The Weekly - 30th June 2025

Re7: Becoming the Ecosystem Expansion and Distribution Partner for DeFi

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website / Re7 Labs website

> Weekly Research / Real-time Insights

> Re7 Capital Twitter / Re7 Labs Twitter

This Week at Re7:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Re7 Labs Featured in Artemis Report on Onchain Yields

Re7 Labs was recognised as one of the top 5 DeFi curators in Artemis’ latest report “Onchain Yields: What the Data Shows & What’s Next.” With $600M+ in curated TVL, we’re proud to help shape the future of institutional-grade, risk-aware yield infrastructure.

Re7 Capital Ranked Top 10 by BarclayHedge

Re7 Capital’s Opportunities Fund secured a top 10 position in BarclayHedge’s April 2025 rankings — recognizing consistent performance among institutional-grade funds.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Investment Analyst(Liquid Token)

We want to hear from you!

Summary

In this edition, we cover:

How Re7 is becoming the ecosystem expansion and distribution partner for asset issuers, blockchain networks, DeFi apps, and infrastructure providers.

Re7: Becoming the Ecosystem Expansion and Distribution Partner for DeFi

At $600m TVL, Re7 is one of the largest on-chain curators globally.

As the industry evolves, we see and hear the needs of DeFi ecosystem stakeholders equally evolving too.

As the tech stack gets more complex and the stakeholder universe becomes richer, specialized partners are increasingly essential to drive effective go-to-market strategies, seamlessly bridging gaps for all participants.

One of the challenges asset issuers have in DeFi is distribution.

At the same time, DeFi dApps like a lending protocol desire more TVL that can be enabled by strategic partners in order to boost market share.

Meanwhile, blockchain ecosystems also growth KPIs like TVL and economic activity at a foundational level.

There is a growing need for a strategic DeFi partner that ties all of these stakeholders together that solves for on-chain distribution, asset/yield management, and institutional risk bridging.

Re7 leverages its extensive on-chain yield experience, tooling, and network to act as the go-to DeFi partner that forms the increasingly vital glue between all market participants to accelerate growth.

World Liberty Financial: A Case Study

In March 2025, World Liberty Financial (WLF) announced the launch of its USD1 stablecoin which went live a month later on BNB Chain.

In just 2 months, USD1 has become the 8th largest stablecoin by total supply.

One of the challenges for USD1 has been distribution, with no easy way for large LPs to gain access to USD1 outside of BitGo or to lend out USD1.

Over 95% of the total USD1 supply is in the top 20 addresses - over 4x that of USDC.

To solve the issue of distribution, World Liberty Financial partnered with Re7 to act as a gateway for USD1 expansion in DeFi by first by launching vaults on Euler and Lista on BNB Chain.

