Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

Easing cycle beginning

3 interesting dynamics not illustrated by the mainstream media

Stablecoin supplies

Decentralised exchange aggregators

Long tail interest

Easing the Path for Risk Assets

Last week’s FOMC confirmed the US is on a path of easing.

In the words of Powell:

"My confidence has grown that inflation is on a sustainable path back to 2 per cent." and "We will do everything we can to support a strong labour market as we make further progress toward price stability."

Risk assets responded accordingly on Friday with SPX and NASDAQ +2% while crypto outperformed at +5.3%.

Crypto has reclaimed the Feb-July 2024 support line ($2.18T).

With the dollar slumping the most in 9 months last Friday, crypto’s response comes at a time of upside expectations, lagging Gold by ~5 months as it often does.

Printing new all-time highs, Gold has been sniffing out a weakening dollar/debasement regime change for months as it often does too.

Central banks have already been easing behind the scenes.

Uncovered Market Dynamics: Illustrated

While everyone is focusing on the dovish macro set-up for risk assets, we thought we’d take the opportunity to do something different.

We look at 3 current crypto market dynamics, not illustrated by the mainstream media.

Stablecoin supplies

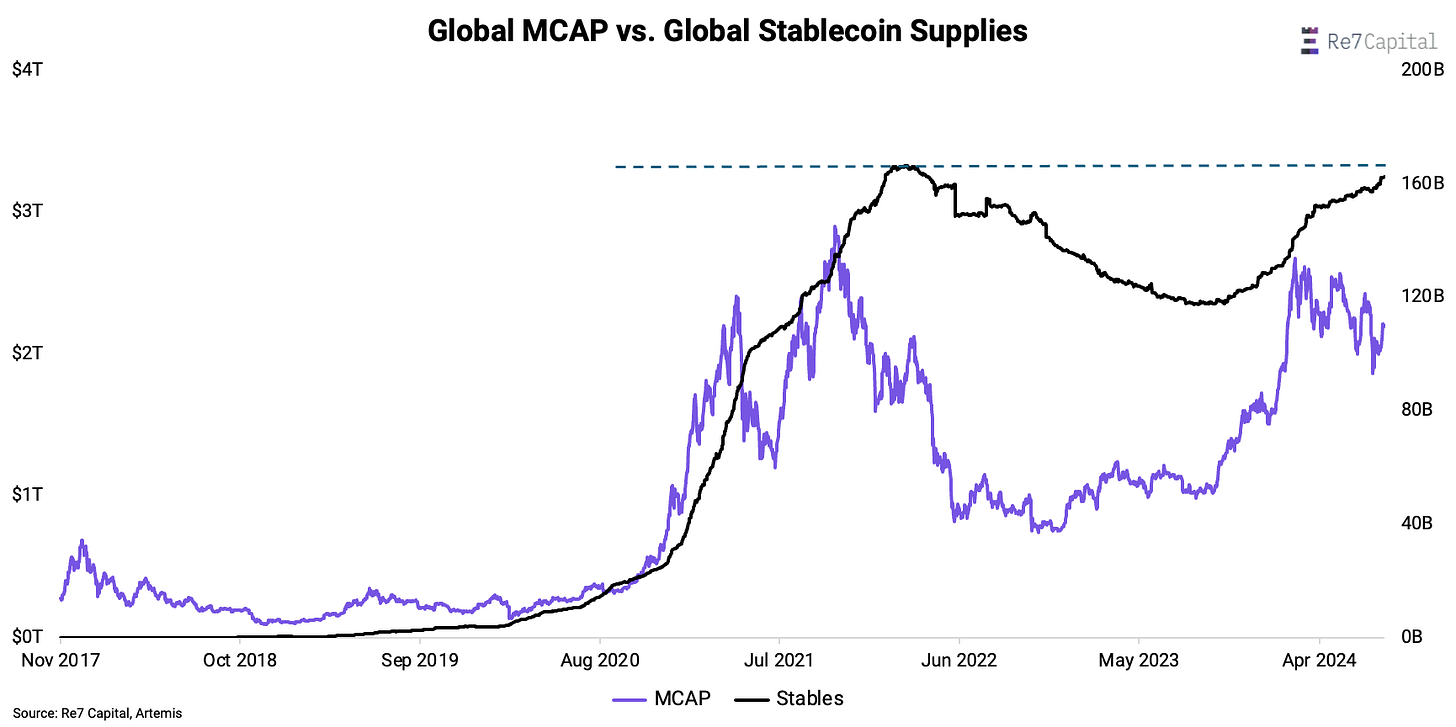

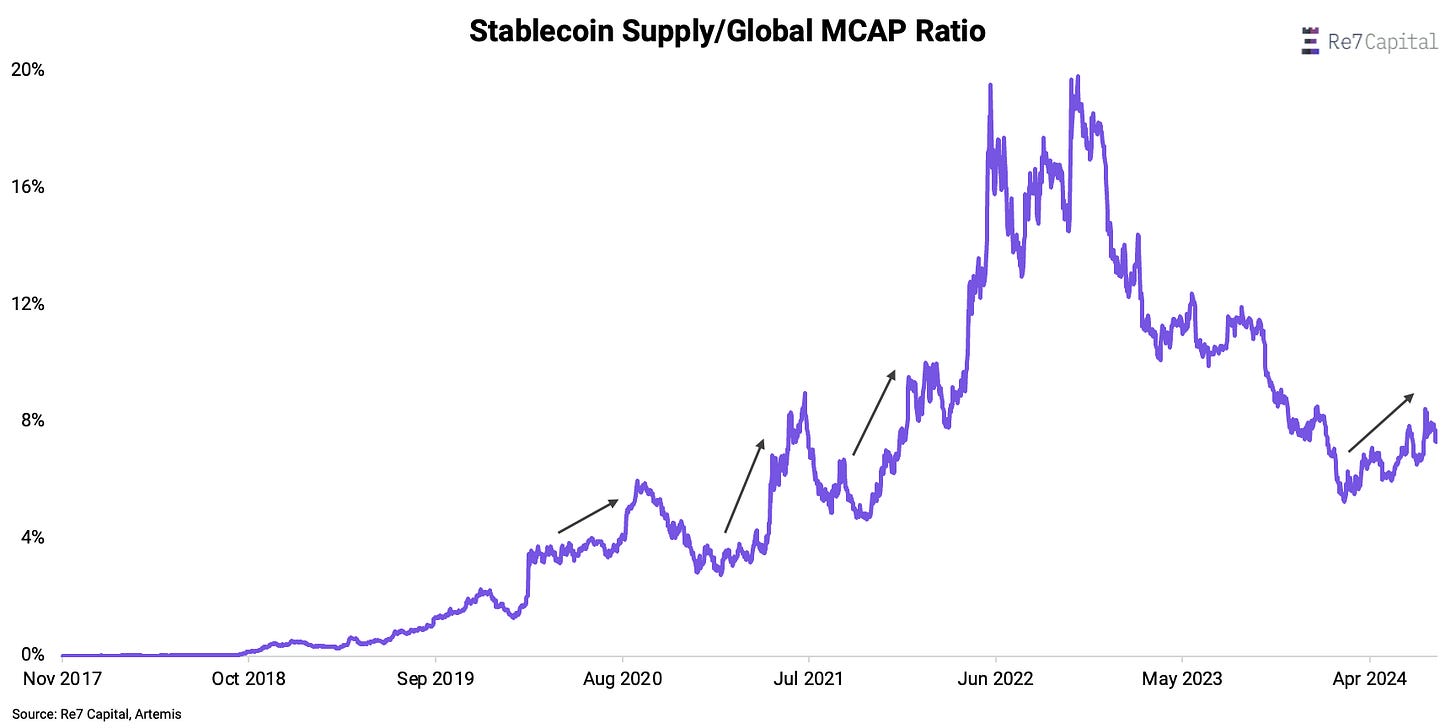

Stablecoin supplies stand at 162B and are set to break new all-time highs ($165B) over the coming months.

Why is this important? Stablecoin growth is a proxy for ecosystem inflows with their rapid growth corresponding to the bull market last cycle.

As the broader market consolidates over the summer, stablecoin supplies continue to increase as the market desire for leverage and DeFi yield opportunities remain high.

We have yet to see saturation levels either with stables/global MCAP ratio 50% lower than its peak in 2022.

Central banks cutting rates across the board and reducing risk premia will likely form the next catalyst for new highs in this ratio.

Aggregators

Last cycle, aggregation theory advocates were waiting to see a dominance of DEX aggregator volume (e.g. 1inch) over direct DEX volume.

Aggregator volume dominance has increased YTD due to Solana (Jupiter) trading dynamics.

