The Weekly - 12th February 2024

On the changing dynamic of US BTC spot ETF flows and market structure

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

The changing dynamic of US BTC spot ETF flows and market structure

Crypto’s outperformance of NASDAQ

Stablecoin supply growth and the reasons driving this

Bitcoin ETF: The Main Event

Since the new year, the main discussion at the water cooler has been the launch of US Bitcoin spot ETFs on January 11th, 2024.

And for good reason. 30-year records were broken.

BlackRock’s IBIT and Fidelity Bitcoin ETFs secured $3B in assets within their month of trading - beating previous leaders like USCL and USCA.

One of the drivers of the intense net inflows of these products was the net outflows of Grayscale’s GBTC - where investors had previously been unable to redeem at the underlying NAV before it was transitioned from a trust to a spot ETF.

GBTC fees are multiples higher than its peers which likely only accelerated the outflows for some investors.

A concern for investors in the run-up to the spot Bitcoin ETFs was the extent of GBTC net outflows offsetting the buy organic buy pressure from investors waiting to get exposure through their IRAs and broker-dealer accounts.

But when we look at the cumulative total net flows since inception it has always remained positive.

In other words, more capital has flowed to the Bitcoin ETFs than flowed out.

A total of ~$6.4B has flowed out of GBTC while $9B has flowed into all other available ETFs - a total net inflow of ~$2.6B as of the 9th of February 2024.

Leading up to the launch date, we saw BTC being bid up and selling off after the event—a buy-the-rumour-sell-the-news set-up.

However, the market started seeing positive cumulative net inflow data points as time went on…

The negative price action for BTC occurred when GBTC net outflows were accelerating from $100m-$650m+.

Fast forward to today and sentiment and price action have shifted positively from:

A recognition that flows were likely largely being rotated from GBTC into other ETF products (with lower fees)

The rate of net outflows from GBTC was decelerating to just ~$100m daily.

Consistent net buy pressure from investors with limited available market supply has translated into positive price action. A dynamic as old as time.

We can see the available BTC supply on exchanges has consistently declined over the past 3 years. Greater demand with increasingly scarce supply available.

Just last month, BlackRock CEO Larry Fink stated on CNBC he saw Bitcoin as an emerging protection asset:

"I believe it goes up if the world is frightened, if the people have fearful geopolitical risks, they're fearful of their own risks," said Fink. "It's no different than what gold represented over thousands of years. It is an asset class that protects you."

