Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website > Re7 Labs Website

> Weekly Research > Real-time Insights

> Re7 Capital Twitter > Re7 Labs Twitter

This week at Re7:

Re7 at HFM Middle East Summit – Dubai (May 14–15)

Evgeny Gokhberg, Managing Partner at Re7 Capital, will speak on how AI, digital assets, and on-chain infrastructure are reshaping institutional finance.

Re7 at Sohn Investment Conference – New York (May 14)

Re7 Capital will be attending the Sohn Conference, with Managing Director Alice Kletskaia representing the team. A key gathering for family offices and institutional allocators — reach out to connect.

Re7 at Avalanche Summit – London (May 20–22)

Portfolio Manager Lewis Harland will speak on DeFi markets, on-chain risk, and yield strategies. Join us there — message us to meet Lewis or the team.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

We want to hear from you!

Summary

In this edition, we cover:

Crypto markets rebounding and what’s driving volatility

Altcoin outperformance and market dispersion

Investors benefiting the most in the current market regime

Higher

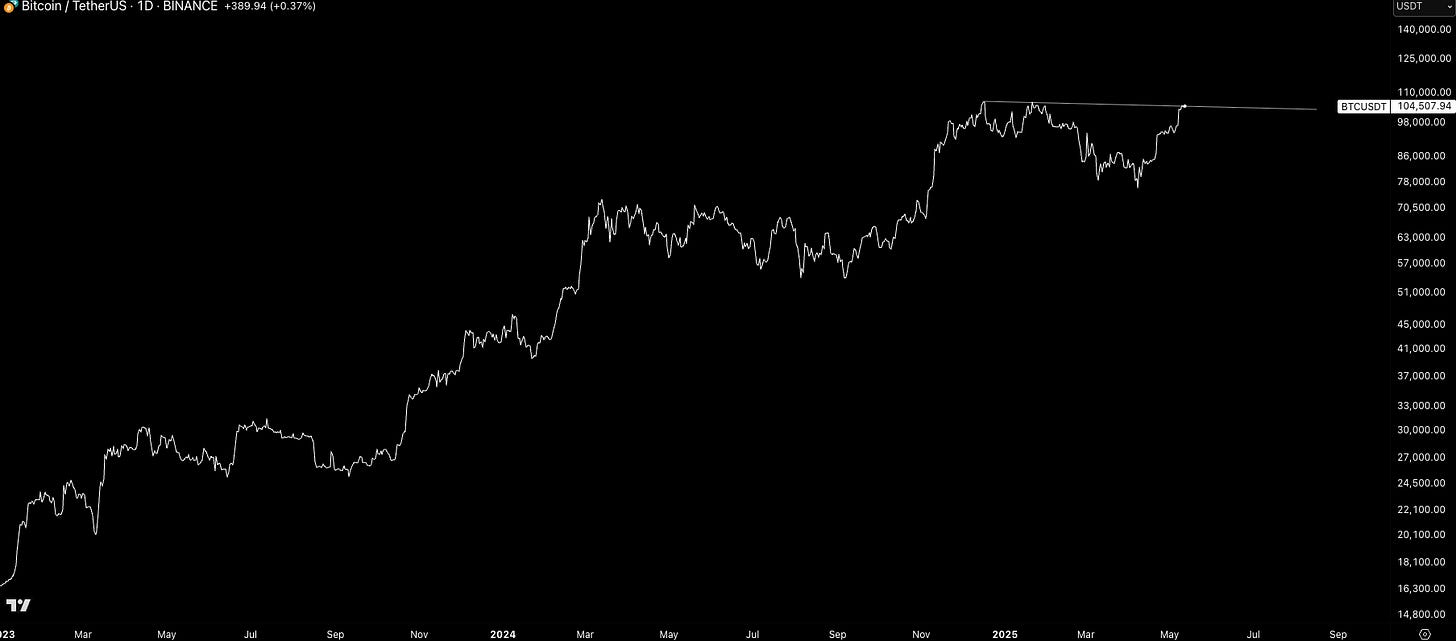

Crypto markets continue to edge higher as we bounce back from all-time-lows in sentiment, risk-off positioning, and technical levels in early April.

Global crypto market capitalisation has reclaimed its key level of $3T heading towards making new highs in the next 2 months at current pace.

BTC broke through $100k last week with the final resistance area ~$105k being tested to confirm new ATHs.

Drivers

“I blinked. Now we’re at ATHs. What has changed?”

One the one hand, we’ve seen one of the main macro concerns for investors, tariffs, ease significantly over the past week.

UK and US trade deal has been finalised. US and China agree to slash tariffs by 115% today.

The impact of high tariffs could not be a reasonable outcome for countries, like China, who are already struggling with a property crisis and high youth unemployment. Trade deals need to be done and resolve needs to be sought.

On the other hand, the recovery in markets is directionally in line with where the gravitational pull is - up.

Why?

As we’ve highlighted before, global liquidity has been rising and continues to rise for the foreseeable future.

It’s also reasonable that we also see economic expansion (e.g. US ISM index) as liquidity filters down into the broader economic activity.

This, in turn, adds fuel for asset valuations with higher earnings and investor confidence during periods of economic expansion.

In a sense, nothing has changed and risk asset (including crypto) being throttled from extreme lows in this market regime was to be expected.

We’re also seeing crypto outperform high growth tech stocks too…

Altcoins

Investors are allocating more heavily towards crypto as risk premia decreases to maximise the upside when monetary policy is accommodative.

This is also expected to continue given the risk of liquidity that leads the ratio continue to risk on a leading basis.

And within crypto, Altcoins are winning in this market.

Altcoin dominance is being pulled upwards as investors deploy down the risk continuum.

Not all alts are born equal though. We still see dispersion in performance across sectors.

Taking 69 micro sectors that Re7 tracks within its market intelligence system, we see a 240% spread in relative strength between the highest and lowest performing micro sector.

Several sectors are not outperforming BTC. An even long list are not outperforming ETH.

So what does this all mean?

The overall bullish market regime is being favourable to investors participating within crypto, investing within the alt market, and actively managing risk across its sectors.

Updates on Re7 Lab Vaults

Re7 Labs vaults have surpassed $500M in TVL!

Total TVL across Re7 Labs-curated vaults has now surpassed $500M—just one week after hitting $400M—all achieved in under 15 months since the Re7 Labs brand was launched.

Explore our top-performing vaults and join the Re7 Labs Alpha TG for real-time insights.

Our Euler Avalanche cluster just received a big chunk of a fresh $500K injection in $AVAX incentives, now supporting the newly added deUSD, sdeUSD, and sBUIDL vaults. deUSD and sdeUSD depositors also earn bonus Elixir potion rewards.

Re7 Silo vaults are now live on Sonic, featuring Re7 USDC, Re7 scUSD, Re7 S, and Re7 stS. Stay tuned—new incentive programs are expected to be announced later this week.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.