The Weekly - 25th November 2025

On Prediction Markets

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

Weekly Summary

Trends in prediction markets

Emerging verticals within the prediction market sector

Market update

On Prediction Markets

Prediction markets are one of crypto’s fastest growing sectors.

While not an entirely new market, recent changes in the regulatory landscape, increased investment, and enhanced distribution have been the perfect recipe for adoption.

Prediction markets generate ~$7B in volume/month with wallet growth up +400% YoY.

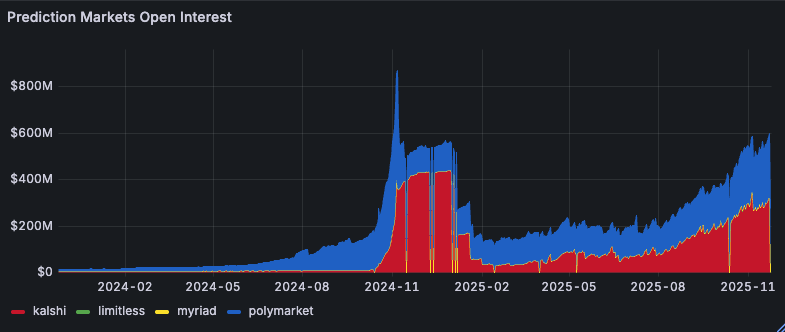

Combined global open interest looks set to make new ATHs over the coming months, eventually surpassing $830m at the time of the US election in 2024.

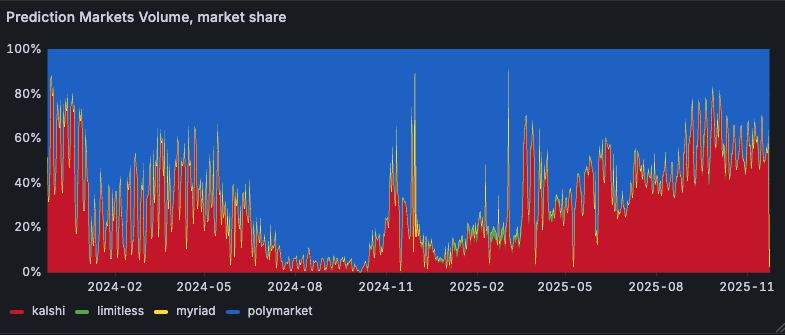

For volume, Kalshi has overtaken Polymarket (now 60/40 split) where its distribution through the Robinhood exchange has given it an edge for accessibility.

Kalshi’s model of operating onshore through CFTC regulation enabled this integration to take place vs. offshore jurisdictions. The challenge here is the reliance and dependency of Robinhood for flow.

