Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

What loyalty programs are and the power of incentives within them

Different types of loyalty program models

How Web3 technology enhances loyalty programs

The importance of analytics for consumer apps implementing programs

Challenges of on-chain points

Loyalty Programs

Loyalty programs encourage certain behaviours that drive growth back to the brand or ecosystem.

Take points which are specific reward units given to a brand or ecosystem participant(s).

The idea of point programs to retain user activity has been well-established for decades. We’re all familiar with the coffee shop stamp cards and airline miles.

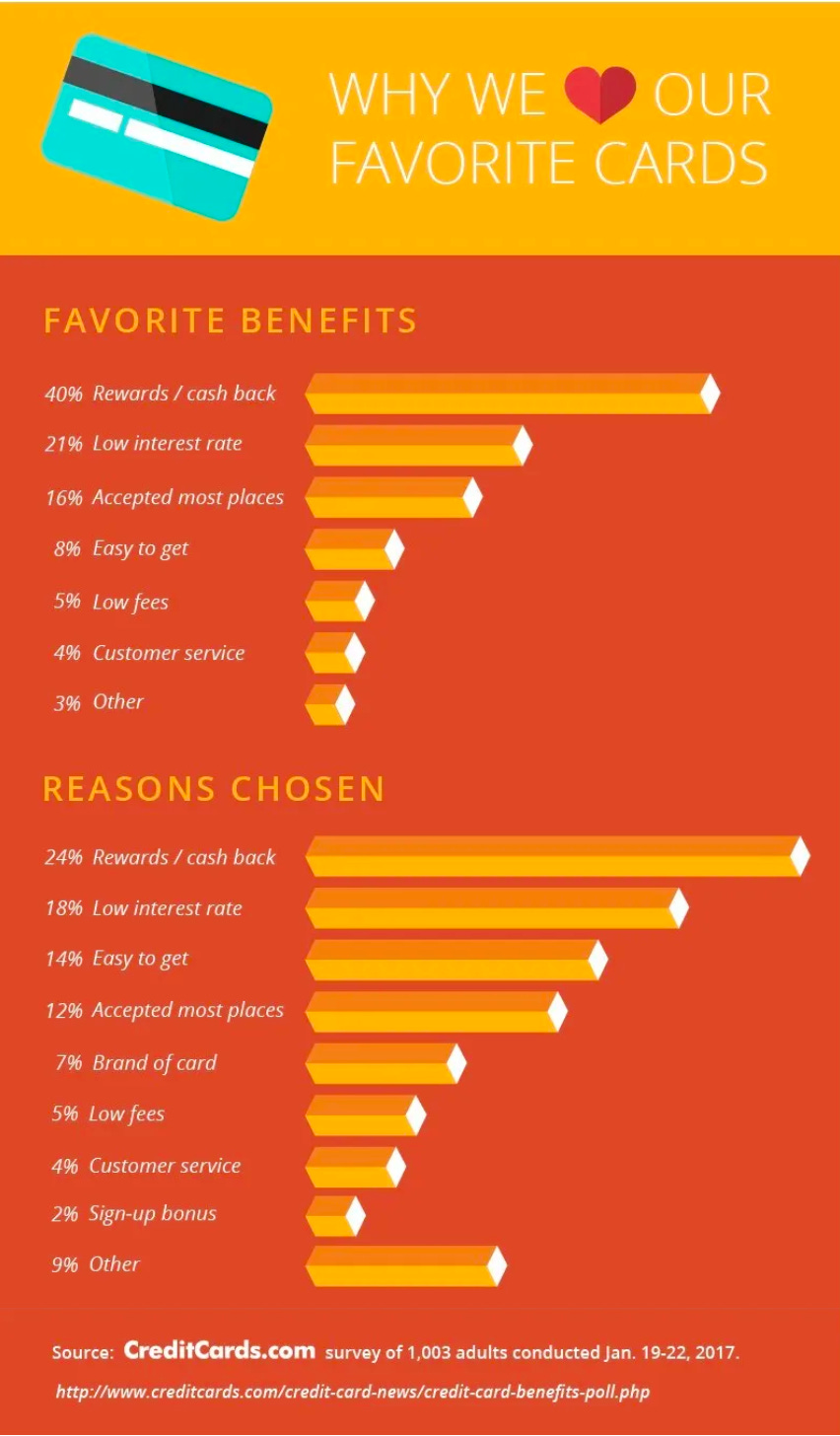

And there’s a reason they’ve stuck around. Customers on average spend 2x after joining a loyalty program. For credit cards, one of the largest point systems around, 40% of users said rewards were the favourite benefit of their respective cards.

