Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

Market signals related to growth and adoption indicating “business as usual”

Market signals point to emerging trends

Business as Usual

Last week, it seemed everyone was double-clicking on the impact of geopolitical tensions on risk assets. With global markets closed, crypto, which operates 24/7 took the brunt of the heat.

After consolidating for several weeks below marginal all-time highs, BTC fell 16.5% to a new Q2 low of $59.6k.

It was felt more broadly too. Global market capitalization fell to $2.1T, before rebounding back to $2.36T.

BTC vs. NASDAQ

While the geopolitical stage carries weight on risk assets, we highlight some market dynamics showing it’s just “business as usual” - the broader trend continues to be up.

Compared to Nasdaq futures, BTC’s retrace last week was the same with the BTC/NASDAQ futures cross in the exact same level as early April.

Altcoin dominance has actually ticked higher in recent days, continuing its broader uptrend since May 2023.

The large swing in altcoin dominance last came when BTC broke convincingly above its previous all-time high of $20k. BTC has been looking to do the same again at these levels.

Stablecoins

US spot Bitcoin ETFs net inflows averaged -$40m last week and, whilst representing a period of reduced investor interest, we still see clear signs of capital inflows elsewhere.

Stablecoin supplies have relentlessly surged to 144b - just 8B below all-time high levels. Stablecoin supplies are on track to break new highs in ~May at current pace.

Yet, it doesn’t appear supplies have reached saturation yet as market desire for leverage and opportunities for high yield within DeFi remains elevated.

Weekly stablecoin volume has surged past 700b despite broader market volatility. With volume outpacing growth in supplies, the velocity of stablecoins has been increasing.

Higher transaction value (effective stablecoin GDP) on a monetary base per unit of time signals increasingly healthy stablecoin economies. We can also see stablecoin utility being found cross-chain, including Solana.

Perpetuals

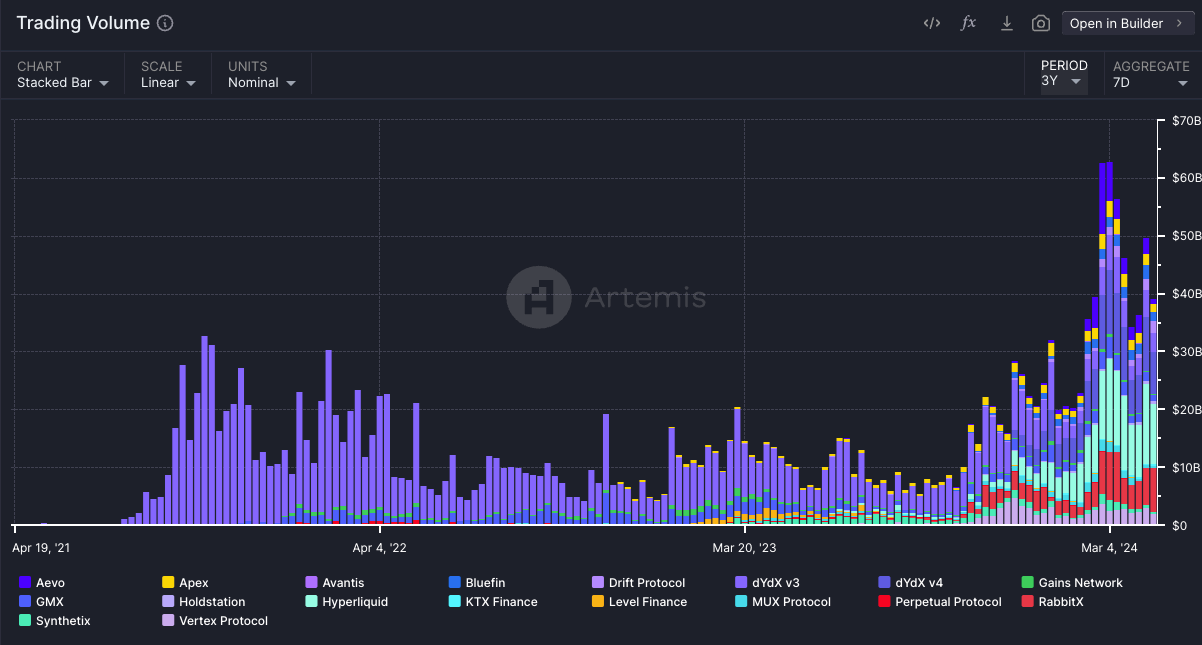

Perpetual swap volume on-chain is consistently hitting >$40B. The volume is also becoming more distributed cross-chain, including RabbitX (Starknet) and Drift (Solana).

Active Users

Finally, the value of blockchain economies stems from their network effects - the active user base of the economies.

Total active users on leading blockchains have now breached 10m/day for the first time in history.

Our interpretation here is that valuations are being driven by fundamentals relatively more compared to previous cycles. With the recent retrace, market valuations have become disconnected from this uptrend.

Emerging Dynamics

With many signals showing it’s business as usual, there are equally emerging trends worth highlighting.

Bitcoin halving occurred last week, with block rewards being halved from 6.25 BTC to 3.125 BTC.

Other than block rewards, miners also gain income from transaction fees paid by network users.

Total BTC fees (USD) have spiked to new highs ($80m/daily) as Runes protocol, a new token standard similar to BRC-20s, rolled out. Users were quick to create rune-based memecoins upon launch.

The demand to create memecoins was so intense, the average transaction fee on Bitcoin also spiked to $35 (7d MA).

While unclear how the Runes memecoin mania will last, it marks a clear shift in Bitcoin network economics for miners that is becoming less reliant on reward subsidies.

Increased demand for fungible assets on Bitcoin is also likely to catalyse the proliferation of Bitcoin L2s over the coming months.

Across Active Users

Across is a low-fee, fast bridge for the EVM ecosystem.

Active monthly users for Across continue to climb to new highs of 46% (green) as it becomes the most popular bridge project for users.

This comes at a time when the total bridge volume has surpassed $30m/day consistently since February 2024.

Global MCAP

$2.36T; Global market capitalisation appears to be kept in a $2.17T-$2.7T range. Markets have found bounced off resistance-turned-support of levels found in April 2022.

ETH/BTC

0.048; ETH/BTC has broken below its longer-term support of 0.05 and wedge. ETH has failed to gain momentum against the orange coin for several quarters.

Bitcoin ETF Net Inflows

-$40m avg.; US Bitcoin spot ETFs saw average net outflows last week. Last week finished on a 59m net inflow.

BTC Perpetuals

Bitcoin OI-weighted funding rates have fully reset, printing negative 14th-20th April. Open interest increased while funding rates turned negative, increasing the risk of a short squeeze.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.