Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Announcement! NEW Re7 Alpha Telegram Group

We're starting invitations to a new Re7 Alpha Telegram group. This will be an anonymous group with regular updates on the best DeFi yields, Re7 Labs updates and first information about cap increases or other opportunities in our vaults.

Here's what you can expect:

Stay Updated: Get the latest news, announcements, and updates on our vaults and the DeFi ecosystem.

Access Exclusive Insights: Gain early access to new vault launches, exclusive offers, and insights from our team.

Our Goals:

Sustainable Growth: We want to showcase our priorities long-term growth and sustainable yields.

Community & Partnerships: We're actively seeking to engage across the space and explore strategic partnerships to offer innovative solutions.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies.

Investment Analyst (Liquid Token)

Re7 is searching for an Investment Analyst - someone who will be working directly with the Liquid Alpha leadership team scout deals, diligencing opportunities and investments, as well as developing overarching investment theses.

Re7 is searching for a DeFi Developer to support the Re7 tech team, developing and maintaining key backend infrastructure for Re7 products and funds.

Summary

In this edition, we cover:

Starting 2025 with a bang: the tailwinds for crypto today

Altcoin dominance breaking out and what it means

The nuances and dispersion of current cycle vs. previous cycles

Walking the Path of Regime Change

Cryptoassets market continue their climb higher in 2025 with global market capitalisation at $3.5T. It’s a period marking new records: BTC just printed a new all-time-high of >$109k. SOL climbs >$293 for the first time.

You don’t have too look deeply to understand why markets are continuing to rally. We’ve had a slurry of tailwinds for the industry for the past quarter including:

Scalable blockchain adoption with block space it being increasingly utilised by the demand side from apps with PMF

Easing monetary policy globally through lowering of interest rates

Inflation concerns tampered

Regulatory clarity from crypto-friendly government structures now in office

Institutional investors and high profile cryptoasset purchases

ETF net inflows continuing their trend for BTC

POTUS launching a $40b+ token on-chain furthering legitimisation of the industry

Altcoin Dominance

As the market reaches new highs, altcoin dominance has also started 2025 with a bang, breaking out of its normal consolidation pattern to the upside signalling further altcoin strength relative to beta in the periods ahead.

This comes as altcoin relative strength measures to beta were bouncing of cycle lows as we’ve highlighted before.

Fundamental Strength Underpinning Alt Rallies

In turn, altcoin strength off their cycle lows comes as fundamentals support current valuation expansions.

Take the $25B on-chain perpetual market.

Its market cap trends closely with the underlying trading volume of the sector’s respective exchanges.

Daily trading volumes are also printing new ATHs ($24B). This makes structural sense as trading volume lead to revenue generation and valuations can be underpinned based on future ‘cash’ flow or relative val analyses.

More broadly, we’re seeing more value being ported and trading on-chain vs. off-chain at record highs.

DEX/CEX spot trading volume has now surpassed 20% in Jan 2025. The trend over 5 years is clear.

Yet, only a select ecosystems are benefitting from this structural shift in investor behaviour.

For example, Solana is now generating 3x the DEX volume than Ethereum and looks to set new highs in short order.

Notice the altcoin dominance is positively correlated with Solana/Ethereum DEX volume ratio.

More performant chains with strong network effects are attracting relatively more capital flows and attention when on-chain economic activity picks up.

This market is hundreds of other nuances and idiosyncrasies that have to be assessed. There is clear dispersion in both capital flows and attention that has changed the playing field this cycle.

Dispersion

As we’ve also highlighted before, capturing optimal market opportunities upon altcoin relative strength remains the challenge for liquid managers.

