Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Announcement! NEW Re7 Alpha Telegram Group

We're starting invitations to a new Re7 Alpha Telegram group. This will be an anonymous group with regular updates on the best DeFi yields, Re7 Labs updates and first information about cap increases or other opportunities in our vaults.

Here's what you can expect:

Stay Updated: Get the latest news, announcements, and updates on our vaults and the DeFi ecosystem.

Access Exclusive Insights: Gain early access to new vault launches, exclusive offers, and insights from our team.

Our Goals:

Sustainable Growth: We want to showcase our priorities long-term growth and sustainable yields.

Community & Partnerships: We're actively seeking to engage across the space and explore strategic partnerships to offer innovative solutions.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies.

Re7 is searching for a DeFi Developer to support the Re7 tech team, developing and maintaining key backend infrastructure for Re7 products and funds.

Summary

In this edition, we cover:

How alts are signalling structural dynamics underneath the surface

The DeFi cycle: what happens when borrowing gets cheap

The divergence between stablecoin supplies and valuations

The Fed, Stablecoins, and DeFi Adoption

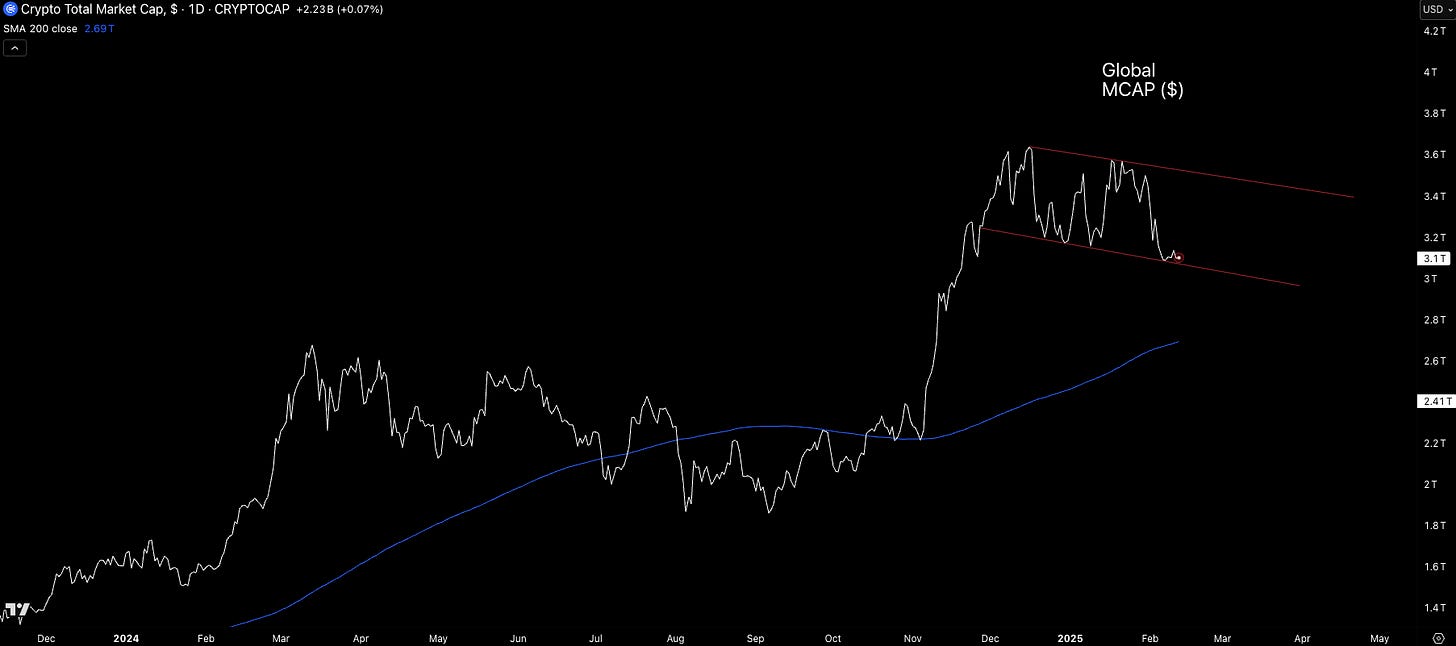

Global digital asset market capitalisation stands at $3T mark, following a standard consolidation range after re-rating 64% since last November following the bullish election outcome.

At the same time, BTC remains resilient >$92k with SOL making higher lows.

Alts Reflect Regimes Underneath the Surface

What’s impressive is that the altcoin market had put in its bottom vs. one of the fastest large cap horses, SOL, in 2025 - returning back within its ascending wedge.

Irrespective of the consolidation chop more broadly, alts appear to be sniffing out regimes that investors often overlook or ignore. They focus too much on the current surface level state of affairs.