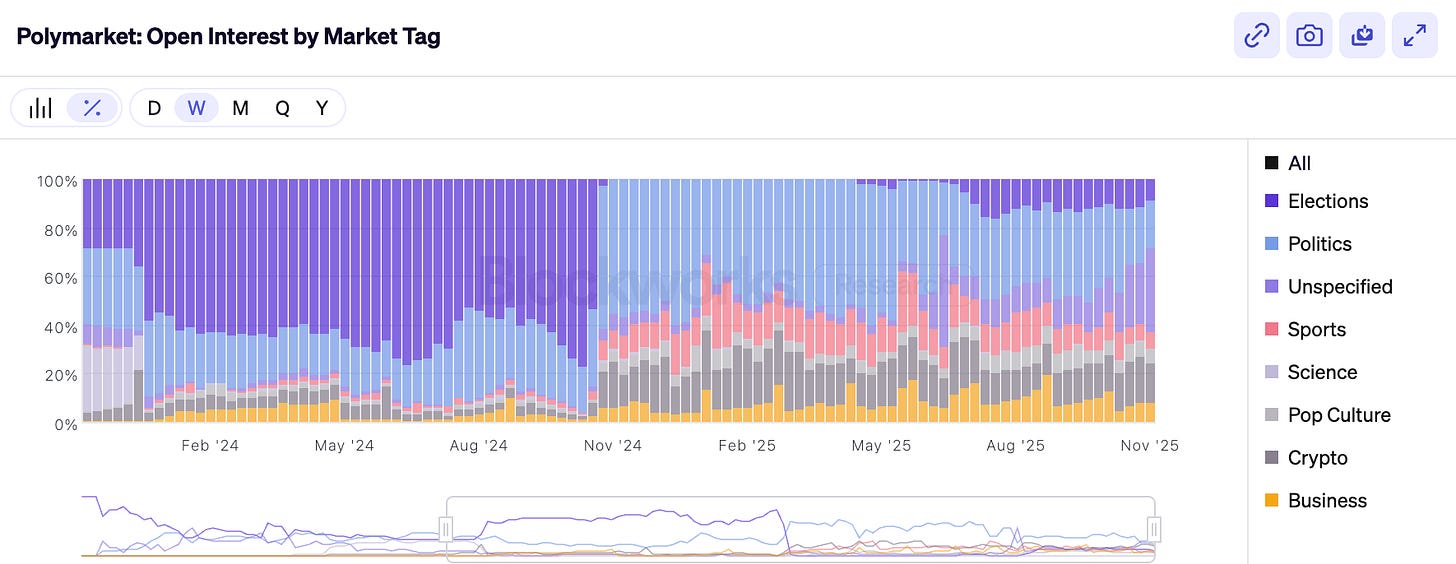

Another important dynamic seen within general prediction market platforms is how interest in categories are constantly in flux.

In November 2024, Polymarket was unsurprisingly dominated by election-centric markets (at nearly 80% of total OI).

After the election resolution, users explored other ways to express bets, leading to increased OI shares in sports and pop culture.

In July 2025, election-centric markets re-emerged as a flurry of Trump headlines circled back into the mainstream, Tariffs, scrutiny on personal life, and immigration.

Base Ecosystem

Outside of Ethereum L1 and Optimism, Base has emerged as the leading ecosystem for prediction markets. Its Coinbase backing, EVM compatibility, and early liquidity/low fees have been points of attraction for founders.