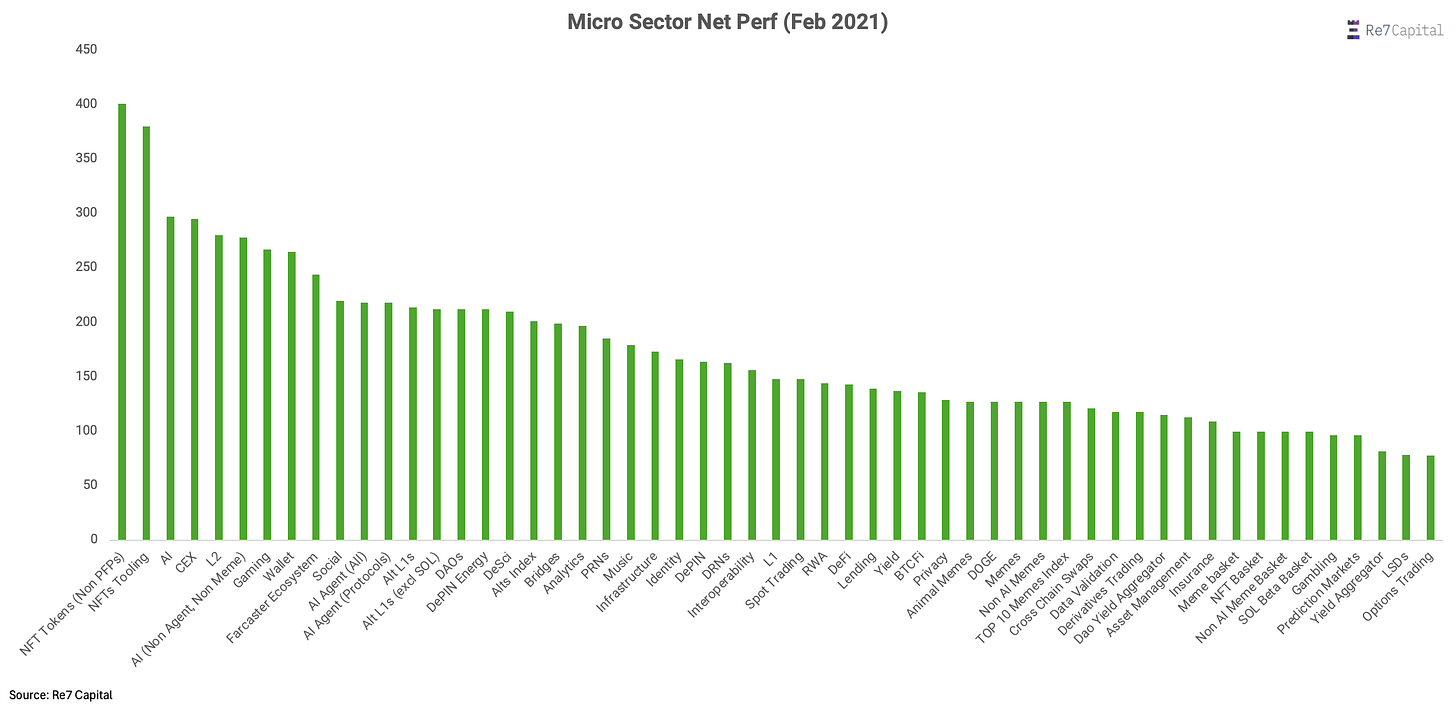

Take the month of Feb 2021 - the period that matches roughly to where the altcoin dominance fractal was in the previous cycle.

Looking across all micro sectors, rising tides lifted all boats. This wasn’t just a Feb dynamic but a cycle dynamic.

The previous cycle game was player to environment.

It was a question of being in the names and sectors that performed relatively better than the other performant names/sectors.

This cycle, the investors game is more player to player.

Take January 2025 MTD micro sector performance below. Rising tides are not lifting all boats. In fact, only <25% of micro sectors are positive MTD.

Investors need to be in optimal names and sectors that are nominally positive and also outperforming other names/sectors whether they are also positive or negative.

This is both the challenge and opportunity.

In many respects, 2025 will be an extension of the structural dynamics seen in 2024: fragmented macro sectors with distinct micro undercurrents.

New vaults go live on Euler and Starknet!

Stablecoin yields remain high:

sUSDe on Euler is best place for liquid yield on top of sUSDe. Supply yields have been as high as 40% recently pushing total yield above 50%.

This is before the 5x boost in points from holding sUSDe in the Stablecoin Maxi Euler vault

mBasis looping vs USDC on Base has reached supply caps a few hours after we increased them! look out for further cap increases.

ETH yields remain high:

Re7WETH on Morpho continues to have one of the highest ETH yields on mainnet. With significant inflows over the last week, total supply is currently at (39.3k WETH / $130m), placing it as top 3 in terms of supply on Morpho mainnet vaults

We also launched this week a new Re7 wstETH vault on Morpho (mainnet). Users can deposit and borrow against weETH, rsETH and ezETH for now, with other collateral assets coming soon.

Also, due to the new v1.1 vault standard by Morpho we were able to add deposits in Re7wstETH as collateral in our Re7 WETH vault. There is a net benefit to use this vault for looping as users will get lending yield, staked ETH yield and Morpho rewards (3.5%+).

Starknet DeFi is starting to take off:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.