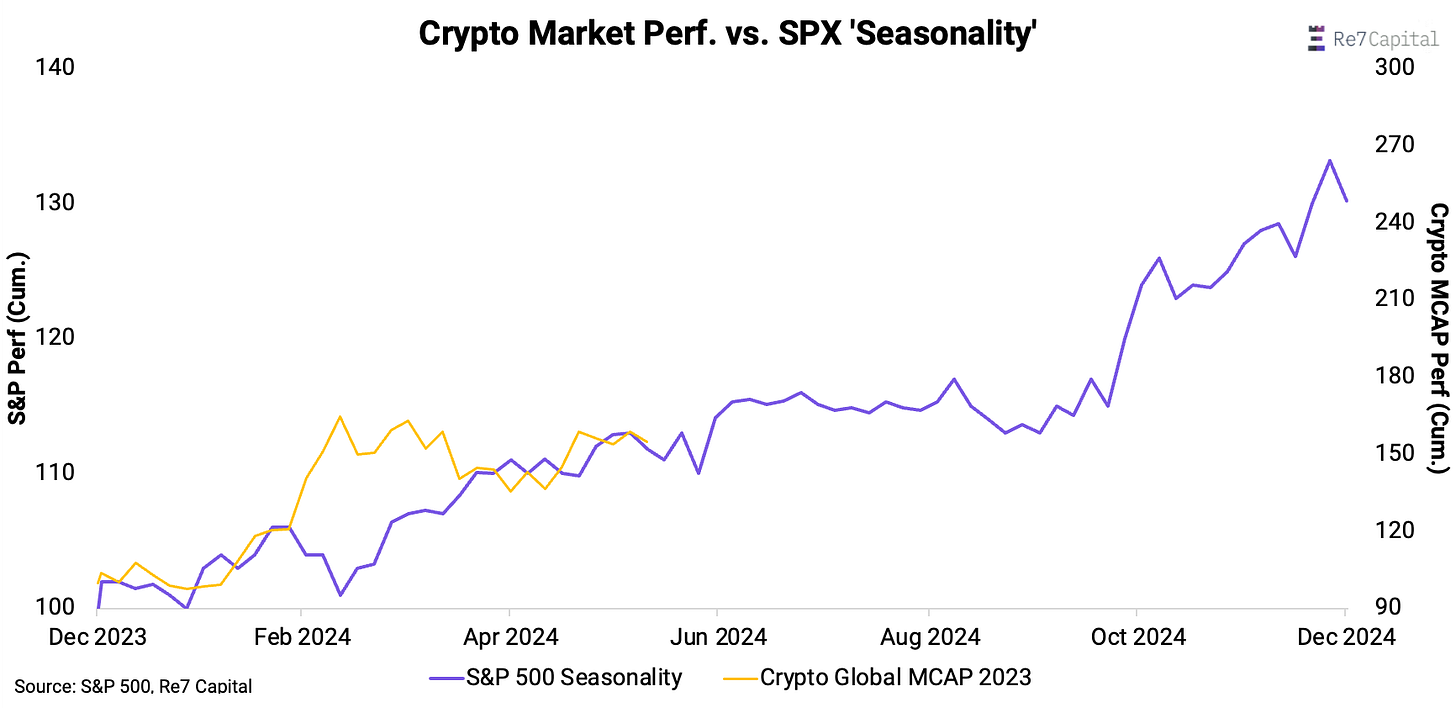

Performance Seasonality

Crypto’s market ‘lull’ as BTC chops marginally below its ATH level is in line with SPX seasonality where summer tends to be the period with the lowest volatility.

SOL/ETH

0.04; SOL/ETH cross at its 200d MA. Initially used as support which historically has been used as support in bull markets and resistance in bear markets.

Stablecoin Supply

144B; Stablecoin supplies staying flat at the same time as crypto chops around the $2.5T mark. No strong net inflows into the Web3 ecosystem with investors likely taking a wait-and-see mode.

Bitcoin ETF Net Inflows

+$500-800m; Relatively strong net inflows into spot BTC ETFs with June 4th being largest single net inflow day ($800m+). Indicates persistent investor interest in BTC particularly at current levels for BTC.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.