Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

How the LSD market is evolving and how to size it

Why LSDs in alternative ecosystems have historically lagged and why the game is now changing

The unique case of dApp chain LSD providers and their distinctive opportunity

LSD

Liquid staking derivatives (LSDs) are tokens that represent staked cryptoassets for an individual proof-of-stake blockchain network.

These are simply IOUs for debt issued for staking assets to secure that network. When a user stakes, for example, ETH through a liquid staking provider, they receive tokens that match the value of the deposit.

One key benefit of this infrastructure is that it enables holders to still generate passive income through staking without sacrificing liquidity. The other benefit is being able to use the new liquid staked token (LST) within Decentralised Finance (DeFi) use cases given LST holds the same market value as the underlying staked cryptoasset.

While LSDs have become a dominant narrative that has gained outside interest, it’s arguably a market that’s not well understood.

Below we’ll highlight some fresh insights, and showcase a fraction of the market trends Re7 tracks within this exciting sector.

The Evolving LSD Market

We can think about LSD’s TAM as being the total staking industry market capitalisation, which is valued at $170B today. Global staking rewards have breached $5.85b.

There are now more than 35 blockchains that have over $50m staking ‘market cap’ - the total value of staked assets on a blockchain.

Given the dollar value of the staked assets is volatile, the total dollar market size also fluctuates in proportion to that volatility. This also applies to staking rewards which are issued in the native asset of that blockchain.

The total LSD market size of the top chains has increased from $200b to over $400b YTD (2x).

During the previous bull market, the staking market size breached $900b, yet the liquid staking tooling was just not ready to service that growing market - in hindsight, there was a mismatch.

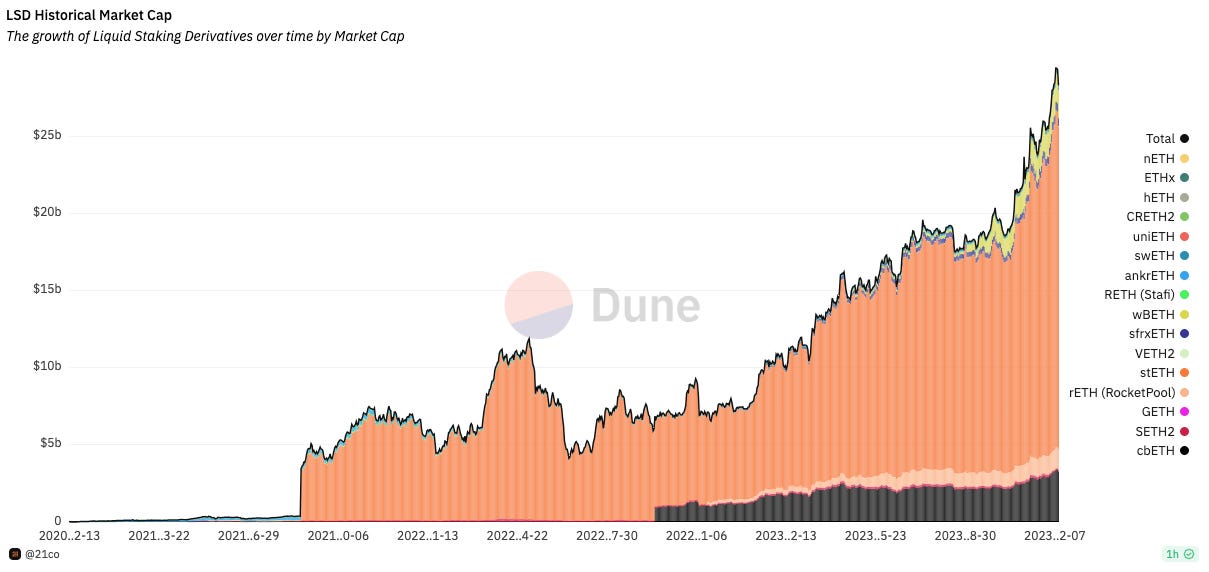

The LSD market cap peak in the last cycle was just $10.57B (34% of ETH staking market penetration).

Now the game is changing. Ethereum, the largest ecosystem LSD market, just breached $30B - now 46% ETH staking market penetration.

Decentralised providers are also winning out vs. their centralised counterparts, often offering more performant validators (e.g. Lido has over 10x Coinbase ETH deposits).

But the broader landscape is also catching up, with practically every blockchain ecosystem now working on native LSD tooling.