Financial

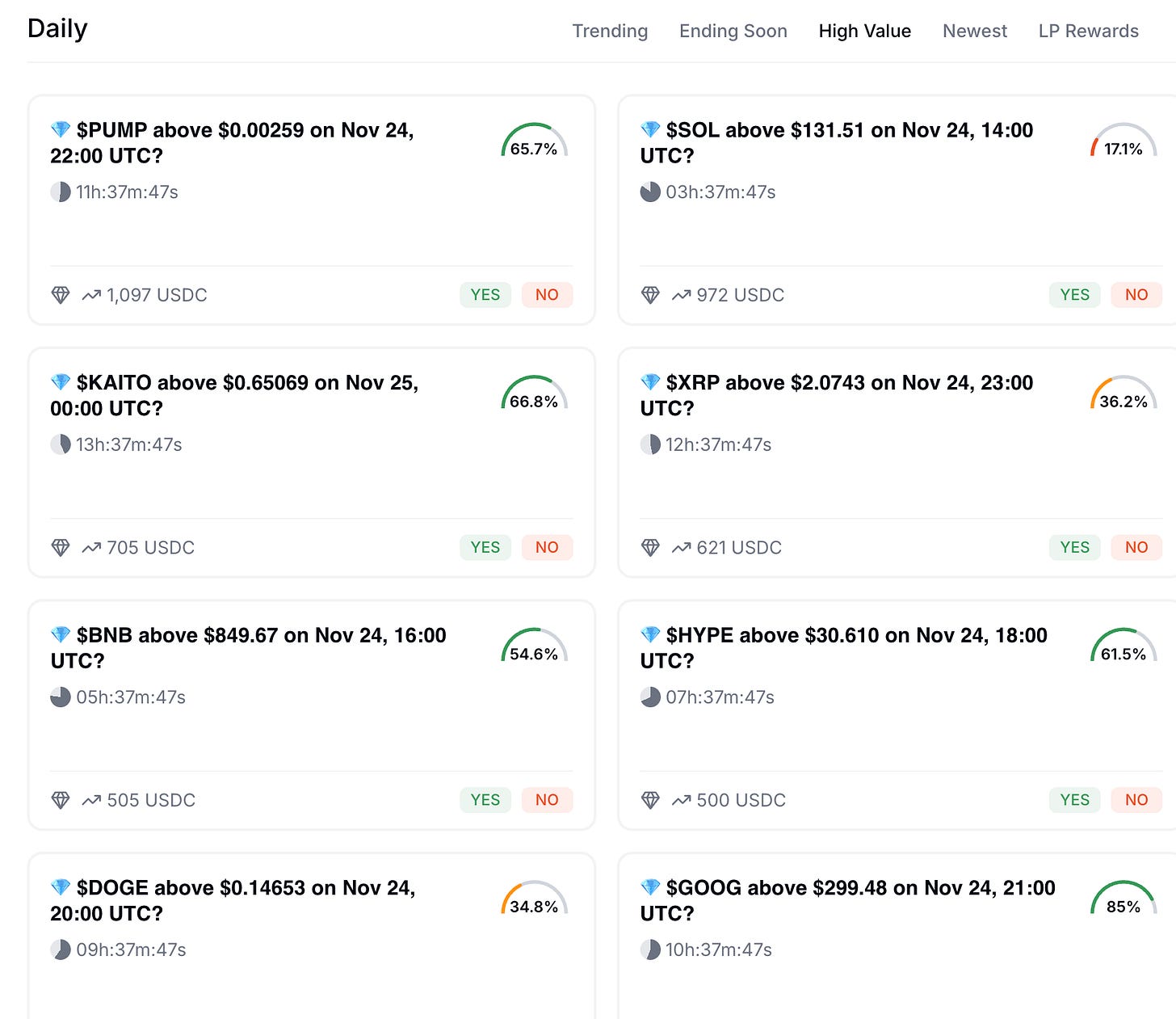

In financial sectors, prediction markets often resemble traditional trading, blurring the distinction between speculation and outcome-based betting.

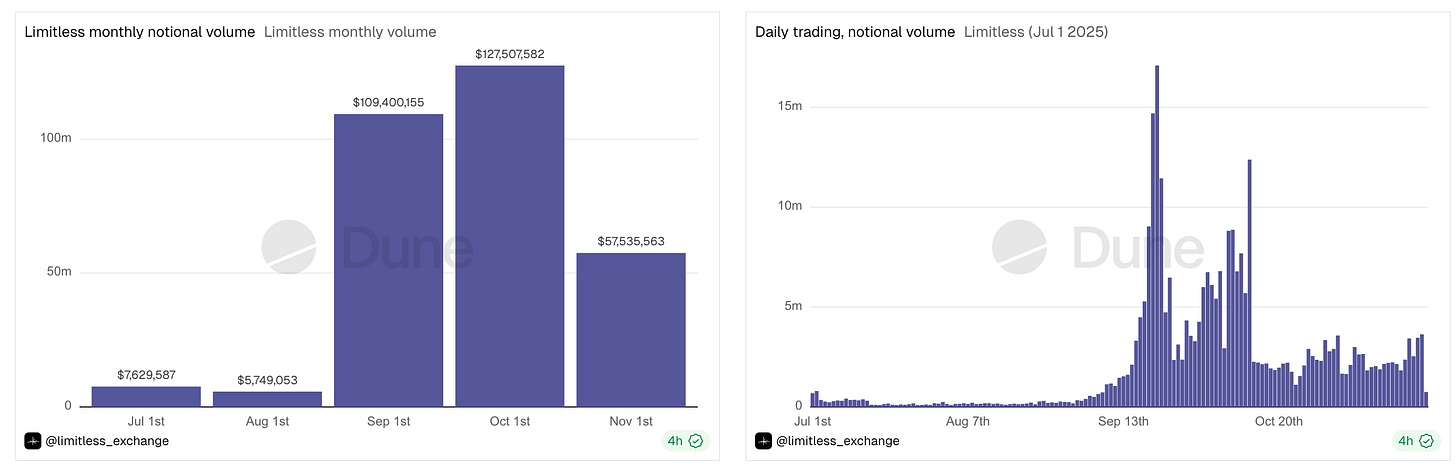

Projects like Limitless on the Base blockchain allow users to bet on short-term price moves using a CLOB—similar to an exchange.

