Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website / Re7 Labs vaults

> Weekly Research / Real-time Insights

> Re7 Capital Twitter / Re7 Labs Twitter

This week at Re7:

Re7 Capital at ETH Dublin 🇮🇪

Re7 Capital joined ETH Dublin from May 23–25, connecting with top minds in Ethereum, DeFi, and institutional capital. It was a valuable opportunity to exchange perspectives on on-chain strategies and capital formation across the evolving DeFi landscape.Re7 Capital at DAS Europe 2025 🇬🇧

Our Portfolio Manager, Lewis Harland, will be speaking at Hedgeweek’s Digital Assets Summit in London on June 5. He’ll be sharing Re7’s latest insights on DeFi market structure, institutional adoption, and liquidity dynamics.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

We want to hear from you!

Summary

In this edition, we cover:

Three trends that no one is talking about

Another week, another set of records. BTC surpassed $110k for the first time as markets extend their gains.

With BTC reaching new ATHs and grabbing headlines left, right, and centre, we showcase three trends flying more under the radar, why they’re happening, and the underlying structural shifts underpinning them.

Trend Setter

CEX/DEX Spot Volume Ratio

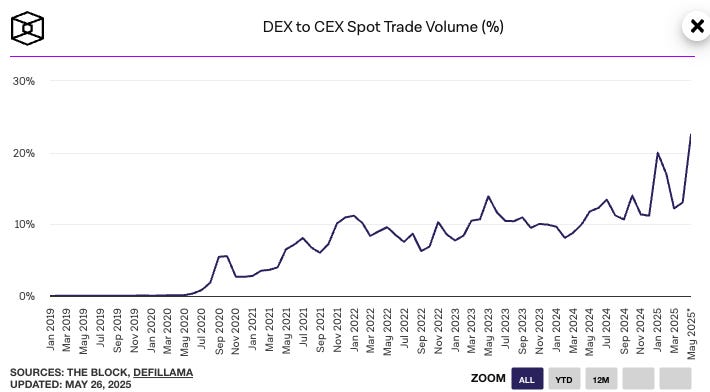

Decentralised exchanges (DEXs) have already generated over $260B in on-chain volume, +66% higher than the two previous months of March and April.

10 DEXs are generating >$1B/month in volume. We are on track to increase DEX volumes by 50% from 2024 at current pace ($3T).

The surface trend is the nominal growth of on-chain volume over the years.

Yet, the underlying structural trend that’s more interesting is increase value being traded on DEXs than their centralised counterparts.

The DEX/CEX ratio has breached >20% for the first time ever.

Contextualising the trend is easy. DEXs are becoming increasingly attractive for end users given the composability within the existing DeFi stack, retaining custody of funds, privacy, and quickness to launch new assets/pairs (i.e. the long tail).

This ATH comes at a poetic time when Tier 1 exchanges experience significant data breaches.

Blockchain-related Mentions in SEC filings

The number of SEC filings and forms in the EDGAR database containing blockchain-related terms shows a clear increase over the last 8 years.

The surface level trend is clear. More filings are pointing to blockchain’s growing significance in corporate strategies and regulatory discussions.

The underlying structural trend is growing mainstream adoption, an increasingly more favourable regulatory environment, and increased corporate confidence.

We can also see that the mentions aren’t growing in relation to any specific word but a broad set of terms (DeFi, stablecoins).

Avalanche TVL

Avalanche total value within its ecosystem has reclaimed the $2.5B mark - a level last seen all the way back in October 2022.

Embedding RWAs on-chain within existing DeFi infrastructure by institutions has marked a key structural shift in the industry over the last few months.

With $23B RWA value on-chain, asset classes like treasury funds have expanded further, enhancing their utility.

Blackrock’s $3B tokenised treasury fund made its first protocol integration with Euler on Avalanche where they want sBUIDL to be used as collateral.

For BlackRock, it turns BUIDL into a “composable ERC-20, enabling onchain utility without compromising redeemability”.

This has paved the wave for vault curators like Re7 Labs to help realise the longer-term vision of DeFi RWA adoption.

Avalanche TVL is the surface trend. Utilisation of RWA tokenisation in DeFi is the underlying structural trend underpinning it.

Updates on Re7 Lab Vaults

Updates on Re7 Labs Vaults:

Mellow interop vaults on Lisk are now live, backed by LayerZero’s OFT technology.

Curated by Re7 Labs, LSK, mBTC, and wstETH vaults are available, with Lisk allocating 50K $LSK in rewards, distributed as follows: 30K for mBTC vault, 15K for wstETH vault, and 5K for LSK vault.

Users can access crosschain restaking strategies with native access to Symbiotic SSNs

Curated by Re7 Labs, rstSOL vault is also live on Kamino Finance with the launch of V2. bbSOL holders can access restaking yield, $JTO incentives, and leveraged strategies.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.