Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

How blockchain optimisations inform the proliferation of use cases within an ecosystem

3 examples of how Solana’s optimisations have driven distinct use case dynamics:

Liquidity Management

DEX aggregation

Stablecoins

Show Me the Optimisations and I’ll Show You the Use Cases

When a blockchain is born, a set of optimisations around security, scalability, and decentralisation has been made.

Those optimisations can inform how certain use cases stand a better chance of proliferation in that environment.

In our Defiant article in January, we highlighted some examples of how Solana was rhyming Ethereum’s previous cycle dynamic on several fronts.

At the same time, data points showed its architecture optimisations were enabling certain types of activity that Ethereum couldn’t 4 years ago. These included NFT mint and IoT payments within DePIN.

We’ve decided to unpack this further by showing 3 further market segments that our research database has been tracking that support this view.

Liquidity Management

Automated Market Makers (AMMs) have become more efficient as DEXs for users by having liquidity dynamically positioned by LPs.

The tradeoff here is that the provisioning of liquidity requires active management to sustain profitability/avoid losses.

Tooling that automates liquidity management for DEX LPs is not a new concept. In fact, we’re seeing in emergent ecosystems like Solana through platforms like Kamino.

The percentage of liquidity on DEXs funnelled through Kamino Liquidity has been trending higher, climbing from 7% to >30% in a year.

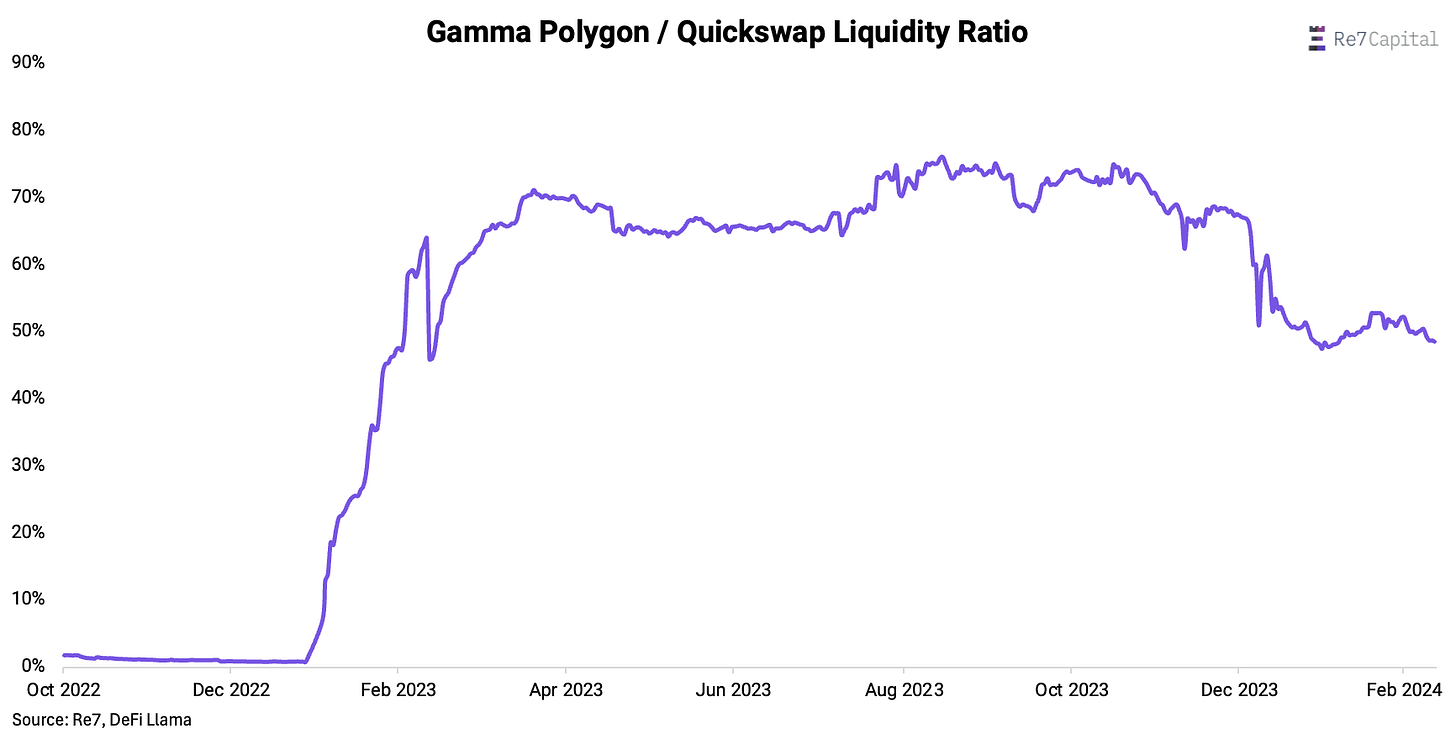

When we compare the same metric for EVM chains, these platforms are in a state of decline (Gamma)…

…or they may be gaining but are still far behind Kamino’s growth rate in nominal terms (Arrakis).

