Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

A shortlist of key metrics that help colour the state of the cryptoasset market today

The State of the Cryptoasset Market

Global MCAP

Total crypto market capitalisation stands at $2.34T - the same level since the start of March this year.

We are now consolidating in what appears to be a bull pennant. Technicals are neutral.

Macro

BTC has been under pressure from a rising dollar (DXY). The stronger dollar is partially driven by interest rate differentials being priced in and a ‘neutral’ Federal Reserve following last week’s FOMC.

Leg higher likely can’t start until the dollar rolls over.

Crypto vs. NDX

Crypto breaking down its positive correlation with NDX. Expectation is that these converge over a longer period with NDX appearing to be the relatively overextended one in the pack.

Market Volatility Expectations

Investors are pricing in lower market volatility across tenures (7d-180d).

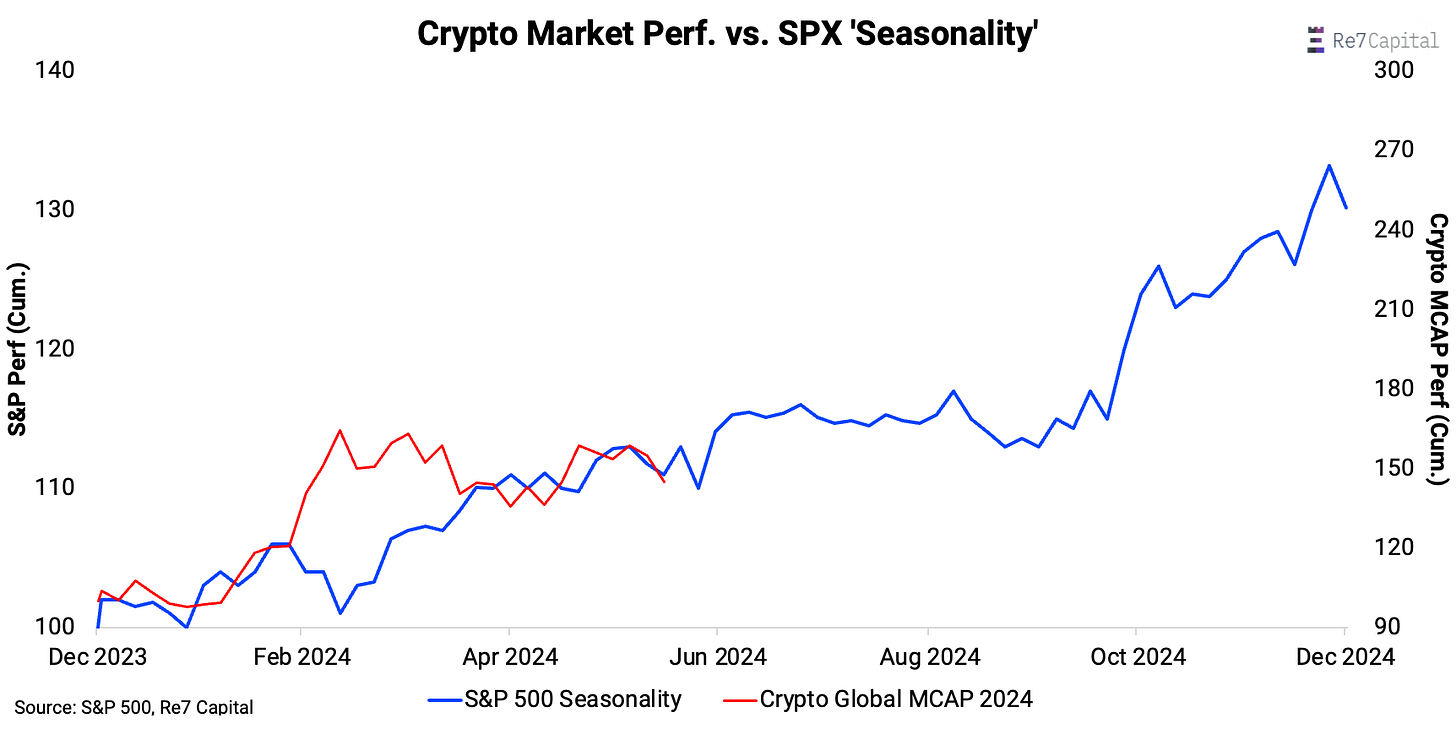

Seasonality

Lower volatility expectations are to be expected in the context of performance ‘seasonality’.

Summer tends to be the slow slog for investors with crypto’s 2024 performance moving in line with seasonality expectations…

ETH/BTC

Sideways momentum has kept ETH/BTC in its falling wedge, maintaining its correction.

ETH shows signs of outperforming BTC on refreshed estimates ETH ETFs could go live in the 1st week of July. All eyes are on a wedge break to indicate what direction momentum will strengthen.

Narrative Performance

RWAs have led the market over the past 3 months (+15%) - the only positive category over the period.

All other major narrative categories have printed negative aggregate performance. (-3% to -42%). AI was a top category YTD (+42%) alongside Memes (+163%).

The 3m delta between these two categories suggests AI as a category has been affected with rotation plays more than memes.

Memes

Meme mindshare continues to dominate the market. Performant blockchains that provide conducive environments for high frequency, lower cost activity are seeing >60% of their token universe volume (CEX+DEX) being meme-centric (e.g. Solana).

