The Weekly - 27th November 2023

On Re7's Solana indicators, the shifting dynamic in perpetual markets, and the growing relevance of Web3 data automation.

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

Two key Solana-centric indicators Re7 has been tracking that, we think, colour the recent momentum well

Two thematic areas we’re paying attention to beyond the consensus calls of today:

DeFi: Perpetual protocols and the growing relevance of the Synthetix ecosystem.

Data management: How data automation is becoming a key theme heading into 2024.

Solana

SOL’s 120% outperformance vs. the market since mid-September has driven much attention back to the ecosystem.

The ecosystem’s ability to grow in a post-FTX world now feels consensus, but we highlight two indicators that we’ve been tracking internally at Re7 that we think colour Solana’s recent momentum well.

Re7’s Metcalfe valuation index (ML Index)

Metcalfe law valuation models posit that the value of a network is directly proportional to the square of the number of active users on that network.

Re7 tracks a number of valuation indices internally and the trend in our ML index for Solana suggests its recent run has been supported by growth in its active user base - trading at fair value today.

This comes after 1.5 years of trading below its Metcalfe ‘fair value’ anywhere between 50-80%.

Relative DEX volumes

Solana’s DEX volumes have been outpacing Ethereum’s de facto exchange, Uniswap, since September and now account for >15%.

Most spot exchanges on Solana right now are AMM-based which makes for an interesting outlook. With Solana’s higher TPS, more trading per unit of price change can take place meaning more efficient active LP management at lower costs.

Yet, Solana has a conducive architecture for CLOB-based exchanges too which have typically been challenging to implement on-chain. For example, market makers can more effectively close and open positions with low Solana fees and high throughput.

Network upgrades are working, MEV infra is getting better, and DeFi teams are starting to release tokens - expanding the native asset universe for DEXs.

Decentralised Perpetual Markets

Decentralised perpetual markets still represent <2% of the total market by volume.

And in a market measured in the hundreds of billions, the opportunity for these, more emergent, decentralised platforms is huge.

Decentralised exchanges (DEXs) aim to complete transactions more cheaply than their centralised counterparts by removing intermediary entities while mitigating risk around custody.

The relatively low market penetration following the collapse of FTX and other major lenders may be surprising for many.

Perpetual DEXs still face problems around UX and more shallow liquidity. But the game may now be changing materially.

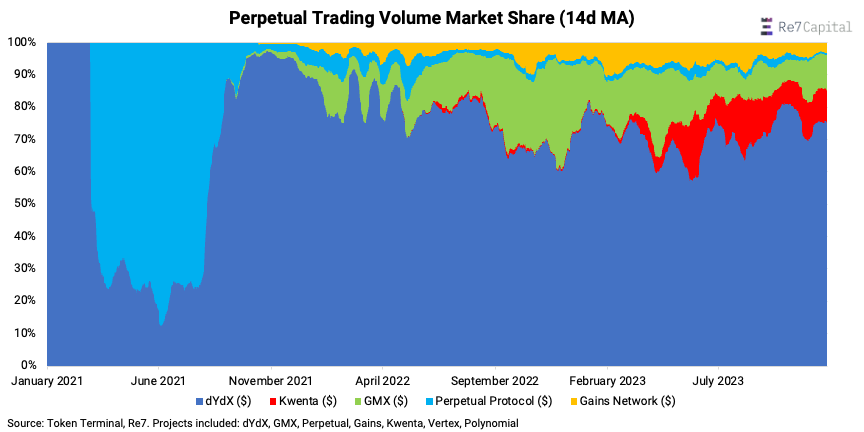

dYdX dominates the landscape as a CLOB-based project while others like Synthetix/Kwenta use a liquidity debt pool-based model.

The vast majority of liquidity in financial markets has been provided through CLOBs - leading some to believe in their longer-term dominance.

But the dynamic has been shifting to Synthetix’s favour over the year leading into its V3 launch.

Kwenta, Synthetix’s leading front-end app, is quietly becoming a relatively more popular perpetual trading venue for users: It has 9x its market share YTD, now producing $55B in annualised volume and $25m in fees.

We see key drivers being Kwenta being able to capitalise on dYdX moving away from Ethereum and optimise its UX more effectively.