Points farming has likely contributed to Kamino’s uptick in recent weeks but we think it still comes down to the respective blockchain mechanics.

Solana has 30 blocks for 1 ETH blocks and reliably low fees (0.000005/tx).

Solana LPers can have more trading per unit of price change. In other words, LPs can perform more active management at a lower cost.

This is why leading Solana DEXs have decided to focus on the LP experience such as analytical terminals.

Aggregation Theory

Aggregation theory states that “the value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users.”

Aggregators streamline consumer markets into a single funnel.

In other words, aggregators combine suppliers, distributors, and consumers/users into a single application.

In the case of decentralised exchanges, aggregators splice trades into several source routes to optimise pricing.

Reliably low fees on Solana have informed DEX aggregator dynamics.

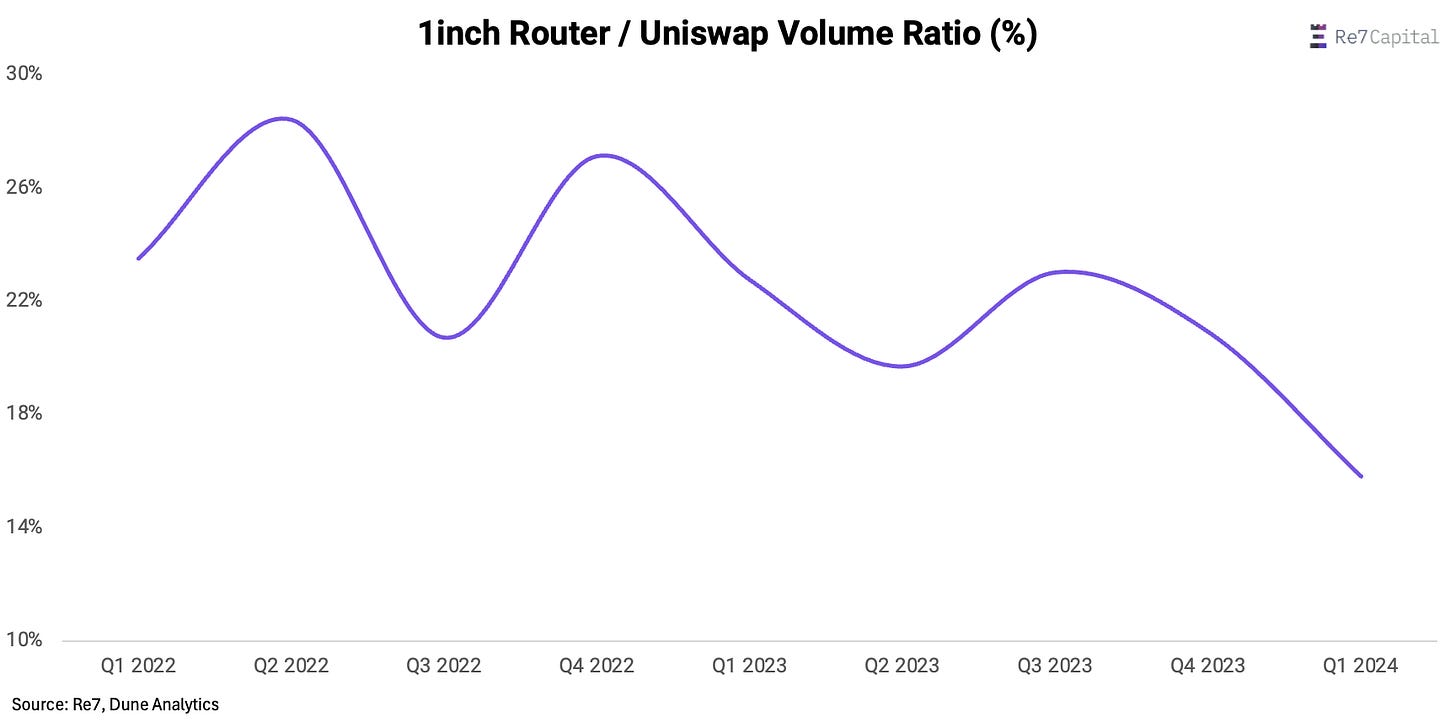

Ethereum aggregator 1inch Router has never represented >30% of Uniswap’s total volume. Since 2022, Router dominance has actually been declining.