These are the largest prediction markets on Base, with over $580m in total trading volume and 1.2M monthly trades.

Outside of general platforms, the dominant traction of financial vertical prediction markets signals that they have been increasingly important as a source to gauge sentiment.

For example, crowdsourcing collective intelligence through quick, binary bets to forecast trends.

Streaming

Prediction markets are also forming around non-political or sport-centric markets such as live streaming.

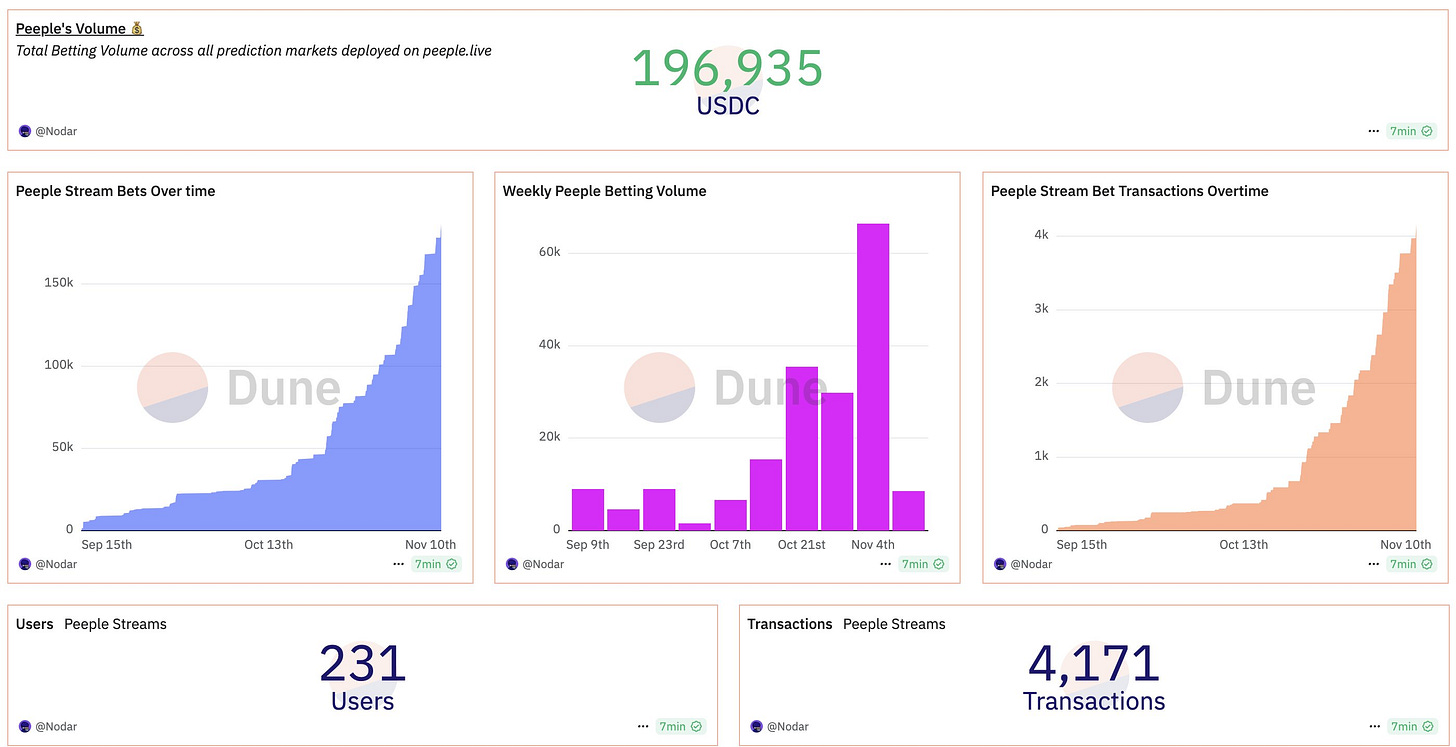

