Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

Stride’s market expansion as a leading Cosmos LSD provider

Stride’s market share to its peers

Why users are looking to Stride liquid staking tokens as collateral in DeFi

Increased stablecoin usage in borrow/lend protocol, Morpho

Taking It in Stride

Stride is a liquid staking provider in the Cosmos ecosystem. Below, we provide a rundown of the latest on-chain trends, covering TVL growth, market penetration outcomes and everything in between.

Stride's total USD-denominated deposit value has increased 72% YTD ($155m).

Since its inception, Stride has continued to take the lion's share of the Cosmos LSD market (90%).

One differentiator has been the efficient go-to-market strategy by the team to onboard new chains/assets as well as optimising incentive structures to bootstrap demand.

At the end of 2023, Stride supported 9 Cosmos chains. Since then, Stride has onboarded 3 more chains including Celestia (TIA) which now makes up >34% of total USD TVL.

Diversification of chain support for generalist LSD providers is important for long-term sustainability.

Increased diversification of integrated chains allows Stride to capture both a wider market and multiple revenue streams from chain yield/staking rewards.

Only 0.7% of the total TIA staked is staked via Stride showing the room for further growth in the TIA LSD market overall. The enhanced utility of TIA as an asset in DeFi could be catalysed for further market penetration down the line.

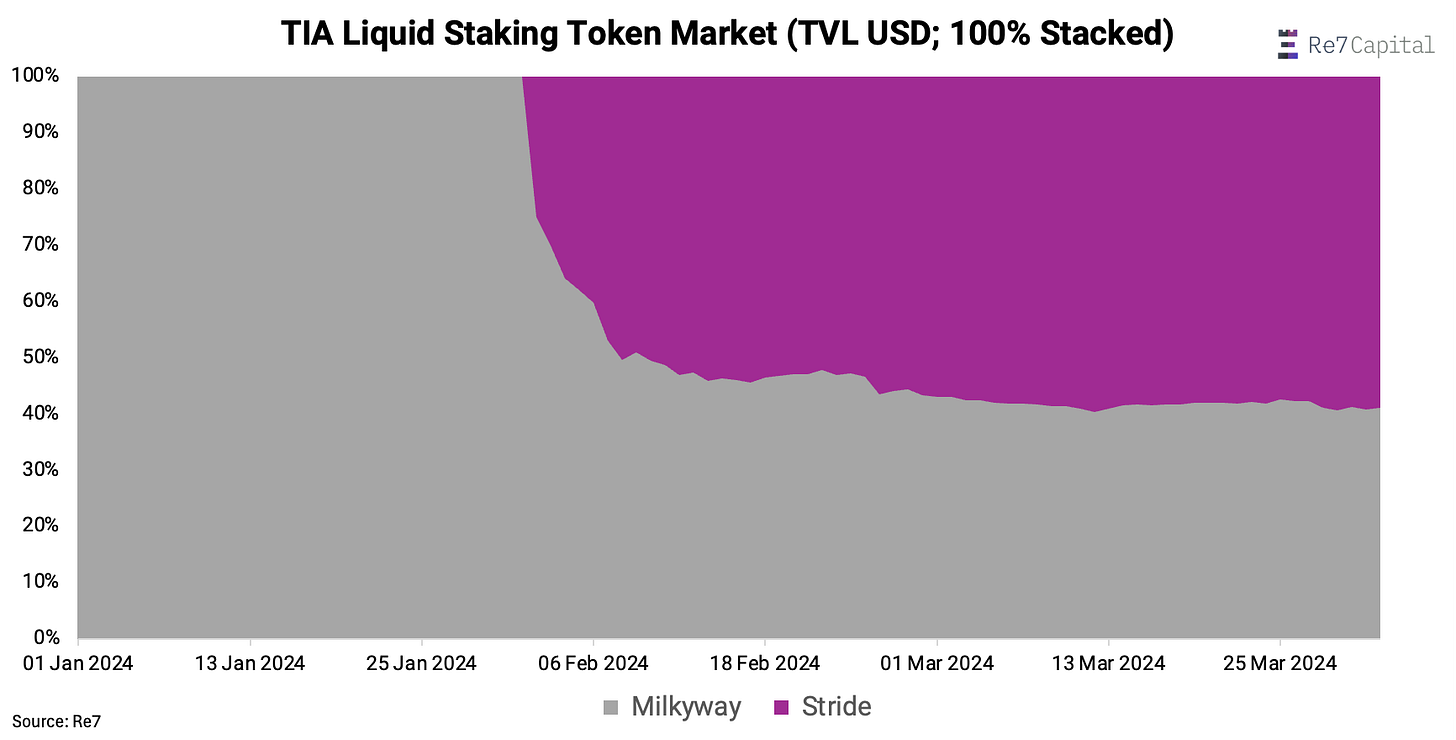

As a generalist LSD provider, Stride has managed to dominate the Celestia market vs. specialists such as Milkyway.

