Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re proud to share that Re7 Capital has been shortlisted in three prestigious categories at the Hedgeweek Global Digital Assets Awards 2025!

🔹 Liquid Ventures of the Year: Annual Excellence

🔹 Liquid Ventures of the Year: Sustained Excellence

🔹 Market Neutral Fund of the Year: Sustained Excellence

More details here.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies.

Re7 is searching for a DeFi Developer to support the Re7 tech team, developing and maintaining key backend infrastructure for Re7 products and funds.

Summary

In this edition, we cover:

the market backdrop and the macro inflection points

the fundamental ATHs across themes and sectors

the divergence between fundamentals & policy with investor sentiment

Market Inflection Point

The Backdrop

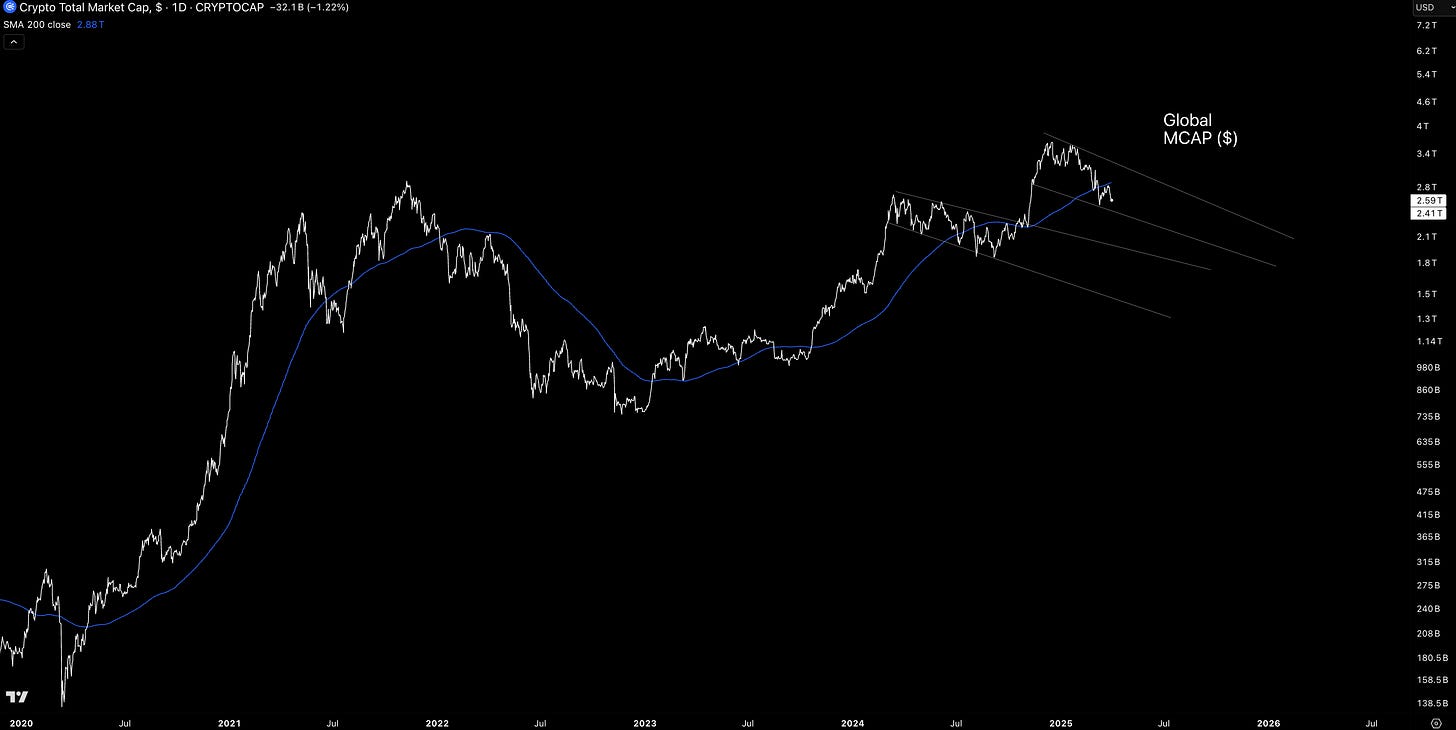

Global crypto markets stand at $2.6B, with markets falling $150b MTD. Zooming out, markets are once again consolidating after rallying to new all-time-highs - a similar pattern we saw in 2024.