On Solana, there is an opposite dynamic. Solana’s leading aggregator, Jupiter (blue), drives 75%+ of total DEX volumes today.

If we remove bot trading (right chart), the number increases to 90%+.

For years, it seemed aggregation theory in Web3 had a limited role. Yet, evidence for the theory starts to become validated in the right environment driven by design optimisations.

Stablecoins

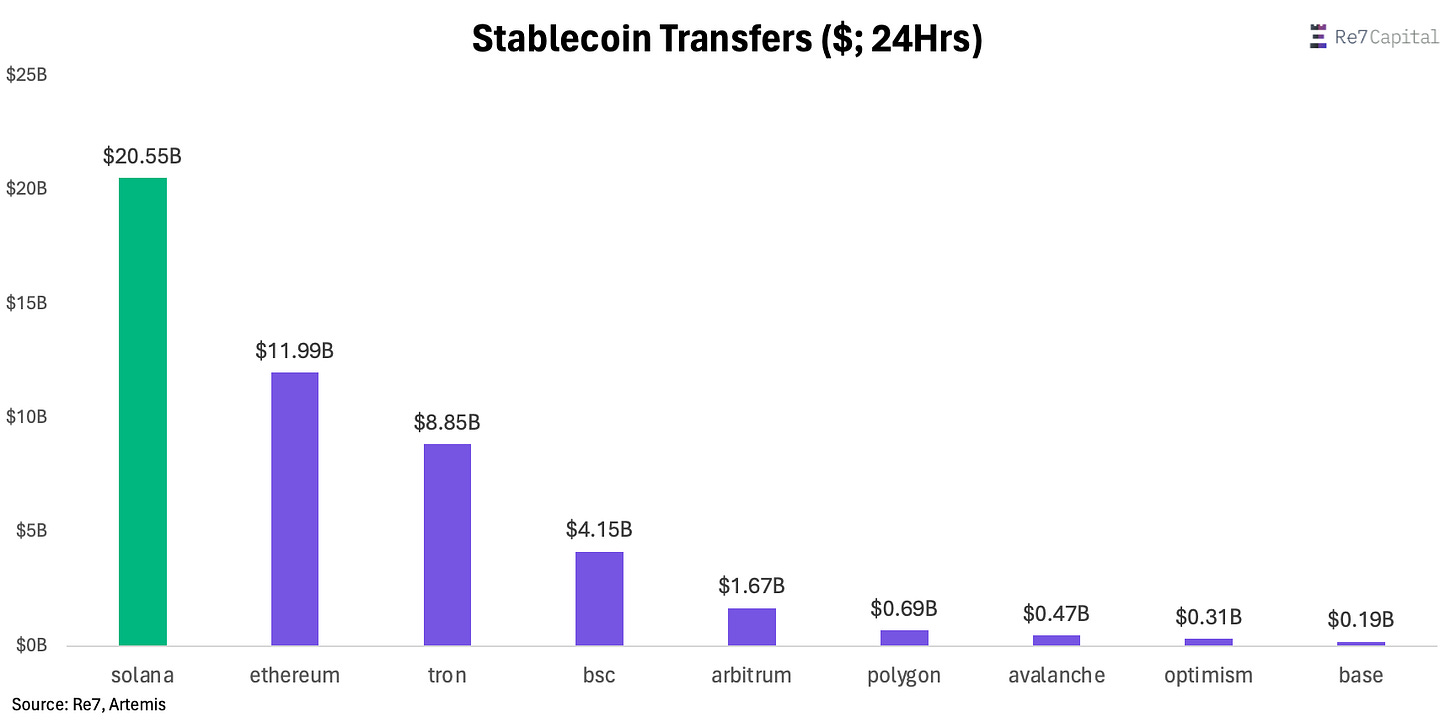

Ethereum and Tron have the largest market share of stablecoin supplies today (90%).

Digging deeper, Solana punches above its weight on a stablecoin supply basis, facilitating a whopping $20.55B in 24Hr on-chain volume.

Solana not only leads the transfer volume stats by ~$9B, it does so with a 98% lower stablecoin supply than Ethereum and Tron combined.

The velocity of Solana stablecoins is therefore much higher than its peers, reaching a peak of nearly 20 (!) in Feb 2024.

The avg. transfer amount of $3.2k on Solana is 94% lower than Ethereum and 50% lower than Ethereum L2s like Arbitrum.

Having short time to finality and block times is conducive for payment-based use cases.

Last August, Visa noted Solana’s differentiation in this arena stating the network could ‘become one of the networks that could help power mainstream payment flows’ by being an ‘efficient blockchain settlement rail’.

Looking Ahead

The theme across all 3 examples above is that blockchain foundations can drive activity through optimisations around flexibility, efficiency, and customizability.