Stride commands a ~60% TIA LSD market share although this has kept flat since mid-February.

Stride also integrated DYDX staking in January 2024 with 3m DYDX ($10m) now staked via Stride's LSD platform.

Stride allows DYDX holders to auto-compound rewards in stDYDX and use their yield-bearing token usable in DeFi.

On the flip side, new chains stand to benefit from LSD providers as they can enhance economic security and decentralise the validator set further.

After 2 months, Stride market penetration is still low at ~2.5% - again showcasing the room for further growth.

Over 5.2m USDC staking rewards have been generated over the past 30 days which stDYDX holders, and therefore Stride, can tap into as a revenue source.

At Re7, we create and actively monitor several market indicators including for LSDs in-house.

Re7’s P/TVL index - which measures the valuation of STRD relative to its TVL - suggests that Stride needs to grow in its valuation. And that’s ok.

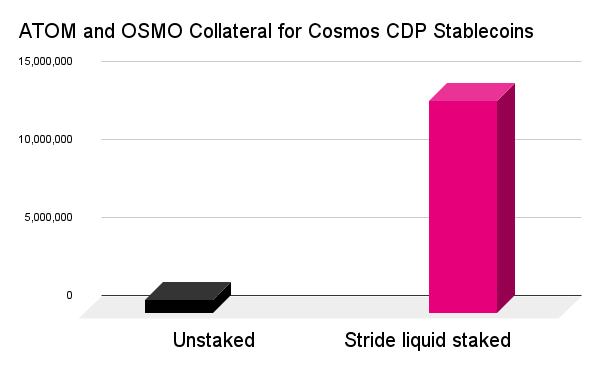

Initial evidence points to Stride LSTs becoming the dominant collateral assets for stablecoin issuance.

This is because users want staking rewards for their collateral. Yield can reduce liquidation risk and ratios like LTV.

As the Cosmos DeFi ecosystem grows further over the next 12 months, LSD providers will be the enabling infrastructure for market expansion, such as stablecoin.

In other words, LSDs like Stride are being positioned as the backbone of alternative DeFi ecosystems.

sUSDe and USDe borrows maxed out on Morpho

What is it?

Ethena is planning their airdrop in a few days and the demand for leverage on their sUSDe and USDe tokens is higher than ever.

Morpho currently boasts the largest money market for using the USDe tokens as collateral.

What does it mean?

Along with the Re7 USDT vault where depositors are earning over 70% yields, MakerDAO has jumped in the game by extending $100m DAI as lending liquidity against sUSDe and USDe.

Their vault is seeing similarly high yields that all get passed back to MakerDAO as revenue. Borrowers have snapped up all available liquidity even in the wake of these massive inflows.

Why does it matter? The high rates are driven by the demand for Ethena's highly-anticipated token and underlying sUSDe yield, both of which have been attractive to the market.

Money markets have seen high utilization but borrow demand hasn't abated, showing that there are participants on either side of the trades who are coming out happy.

The rates carry over to DeFi lending protocol's profits, with giants like MakerDAO and Aave having record revenue for the quarter.

Global MCAP

$2.54T; Global market capitalisation continues to face resistance at the $2.5T mark - we remain ~17% below ATH levels where price discovery ensues after breaking above ATH levels. Daily RSIs neutral.

ETH/BTC

0.05002; ETH/BTC being pulled out of its multi-year wedge and down to its long-term support level of 0.05.

Stablecoin Supplies

Stablecoin supplies have grown 23% since October 2023 lows ($110B). In other words, $26B in net new inflows has occurred in just over 5 months as investors capitalise on a growing set of investment opportunities within Web3.

Bitcoin ETF Net Inflows

$183m; After 5 days of net outflows, US spot BTC ETFs have seen net inflows resuming at a pace of ~$180m/day in a sign of continued/strong interest by investors to gain crypto exposure.

ICYMI: Re7’s Latest Contribution to OurNetwork

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.