Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Re7 is Hiring!

Re7 utilises our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of DeFi and alpha strategies.

We also work with leading projects and blockchains to design their DeFi ecosystem and provide on-chain risk curation and vault management services through Re7 Labs.

We are looking for a talented DeFi Business Development person to support the Re7 Group, scale its vaults, establish partnerships and source crypto clients who could benefit from Re7’s product suite.

Summary

In this edition, we cover:

Market signals pointing to institutions positioning into crypto

Measuring the record-breaking demand for crypto and capital flows into the industry

Dispersion in the market

ATHs

Another week, another week of records.

Our belief that this quarter was shaping up to be an eventful one has so far not disappointed.

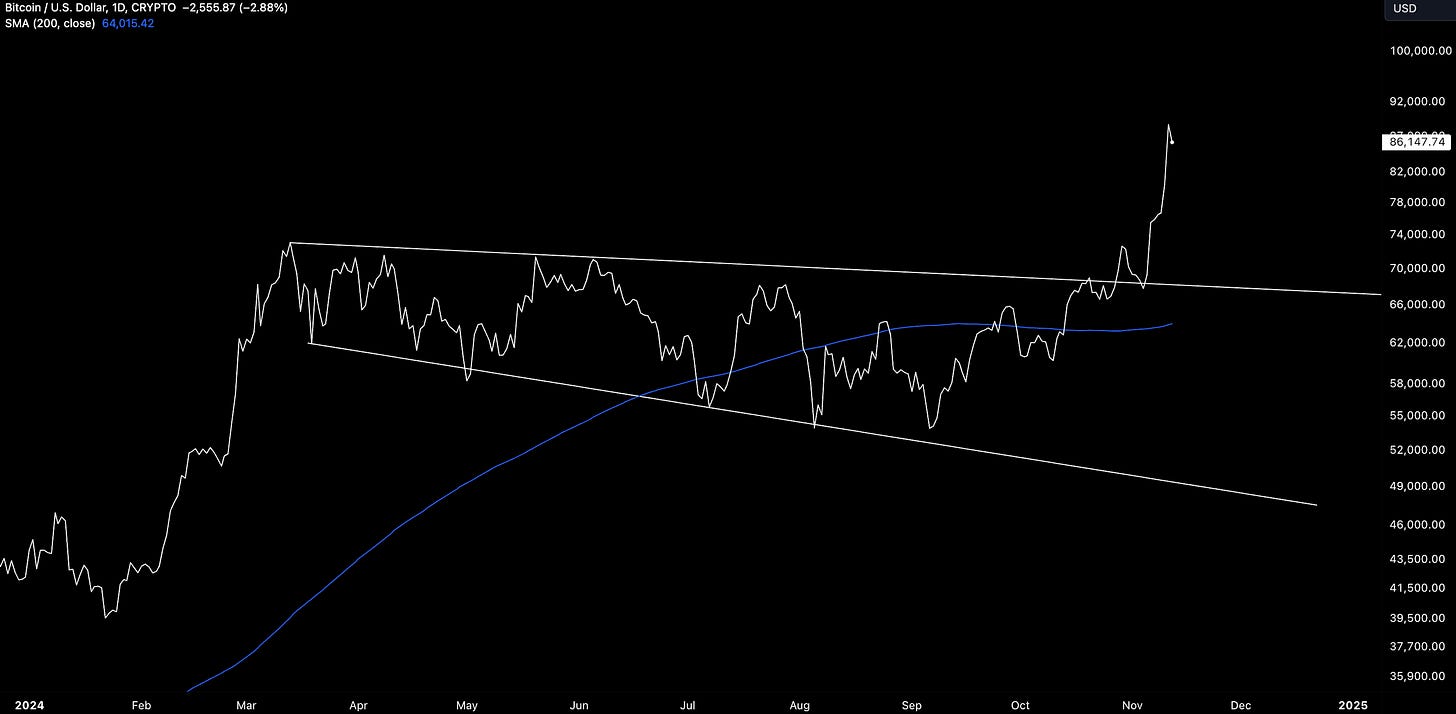

Following the US election last week, the S&P and NASDAQ both printed new highs while BTC has continued its rally towards $90k in rapid fashion.

It’s Risk-On.

The need for a higher rate of return from investors above the inflationary pressures and fiscal spending anticipated due to a Republican white house, House, and Senate sweep.

Institutional Participation

Crypto is just the fastest horse in this type of environment. BTC has outperformed NASDAQ by 20% while the crypto market globally has outperformed the index by 22%.

