The Weekly - 13th November 2023

On NFT activity and the growing relevance of the Solana NFT ecosystem.

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

The increase in Ethereum NFT activity

The ‘asset lag effect’ and its implications for NFT activity over the coming months

Solana’s NFT mint dominance and drivers

How low-cost NFTs enable more use cases

The positive sentiment in crypto today has been expressed all the way down the risk continuum. One of the most speculative areas of the market on this continuum is NFTs which have seen a rise in activity.

NFT marketplace volume on Ethereum for October surged by 23% MoM - up from $210m in September to $260m.

Split out by marketplace, we can see that Blue dominates >50% of the total monthly volume.

One potential driver here is Blur’s heavy incentive programme which is set to end on November 20th. Traders have taken substantial losses on NFTs to maximise their potential airdrop value (which may ultimately exceed their losses).

That said, it may not be just opportunistic airdrop strategies that are driving activity. Broader macro factors could equally be at play.

Assets tend to have a 12-15 month ‘lag’ in all economies and the crypto economy is no different.

When capital (or savings) becomes abundant, users will speculate more on assets further down the risk continuum (and vice versa).

Therefore, measures in consumer spending capabilities (e.g. personal savings rate) should be a leading indicator for NFT volumes related to highly speculative assets like PFPs and artwork.

We see support for this in the data: The first major jump in speculative NFT volumes occurred 16-17 months after the rate of change in American savings rate jumped due to COVID stimmy cheques in March 2020.

After the tightening cycle took hold during 2021-2022, the American savings rate once again flipped positive in ~Jan 2023 - the model’s implication being a substantial rise in NFT volumes in ~April 2024 onwards.

Looking ahead, we may also see diverging activity on alternative ecosystems relative to Ethereum.

Blockchains like Solana have dedicated solutions (called State Compression) to reduce the cost of NFTs by reducing the cost of storing data on-chain. It is one of the cheapest ways to create an NFT today.

The net result is the ability for users, companies, and communities to mint NFTs at a fraction of the cost vs. alternative EVM ecosystems. Cost savings also scale as the number of mints increases.

A core thesis at Re7 is that state compression paves the way for a faster rate of experimentation by creators and consumer applications that will drive a dominance of Solana NFT mints vs. more expensive ecosystems.

The ability to mint millions of low-cost NFTs will enable more use cases as the cost of distribution falls dramatically.

One example is ticketing where event organisers issue NFTs connected to millions of tickets tied to a blockchain. These are reasons why NFTs will be at the centre of the inevitable Web2 <> Web3 convergence.

The shift from Web2 to Web3 signals a profound change in how we perceive digital and tangible assets. NFTs, with one foot in each realm, present unparalleled opportunities for ownership, creativity, and innovation.

Since launching in March 2023, state compression makes up >98% of the total mint volume on Solana with total mints now exceeding 4m/monthly.

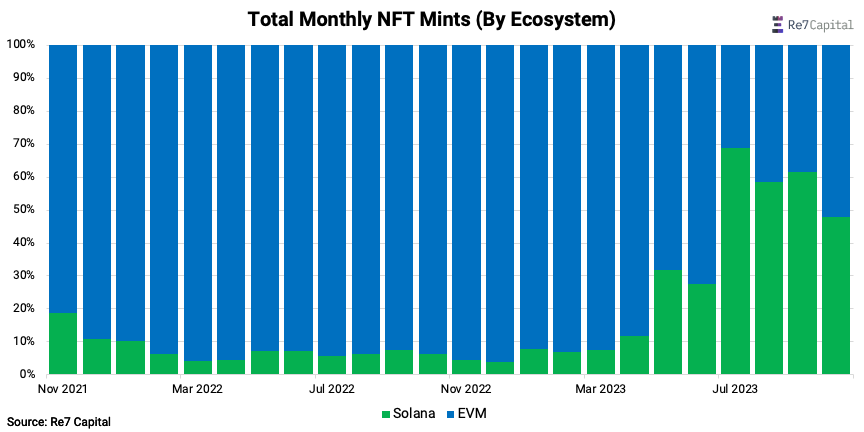

The technology has also been driving Solana mint dominance in the market. Solana now commands >60% of total monthly NFTs vs. its peers.

Put differently: Solana as a single ecosystem, generates the same or more NFT mint volume than all of the leading EVM chains put together.

Distribution channels for NFTs are also enhanced which would be prohibitively expensive on networks like Ethereum.

Solana NFT distributors like Drip Haus are making use of compressed technology to help celebrities drop thousands of NFTs across art, music, games sectors etc to a vast audience as a tool for engagement.

This positions more efficient ecosystems like Solana at the centre of a positive flywheel effect where the mainstream audiences start to become interested in seeing what campaigns are taking place for those individuals/companies they follow. They will ultimately be users of Solana.

And it’s the more efficient architecture that will make Solana a key onboarding funnel for millions of users eventually owning NFTs - all at a time when NFT activity is potentially poised for growth in 2024.

What’s more, we’re only just scratching the surface of what use cases are possible.

GHO Supply hits its supply cap

Aave's collateralized debt stablecoin has had a rough start despite finding product market fit.

The dollar-pegged coin has been trading below $1 since inception because of high demand for fixed-rate borrowing against a wide range of collateral. The result is GHO price has struggled to maintain peg.

With the mint cap of 35 million GHO reached, there will be less sell pressure on the token as supply cannot increase further for now.

The GHO team has been working on a number of other initiatives to support price including launching targeted incentive programs on Maverick and Uniswap.

Global Market Cap

$1.37T; Markets were up 7% last week with a risk-on environment. Overbought on daily timeframes but with RSI W at 70, it’s possible we may see a further run up towards $1.5T before a more substantial retrace.

DeFi

$57.4B; DeFi market capitalisation breaching $55B, reaching a new high since August 2022. Now at resistance which was 2021 support (July).

Altcoins

$296B; The altcoin market capitalization has surged to new highs since August 2022 indicating increasing relative momentum of assets outside of beta + stablecoins. A market for capital flowing down the risk continuum.

Overbought but there are plenty of examples of continued run in these setups (e.g. August 2021, Jan 2023).

Bitcoin Dominance

BTC.D; Bitcoin dominance finding resistance at 52.25% - a key level we saw as a potential moment for pause back in October. Support may be found at a time of a market retrace where Bitcoin maintains its relative value in the market for some time.

Stablecoin Supplies

113B; Global stablecoin supplies have grown by 2.2B from October 2022 bottom indicating net new inflows making their way into the market.

Stablecoin supply is about to breach its 200d MA with the rate of change analysis (bottom) showing supplies potentially now on a path of growth, not decline. This comes at a time when US10Y struggles to breach past 5.5% as the equity/crypto risk premium starts to increase.

Trader Positioning

BTC; OI-weighted aggregate perpetual funding rates have been becoming more positive as traders form a more bullish outlook. Cautious outlook until funding rates have become more neutralised (especially if price momentum slows).

> The Ethereum Investment Framework [Token Terminal]

> Engineering the Dollar from ETH and Perpetuals [The Fintech Blueprint]

> dYdX V4 [Epicenter]

> Chris Burniske & The Psychology of Investing [The Delphi Podcast]

> Mina’s zkApps and o1js [Zero Knowledge]

> ON-192: Layer 2s [OurNetwork]

> 0x Metrics [CabronElBufon]

> Crypto price action [Arthur_0x]

> Crypto <> AI [PhilJBonello]

> Nansen Polygon Report [Nansen]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.