Unlike Ethereum, Solana’s low-cost architecture at the base layer has allowed for effective trade order splits.

Yet, the dominance of Jupiter (43%) as an aggregator is now being challenged albeit slowly. Direct DEX UI interactions are now driving relatively more volume.

Token launchpads that integrate with DEXs (eg Raydium), where that DEX snowballs liquidity, negates the need for order routing.

Long Tail

Finally, meme volume remains ~20% of all spot volume within crypto - a 3x growth in market share in 12 months.

Token launchpads have been a key driver of their relative prominence in the spot market.

With pump.fun leading the token launchpad market on Solana (for now), annualised revenue has now topped $300m.

However, given attention is a finite commodity, it has been challenged by alternative ecosystems over the past 2 weeks.

An alternative interpretation is more zoomed out.

Taking the combined deployment transactions between Solana and Tron launchpads, we can see interest in launching tokens in this market has remained resilient - in line with volume market share dynamics.

Restaking Narratives Still Alive With the Launch of Babylon BTC Restaking

This week Babylon native BTC restaking launched, creating high BTC transaction costs as users rushed to fill the initial supply caps. Over $160m in BTC was restaked in the first week of mainnet launch.

Restaking and shared security have been one of the main metas over the course of the year, and BTC restaking promises to be a heavily contested field. With multiple BTC restaking and LRT protocols going live, we expect to see a similar hype to the earlier days of ETH restaking.

The early leaders are some familiar names like Swell Network, but also new protocols like Lombard. Each will be fighting for TVL with similar points and incentive programs.

Re7 Labs has WBTC and tBTC restaking vaults on Symbiotic, along with Meta Morpho vaults for WBTC and tBTC launching very soon. These will allow users to both re-stake and do loops using Morpho Blue.

ICYMI - SocialFi - Are you Paying Attention?

The genie is out of the bottle.

Re7 believes that the on-chain financialisation of digital social interactions represents the next evolution of the creator economy - projected to grow 120x to $242B by 2030. Re7 is also looking to capture the opportunity better than anyone else.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.