Unlike 2024, however, quantitative tightening is expected to practically complete on the 1st April - the most aggressive Fed regime which began in 2021. Upon completion, we should see liquidity measures gravitate higher all else equal.

The reason this is key is that crypto markets continue to be correlated to equities and risk assets trend positively to liquidity measures.

Cyclically, BTC has also not yet completed it 4 year cycle where the halvening marks the halfway point. And given risk assets are influenced by liquidity, the pattern can reasonably continue as expected, rhyming more closely with previous cycles.

The Fundamentals

Irrespective of this, we continue to be excited at seeing record-breaking growth across sectors.

Take global stablecoin supply, which is on track to reach $250B in the next quarter and growing ~66% YoY.

Solana is also seeing the fastest rate of growth at an ecosystem level, seeing >3x growth in just 6 months.

The percentage of Solana stablecoins in DeFi (defined here as excluding CEXs and Infra supply) remains steady during this growth.

Growth of stablecoins in DeFi signal increased liquidity, user adoption and trust of that ecosystem. Stablecoins are critical parts for DeFi applications to function and can enhance lending activity, DEX efficiency, and stability for yield opportunities.

Elsewhere on Solana, liquid staked token supply continues to reach new highs. Rising LST adoption often correlates with their use in DeFi as LSTs are used as collateral in lending and DEX liquidity.

Take JitoSOL, the largest LST on Solana. The supply of JitoSOL has remained steady in DeFi where its use has enabled more complex yield strategies for certain applications including lending.

Take another example - Lending. Total Q1 borrows has reached new highs since Q2 2022 ($22.2B). DeFi protocols are generating >$500m in annualised revenue by monetising debt through interest payment fees.

Fear & Greed

These positive trends come at a time of coming out of the most fearful period the market has ever seen.

Fearful sentiment has bee coupled with altcoin seasonality index reaching extreme lows vs. BTC. We are at levels not seen since summer 2024, prior to global market capitalisation breaking out of the previous consolidation pattern to the upside.

Meanwhile, the prevailing winds for crypto regulation have shifted more positively.

Paul Atkins as SEC head, who pledged "rational" crypto regulations on March 26th. One day after, the SEC dropped its appeal in the Ripple case on March 27th, marking a significant win for the crypto industry by reducing regulatory uncertainty.

Therefore, we are witnessing a growing divergence between fundamentals and broader market sentiment. For those looking under the hood, the ecosystem is in high gear and firing on all cylinders.

New Re7 Vault Launches

It was a packed March at Re7 Labs. Here’s a quick look back:

Turtle x Re7Labs Vault ‘tacETH’ is live, allowing to deposit ETH, stETH, wstETH or wETH into a single-asset vault with projected Yield 30%+ APR, based on TAC at 750M FDV. In addition, 40 TURTLE deposit bonus per $1K deposit until incentives run out.

Berachain baults curated by Re7 on Euler are live, earn supply yield and incentives on WBERA, HONEY and USDC.E, with bonus srUSD / Honey loops until the initial 1m cap is hit.

We are excited to announce that Resolv launched its own restaking vault, rstUSR — curated by Re7. This vault will collect native yield from wstUSR in addition to Resolv, Symbiotic and Mellow points.

We also launched the Re7 Resolv USR vault on Morpho Base, earning 30x Resolv points and accepting PT-USR-24APR2025, RLP, wstETH, LBTC, WETH and cbBTC as collateral.

We launched a new rUSDC pool on Vesu Starknet in partnership with Relend with $15m in supply. Borrow rUSDC with ETH, wstETH, WBTC, USDC, STRK and xSTRK as collateral and get exposure to DeFi Spring rewards.

We're excited to introduce mRe7YIELD, a delta-neutral DeFi yield strategy designed to maintain balanced market exposure while optimizing returns. Risk-managed by Re7 Capital, mRe7YIELD is tailored for those seeking stability and consistent yields.

Supported Tokens: USDT, USDC, DAI against mRe7YIELD.

Last Month APY: 20.83%

We launched multiple Lido v3 pre-deposit vaults with leading node operators such as Stakin, Luganodes or Blockscape. You can find all our v3 vaults here.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.