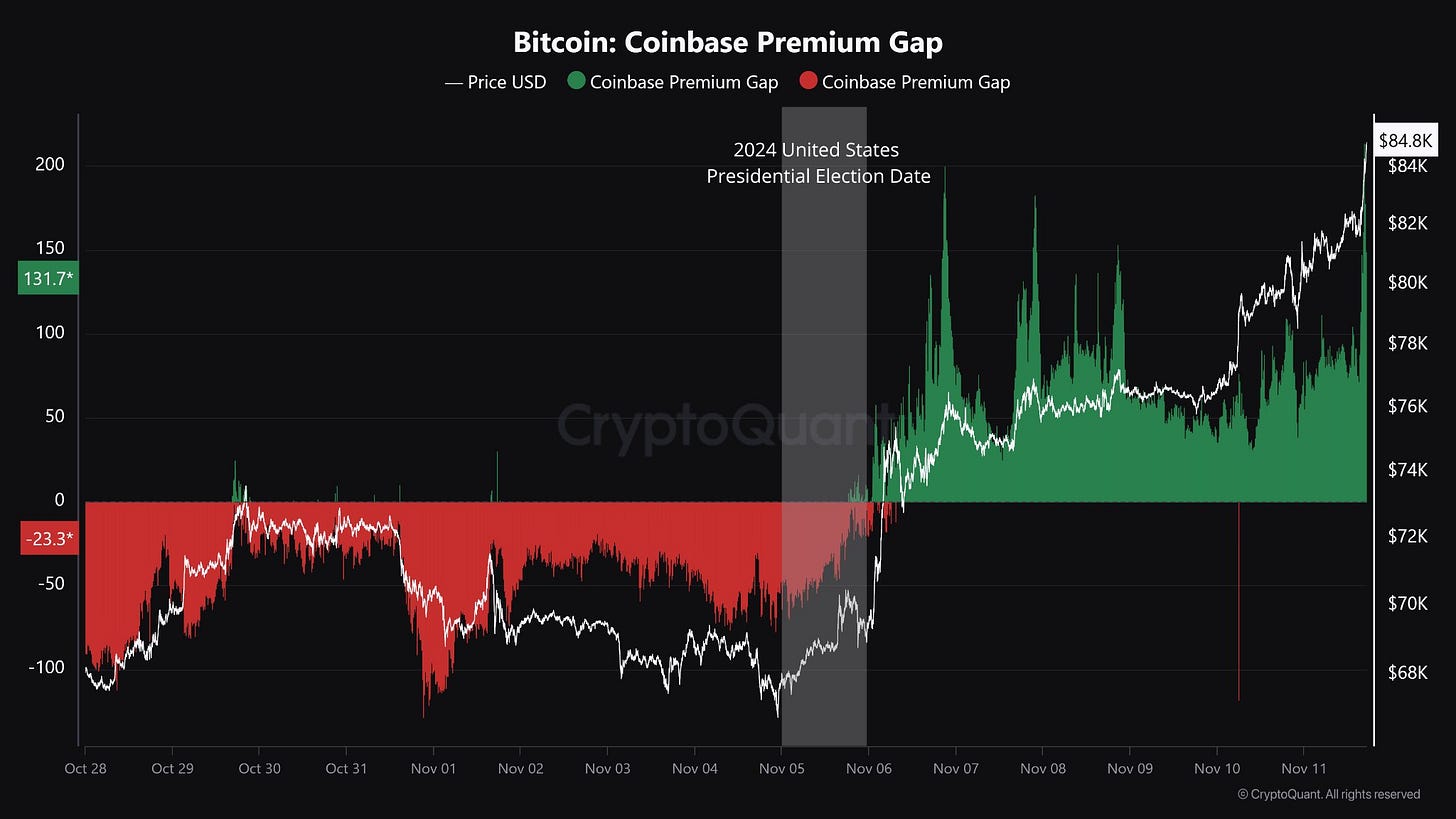

BTC’s rally has been met with a ‘Coinbase Premium’ - the price difference between Coinbase and other exchanges like Binance.

A higher premium suggests stronger buying interest from US investors as Coinbase is one of the primary, regulated, exchanges used by US institutions.