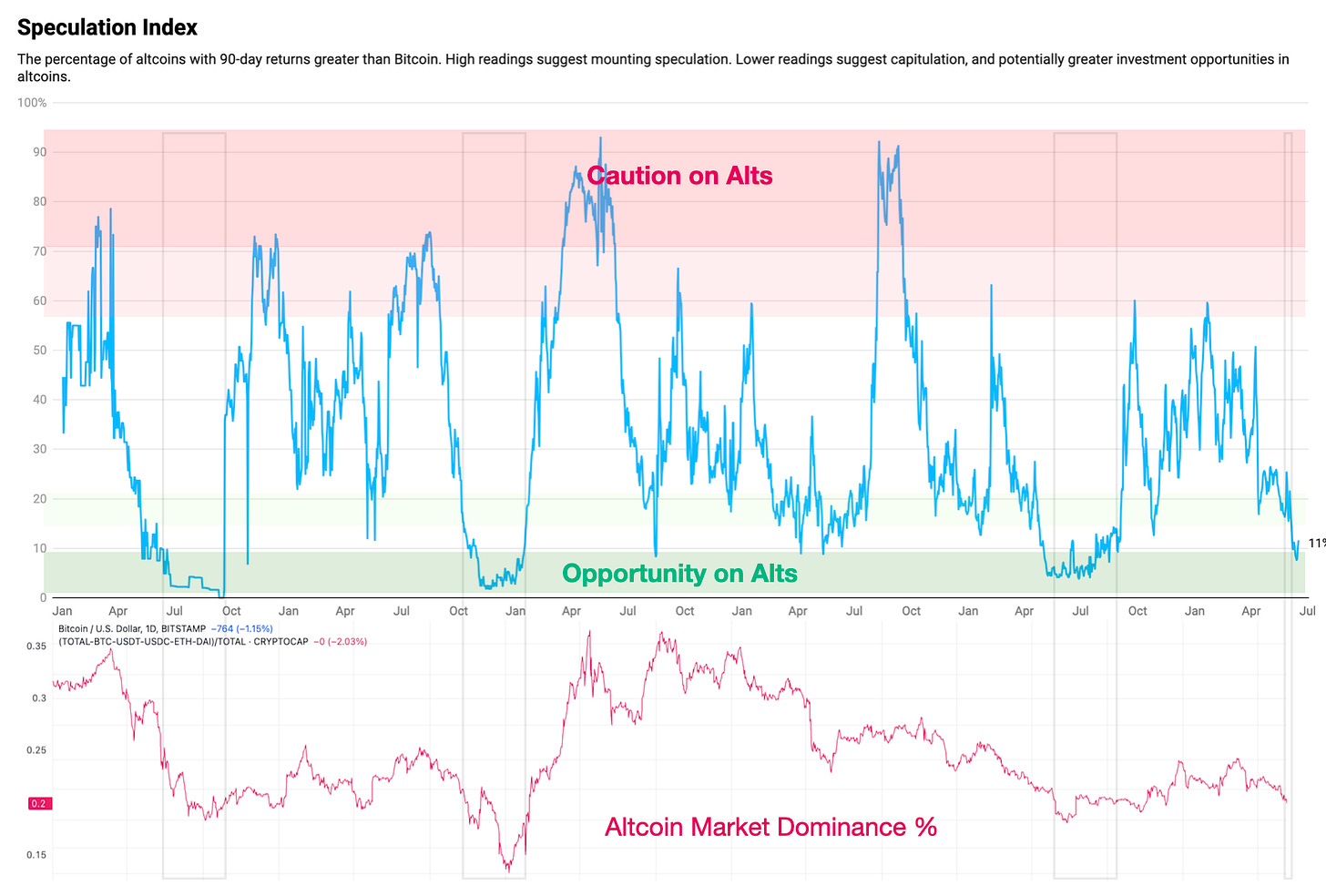

Altcoin Market

The percentage of altcoins with 90d returns greater than BTC is reaching the lowest point since the current bull market began (blue).

Lows in the Speculation Index have historically coincided with local bottoms in the altcoin market dominance (i.e. where alts outperform vs beta).

Re7 x Mellow

The restaking narrative has continued to have legs with market expectations for yield and airdrops keeping attention on the sector high.

Symbiotic, a new restaking protocol backed by Lido and Paradigm, launched last week and within a few days had already reached initial deposit caps.

Re7 Labs is participating, with its own Liquid Restaking Token that earns both Symbiotic and Mellow points along with the underlying wstETH yield. Users that deposit will be able to take advantage of a seamless restaking infrastructure from Symbiotic, while also getting an LRT for use throughout DeFi.

When delegation to networks is live in these restaking protocols, management of where stake is shared will be an important consideration that will move LRT from undifferentiated deposit tokens to a conscious choice by users on various risk profiles.

ICYMI

In a recent post on our blog, we have dived into how users can start thinking about restaking risks and rewards.

Restaking: Risk / Reward Management

TL; DR: Similar to our risk index framework for DeFi protocols, we propose a rubric for evaluating restaking opportunities to help restakers make informed decisions with a clear view of risks and return profiles. Using this risk management framework as a foundation, we are excited to announce that Re7 Labs will be launching a new vault for a liquid resta…

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.