Alternative Ecosystems

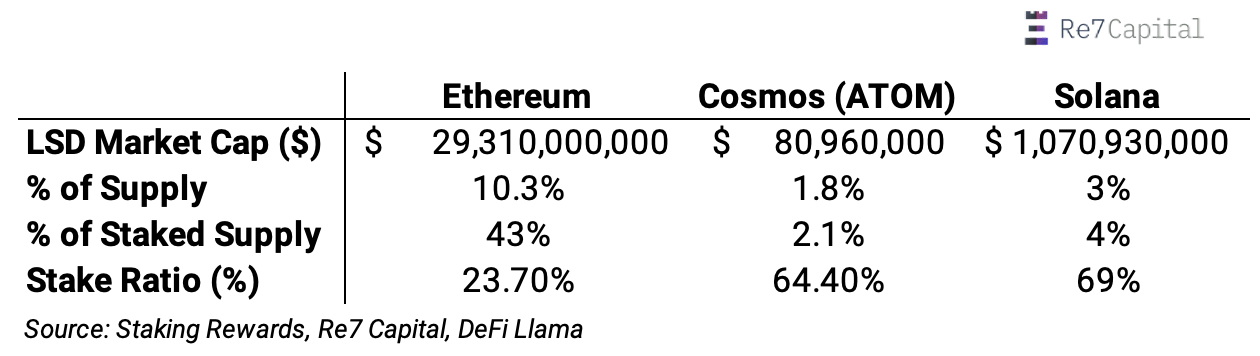

Yet, Ethereum still accounts for >90% of the total LSD market. For the leading alternative ecosystems offering LSD tooling, Cosmos and Solana only have 2% and 4% of the total staked supply in LSDs.

In other words, these ‘leading’ alternative LSD ecosystems are still ‘early’ in their market penetration. There are good reasons why they have been lagging too:

It is technically challenging to implement liquid staking for certain proof-of-staking networks (PoS) such as Cosmos.

PoS networks often have high staking rewards that can range from 10-30% where DeFi applications can’t compete on nominal yield alone

Problematic given smart contract risk may also be higher with more nascent tooling in alternative ecosystems.

Limited DeFi applications whereby LSTs can be useful for market participants.

But these are all reasons that aren’t a steady state. They are being addressed head-on.

For example, the Cosmos community approved of ATOM inflation cut from 14% to 10% in November. Meanwhile, the growing number of Solana DeFi applications are now including LSTs in their core offering coupled with a growing number of Solana tokens coming to market that will underpin its emerging financial system.

Higher on-chain activity will also drive MEV revenue which can be captured by LSD providers too, creating ‘tokenised flash bots’ opportunities.

Collectively, these developments are driving ATH appetite within these respective ecosystems.

dApp Chain LSD Ecosystems: A Unique Case

Not all LSD markets are dynamically the same. Cosmos has multiple PoS chains within its ecosystem that may have their own staking layer.

In other words, Cosmos’ LSD ecosystem TAM isn’t constrained to just the Cosmos Hub or ATOM. It’s the sum of the market capitalisation of all the self-sovereign dApp chains.

dApp chains enable Cosmos LSD providers to have their TVL accelerated by onboarding a diversified set of ecosystems.

Cosmos LSD providers also have diversified revenue streams and are able to tap into the crypto economics of their integrated dApps.

For example, dYdX stakers now receive 100% of dYdX perpetual trading revenue. LSD providers can take a cut of these rewards.

Example: Assuming a 30% LST share, ~20% APR, and $7.5B DYDX value staked, an LSD provider taking a 10% fee cut translates to ~$50m ARR.

Cosmos LSD providers are effectively indexed to all of Cosmos‘ growth.

Looking Ahead

LSD tooling is compelling as the multi-chain thesis is no longer a thesis. It’s a reality. There are a growing number of high-value PoS networks and dApp chains that need to bootstrap their security layers but ensure their native asset has utility in the broader ecosystem.

We note LSTs are often the primary collateral type of every major DeFi protocol in emerging ecosystems too - a trend that may become entrenched as liquidity begets liquidity.

What analysts also often miss is that the LSD market is also a structural play on the fat protocol thesis (Monegro, 2016) too - a thesis where value is concentrated at the shared protocol layer longer-term.

The definition of LSDs may also broaden over time to encompass more parts of the Web3 tech stack. Oracle network, Chainlink, now has over $600m in staked value would could be positioned as a brand new $600m LSD market overnight.

The ever-evolving nature of the LSD market and Web3 as a whole is what makes analysing this industry complex.

But it’s also what makes it incredibly exciting.

Spotlight

Re7 Featured on Token Terminal’s podcast, Fundamentals.

