Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

Look back: the evolving drivers for interoperability infrastructure

Emerging trend changes in the interoperability landscape

Native bridges vs. 3rd party bridges

GMP vs. asset transfers

Look forward: Chain abstraction representing the next evolution of interoperability infrastructure

Linking Islands with Ferries

The trend towards interoperability within Web3 has been widely discussed for some time. The proliferation of independent blockchain ecosystems has generated a natural need for infrastructure that facilitates communication between those ecosystems.

For Re7, since ~2020, the 1st driving force was the proliferation of sidechains and L2s, whereby developers wanted to seek scalable infrastructure while retaining access to established liquidity and users on an existing layer 1 blockchain.

The 2nd driving force we see in process today is increased experimentation around blockchain modularity.

Specialised infrastructure that now enables lower-cost data storage for developers (e.g. Celestia, Eigenlayer) enables them to spin up their blockchain more cheaply.

More chains, more need for interoperability.

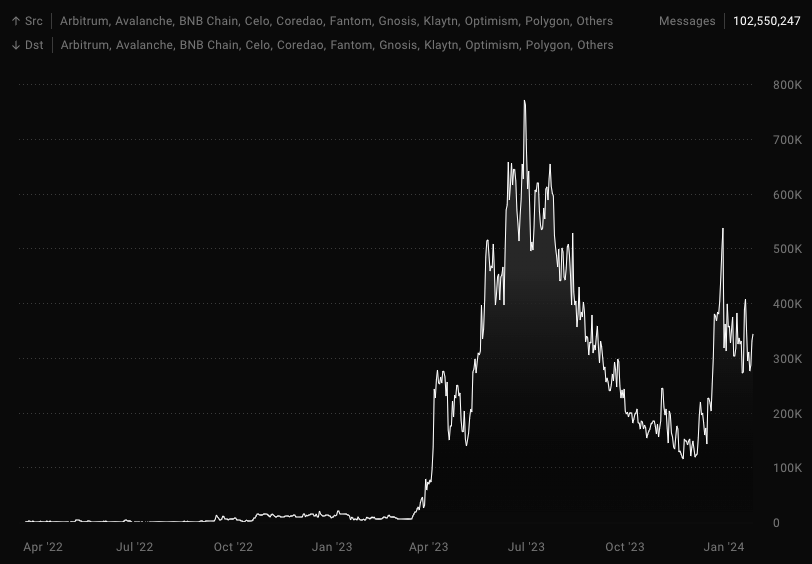

So how does the data look? Bridge volume since October 2022 has been flat - often failing to breach $200m/daily.

Yet, the complexity of interoperability requires going into the deeper layers to understand emerging trend changes.

Evolution of long-standing interoperability infra: Token Bridging

One form of interoperability is simple token bridging. Users transfer assets from one network to another.

Many of the new generation layer 2 blockchain teams have built their native bridges (e.g. Optimism Bridge) to facilitate the cross-chain transfers of assets (e.g. USDC, ETH).

The volume facilitated by these native bridges has declined from 70% at their peak in April 2023 to ~45% today.

One possible reason is their decline is an artefact of 3rd party bridge launches that are competing for mindshare (e.g. DLN, Allbridge Core).

However, we see a fundamental reason being select 3rd party bridges as succeeding in taking volume market share by offering lower and faster products.

For example, Across is an L1/L2 blockchain bridge that uses a relayer network that aims to provide the theoretical lowest cost and fastest bridge experience for users.

And it seems to be working. Across’ bridge volume is diverging from the ‘flatness’ within the broader market.

Across is also eating native bridges’ lunch when it comes to volume facilitation…

The working hypothesis in this specific case is that users only care about a fast experience.

After all, Millennials may be becoming increasingly impatient as a generation, often requiring quick gratification in an increasingly hyperconnected world.

Reducing costs also increases the obtainable market - by making it affordable for lower-value users.

Lower-cost bridges are also winning in a flat bridge volume landscape due to aggregator funnels.