ETF Records

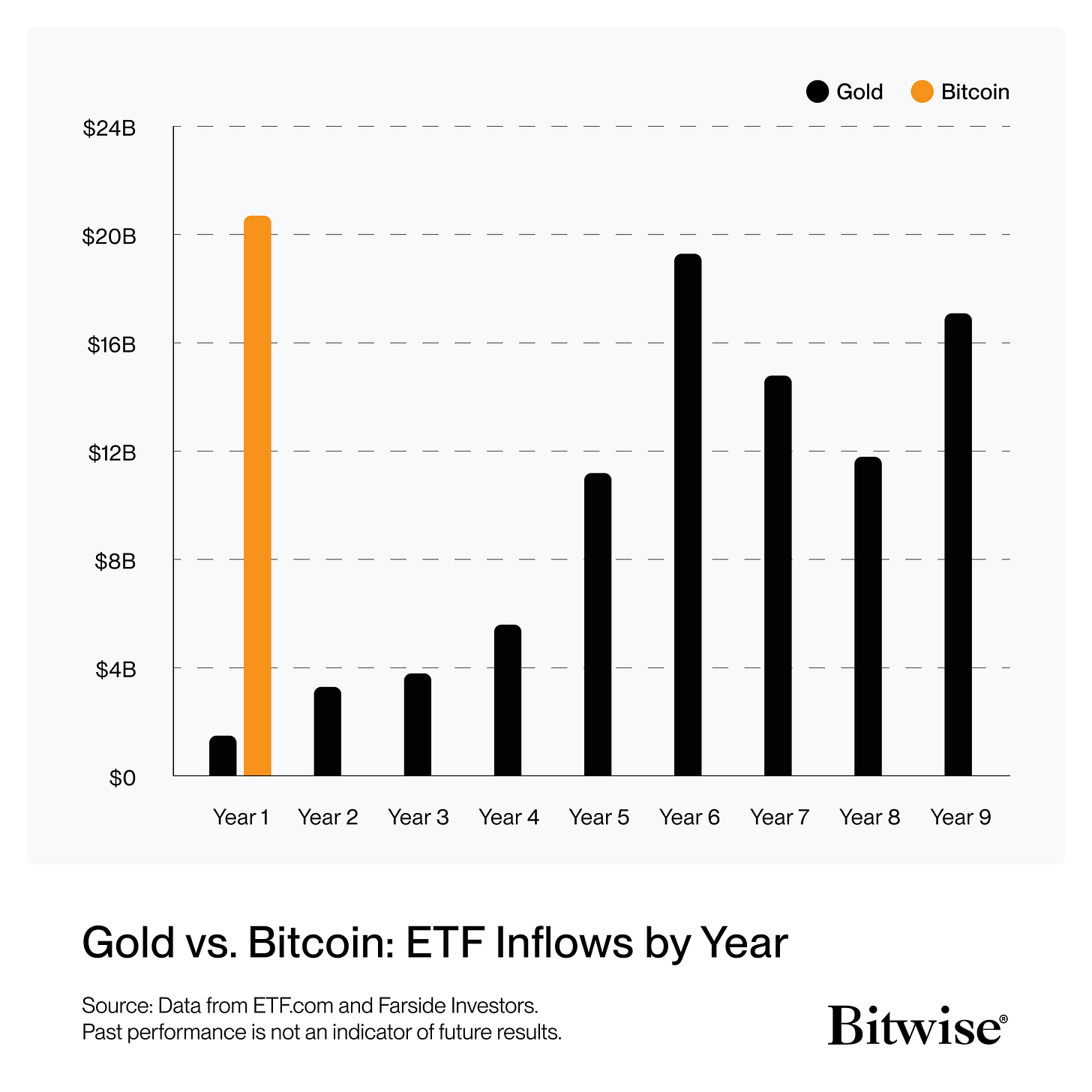

The demand for crypto via ETFs has also been record-breaking and likely also driving performance.

US Bitcoin spot ETF inflows have exceeded $20m just this year - over 10x Gold’s inflows in its 1st year when its equivalent launched.

The difference in flows is so huge in fact that Gold had to wait half a decade before seeing comparable capital allocations.

Total AUM for Bitcoin spot ETFs is now $60B - a new high water mark.

Capital Flows

Of course, the bull market doesn’t just stop at Bitcoin. The price discovery can be found throughout the entire market.

Stablecoin supplies have increased +$5b in the last week alone - one of the sharpest increases on record for 1 week.

This is likely because we are now entering a ‘Goldilocks’ environment of lowering rates coupled with breaks in previous cycle ATHs:

(1) Stablecoin supply shrank as rates increased

(2) Stables bottomed when the Fed pausing rates signalled rate cut path ahead

(3) Stables breaking out as Fed cuts rates coupled with market ATH breaks (Goldilocks)

Increased stable supplies signal increased capital flows into the crypto market as we can see from the correlation between stable supplies and global market cap.

