Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

How Web3 is underpinning the next creator economy

Farcaster

as a social graph network

data trends from Re7’s market intelligence platform

channels driving attention through tokenisation

Web3 Social - The Next Creator Economy

We live in an increasingly digital-first world where content, interactions, and consumption are being removed from the physical world.

In the early 2010s, users became influencers, building large audiences that could be monetised.

They then sought independence from platforms by representing independent businesses.

Now, creators are becoming the platform. Technologies like blockchain are blurring the lines between fans and creators.

Blockchain enables more creative ways for users to maintain greater control over their data, assets, and monetisation opportunities through digital culture.

This comes when the ‘creator economy’, a $156B market projected to reach $530B by 20233 by researchers, has never been more relevant.

Farcaster - A New Social Graph

Web3 social platforms need a social graph layer to formalise their network effect.

But instead of using closed-off infra, these platforms act as public utilities.

The below piece explores the emergence of one of the first, and largest, social graph layers, that exists today - Farcaster.

Founded in 2020, Farcaster is a platform for developers to build social apps and networks.

Frames

DAUs were catalysed in late Jan when developers and users could embed interactive experiences into posts within Farcaster channels (Frames).

Users could mint NFTs, build games, or insert instant checkout links directly from their social feeds.

In other words, the platform became more expressive and catalysed more attention from its users.

