Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

The rise of memecoin activity from financial nihilism

How and why Solana has become a fruitful ground for meme speculation

How memecoin activity has represented scalability ‘pilots’ for institutional use cases like Stablecoins

How token infrastructure ties all these use cases together

Solana Meme PMF

As ever, the blockchain landscape is evolving rapidly. New adoption drivers are also changing fast.

One more recent phenomenon in 2024 that has emerged is the the speculation around memecoin trading - an extension of the financial nihilism traditional markets are currently facing.

One ecosystem that has been at the centre of this persistent frenzy has been Solana.

As we’ve highlighted before, Solana’s higher throughput, low transaction fees, and state costs make it a fruitful ground for higher velocity of activity and experimentation.

Solana’s daily active addresses are >1.4m/daily, leading the market in transaction count at 33m/day.

To illustrate the extent of the growth:

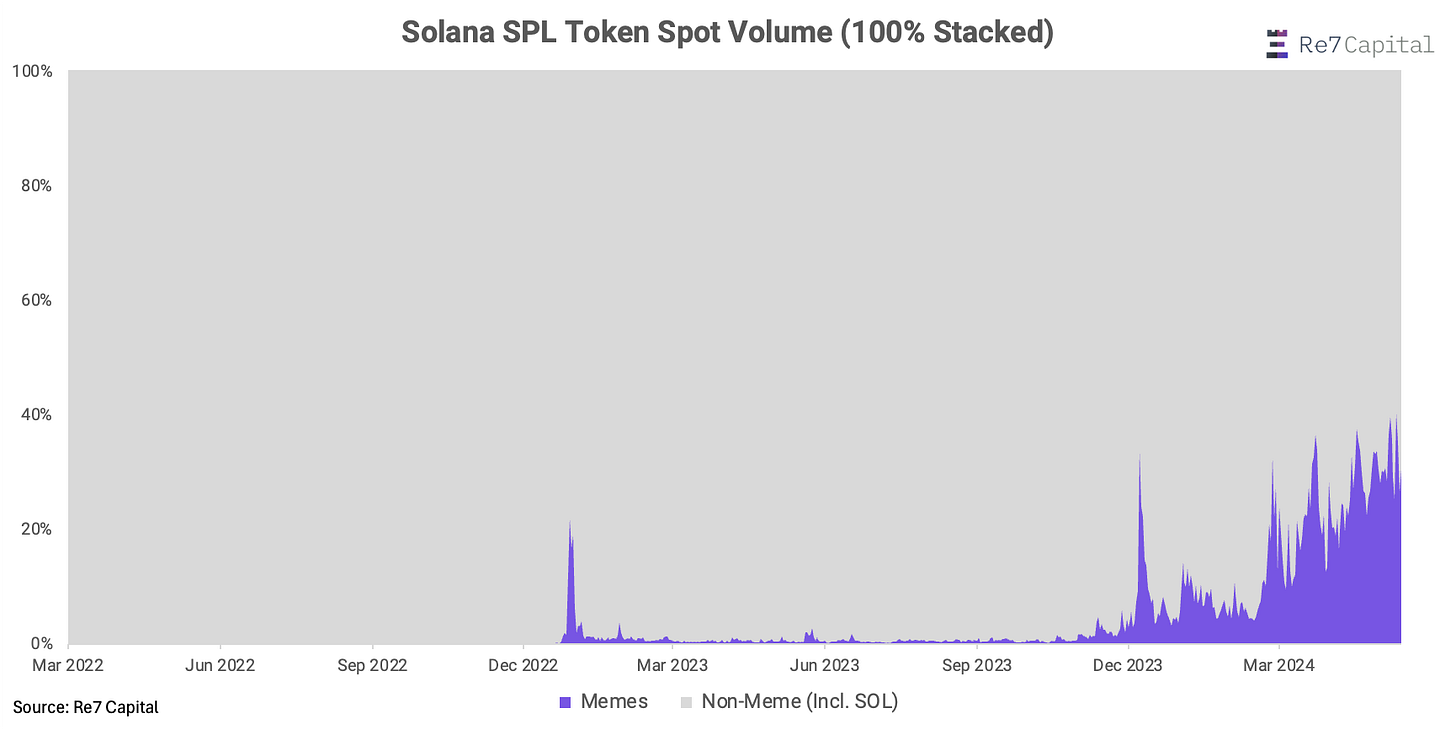

Memecoins spot trading on Solana (combining centralised and decentralised exchanges) now represents nearly 40% of the total spot trading volume of all assets on Solana.