More stables means more value that can be put to work within sectors like DeFi (e.g. leverage, lending).

This, in turn, supports the underlying fundamentals and valuations for those projects that receive increased activity on their ecosystem, app, or platform.

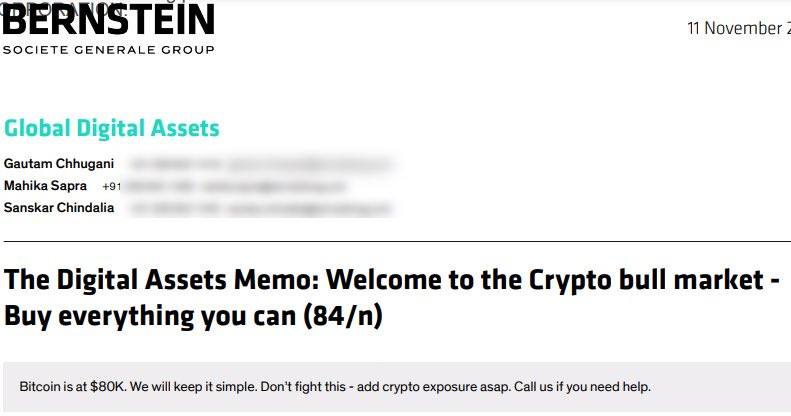

More institutions are connecting the dots too.

Wall Street’s top-tier sell-side research and brokerage firm, Bernstein, makes clear the opportunity they see directionally.

Alts

BTC has set the agenda for the broader market as it often does.

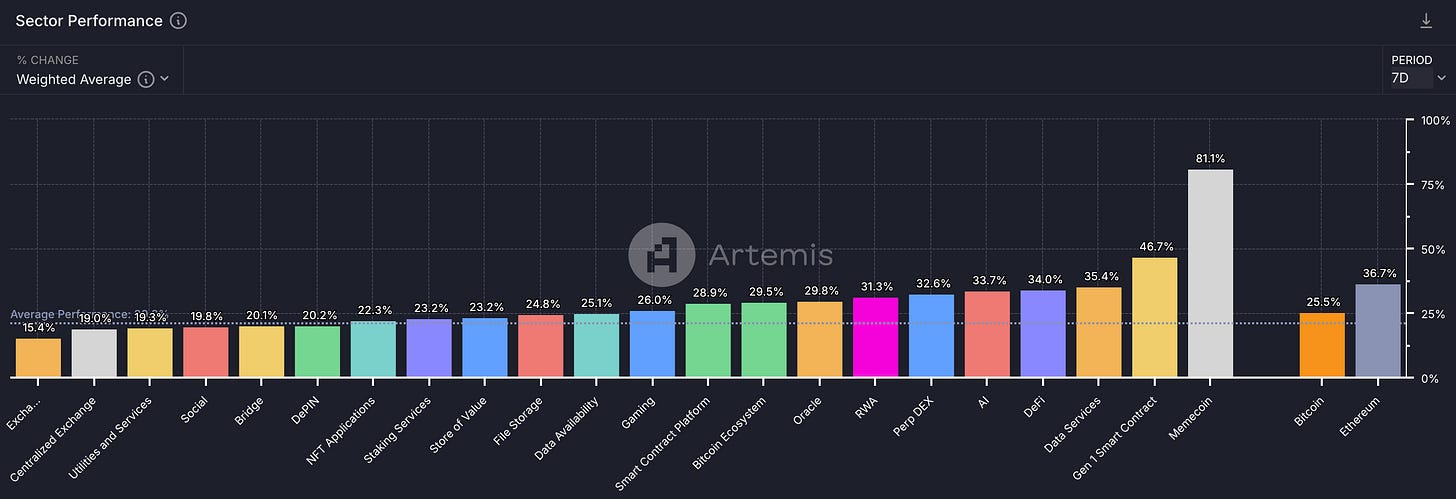

Since the US election outcome (the catalyst for the recent rally), the altcoin market has outperformed BTC by ~10%.