One early-stage project seeing initial PMF is Peeple.live, which enables users to bet on outcomes tied to live streams, such as gaming.

Users join live streams and place YES/NO bets on missions set by streamers themselves.

Over 300k bets have been placed, with $200k in total betting volume.

Prediction markets are being expressed through different verticals. Unlike in the Augur days, where markets were general, we now see streamer-driven market creation and more immersive experience for betters.

Market Update

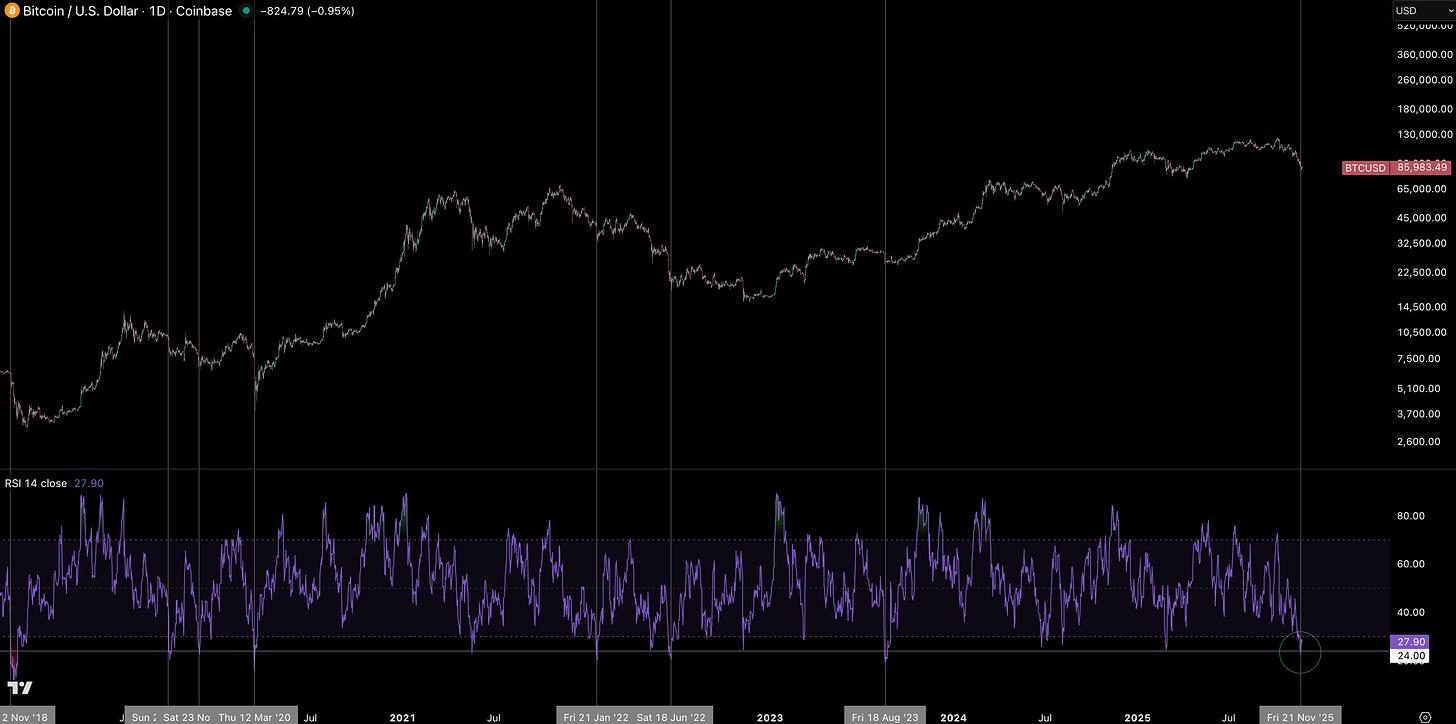

Crypto markets fell a further 7.5% last week, mirroring the direction of equities as investor sentiment grew cautious.