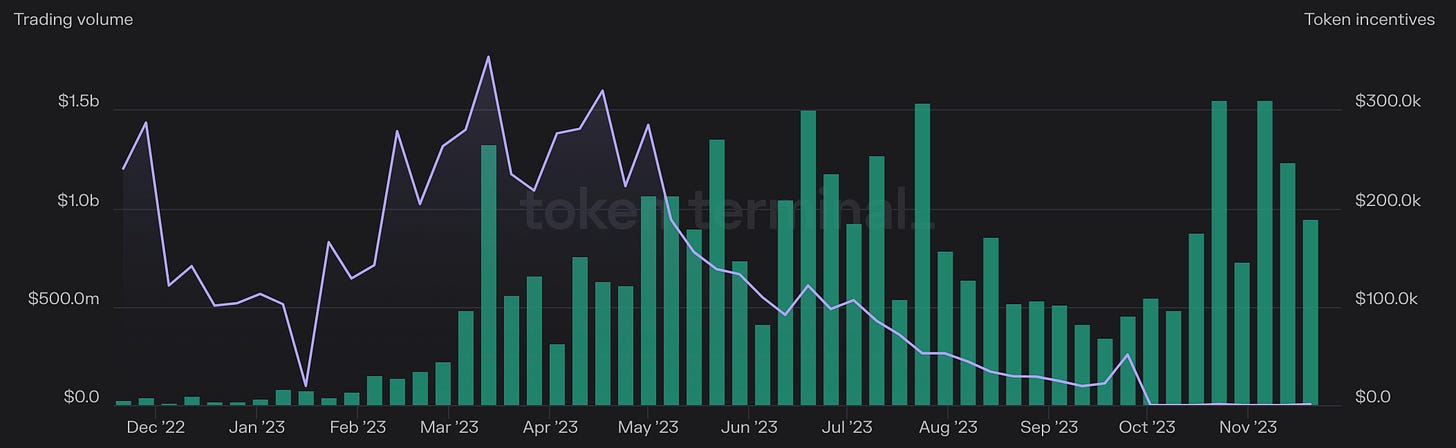

Kwenta’s volume has also been outpacing dYdX YTD…

What’s more impressive is Kwenta’s token incentives have been declining since March at a time when it experienced its largest volume growth.

Data Automation

Today, Web3 developers face three key issues when launching/managing their applications:

Inability to self-execute smart contracts due to complexity and resource requirements

Expensive gas fees

Inability to connect to real-world data on-chain that could enhance an app’s utility and expand its TAM

Over time, crypto-native and Web2 app developers will lean more heavily on outsourcing infrastructure to build more useful applications while also reducing costs where possible.

Just as we see in Web2 automation tools like Zapier, similar tools are needed for smart contract developers to streamline their application buildout.

Many of these developers will also not have the time or resources to build or manage their own backend tooling for on-chain transaction management.

Automating low-level tasks enables developers to enrich their applications with features that drive growth.

Web3 data automation isn’t a future issue. It’s a today issue - and we’re already seeing demand for these services.

For example, Gelato’s Web3 Functions is a product that allows developers to connect smart contracts to off-chain data & computation.

A fund manager could set up a Gelato Function to trigger the addition of liquidity based on predefined conditions such as their loan collateralisation ratio.

The number of ‘active tasks’ used per day ~80 applications continues to climb steadily higher YTD with >1.4m runs executed weekly.

Gelato’s Automate services specifically automate smart contracts. For example, an NFT lender can leverage Gelato’s Automate to ensure that an NFT is given back once a lending period is completed.

Automate task-creations-per-week made new ATHs in mid-November (7k/week) with Optimism taking the lion’s share for now.

Projects like Gelato have supported a higher network coverage and cheaper transaction overhead than their larger cap counterparts.

Gelato also fulfils>2x the number of Automate tasks than the $14b network, Chainlink.

What’s exciting is data management is a cross-sector theme. It can enhance use cases for the tokenisation of real-world assets, gaming, and prediction markets.

Looking ahead, we are excited to see how automation convergences more with AI autonomy that would enable self-governing applications that are able to execute with minimal manual input.

Stablecoin Inflows vs. US10Y

Stablecoin inflows have been positive, and currently on track for the 5th straight week of growth.

Both USDC and USDT have seen growth in their market caps as capital returns to the space, chasing after price action and continued narratives like the Spot ETF approvals.

Stablecoin supply started shrinking when US 10-year decisively broke 2% and began to expand when it hit 5% - a level that investors see as the yield peak and look to deploy into risk assets

Global Market Cap

$1.37T; No change in markets over the last 2 weeks after reaching the $1.4T resistance - the area of support in Q1 2022. Levels moved from overbought to neutral on the daily.

DeFi

$56.7B; DeFi market capitalisation breached 2022-2023 resistance into what appears to be a bullish breakout.

Altcoins

$287B; The altcoin total market capitalization has cooled after also breaking its 2022-2023 resistance. Signals more capital flows into assets down the risk continuum.

Bitcoin Dominance

BTC.D; Bitcoin dominance remains at 52-53% after being rejected at our perceived local ceiling at 54%. Break below YTD support would signal a more prolonged period of outperformance of altcoins vs. beta.

Trader Positioning

BTC; OI-weighted aggregate perpetual funding rates have remained positive as BTC stays above $34k. Traders have continued to take a predominantly bullish stance in the perpetual market.

> Fantom [Token Terminal]

> Liquid Restaking is Coming Sooner Than You Think [Bell Curve]

> Goldmna’s Jan Hatzius Believes the Hard Part Is Over [Odd Lots]

> CZ Guilty, Binance Settles Criminal Charges [The Breakdown]

> On US Crypto Regulation [The Scoop]

> On Distributed Bridge Relayers [Hart Lambur]

> Blast TVL hits $390 million, with no product [Blockworks]

> Your 2023 crypto reading list [Blockworks]

> On Cosmos’ Fork [Mikko Ohtamaa]

> Nansen Polygon Report [Nansen]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.