Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Re7 is Hiring!

Re7 utilises our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of DeFi and alpha strategies.

We also work with leading projects and blockchains to design their DeFi ecosystem and provide on-chain risk curation and vault management services through Re7 Labs.

We are looking for a talented DeFi Business Development person to support the Re7 Group, scale its vaults, establish partnerships and source crypto clients who could benefit from Re7’s product suite.

Summary

In this edition, we cover:

Growing crypto investment product interest and allocations

Market dynamics favouring active managers

Measuring how fundamentals drive value in crypto markets today

Bringing Institutional Strategies to DeFi: Risk, Yield, and Market Trends with Re7 x Edge Pod

Edging Higher

The crypto markets have started their positive charge into year-end so far in Q4 at +3%.

Global market capitalisation is now $2.4T, +20% from the September local bottom.

The 200d moving average has been reclaimed and is now used as potential support - typically found in bull periods in previous cycles.

Crypto Investment Products - Everybody Wants a Slice

We are also seeing price momentum coincide with a notable pick-up in investor interest in crypto investment products.

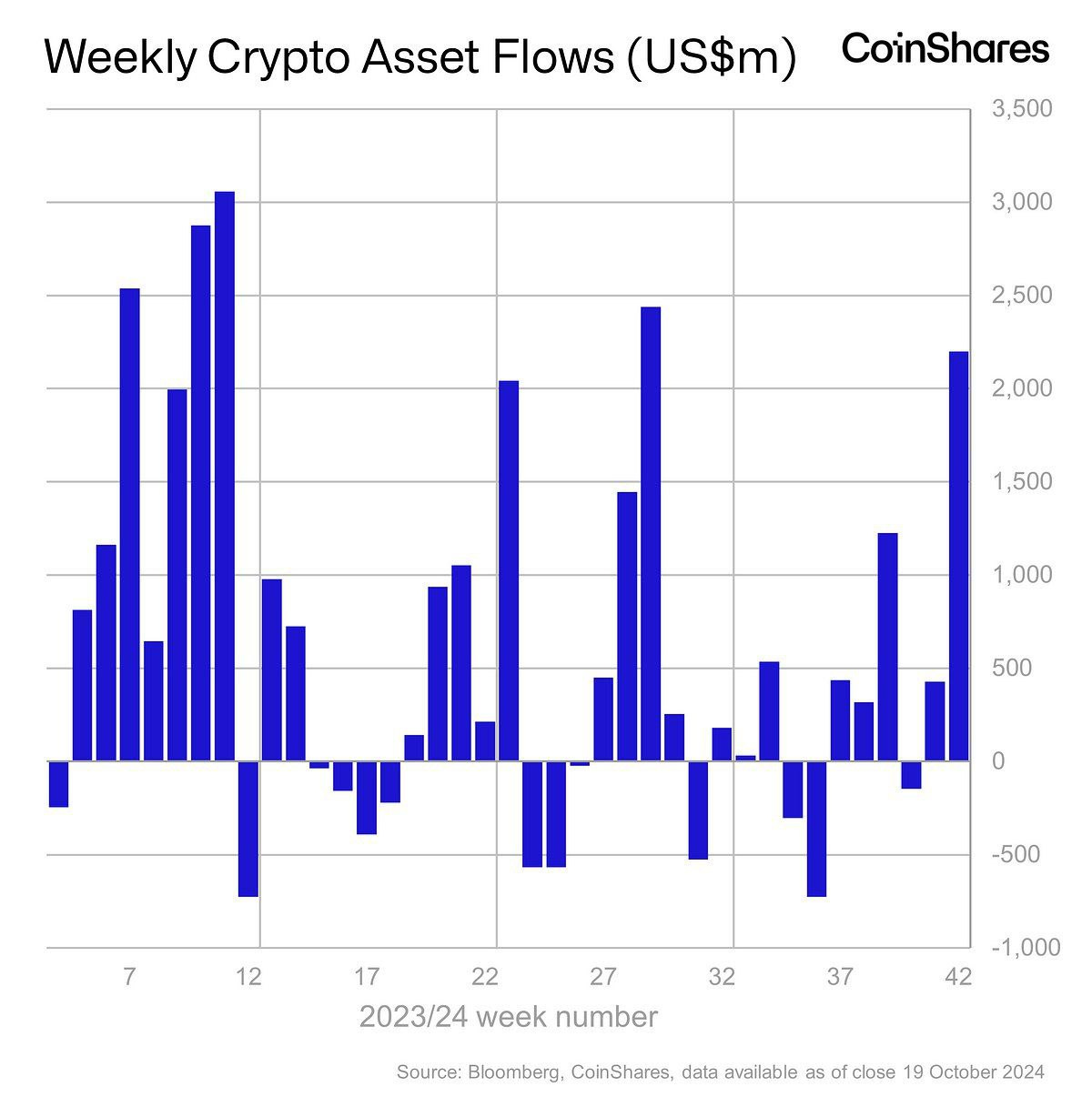

Total cryptoasset inflows reached $2.2b last week - the largest weekly inflows since July 2024.