Bringing Loyalty On-Chain

Even the notion of rewarding users within Web3 applications is not entirely new. In 2022, Starbucks launched their Odyssey program where users can earn points that can be redeemed for exclusive experiences and products.

However, the difference with Web3 points here is that the programs are generated using blockchain technology to create a secure, transparent, and tamper-proof record of customer activity and participation.

As more brand access and value comes on-chain, rewarding users for behaviours will also be facilitated on-chain.

Global, forward-thinking, brands have started gamifying traditional customer loyalty concepts to enhance the capabilities of reward programs.

Loyalty Points vs. Voucher Models

Today, there are two main approaches to rewarding customer loyalty:

Web3 loyalty points - focuses on the accumulation of points (fungible units) which can be redeemed for products and experiences.

Web3 Voucher programs - participants earn non-fungible tokens with each generated asset distinct to the audience. These programs are more dynamic, and engaging, giving customers rewards that are unique and often personal.

Take Nike, where is SWOOSH platform allows customers with points to co-create Nike virtual creations (NFTs). No longer is it simply about redeeming points for discounts. They can enable customers to become brand ambassadors themselves.

For Web3-native apps, users can become brand ambassadors for that respective network.

There are several components to the emerging points tech stack. A number of loyalty studios like thirdweb are now popping up as developers realise the potential of these programs.

The Role of Analytics

Speaking to a number of these studios, we’ve appreciated how much analytics plays a key role in developing and maintaining effective loyalty programs for founders.

Understanding how to reward users effectively isn’t a simple matter of implementing a framework and reward. It’s a bidirectional feedback loop between design and user output that can be constantly analysed to guide adjustments to the framework.

Just earlier this month, Visa announced a new loyalty solution to gamify rewards for brands using its settlement network.

Visa has issued over 1.2B credit cards worldwide and settles over $12T annually.

This comes as the company accepts digital dollars (USDC) and extends its stablecoin capabilities to the Solana blockchain.

Analytics for how the behaviour of customers changes based on reward schemes will be a key piece of the engagement solution:

Web3 Enhancing Loyalty Programs

This is why on-chain implementations of loyalty programs are enhanced because activity can be queried and analysed in real time.

Technology is improving whereby the cost to facilitate loyalty programmes is also collapsing. Take Solana’s cNFTs which compress their data and store it off-chain making them more affordable in large quantities for use cases around gaming and music.

Meanwhile, token extensions can couple metadata with transactions meaning information about transactions can be enriched to enable more effective reward schemes.

As an example, take Drip - an NFT platform on Solana where users are rewarded with collectables for free.

An artist drops an NFT collection on Drip to its fans while creating a loyalty program

One fan contributes to the creator’s profile by donating or thanking them

The active fan is rewarded with a relatively higher number of points

The creator sets up an exclusive VIP event with Steve Aoki in NYC where only fans with >75 points can mint an NFT ticket (gated access).

Speaking to founders and point studios, it’s also clear that loyalty programs are more likely app-centric than protocol-centric. Starbucks doesn’t need to launch a token but can simply launch a point program.

That said, points can either be a precursor to a formal token launch or to replace one altogether.