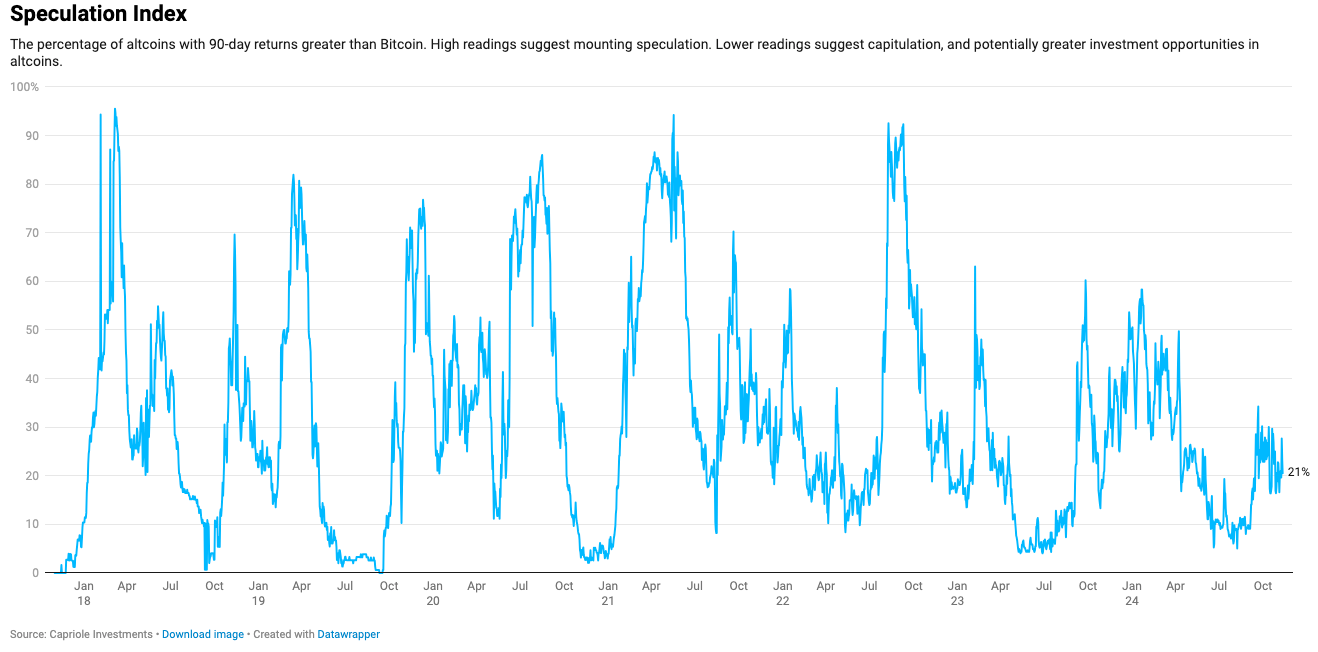

At the same time, indices measuring the magnitude of altcoin speculation are near cyclical lows, not highs showcasing the potential room left for alts to run this cycle.

That said, we continue to see dispersion within the altcoin market that active managers have been able to capitalise on. Only 50% of macro sectors have outperformed BTC over the past week.

Rising tides don’t necessarily lift all boats equally. And that comes with opportunity.

Fixed vs Variable yield spreads open up large opportunities for DeFi rate traders

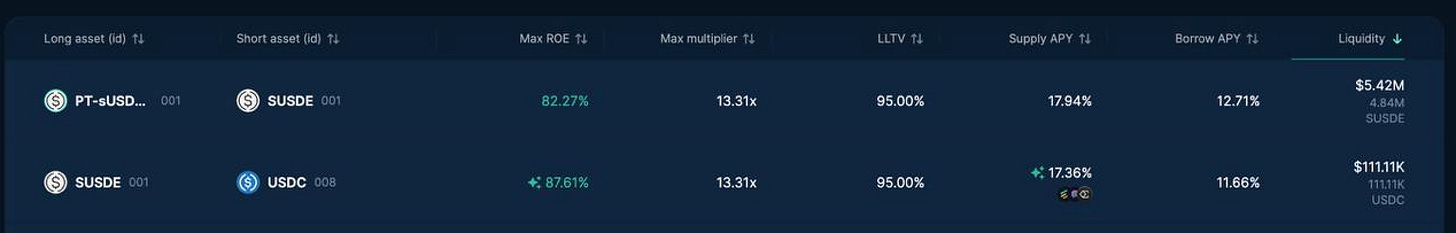

PT-sUSDe march loop on Euler with sUSDe borrow is the cheapest place to get leverage on sUSDe PTs now.

Over 6% spread between PT yield and borrow rate and up to 13x leverage. Available liquidity is over $5m.

The difference is driven by a quick reaction to future expected yields in the Pendle fixed rate markets for sUSDe. Fixed rates now are 20% to March 2025, while the current variable rate has not yet increased from 13%.

Pendle has announced their new Boros product which will allow rate trading on leverage starting with perpetual rate swaps.

ICYMI: Re7 Wins Digital Banker’s Best DeFi Yield Farming Award

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.