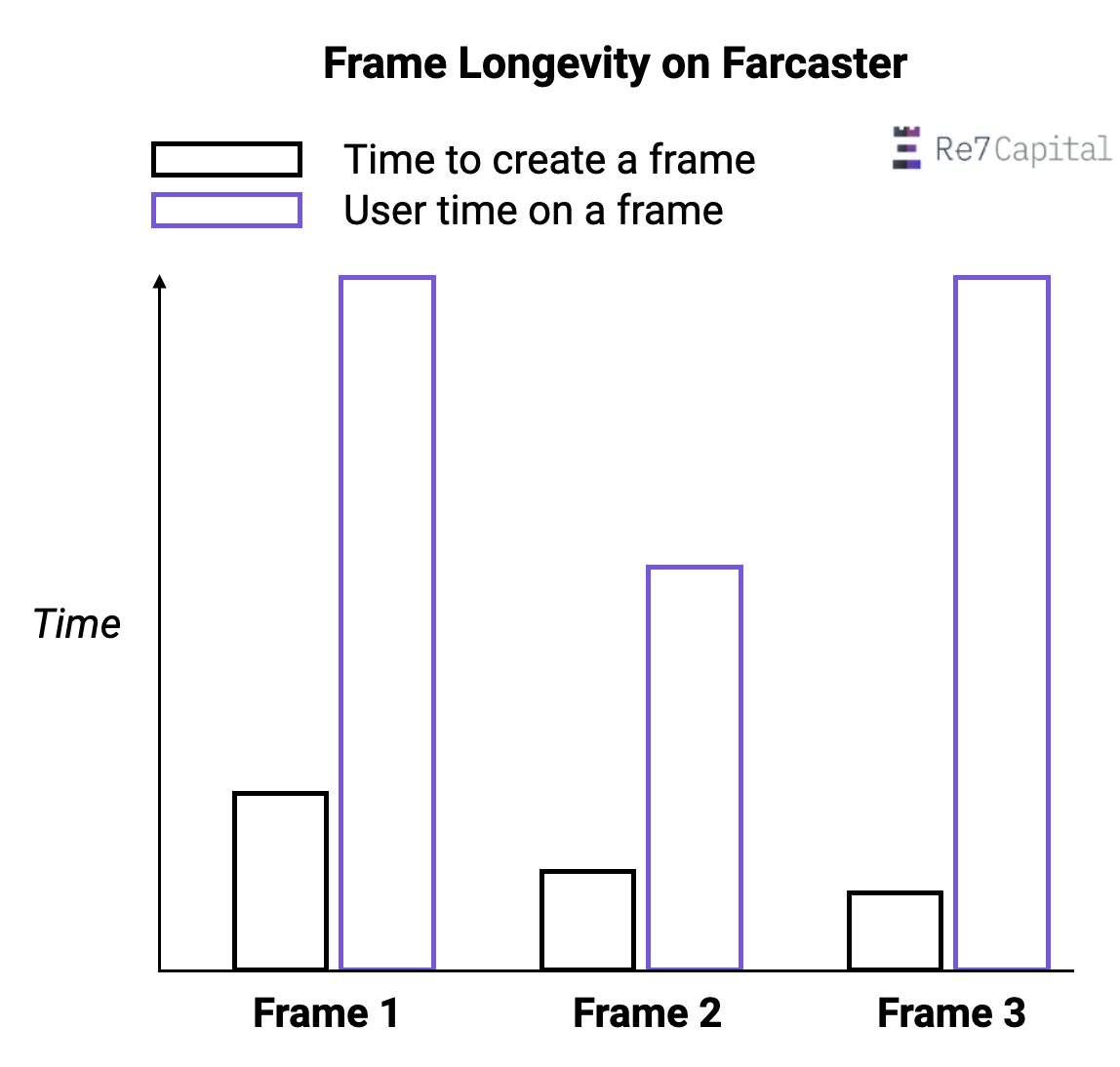

Frames proved a highly scalable product feature - from a longevity, cost, and rate of innovation perspective.

Once built, it can be accessed by any user, can be created by several SDKs, and can be endlessly composable.

Farcaster DAUs dominate the Web3 social market today at 70%+.

How Farcaster Is Being Used

We’ve also noticed a greater portion of Farcaster interactions tend to be reactions and casts (i.e. posts). As content receives more reactions, it acts as a reinforcement for more content to be produced for consumers.

Farcaster is also showcasing how Web3 social graphs can be revenue-generating businesses.

In Farcaster’s case, users pay ‘rent’ to store data/identity on-chain such that greater demand for storing critical information in the social graph leads to higher revenue potential.

Attention Is All You Need

As public community spaces, we can also analyse social channel dynamics in real-time with a richer set of on-chain data - unlike traditional Web2 social networks.

Farcaster has over 12k channels today. 13 channels have a weekly caster count of >5,000. The majority of channels fall to the wayside showing a power law distribution of traction.

After all, attention is a finite resource.