Token Terminal and Evgeny dive into the vast arena of DeFi, exploring everything from generating yield to managing risks, discussing the intrinsic value of crypto, how investors should approach valuing multidimensional cryptoassets, and what Re7’s edge is in the space.

Synthetix Revenue

The Syntehtix council has voted unanimously to end SNX inflation for stakers a bittersweet moment that starts to turn one of the oldest protocols in DeFi towards a long-term incentive structure.

Synthetix is one of the highest revenue protocols. On the back of success with their perpetual products, fees have passed $30m for the year and are growing.

The upcoming v3 will also introduce a buyback and burn mechanism on chains where v3 launches, making the token deflationary.

SNX stakers have earned a steady double-digit yield from fees and inflation, but with fees growing and further tokenomics changes coming in v3, now seems like the right time to test the Synthetix system supported just by the protocol's real yield.

Global Market Cap

$1.54T; Markets are down ~5% from the resistance line of ~$1.6T. Bearish divergence on the daily with RSI being reset at 64.

Liquidity

Chinese liquidity injections via the medium-term lending facility are the highest they’ve been in 2023. Green-shaded areas are periods of notable increases in reverse repo and MLF injections.

ETH/BTC

0.053; ETH/BTC still kept within its multi-year wedge pattern, sticking to support. 0.05 proving to be a sticky support for the ratio given the importance of the technical set-up.

DeFi

$62.8B; An ascending channel may be forming for DeFi market capitalisation since 2023. Currently retracing from top of channel.

Altcoins

$326B; More extreme move in the altcoin market using the same fractal. Hitting resistance at levels used as summer 2021 support.

Bitcoin Dominance

BTC.D; No material change in Bitcoin dominance from last week. One read on this is that alt coins are keeping up with any/all positive BTC moves.

Trader Positioning

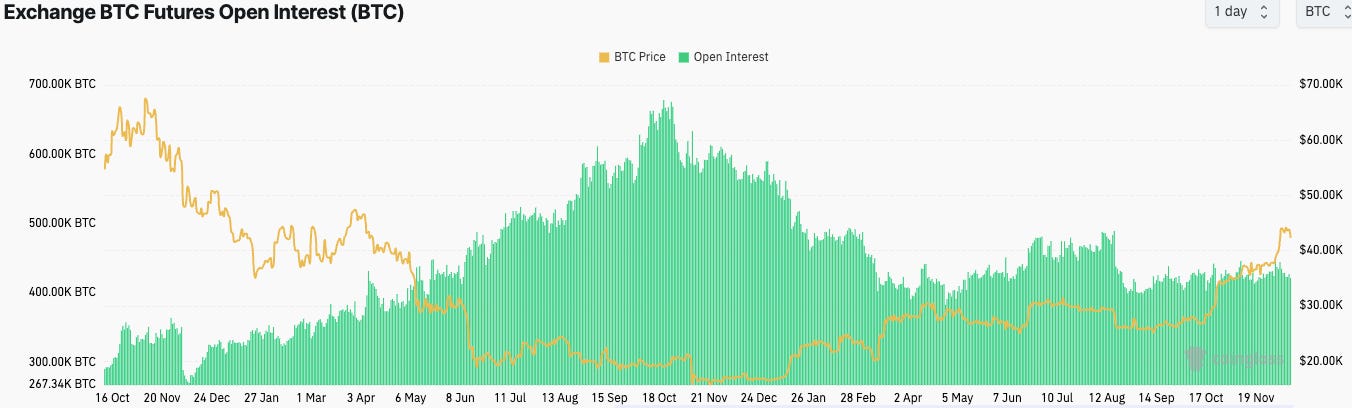

Over $350m in liquidations occurred over the past 24 hrs of which 90% are long.

No significant change in OI given volatility either. BTC-denominated OI fallen 1k over the past day.

OI-weighted funding rates remain positive for BTC markets (0.0118%) meaning the recent drawdown has not fully reset trader positioning. BTC Traders still remain predominantly bullish in their stance.

> SVM vs EVM [Uncommen Core 2.0]

> Can Open Banking Power AI-based Finance? [The Fintech Blueprint]

> Is Crypto Really Back? [Empire]

> Anomica Brands: NFTs & Blockchain Gaming [Epicenter]

> IMX Founder on Web3 Gaming in 2024 [Blockcrunch]

> Pudgy Penguins announces 'Pudgy World' Web3 game on zkSync blockchain [The Block]

> SMV on EVM [Chris Burniske]

> TON blockchain slows to a halt as Ordinals-inspired protocol sees surge in activity [The Block]

> Starknet Aidrop [The Block]

> Code Is Not (Always) Law [Coindesk]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.