Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

Re7’s tech cycle framework and defining the ‘golden era’ for Web3

How traditional markets and value are leveraging Web3 technology

How Web3 technology is tapping into traditional markets

Institutionalisation of Web3

In February, we showcased our long-standing Web3 cycle thesis where we argued Web3 industry was now entering a ‘golden age’.

As a reminder, at Re7 we see crypto as undergoing a transition into a “Golden Age” of its technological revolution - a period of coherent growth, driven by institutionalisation and Web2 convergence.

Web3 technology is fast entering multiple facets of society.

Anyone from businesses, founders, economists, and AI developers, are all waking to the idea that Web3 technology provides a structurally sound framework for transacting value through tokenisation.

We no longer see Web3 operating in a silo to traditional ecosystems.

Bridging Traditional Markets to Web3

Fast forward just a few weeks later and we see further headlines supporting this thesis.

BlackRock, the largest asset manager in the world ($9.1T) filed with the SEC to start a real-world-asset (RWA) tokenisation fund on the Ethereum network.

It’s the perfect showcase for how traditional markets are being bridged to Web3.

How it works is relatively simple. Investors can have exposure to yield opportunities (e.g. U.S. Treasury Bills, repurchase agreements) with yield being paid out via blockchain rails every day.

The how? BlackRock will use Securitize as a tokenisation platform and transfer agent.

Perhaps, the most interesting data point of all is the utilisation of public decentralised networks, such as Ethereum. They haven’t chosen to use their own private blockchain.

It’s not just BlackRock. Citi, Franklin Templeton, and JP Morgan have made headways with creating blockchain-based funds.

And while we are only just entering the golden age of Web3, tokenised U.S. treasuries market has already surged to $730m from $100m in early 2023.

There is plenty of room left with the opportunity measured in the trillions. Citi now sees the tokenisation market at $5T. 21.co sees it higher at $10T.

Bridging Web3 Value to Traditional Markets

With the cryptoasset market now reaching $3T, there is a huge opportunity to also bridge on-chain value to traditional markets.

This is the reverse example as seen in the BlackRock example above but the set-up is largely the same.

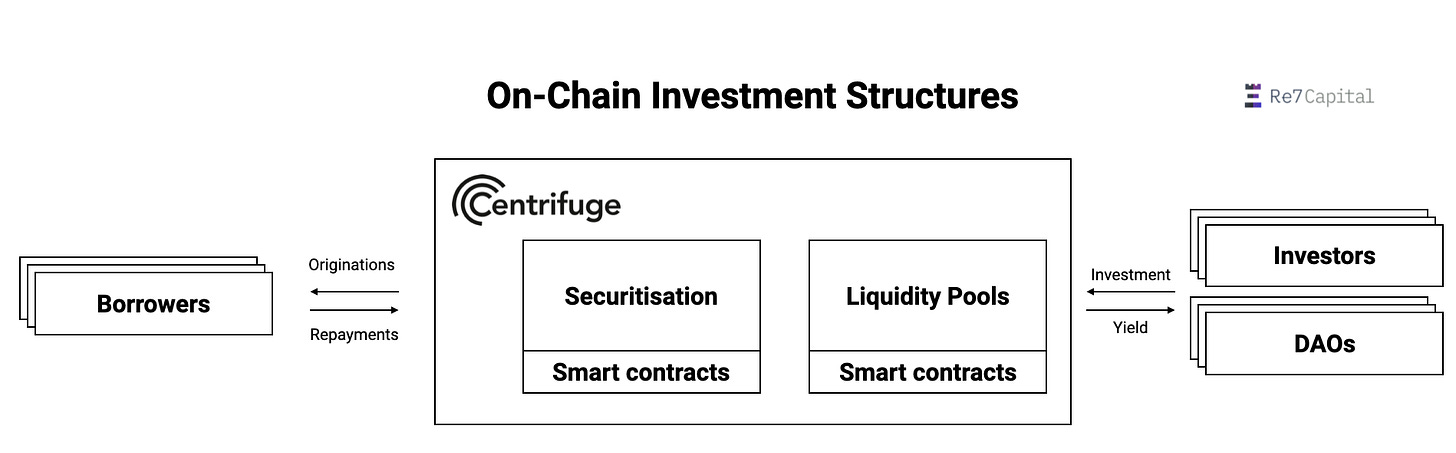

You can have a crypto asset manager like Blocktower Credit (a BlackRock), Centrifuge as the tokenisation platform (a Securitize), and a custodian like Finoa (a BNY Mellon).

Native operators with large balance sheets (e.g. DAOs, stablecoin issuers), can use tokenised platforms like Centrifuge to access regulated, secure tokenised fund opportunities.

For example, stablecoin holders who don’t have access to native yield can deploy their assets in tokenised T-bill funds.

Just like investors using BlackRock in the example above, deployers can:

See asset-specific performance in real-time

See the entire financial transaction on-chain

Share back office by leveraging a public distributed ledger

Automated settlement on execution for all investors

Looking ahead, we see huge opportunities for native Web3 value to access an increasingly comprehensive set of yield opportunities through regulated investment structures.

If you look closely enough, the data points are already forming. Several DAOs are preparing to move capital into RWA opportunities through Centrifuge.

Aave (September 2023)

Frax (December 2023)

Arbitrum (December 2023)

Gnosis (January 2023)

Celo (January 2023)

Closing Remarks

When we think of institutional adoption of Web3, we often think about traditional players coming into the industry and leveraging the benefits the technology has to offer.

While true, we often forget a reverse dynamic as the value within Web3 grows - where native operators need to tap into traditional businesses to fuel their growth further.

This phenomenon will be cross-sector too, whether in finance or NFTs.

It all becomes one big melting pot of mutualistic arrangements.

And terms like ‘traditional finance’ and ‘decentralised finance’ will become outdated.

It will all become ‘finance’. And that’s ok…

It means the ‘golden era’ of Web3 is being realised fully.

Aave Merit Program

Aave gives back to users with Merit program.

Aave DAO is on pace to earn over $100m in revenue this year on the back of growing users and high stablecoin borrow rates.

This makes it one of the most profitable protocols in the space which has not yet moved towards a fee-sharing model with token holders.

$20m of these earnings have been earmarked for the Merit program, airdropped to users based on specific actions.

280 ETH was distributed last week to users with more drops to come in the upcoming months.

This sets the stage for a future “fee-switch” proposal that gives revenue back to Aave stakers.

The move is part of a wider trend as DAOs surviving for multiple cycles are realizing record profits on low costs. Now they are looking to give back to users and token holders alike.

Global MCAP

$2.58T; Global market capitalisation faces resistance at the $2.5T mark - we remain ~18% below ATH levels where price discovery ensues after breaking above ATH levels.

ETH/BTC

0.05143; ETH/BTC being pulled towards multi-year wedge support and level (0.05).

Altcoin Dominance

Altcoin dominance (excl. stablecoins, BTC, ETH) ticking higher to 24% over the past week as majors consolidate just below marginal ATH levels printed earlier in March.

BTC market dominance (orange) and ETH market dominance (purple) declined in March as L1 market dominance (blue) and Altcoin (red) increasing indicate capital rotation moving down the risk continuum away from beta.

Comes as Jerome Powell pointed to rate cuts in 2024 even if it means lingering inflation.

DEX Volumes

Solana/Ethereum DEX volume ratio has surged to new ATHs (78%) with Solana now printing nearly $30B in weekly aggregate volume. Solana memecoins have been a key driver of this dynamic with $SLERF recording a trading volume of $2.27B in its first day of trading.

ICYMI: Re7’s Latest Contribution to OurNetwork

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.