Bridge aggregators like LI.FI is sourcing nearly 25% of its entire volume from Across where LI.FI now accounts for 12% of Across’ volume.

The emergence of new infra: General Message Passing

The other side of the interoperability market, general message passing (GMP), is less well understood.

GMP is a more generalised interoperability solution that enables cross-chain function calls and arbitrary data. In a sense, GMP is a superset of token bridging.

In 2023, GMP facilitated just 0.6% of the ~15.7b transactions enabled by blockchains.

For example, GMP can enable cross-chain NFT collateral where users can borrow and lend using NFTs minted on one chain as in applications on other independent chains.

GMP protocols demonstrate it’s not all about asset transfers. Messaging counts have only started rising in the last year…

GMP is also becoming a more prominent type of activity within generalised projects. For example, over 75% of Axelar’s volume is now GMP-based volume.

Just as with any other sector in Web3, it’s all about championing a particular market niche.

Axelar may never be able to compete with Across’ low transfer fees but it doesn’t have to or need to. Likewise, Across will not tap into the GMP market as it stands today.

Looking Ahead: Chain Abstraction

So far, we outlined two driving forces behind the growth of interoperability infrastructure.

Looking ahead, we see the 3rd as being a key initiative around UX abstraction - specifically an emerging concept called chain abstraction where a user doesn’t know where its respective on-chain activity is taking place.

For example, it’s conceivable that users have one unified account on several chains but move assets freely between them.

For example, a DEX user wanting to sell their asset for another that exists on another chain won’t need to bridge themselves.

How? Key management systems (see NEAR’s fastauth) can map native addresses to one another allowing users to interact with just one frontend.

Applications can be built as smart contracts on an L1 where token transfers will just be represented by smart contract calls between integrated apps.

In other words, there is no ‘bridging’ in the traditional sense.

For this reason, we see, chain abstraction as a possible next evaluation of GMP capability. But it’s still very early.

We chain abstraction initiatives to only enhance the interoperability sector further as well as negate existing cross-chain infrastructure that will quickly become redundant.

GMP will ultimately be a key part of abstracting interface complexity without users needing to switch or leave a single interface.

And it’s exactly these design principles that will help enable Web3 to grow to 1B+ daily active accounts one day.

Global Market Cap

$1.583T; Markets remained largely flat over the last week after rebounding off January’s low of $1.45T. Retrace was 18% from highs. Daily RSI neutral at ~50.

Crypto vs. Equities

US equity futures edge higher near ATH levels as investors price in rate cuts (40% one rate cut in March). Divergence between crypto beta (BTC) and SPX reducing as the former recovers in the direction of equities.

DeFi

$71B; Little change in DeFi sector which hovers just below 2024 highs of $77B.

ETH/BTC

0.05357; ETH/BTC retracing 12% from 2024 highs and now fast approaching wedge support.

Fund Flows

Friday had a minor $14m net inflow to US Bitcoin spot ETFs - the first positive print after 4 consecutive net negative days (-$421m total across those days). GBTC discount to NAV has narrowed close to 0% which can act as a proxy measure for the extent of GBTC selling (via redemptions). Early evidence of GBTC outflows trending down.

Altcoin Market

The altcoin market retraced back down to ~$314m and closed above the resistance-turned-support line.

Trader Positioning

OI-weighted funding rates remain positive (0.096%) but flat. Market is still figuring out where to go post ETF launches as with the previous week.

The extent of liquidations declined over the past few days with $40m in BTC shorts occurring last Friday adding to volatility.

> zkSync & the L2 market [Fundamentals]

> AEVO [0xResearch]

> Building modern digital lending [The Fintech Blueprint]

> ETFs, Global Macro, Tokenisation [RV]

> Autonomous AI Agents [Epicenter]

> ON-201 [OurNetwork]

> Introducing Solana Activity Monitor: What's Driving Solana User Activity? [Artemis]

> Rollups as chains [Hayden]

> Solana signups record highs [The Block]

> Jupiter vs. CEXs [0xjaypeg]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.