Adjusting out SOL, memecoin spot volume dominance climbs to ~70%…

There have been several key infrastructure projects that have helped drive memecoin speculation.

At the mint level, Pump.fun has allowed anyone to create and launch instantly tradeable new tokens for <$2 in under a minute.

Just last week, Pump.fun made 8.7k SOL in revenue (~$1.4m), with Celebrities now minting their own collection through the platform.

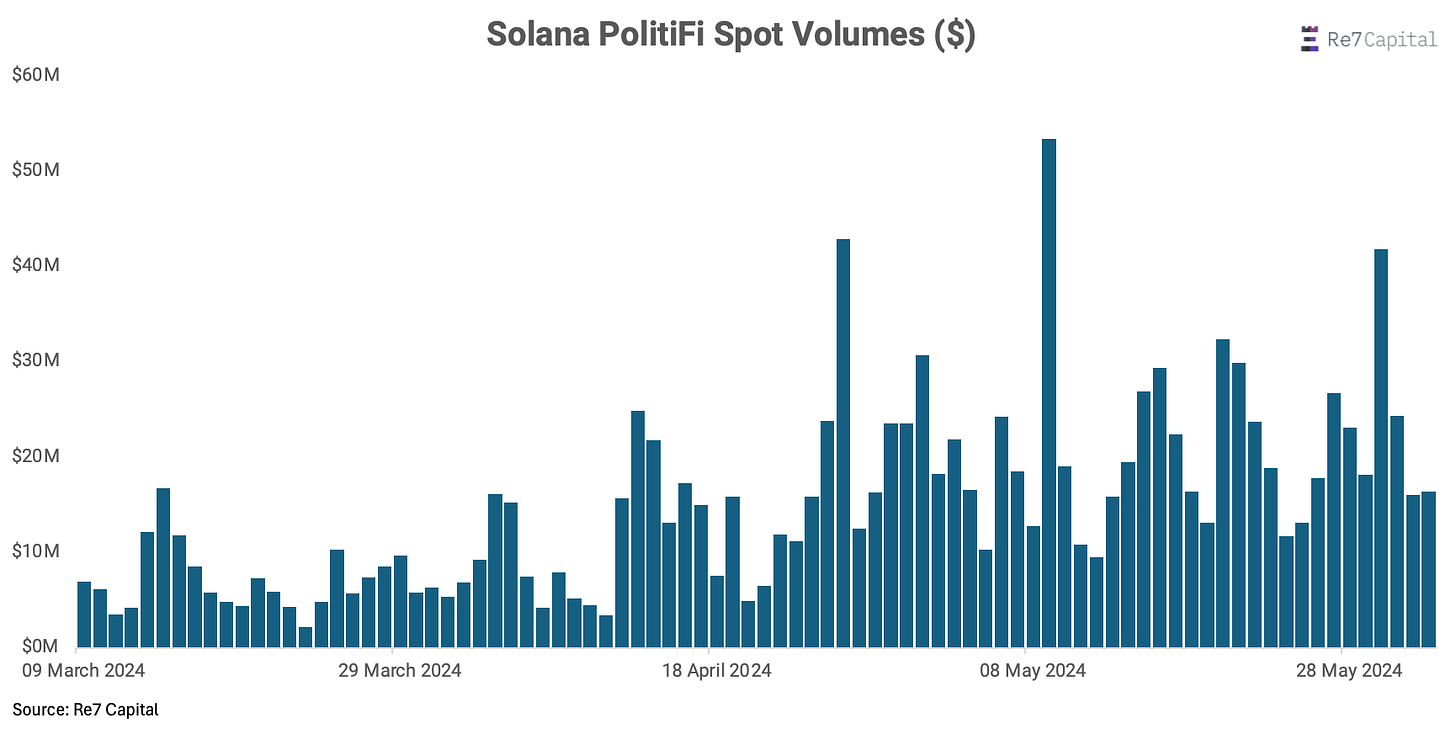

Another driver has been the broader macro/political environment. Political-based memecoin spot volumes have trended higher over the past 3 months.