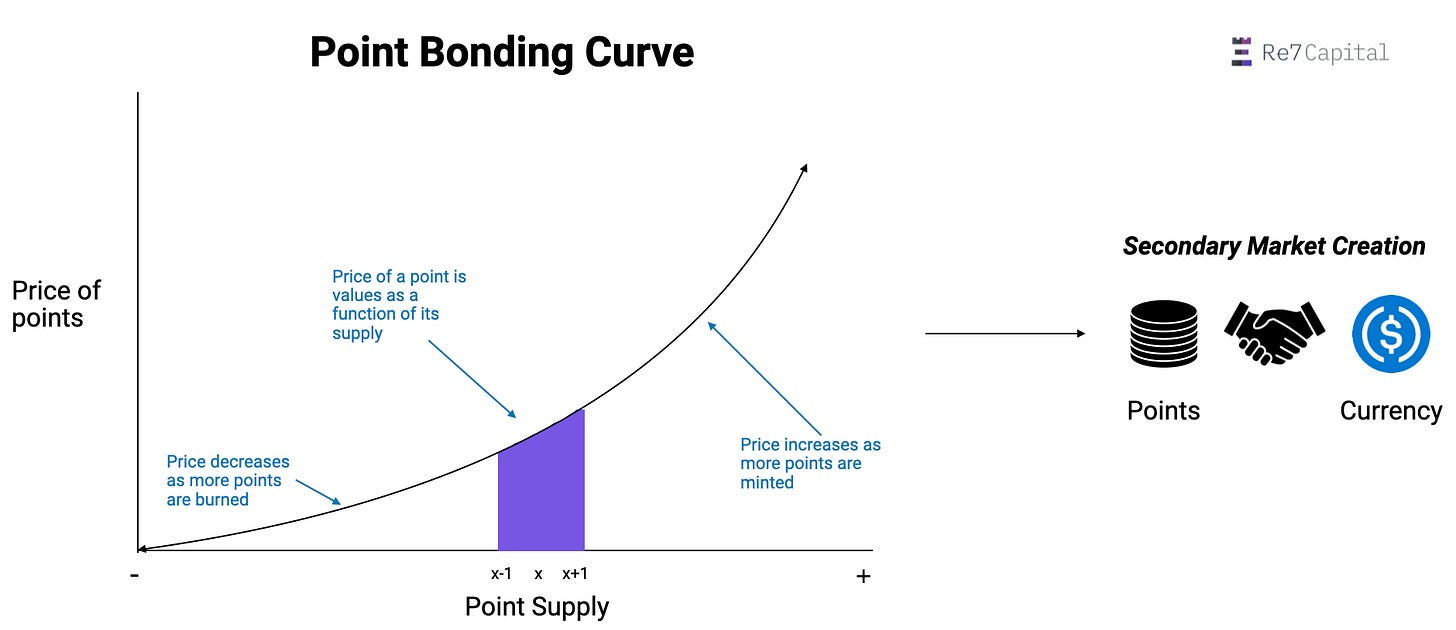

For the latter, bonding curves (a price-to-supply correlation) can be used to prescribe intrinsic value to points. As more points are minted by contributing capital, the price of those points increases.

Secondary markets can exist in parallel allowing point purchasers or earners to sell their units for other assets. If people can sell points, users can buy points.

One benefit of this points model is it removes the need for founders to bootstrap liquidity pools for points and prescribe actions from day 1 to create a market for those points.

Challenges

The line between points and tokens is blurred. It is unclear how points can co-exist with a token for crypto-native projects given they may be competing for actions or behaviours.

The industry needs to split out the goals of the respective instruments.

If I fly British Airways, I may choose to buy avios points to get a discount to my ticket but I don’t need to be BA equity holder or compete with investors to accomplish this action.

Points are tokenised actions as cryptoassets are tokenised network equity.

Another challenge for founders is to know how many program design iterations are needed before issuing points. You want to maximise participation that drives growth but ensure the framework is easy to understand and, in some cases, fun to engage with.

Look Ahead

We are just starting to understand how loyalty programs for both Web2 and crypto-native businesses can be enhanced by moving them on-chain.

Loyalty programs are likely to prescribe as well as reward the specific behaviours needed to catalyse growth for the next adoption cycle.

They offer an unmatched experience that blends the best of the digital and physical worlds - marking a new chapter in user loyalty.

Aptos

The Layer 1 networks are coming to the party with additional incentives across the board. To compete with the large grant programs of chains like Optimism and Arbitrum, other chains are looking to similar programs to boost activity.