BTC fell to $80k becoming the most oversold since August 2023.

US Bitcoin ETFs also showed record monthly outflows, confirming “that the euphoria earlier this year has been fully exhausted.”

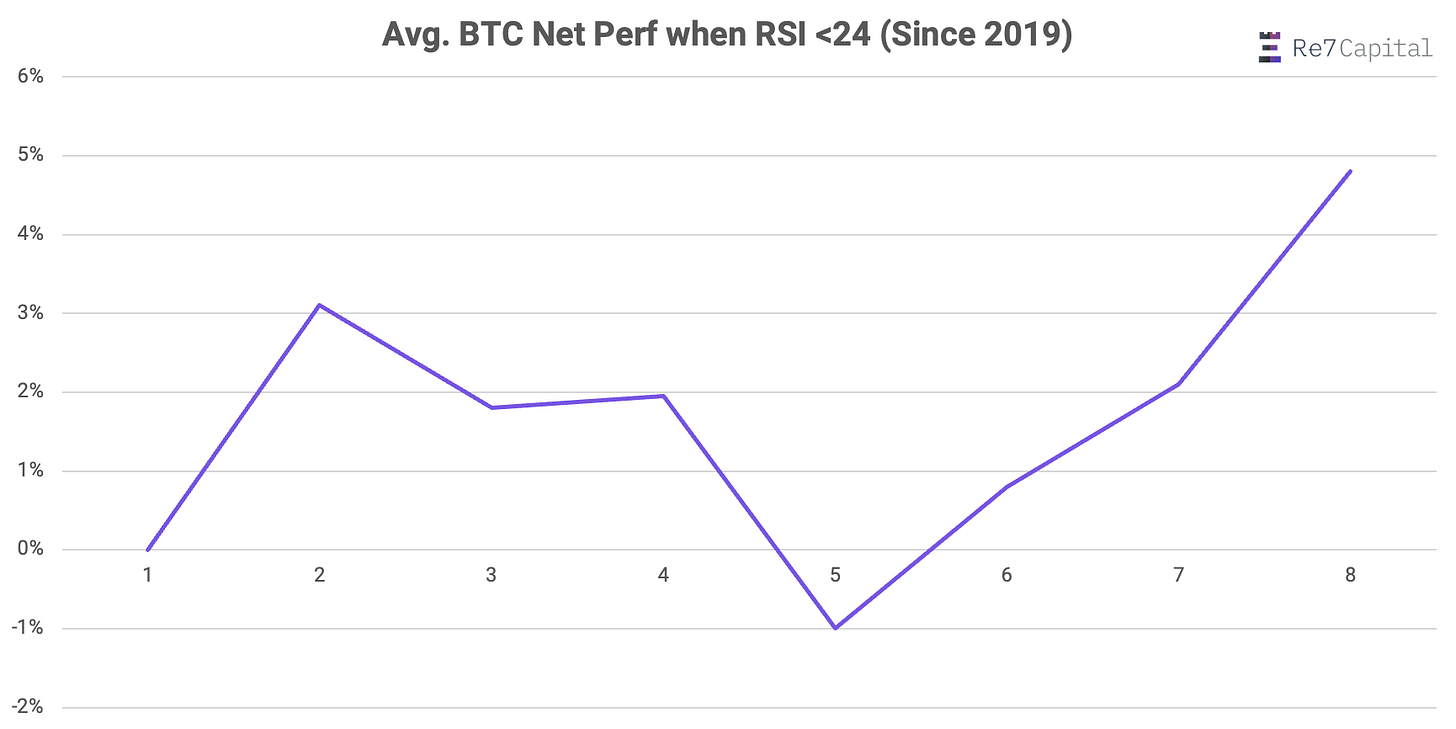

Since 2019, when daily RSI falls below 24, BTC chops for a few sessions before a relief rally ensues regardless of it being in a bear or bull market.