Yet, there are always structural dynamics underneath the surface at play which can provide clarity especially during times of short-term consolidation.

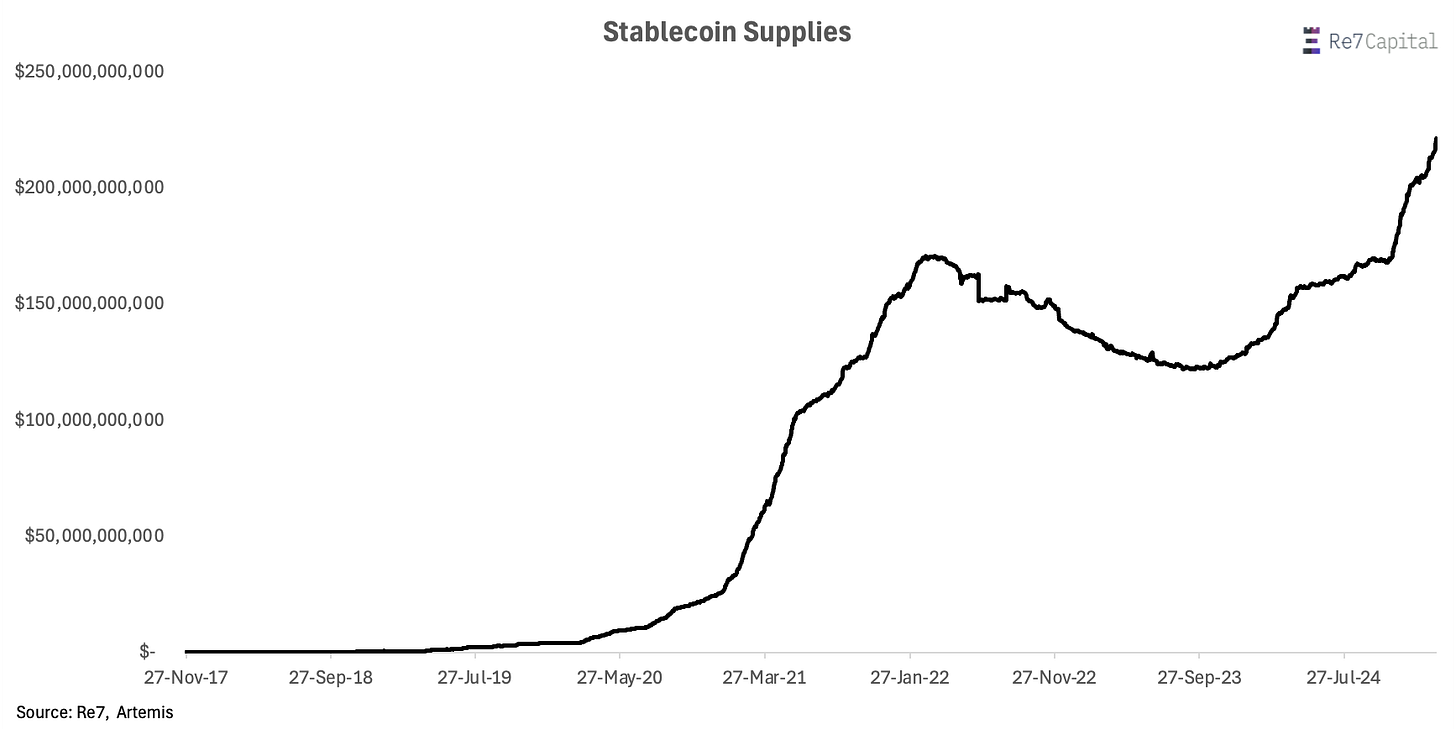

Stablecoin supplies continue to reach new all-time-highs, surpassing $220b. This marks a 30% increase in just 3 months…