One example is Aptos, where incentives are currently running across all major platforms. This is creating high-yield opportunities in LP positions, stablecoin pools and lending markets.

The intent is to continue the extensive growth of the network, which is already sitting at an all-time high TVL. Expect to see more of these programs as the networks all fight for mind share and capital that is still scarce.

Global Market Cap

$1.58T; Markets remained largely flat over the last week again after failing to breach $1.66T in global market capitalisation. Markets have declined 14% since the US Bitcoin spot ETF was launched.

One potential pressure point is GBTC where investors may be exiting the ETF after being locked in the Grayscale trust for up to several years (as indicated by the 0.9% discount to NAV).

Crypto vs. Equities

Global equities power higher with futures indicating another record for Wall Street. Investors are continuing to bet on falling interest rates and a strong earning season.

We can see the emerging divergence between crypto beta and the equity market YTD indicating idiosyncratic pressure within the crypto market.

DeFi

$70B; The DeFi sector failing to break above $77B reaching the same resistance levels as summer 2021 before the sector rallied to $200B in market capitalisation.

ETH/BTC

0.0583; ETH/BTC retracing after breaching its 200d and 200w MAs. Cross is now +22 off its 2024 low of 0.479.

Dominance

Dominance declines over the past few days in ETH (purple) and Alt L1s (blue) coinciding with an increase in stablecoin dominance (white) and Bitcoin dominance (orange) indicating the market turning more cautious market.

Altcoin Market

The altcoin market retracing from its $400B highs over the new year. Remains to be seen if $300B can/will be hit - channel resistance turned possible support (-11% from current levels).

Trader Positioning

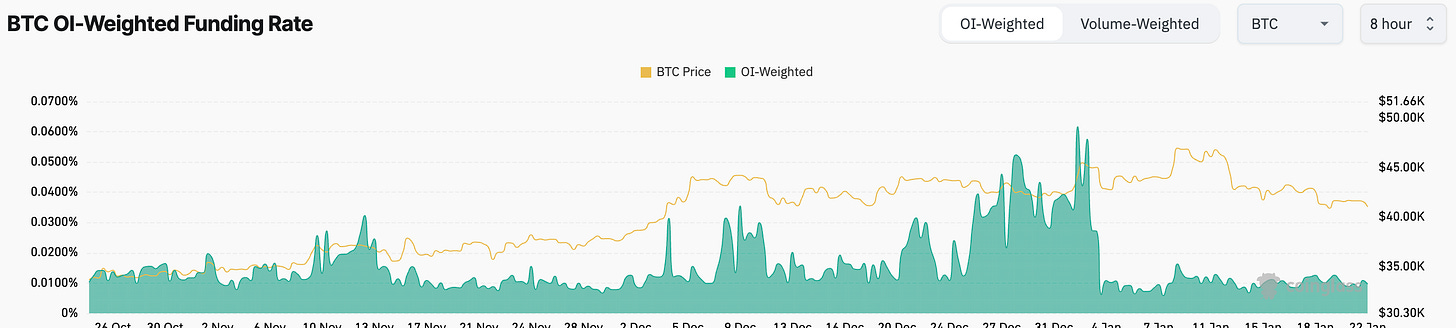

OI-weighted funding rates remain positive (0.01%) but flat. Market is still figuring out where to go post ETF launches.

$22m longs liquidated so far on Monday 22nd January vs. $3m shorts (liquidations are still skewed more heavily towards the long side).

> On Chain Abstraction [Base Layer]

> TradFi Embracing Crypto [Bell Curve]

> Decentralised P2P File Sharing [Epicenter]

> Why SEC’s Case Against Coinbase is Significant [Unchained]

> Five Biggest Stories in Crypto this Week [The Breakdown]

> UMA and MEV [Hart Lambur]

> Lido wstETH bridge on BNB [Lido Governance]

> Solana Mobile 2 Orders [Paul Bohm]

> Cryptoasset Fund Flows [Coinshares]

> Artemis Weekly Wrap-up (1/19/2023) [Artemis]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.