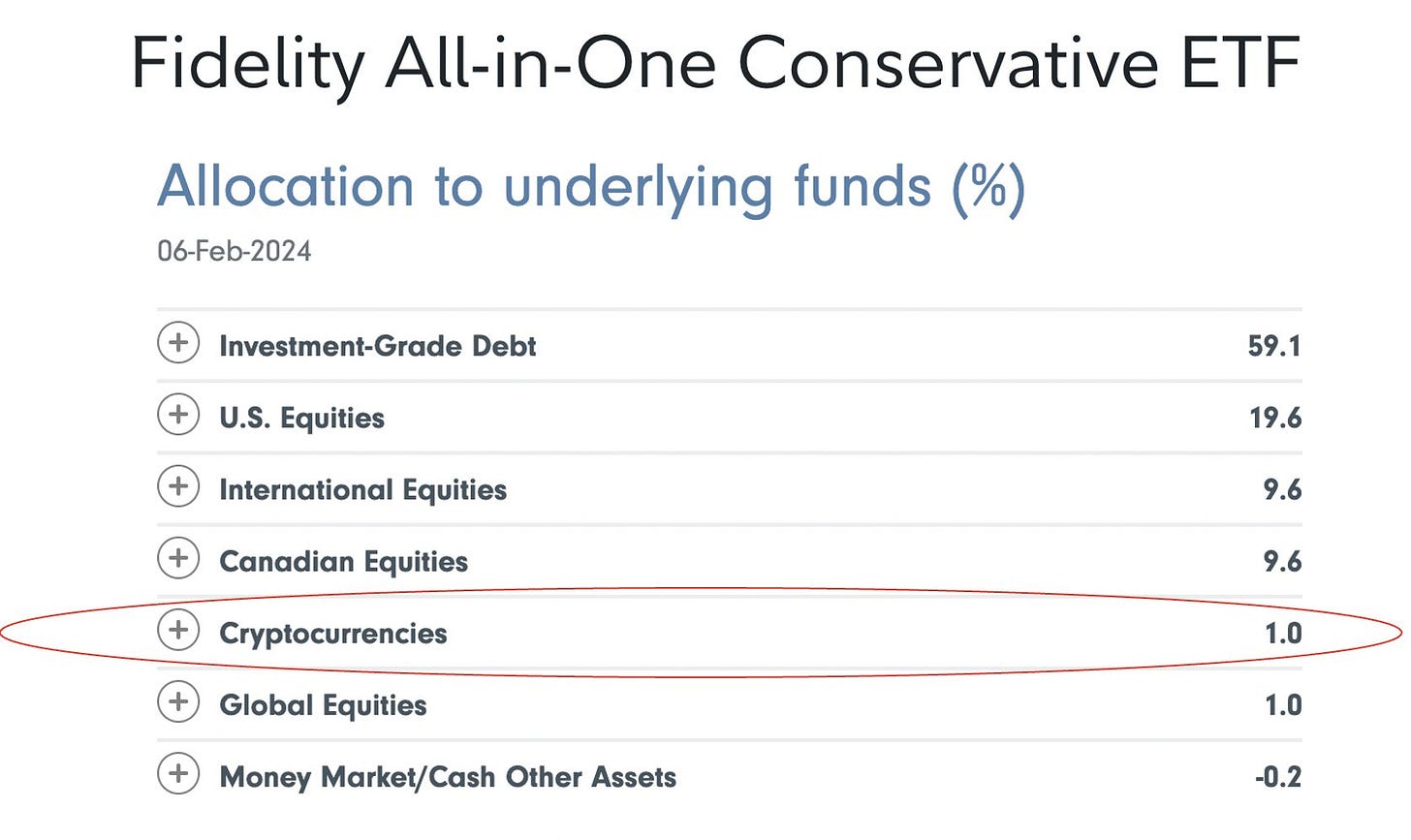

Fidelity has started recommending 1-3% crypto allocations using available ETFs.

All eyes will be on other ETF launches for alternative cryptoassets like ETH and so on.

It feels like the genie has been let out of the bottle.

But zooming out, ETFs are the mere enabler.

We, at Re7, see the investor opportunity as expanding to the whole of Web3 and the use cases it provides cross-sector.

So too does Larry Fink apparently, stating that ETFs are “step one in the technological revolution in the financial markets. Step two is tokenisation.”

All of these positive market structure developments come at a time of potentially prolonged global liquidity growth - a key driver for asset prices over the years including crypto.

And that makes for an exciting mix indeed.