On-Chain Liquidity Flywheel Through The Lens Of Fed Rates

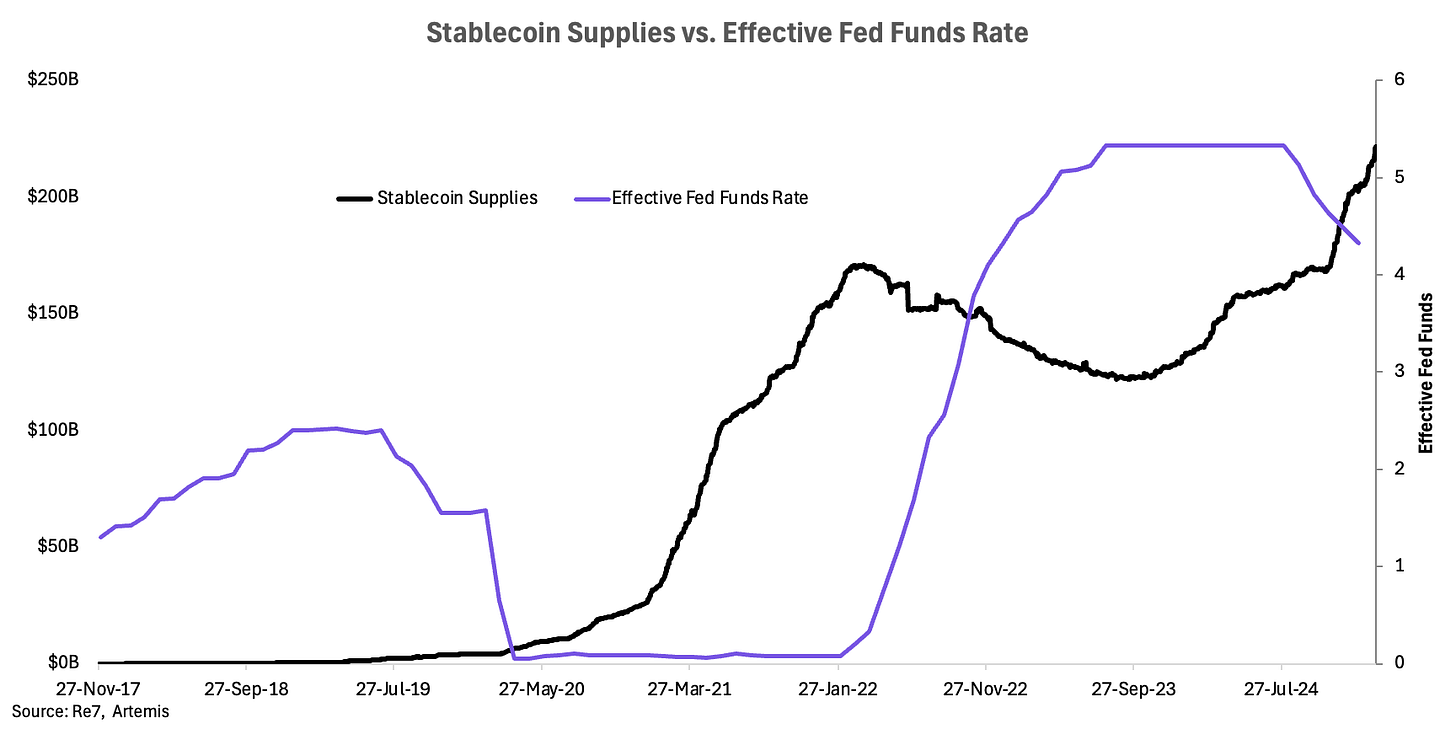

As we’ve highlighted extensively before, risk premia play a key role in stablecoin dynamics. Lower fed funds means investors start allocating to higher yield alternatives such as staking and crypto lending.

Traditional yields like treasuries or money market funds drop, driving more on-chain yield adoption and therefore more stablecoin mints to meet increased demand.

The inverse relationship between stablecoin supplies and fed funds rates is clear since inception. Investors also start to shift their behaviour before rate cuts/increases.

The Look Ahead

So while many focus on rate cuts in 2025, they miss the bigger picture: the regime trajectory today is lower rates > higher rates.

Why is this important?

Continued lower rates make borrowing cheaper which increases DeFi liquidity and borrowing capacity.

Lower borrow rates attract leverage traders and borrowers.

Higher borrows leads to even more revenue boosts (e.g. loan originations and interest payments). Lending revenue has 3x since fed funds have started falling.

Higher valuations attract further capital flows and so on. It’s these valuations re-rates that can sometimes outpace market beta (e.g. SOL).

The cycle repeats until the macro yield regime changes.

Summer 2024 was a divergent period between continued stablecoin growth and valuation consolidation.

Valuations had to catch up eventually, re-rating +64%. We could be in or entering into a similar period dynamically.

With treasury yields potentially coming down further this year from weakening inflation, the wheels are in motion for an upside reflexive loop for increased capital flows into the industry, on-chain adoption, and valuations.

And so what feels like a temporary consolidation in markets on the surface, alts could be reflecting this positive feedback loop underneath the surface.

Starknet Lending and DeFi Spring Rewards:

We launched 2 new curated pools on Vesu offering fresh opportunities for earning, borrowing, and optimizing capital efficiency:

Re7 Starknet Ecosystem: Borrow USDC against your EKUBO and STRK

Re7 wstETH: Borrow ETH against wstETH and maximize staking rewards and DeFi Spring rewards

Check the Vesu announcement here!

We also increased debt cap (again) in our Re7 xSTRK pool to 8m STRK. More room for leveraged looping!

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.