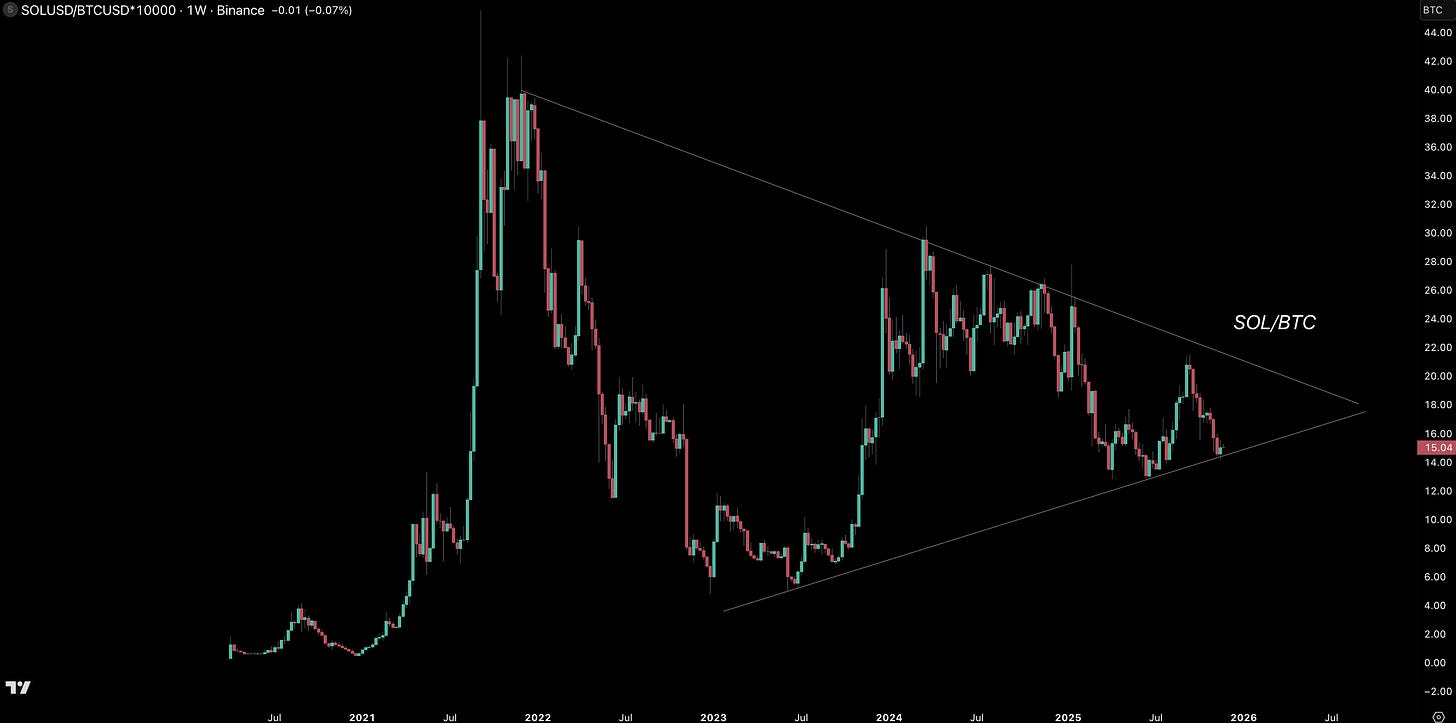

Interestingly, the broader structures of relative ratios for key names remain in tact and at support, such as SOL/BTC.

We see this with alt indices too. The market capitalization excluding BTC and stablecoins is being tested at support, yet not invalidated when it comes to its broader structure.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.