The Weekly - 14th October 2024

The shift in on-chain trading and transfer dynamics since the altcoin breakout

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

How on-chain trading and transfer dynamics have shifted since the recent altcoin breakout

Alt L1 Spot DEX Volumes

Spot vs. Perps

Long Tail Drivers

Stablecoin transfers

On-Chain Trading and Transfer Dynamics

As we covered in our last Weekly, Altcoins was once again leading the market heading into end-of-year bullish seasonality.

With alts strength continuing on, we decided to cover the dynamics of on-chain exchange volume seen since their break out.

Alt L1 Spot DEX Volumes

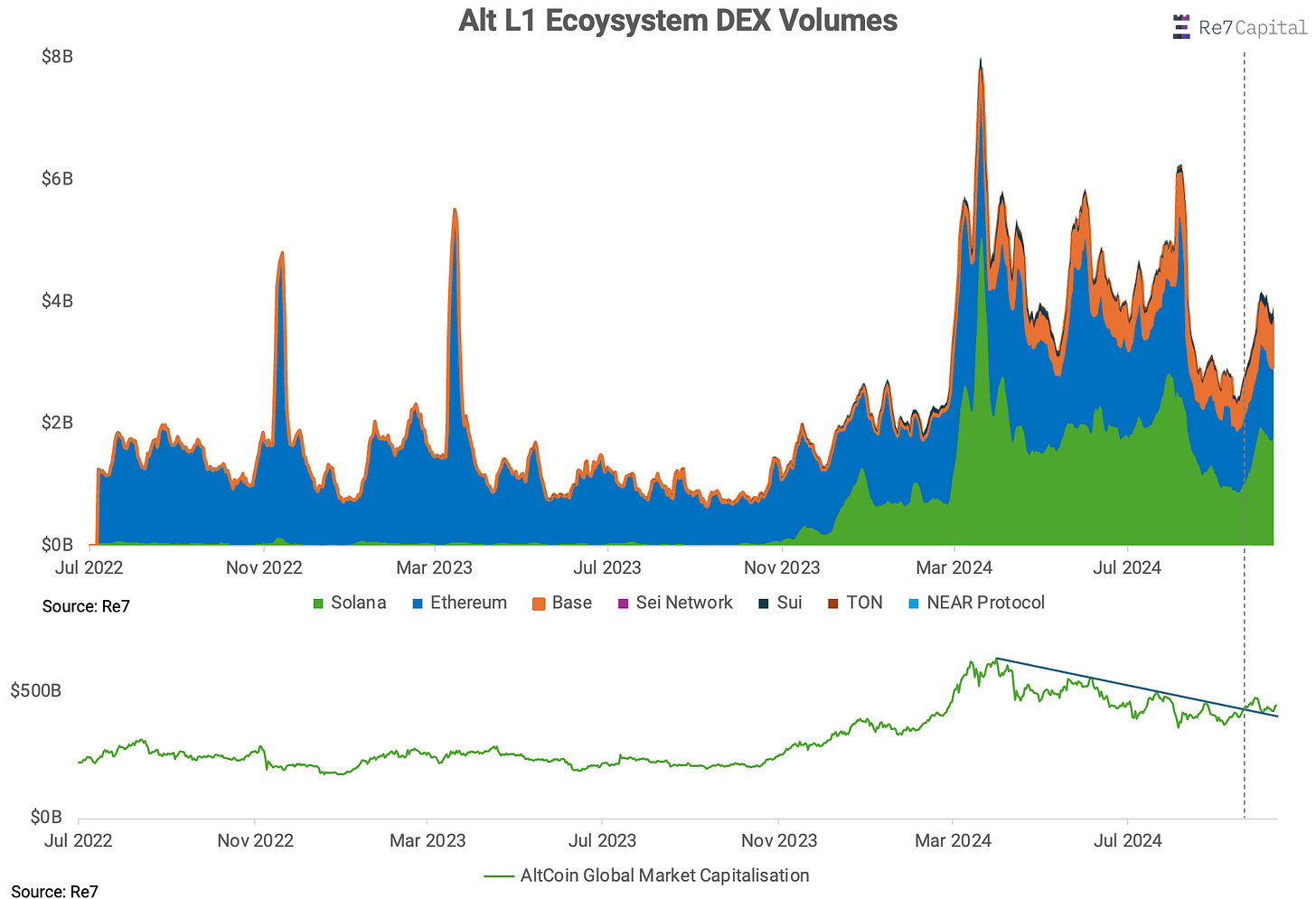

The aggregated Alt L1 ecosystem to Ethereum has surpassed $4b daily once again.