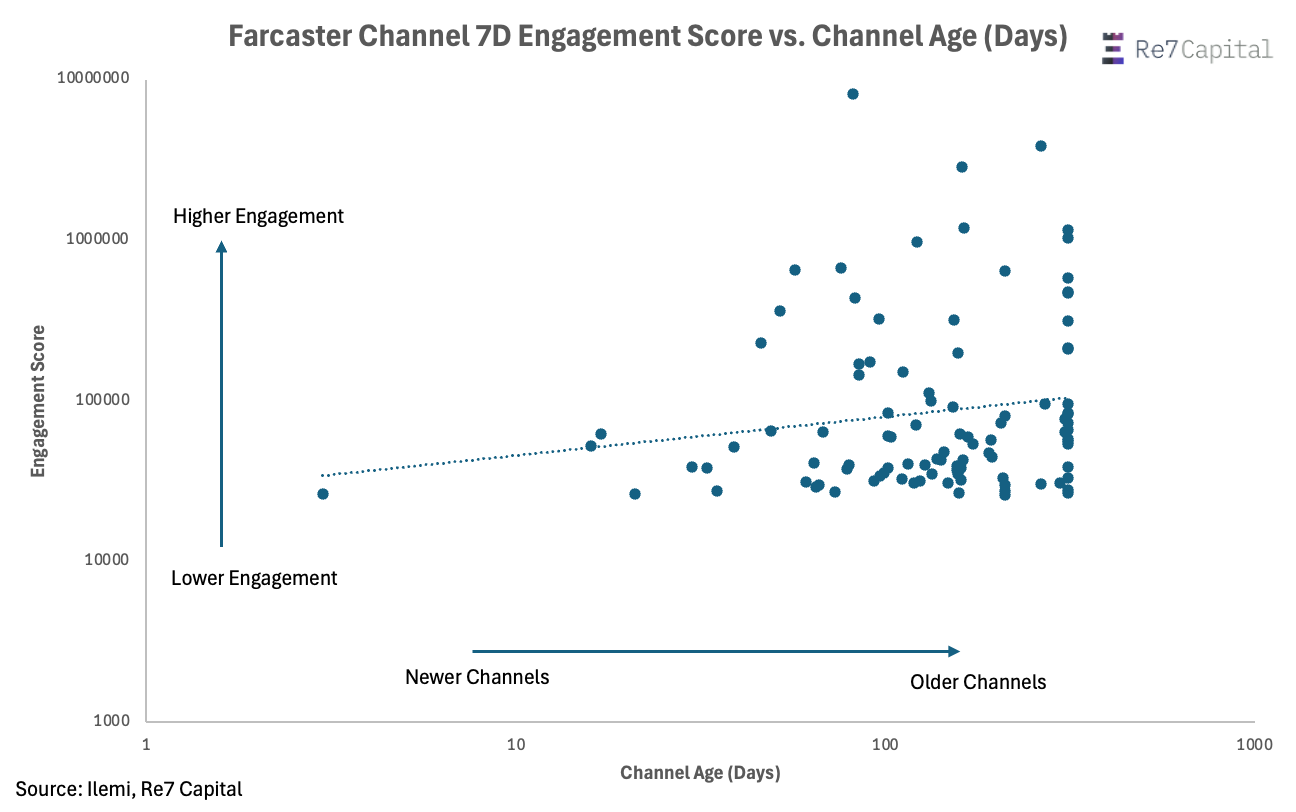

In fact, we see older channels as having higher engagement scores overall.

Older channels also tend to have a relatively higher caster and cast count.

One interpretation is building out a cultural network effect is easier when you can snowball attention at a time when there are limited competing channels for attention.

Another consideration is the tokenisation of channels and culture.

Channel tokens can be created to drive and reinforce specific social behaviours towards a unified cultural goal. Farcaster tokens are a $330m market today.

Front-end apps are being built to allow users to easily create their own tokenised channel community.

It’s therefore unsurprising that some of the more active channels on Farcaster are also tokenised.

Looking Ahead

Social is emerging as an exciting and fast-moving sector within Web3. The rate of innovation for Web3 social coincides with creators and communities exploring new monetisation models.

Integrations with DeFi, agents, and traditional Web2 businesses are only likely to drive more attention to Web3 social networks. ‘Web3 social’ will just become ‘social’.

Challenges remain in identifying bots vs. organic traction, G2M strategy for both the social platforms and their communities, user stickiness, and data handling costs.

Yet, these challenges are there to be overcome and Farcaster has been leading the charge with others to change the social game forever.

New Stablecoin Yield Opportunities With RE7 Morpho Vaults

The Re7 Labs team continues to release new and interesting vaults on top of Morpho Blue and other DeFi protocols.

Morpho offers a flexible platform for deploying bespoke lending markets for projects that can enable interesting opportunities for lenders and borrowers.

The most recent ones to go live with rewards are the f(x) Protocol USDC vault and the Re7FRAX vault.fxUSDC allows users to deposit and earn FXN rewards, while enabling borrowers to lever up on Aladdin DAO's arUSD.

The vault has seen almost $1m in inflows since launch, and the high utilization means yields are continuing to increase for suppliers. Leverage on arUSD is another available strategy, allowing depositors to get boosted stability pool yield and points from Ether Fi.

Re7FRAX has been in the works for a while now but finally has gauge rewards giving a juicy yield for users who stake Re7FRAX. Navigate to the FRAX staking site and lock your Re7FRAX at a longer duration for a yield boost.

While FXS rewards will be good as the pool grows, there is an expectation of decent native yield from borrowers with sUSDe and USDe collateral, which are still giving decent yields and Ethena sats.

ICYMI - Re7 x OurNetwork (L1s)

OurNetwork teamed up with Re7 for the Layer 1 blockchain edition of the newsletter, providing the overall sector highlights.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.