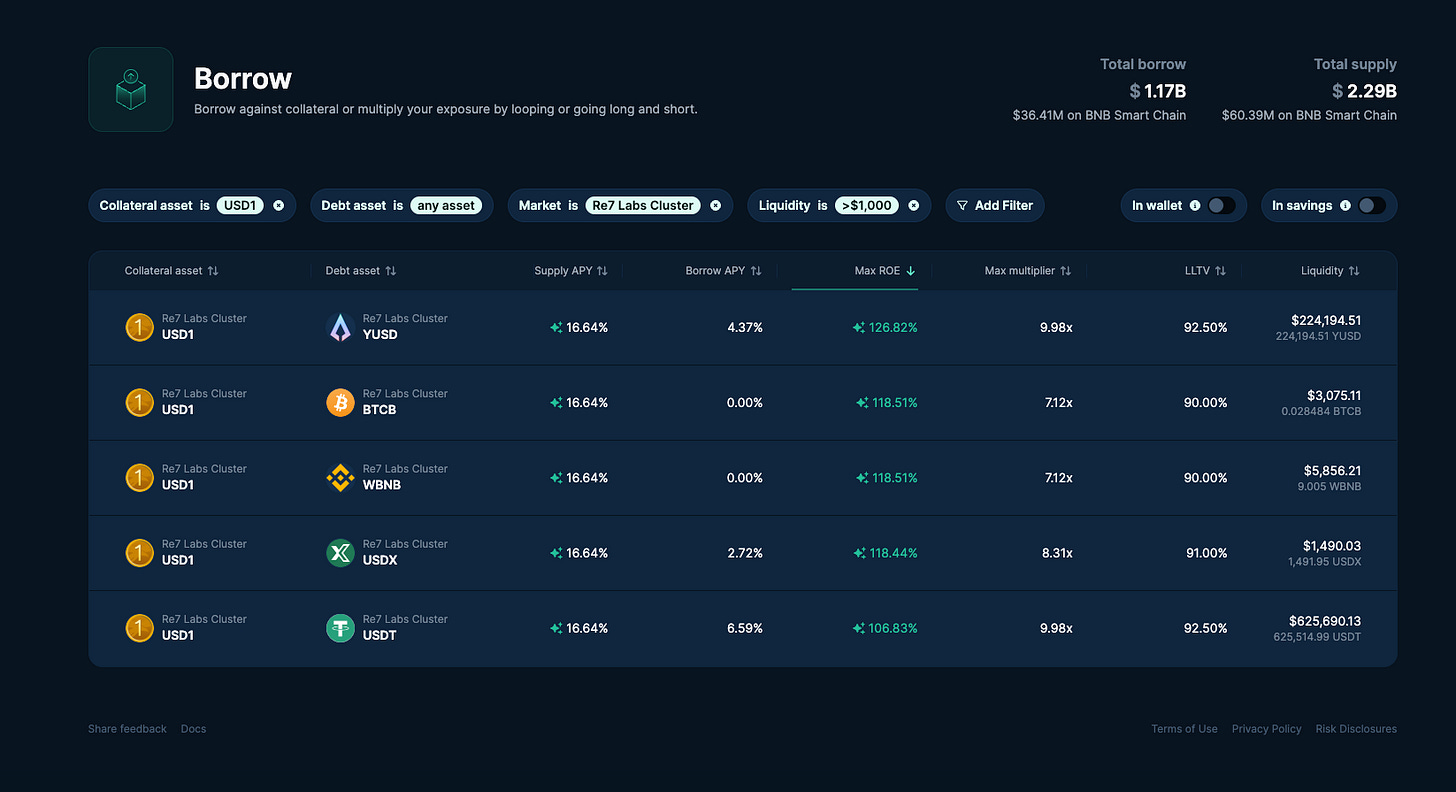

USD1 Vault

Deposits in the Re7 USD1 Euler vault can be used as collateral to borrow from other markets or lend to them (e.g. Re7 USDT, Re7USDX).

Re7 optimises yield for USD1 depositors through various strategies including looping (i.e. a strategy that amplifies yields by borrowing, swapping, and re-supplying).

The Re7 USD1 vault launch target of $10m deposits was met shortly after vault deployment, validating institutional demand and execution.

With supply cap increased to $50m, vault utilisation remains balanced today at 60%.

Balanced utilization is often ideal, ensuring lenders earn reasonable returns while maintaining enough liquidity.

With these partnerships, Re7 is then able to help distribute assets from issuers on alternative DeFi apps in the future so those issuers can break into even more markets, including cross-chain capabilities.

Re7 isn’t just a vault curator. Re7 is an ecosystem expansion partner that helps solve distribution by solving for utility.

Through this strategic partnership, blockchain networks and DeFi apps can increase TVL market share and remain competitive while infrastructure, such as oracles, expands its market offerings.

All of these stakeholders are able to provide their own incentive programmes to create a strong overall competitive advantage for the products.

We are incredibly excited to be working with World Liberty Financial and look forward to working with numerous DeFi applications to expand their stablecoin reach.

If you are an asset issuer, blockchain network, DeFi app, or infrastructure provider and are interested in partnering with Re7, please reach out at hello@re7labs.xyz.

Markets

Crypto markets bounced off its $3T support last week (+8%) in what was an overall strong re-bound move following geopolitical tensions easing.

BTC has been edging higher and looking make new ATHs, now potentially looking to consolidate after rallying 8% in the last week.

When we chart global crypto market capitalisation as a ratio of NASDAQ 100, it rhymes with forward-looking liquidity measures. After all, liquidity impacts all asset prices.

So as other pockets of risk markets like high growth tech make new all-time-highs in line with financial conditions easing, the volatility coil is being wound for it to potentially play ‘catch up’.

Updates on Re7 Lab Vaults

We are excited to announce that USD1 on Binance Smart chain has been added to the Re7 Labs Cluster on Euler with up to 14% APR in rEUL incentives.

We also launched other opportunities on Binance Smart Chain with the inclusion of USDX and sUSDX to the Re7 Labs cluster.

We are excited to share new additions to Euler on Avax: UTY and yUTY have been added to the Re7 Labs cluster.

We are excited to introduce a new BTC Yield Strategy on Gearbox Protocol. Borrow tBTC against BTC-native collateral and earn additional incentives until July 25th.

Keep an eye out for our Re7 Morpho vaults on Katana, these should be live very soon with an official announcement.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.