One potential driver was increased optimism over a potential Republican US election win.

Regardless of the driving factor, this is a signal that investors are deciding to increase their allocation to crypto ETFs to maintain and/or build their exposure to this asset class.

There have been more recent signals that imply investor interest in crypto will continue.

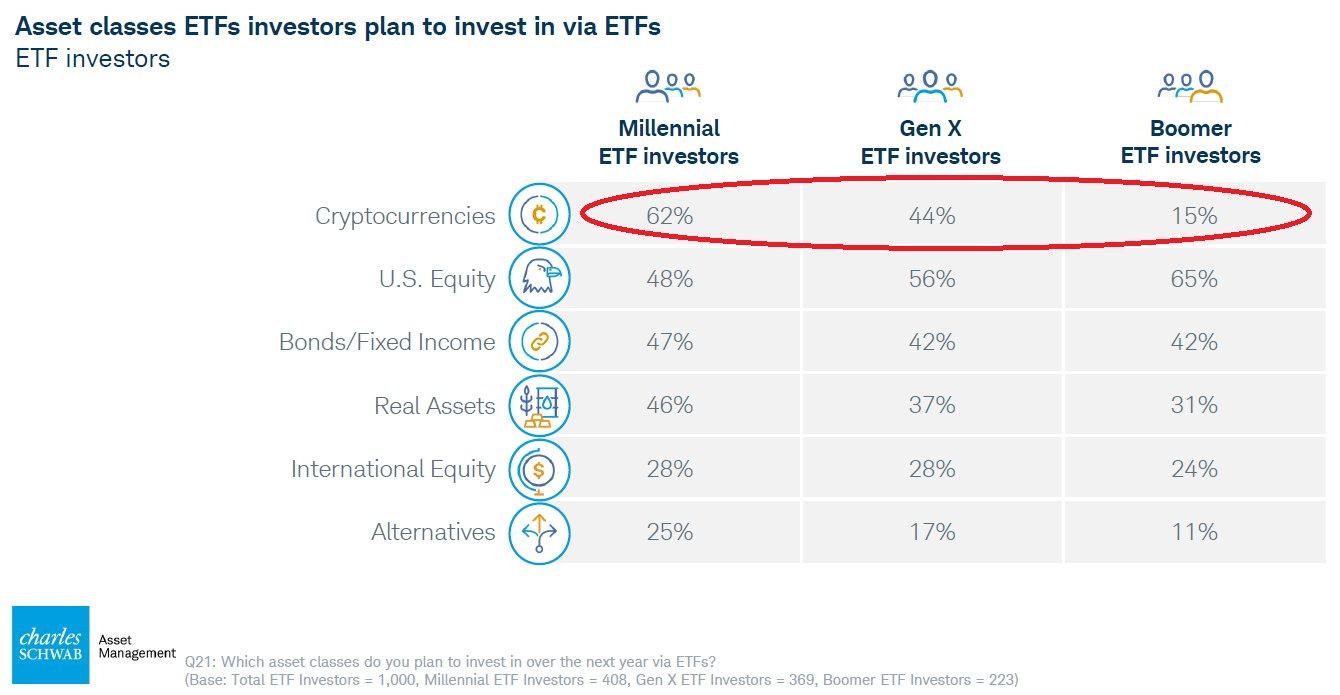

The $7T asset manager, Charles Schwab, asked ETF investors which asset class they plan on investing in over the next year.

Over 45% responded with ‘cryptocurrencies’, second to U.S. equity and higher than bonds, international, and alternatives.

Perhaps more significant is the relative difference in investment interest between generations.

The #1 asset class for Millennials was crypto at 62%, higher than U.S. equity at 48%.

For Gen X, crypto was still ranked 2nd.

This may signal a broader structural shift in asset allocation preference across generations for investing. While surveys aren’t perfect, the takeaways align with a myriad of research pointing to similar conclusions.

Market Dispersion

Despite the rally since September, not all sectors have performed equally.

For example, over the last month, the largest losers have printed -10%-13% while the largest gainers are up 25%+.

In other words, the last month has put in a market-wide sector performance delta of >35%.

With rising tides not lifting all boats, market dynamics continue to favour active long managers who can proactively position into the more performant segments of the market.

In a similar vein, we are even seeing indices that use fundamental-based KPIs to inform weights outperform their market cap-weighted counterparts.

Using a fundamentally driven approach to crypto investing allows investors to determine (and therefore get exposure to) what drives value in this market.

This is particularly informative given the market dispersion that ensues.

Evgeny Gokhberg Founder, Re7 - The Edge Podcast

Evgeny sits down with The Edge Podcast to discuss bringing institutional strategies to DeFi: Risk, Yield, and Market Trends:

The origins of Re7

What is Re7 Capital

Approaching DeFi yield strategies

Managing risk on behalf of investors

Liquid token investing

…and much more

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.