We can see that the strong rebound in volumes across the board has coincided with the breakout in the altcoin market capitalisation.

As investors get the signal altcoins are returning, the demand to speculate on the long tail of assets equally returns.

Non-stacked analysis shows that select ecosystems have benefitted more since the altcoin break out.

Notably, Solana spot DEX volume has 2x off the bottom while Base volumes are up 70% over the same period.

Meanwhile, Ethereum volumes have been flat.

Volumes by Market Type

When aggregating volume by market type, we also notice that spot has increased by 83% while perp DEX volume has been flat.

Since 2022, perps have mostly kept in line with spot with notable periods of lag. This runs counter to CEX dynamics where perps are often 5-10x that of spot.

Spot’s UX, simplicity, speed of market curation, and easy token accessibility have ensured it maintains its edge over its perp counterparts - which often require more sophisticated market makers.

Long Tail Drivers

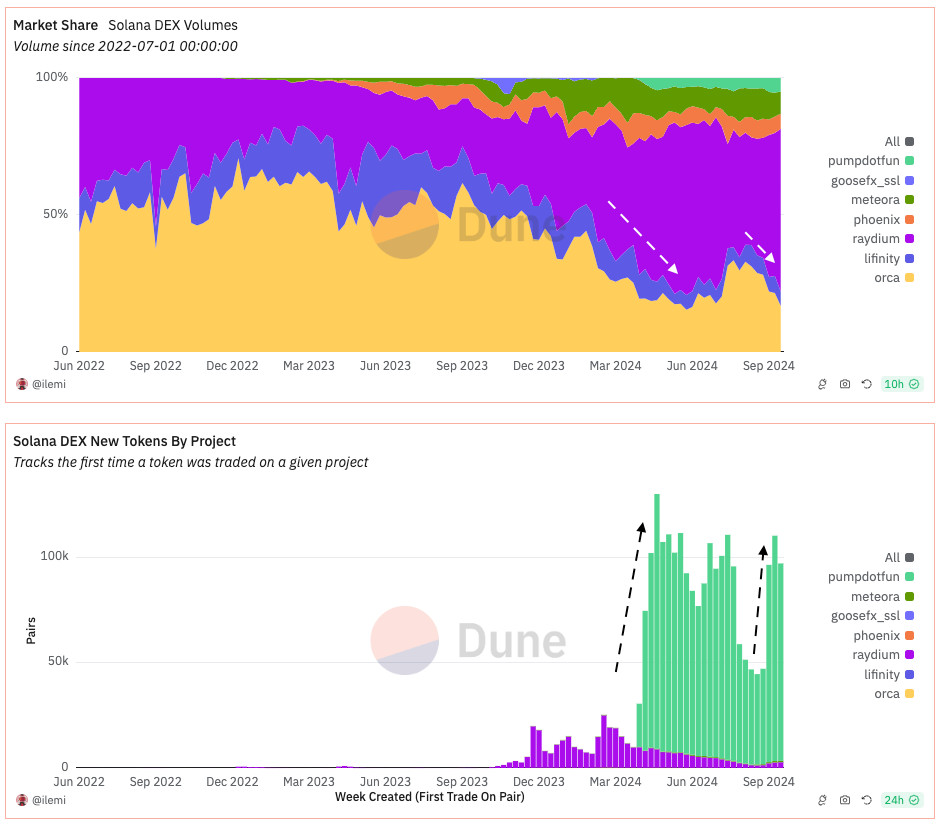

Coming full circle, the demand for trading alts has been expressed increasingly more in the meme sector.

Within the largest ecosystem by DEX volume today, Solana, on-chain meme spot volume is once again approaching ATH levels of 40%.

The underlying DEXs that facilitate the trading of these assets are the beneficiaries but not all are created equally.

Raydium generates $7b/week in volume with its spot market dominance increasing over its peers when meme platforms like Pump.fun see increased demand for market curation.

This highlights the importance for projects to establish key partnerships and gateway access with apps or frontends that funnel user demand within their respective niche.

Having a second-mover advantage is often overlooked for this reason.