Solana’s Stablecoin PMF

As much as memecoin trading has reflected the growing divide in attention between generations, they have represented scalability ‘pilots’ for institutional use cases.

After all, blockchains are agnostic to the use cases built on top of them.

One example is stablecoins - where Solana now dominates>75% of total stablecoin transfer volumes today.

For example, Paypal launched its stablecoin, PYUSD, on Solana mainnet last week.

The payment company stated, “Solana network's speed and scalability make it the ideal blockchain for new payment solutions that are accessible, cost-effective, and instantaneous.”

Paypal’s PYUSD supply has started with $45m out of the gate, which is >1% of the total stablecoin supply on Solana (yellow below).

More interestingly, the supply dominance PYUSD on Solana is already 100% higher than on Ethereum despite only being live for 5 days vs. 305 days.

In other words, there are early signs that Solana is already proving to be a more productive environment than other ecosystems.

Infrastructure ties it all together

Unlike other ecosystems, we’ve seen a deliberate focus on supporting new types of fungible tokens through new business standards.

Solana’s token extensions enable a new generation of stablecoins for imbuing the assets with a native set of rich features ranging from confidentiality to token-gate access.

The benefits of next-generation token standards apply across the meme-institution use cases spectrum.

Token-gated access could grant specific fans who bought 2x concert tickets early access to buy a singer’s token collection.

Stablecoin users can make cross-border payments between one another who have both been KYC’d (e.g. through Paxos).

This further highlights how these vastly different use cases are more closely tied than intuition leads you to believe.

It’s all part of the same adoption cycle - a period of coherent growth, driven by structural shifts from institutionalisation and Web2 convergence.

ETH Borrow Rates

With high demand for ETH farming coming from all sides, ETH borrow rates are passing native staking yield for the first time since the merge.

Shown here on Arbitrum, ETH borrow rate is now above stETH yield, making leveraged staked ETH strategies unprofitable.The levered stETH positions have been a constant staple in the market, but with the expected yield from restaking, new strategies are less sensitive to underlying yield from staking.

Aave added weETH markets over a month ago, and have been aggressively raising supply caps. On arbitrum there is over weETH 250m deposited, making it the second largest listed asset after WETH.

The borrow rate increase is also favorable for Aave, which takes a cut of all interest paid on the platform. The spike in rates made Aave's annualized revenue pass $100m.

While the long-term demand for ETH from Liquid Restaking Tokens remains to be seen, we expect that the higher rates signal a new normal.

This is because ETH DeFi users have a wide range of opportunities that pay more than these borrow rates and restaking yield likely settles to be some points higher than regular ETH staking.

Global MCAP

$2.5T; Global market capitalisation broke out above bull flag with the next target being $2.6T (+4%), then $3T (+20%).

ETH/BTC

0.0552; In an interesting turn of events, the ETH/BTC cross has reclaimed its multi-year wedge pattern now using it once again as support.

One interpretation is the likelihood of ETH spot ETFs being approved in the US has now been priced - with the prospect of BTC no longer being the special child receiving net new inflows.

Stablecoin Supply

145B; Stablecoin supplies have seen an impulse after staying flat over the past month. Impulse comes as market sees uplift - net new flows making their way into the market once again.

Bitcoin ETF Net Inflows

+$30-40m; US spot Bitcoin ETFs seeing 14 consecutive days of net inflows ($2.18m total) as BTC edges just below its ATH of $73,757.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.