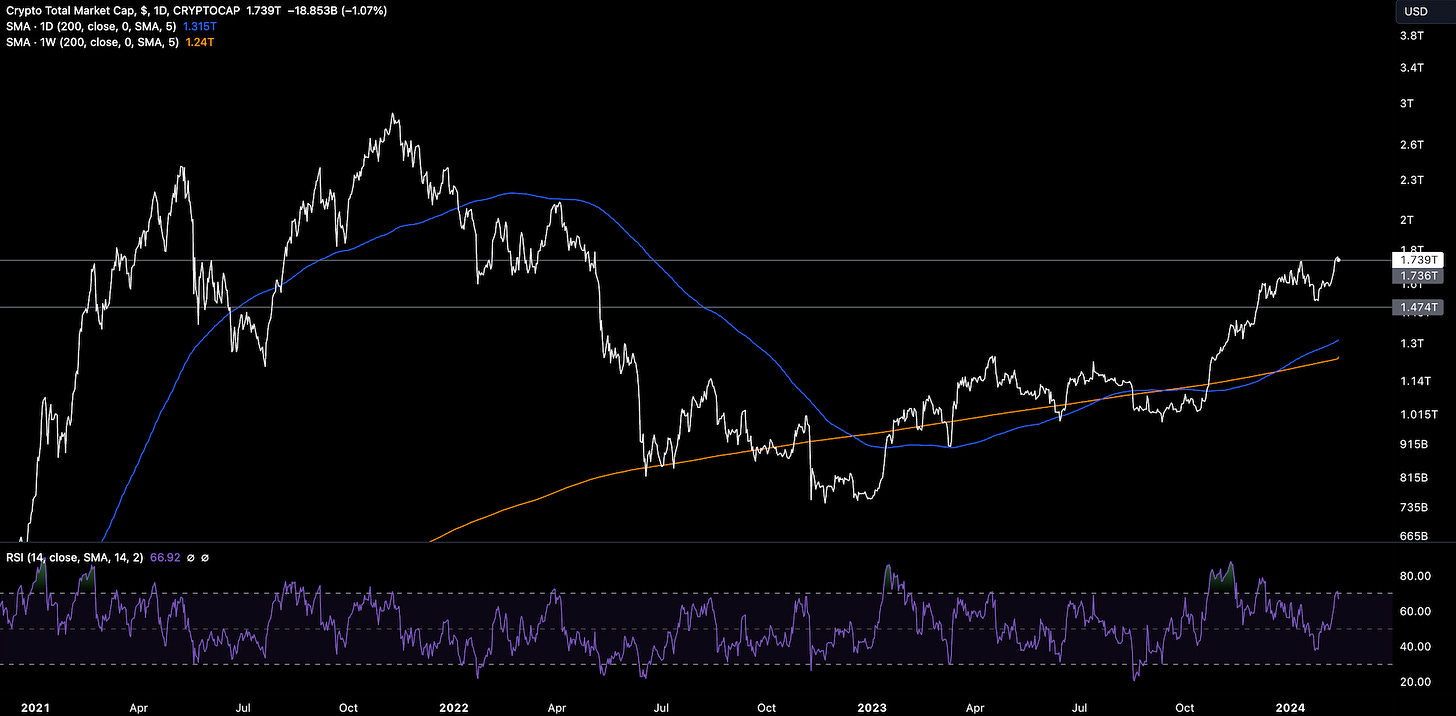

Global Market Cap

$1.74T; Markets +10.7% last week and testing the $1.8T resistance level. This was the area of consolidation between Jan-Feb 2022. TBD whether $1.8T will be used as support in the near/medium-term.

Crypto vs. Equities

Crypto continues to outperform NASDAQ, printing +8% on a relative basis last week. Watching for a wedge breakout over the coming months.

DeFi

$76B; DeFi consolidating in the $67B-$76B range since December 2023 - a similar range during summer 2021. Also watching for resistance-turn-support over the coming weeks.

ETH/BTC

0.05186; ETH/BTC retracing 15% from its 2024 highs and approaching reliable support of 0.05 once again. Dancun network upgrade set to go live March 13th and possibly see a bounce of support leading into the highly anticipated launch event.

Stablecoin

124B; Stablecoin supplies continue to climb, growing >13B since its low in October 2023 - a time when US 10Y peaked at 5%. Stablecoin supplies are a good measure of net ecosystem growth.

Investors are seeking market opportunities within the crypto ecosystem risk premium changes, which in turn is driving utility and fundamentals to respective infrastructure/applications within Web3.

Trader Positioning

OI-weighted funding rates remain positive (0.013%) but largely flat since the new year.

Liquidation analysis shows minimal nominal liquidation for BTC but shorts continue to be caught out relatively more as spot edges higher post ETF launches.

Aptos

In a push to move users over to new chains, incentive programs are springing up outside of the EVM universe of L2s.

One we are keeping an eye on is the Aptos ecosystem incentives, which are being distributed through several protocols on the Move language chain.

Almost every main activity in their DeFi ecosystem is currently benefiting with APT rewards from LPing in various dex liquidity pools as well as incentivized lending and borrowing across money markets.

While TVL has more than doubled through the last few months, the magnitude of rewards means there is still opportunity for farmers. With some protocols running points programs and others speculating on airdrops, early entrants to the ecosystem are benefiting from high yield and potential further upside rewards as well.

> Farcaster: Web3’s First Mainstream App? [Lightspeed]

> The Evolution of Derivatives [The Fintech Blueprint]

> Rethinking Our Exponential Future [RV]

> Algorithmic Game Theory [Zero Knowledge]

> Weekly Roundup [On The Brink]

> ON-204 [OurNetwork]

> Crypto liquidity [tedtalksmacro]

> Ethereum Validator Entry Queue Signals Renewed Interest in Staking [Coindesk]

> Polygon Type 1 Prover [Polygon]

> Waves of the Market [Burniske]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.