Stablecoin Transfer Volume

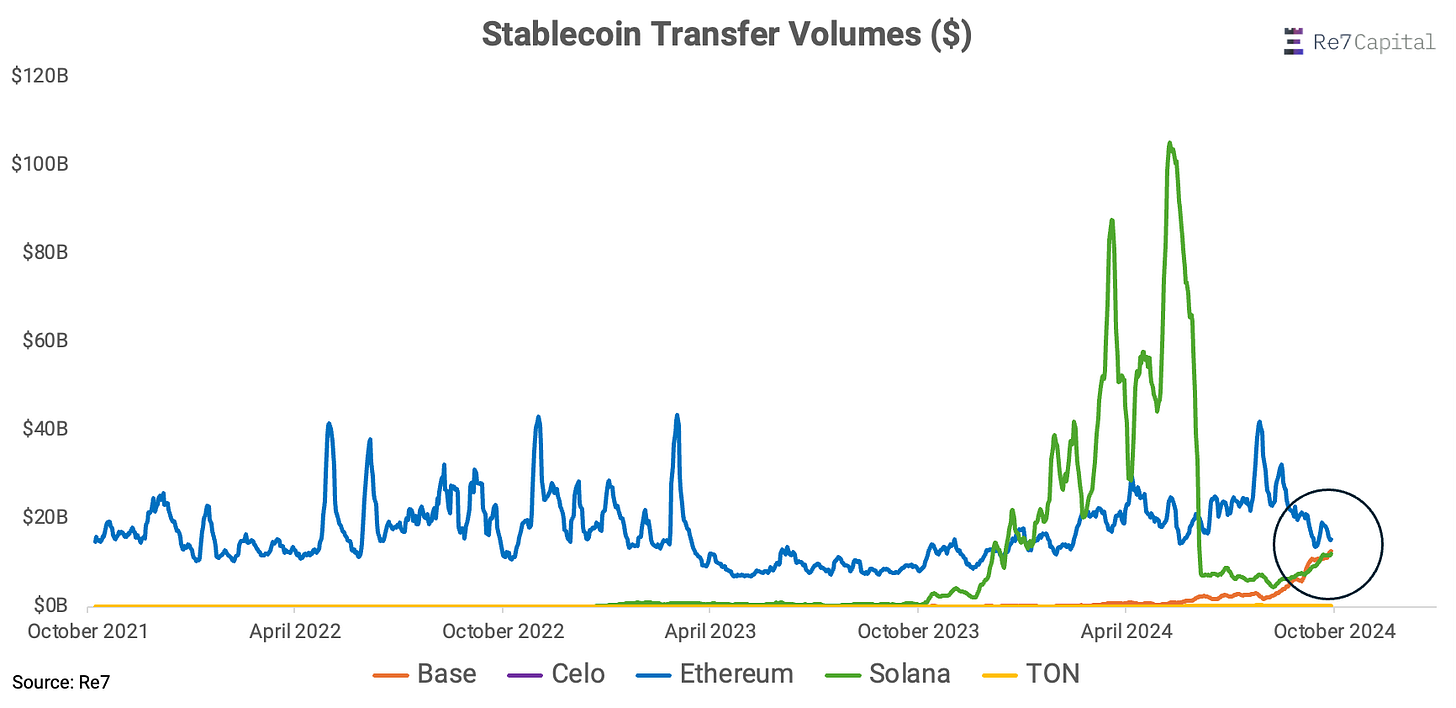

Finally, stablecoin transfer volumes have also bounced at the same time. As more investment opportunities open up on-chain, investors naturally look to move more value in stables (we can see this with Solana in Q1 2024).

Solana stablecoin transfers are up 2x off the bottom while Base is up 2.5x.

Base’s growth is largely due to a larger % of spot DEX trading pairs using USDC - an asset that is natively issued on Base.

Re7LRT DeFi integrations highlight:

Re7LRT, the restaking token using Mellow and Symbiotic, has recently added more DeFi integrations that can make it attractive for users to deploy their Re7LRT in other protocols.

Gearbox gauge voting has made Re7LRT the cheapest LRT to borrow with, pushing up the yield on leveraged loops and making a juicy opportunity for points farmers.

Similarly, a borrowing market on Silo is available where users can deposit Re7LRT as collateral to borrow ETH.

A new Uniswap pool is created, lowering slippage for these DeFi integrations and allowing users to immediately trade out of their Re7LRT instead of waiting in the exit queue.

Are there other integrations you want to see or propose? Do reach out as we continue to expand the utility of our vaults.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.