Looking ahead, we see roadmaps for further optimisations across the board of ecosystems, both young and old:

Solana’s firedancer enhances the network’s speed and reliability set to launch in 1H 2024.

Ethereum Dencun upgrade allowing rollups to store data more cheaply launching March 13th.

Ongoing optimisation in more emergent ecosystems like Aptos (e.g. previewnet) to enhance scalability and performance.

As these optimisations get enacted, we look forward to re-evaluating the shifts in use case dynamics. Over time, it will become clearer which shifts are temporary and which ones become entrenched for the long term.

Altcoin Market Dominance (%) vs. BTC/USD

Altcoin dominance has been creeping up steadily over the last 6 months as BTC breaks new ATH levels. Yet, altcoins have yet to have their cycle ‘breakout’.

Why does it matter? BTC convincingly breaking above its ATH shortly preceded the growing dominance of altcoins in the last cycle. Today, BTC looks to break out above its ATH levels convincingly.

MakerDAO

MakerDAO is raising DSR yield to 15% and increasing borrowing rates against crypto assets.

This move is a reaction to continued high rates in DeFi that have led to a declining supply of DAI.

The Maker PSM has also seen massive outflows as users swap borrowed DAI for USDC in a kind of cash and carry trade (borrowing cheap DAI for use in higher yield opportunities).

Why it matters? The DSR functions as a kind of base rate in DeFi. With it going up, expect other rates like supplying on Aave to also turn higher.

MakerDAO also hopes this stops the bleeding of the PSM and drawdowns on the remaining $1b of RWA owned by the protocol.

Global MCAP

$2.62T; Global market capitalisation breezes through $2.5T this week, breaching the latest resistance area of the last cycle in May 2021. Next target is $3T (+14%) which is ATH level.

ETH/BTC

0.05635; ETH/BTC still kept within its multi-year ascending wedge. Optimism hangs in the balance when it comes to spot ETH ETF approvals in the US this year. This comes as Coinbase met with SEC over spot Ethereum ETFs, arguing it as a commodity-based product.

SOL/ETH

SOL/ETH looks to edge closer to a decisive break in its ascending wedge (likely before 25th March 2024).

Global Spot Exchange Volume

$100B; Daily exchange has 10x since August 2023, reaching levels not seen since Q4 2021. Higher prices have been supported by higher volumes (esp. due to ETF net flow dynamics).

Futures

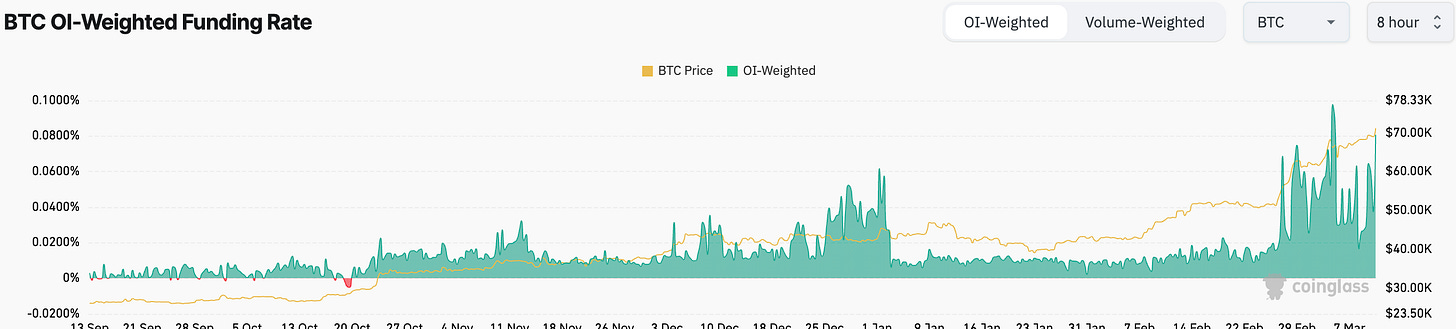

OI-weighted funding rates remain elevated 0.08% as traders take a predominantly bullish stance. OI continues to make new ATHs $32B.

ICYMI: Re7’s Latest Contribution to OurNetwork

> The ZK-Proof Endgame for full interoperability [Bell Curve]

> Weekly Roundup [On The Brink]

> The Chopping Block [Unchained]

> Bitcoin ETFs TWAPs [The Scoop]

> Intent-based Modular Data Layer [Epincenter]

> Tradeoffs of Dencun [Mikko Ohtamaa]

> Bitcoin ATHs [Balaji]

> Bitcoin ETF records [Eric Balchunas]

> LSE ETNs [Bloomberg]

> Memes [Tyler Reynolds]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.